Maharashtra is struggling to attract investment in power generation in spite of a mounting shortfall.

MUMBAI: The ghost of Enron is still spooking investors away from power generation in Maharashtra, even as the power shortage worsens each year, with more blackouts for consumers and losses for industries.

Power producers are reluctant to put money into projects where the returns are not assured. “Enron did have a counter-guarantee and yet they didn’t get paid for the supply they generated after the deal was called off and restarted,” said Harry Dhaul, president of the Independent Power Producers Association of India (IPPAI). “The sanctity of a contract is not maintained in Maharashtra.”

Investors are pressing for better deals from the government in order to make their power ventures profitable. “Even today we have politicians haggling over allowing us to generate power at Rs 3.50 a unit though they are purchasing power at over Rs 8 from other states,” said Harry Dhaul.

It currently costs more than Rs 5 to produce a unit of electricity at Dabhol because the plant runs on naphtha. This is expected to come down to Rs 3 per unit when it switches over to gas as fuel, but that can again escalate along with gas prices. The fuel price is lower for coal-based plants, but that is not the only complicating factor for a private producer to work out the profitability of a venture. There is the issue of one-third of the power in the state being lost in transmission and distribution, mostly due to theft.

But the biggest concern is red tape, especially the various clearances that delay projects and add to costs. “The problem put forward is always to do with environmental and pollution concerns. The reality is that it is all too time-consuming for someone who is investing and cannot wait for so long,” said MN Chaini, former power secretary.

Reliance Energy’s 1200 MW Dahanu project, for instance, has been delayed. “Dahanu is a world class project but has run into problems due to environmental concerns, as it falls in an ecologically fragile zone,” said Pankaj Pandya, an REL consultant. Experts say some delays are designed to extract pay-offs. “In any South Asian country, cuts are part of the system,” said Akbar Jung, former special secretary in the Union ministry of power.

Bureaucrats and politicians have finally been galvanised into action, faced with a 6800 MW power shortfall, which even the restarting of the 2100 MW Dabhol project, now run by Ratnagiri Power, can hardly dent. The state government has been signing numerous Memorandums of Understanding (MOUs) with private power generating companies. However, none of these appear to have been actualised till now. The problem lies with concerns over the investment bearing fruit. “In Maharashtra, people seem to have a problem with making money. The investor needs returns. No one’s here for charity,” said Suneet Maheshwari, MD of Feedback Ventures, an infrastructure consultancy firm.

Maharashtra’s minister for power Dilip Walse-Patil told DNA the state had learnt its lessons from Dabhol. “The pricing is now done on the basis of competitive bidding. We have signed PPAs and you will see the difference in the next two years.”

But investors remain sceptical. “There is now some semblance of order in tariffs. But for a private player the subsidy on agriculture is still an issue. Investors are not convinced that the various disparities in the current tariff rates will bring them returns,” said Sunil Bhandare, former CEO of Bombay First.

Experts say foreign investors are still waiting to see the fate of the Dabhol project, which is expected to run at full capacity early next year, before putting their dollars into power projects in Maharashtra. “Our investors need at least one success story,” said Suneet Maheshwari.

![submenu-img]() SL vs SA, T20 World Cup 2024: Nortje, Rabada shine as South Africa beat Sri Lanka by 6 wickets

SL vs SA, T20 World Cup 2024: Nortje, Rabada shine as South Africa beat Sri Lanka by 6 wickets![submenu-img]() Odisha Lok Sabha Election Results 2024: Party-wise Winners to Be Announced Soon

Odisha Lok Sabha Election Results 2024: Party-wise Winners to Be Announced Soon![submenu-img]() Madhya Pradesh Lok Sabha Election Results 2024: Full List of Winner and Loser Candidates will be announced Soon

Madhya Pradesh Lok Sabha Election Results 2024: Full List of Winner and Loser Candidates will be announced Soon![submenu-img]() Chandigarh Lok Sabha Election Result 2024: Full List of Winner and Loser Candidates Will Be Announced Soon

Chandigarh Lok Sabha Election Result 2024: Full List of Winner and Loser Candidates Will Be Announced Soon![submenu-img]() Tamil Nadu Lok Sabha Election Results 2024: Full List of Winner and Loser Candidates will be announced Soon

Tamil Nadu Lok Sabha Election Results 2024: Full List of Winner and Loser Candidates will be announced Soon![submenu-img]() Meet man who won medals for India in bodybuilding, cracked UPSC in 1st attempt, resigned as IRS after 10 years due to...

