Even if we consider the budget estimates for the fiscal 17-18, the rise for the next fiscal is just 7.89% and meager if the inflation is factored in

Gujarat government will spend just 2.46% higher in the next fiscal, compared to the amount it is estimated to spend at the end of the current fiscal. Experts say if average inflation of 5.0% is considered, the value of spend next fiscal will be lower than the revised estimates at the end of the current fiscal. Even if we consider the budget estimates for the fiscal 17-18, the rise for the next fiscal is just 7.89% and meager if the inflation is factored in.

The fine print paints a different picture than the one shown by Finance Minister Nitin Patel on Tuesday, when he presented the budget that claimed high spending for rural sector and job creation for the youth.

Revenue outlay for development sectors rose marginally from Rs 82,241.29 crore as per the revised estimates for 2017-18 to Rs 82,443.37 crore for the fiscal. The rise in capital outlay was little better from Rs 26,647.88 crore (RE for 2017-18) to Rs 29,121.60 crore (BE for 2018-19). Overall, the rise in total expenditure is a meager 2.46%.

The figures improve marginally if budget estimates of 2017-18 is considered. The estimate for expenses rise from Rs 1,03,498.49 crore to Rs 1,11,654.97 crore, indicating a rise of 7.89%. Experts say this is grossly inadequate, even inflation of 5% is considered. Then it is near stagnancy in development expenditure.

The figures improve marginally if budget estimates of 2017-18 is considered. The estimate for expenses rise from Rs 1,03,498.49 crore to Rs 1,11,654.97 crore, indicating a rise of 7.89%. Experts say this is grossly inadequate, even inflation of 5% is considered. Then it is near stagnancy in development expenditure.

"If we want real rise in expenses, it should be around 15% compared to the previous year, in order to benefit the masses. Otherwise, the rise will just be able to compensate for inflation and there will not be any substantial benefits," said Mahender Jethmalani, economist at Patheya Budget Centre.

Experts say that this will only lead to tinkering with the allocations here and there, with no substantial boost to social welfare or economic development. "It practically means that the size of the budget has stagnated. If we consider inflation, then the real expenditure will actually fall and all sectors will suffer," said Hemantkumar Shah, professor of Economics at HK Arts College.

Bhagyesh Soneji, chairperson of ASSOCHAM – Gujarat, said that the main victims would be sectors such as social welfare, women and child development and education. "This raises a question that if the government is collecting higher taxes, where is the expenditure going?" asked Soneji.

![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Taiwan detects seven Chinese military aircraft, five naval vessels near its waters

Taiwan detects seven Chinese military aircraft, five naval vessels near its waters![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...

Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...![submenu-img]() India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...

India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...![submenu-img]() Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'

Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'![submenu-img]() IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets

IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets![submenu-img]() IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?

IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?![submenu-img]() 'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede

'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede![submenu-img]() LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders

LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

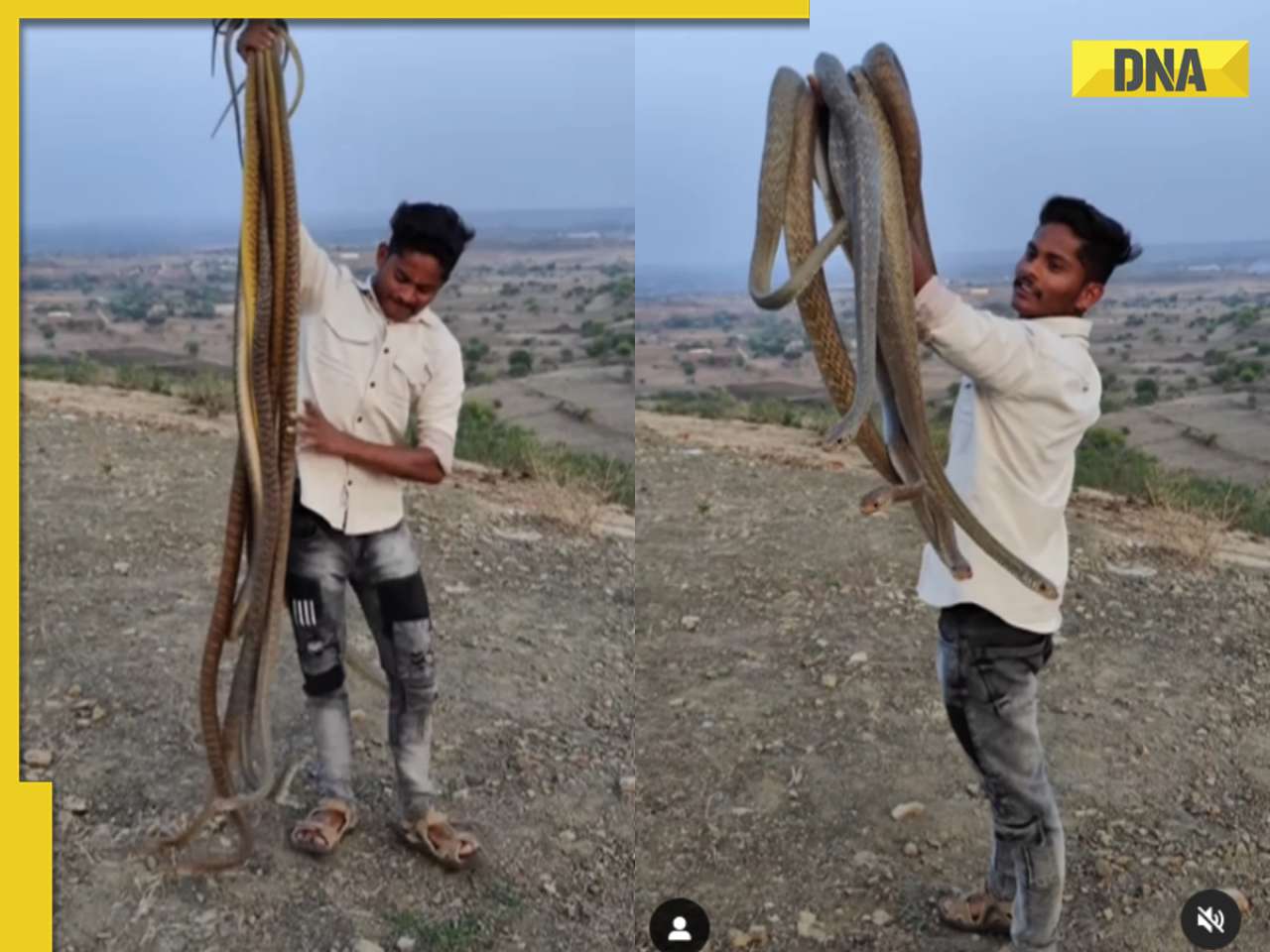

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() Viral video: Man fearlessly grabs dozens of snakes, internet is scared

Viral video: Man fearlessly grabs dozens of snakes, internet is scared![submenu-img]() This mysterious mobile phone number was suspended after three users...

This mysterious mobile phone number was suspended after three users...![submenu-img]() School principal, teacher engage in physical altercation in Agra, video goes viral

School principal, teacher engage in physical altercation in Agra, video goes viral

)

) The figures improve marginally if budget estimates of 2017-18 is considered. The estimate for expenses rise from Rs 1,03,498.49 crore to Rs 1,11,654.97 crore, indicating a rise of 7.89%. Experts say this is grossly inadequate, even inflation of 5% is considered. Then it is near stagnancy in development expenditure.

The figures improve marginally if budget estimates of 2017-18 is considered. The estimate for expenses rise from Rs 1,03,498.49 crore to Rs 1,11,654.97 crore, indicating a rise of 7.89%. Experts say this is grossly inadequate, even inflation of 5% is considered. Then it is near stagnancy in development expenditure.

)

)

)

)

)

)