Meet man who won medals for India in bodybuilding, cracked UPSC in 1st attempt, resigned as IRS after 10 years due to...![submenu-img]() IIT-JEE topper with AIR 1 joins IIT Bombay, gets job at NASA as scientist, leaves to work as…

IIT-JEE topper with AIR 1 joins IIT Bombay, gets job at NASA as scientist, leaves to work as…![submenu-img]() Meet man who grew up in orphanage, began working at 10 as cleaner, delivery boy, then became IAS officer, is posted at..

Meet man who grew up in orphanage, began working at 10 as cleaner, delivery boy, then became IAS officer, is posted at..![submenu-img]() Meet UPSC topper who cleared JEE Advanced, went to IIT Kanpur, left high-paying job to become IPS officer, secured AIR..

Meet UPSC topper who cleared JEE Advanced, went to IIT Kanpur, left high-paying job to become IPS officer, secured AIR..![submenu-img]() Meet woman who cracked UPSC exam twice, left IPS to become an IAS officer, secured AIR...

Meet woman who cracked UPSC exam twice, left IPS to become an IAS officer, secured AIR...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() Neha Sharma reveals if her father's political career has backfired on her in Bollywood: 'I am not here to promote...'

Neha Sharma reveals if her father's political career has backfired on her in Bollywood: 'I am not here to promote...'![submenu-img]() Venom The Last Dance trailer: Tom Hardy and his symbiote fight aliens in trilogy's finale, film to release on...

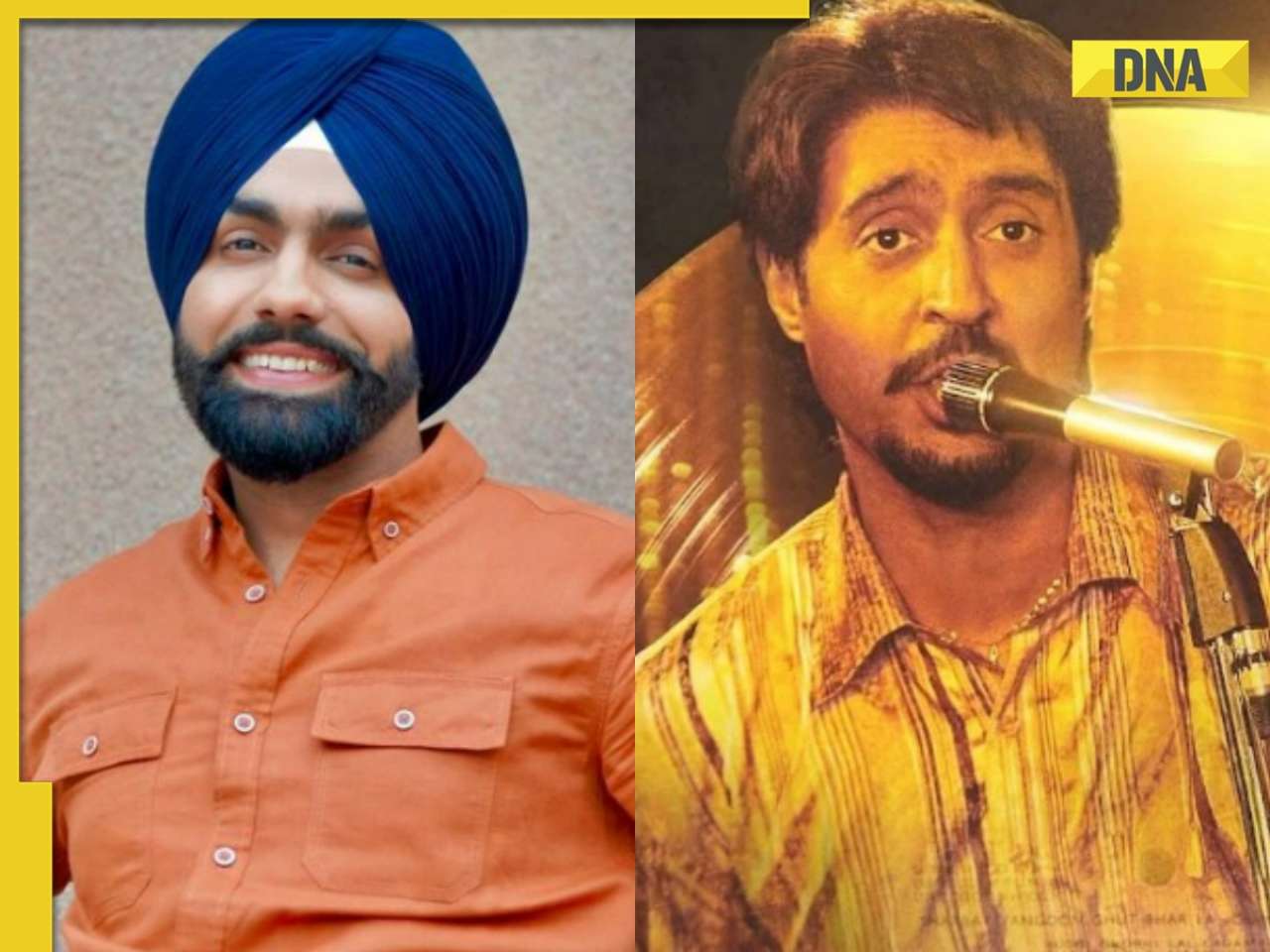

Venom The Last Dance trailer: Tom Hardy and his symbiote fight aliens in trilogy's finale, film to release on...![submenu-img]() Ammy Virk defends Diljit Dosanjh's decision to not wear a turban in Amar Singh Chamkila: 'You can't stop the trolls'

Ammy Virk defends Diljit Dosanjh's decision to not wear a turban in Amar Singh Chamkila: 'You can't stop the trolls'![submenu-img]() This flop of Aishwarya Rai was rejected by Priyanka Chopra, didn't earn even Rs 10 crore, director took 12 years to...

This flop of Aishwarya Rai was rejected by Priyanka Chopra, didn't earn even Rs 10 crore, director took 12 years to...![submenu-img]() Annu Kapoor reveals why he did Hamare Baarah, reacts strongly to those demanding ban on film: 'If they bring a gun...'

Annu Kapoor reveals why he did Hamare Baarah, reacts strongly to those demanding ban on film: 'If they bring a gun...'![submenu-img]() Watch viral video: Isha Ambani stuns during Anant Ambani and Radhika Merchant's pre-wedding celebrations in Italy

Watch viral video: Isha Ambani stuns during Anant Ambani and Radhika Merchant's pre-wedding celebrations in Italy![submenu-img]() Former air hostess reveals harsh realities of flight attendant job, says 'people think...'

Former air hostess reveals harsh realities of flight attendant job, says 'people think...'![submenu-img]() 'Egg fry or fish fry': Viral video shows egg dish looking like goldfish; watch

'Egg fry or fish fry': Viral video shows egg dish looking like goldfish; watch![submenu-img]() Viral: IndiGo crew protects passengers from rain, watch heartwarming video

Viral: IndiGo crew protects passengers from rain, watch heartwarming video![submenu-img]() This variety of mango costs Rs 2.50-3 lakh a kg, know why

This variety of mango costs Rs 2.50-3 lakh a kg, know why

)

)

)

)

)

)