Buffett, the 80-year-old 'Oracle of Omaha' and billionaire investor, released his closely watched annual letter to shareholders on Saturday.

Warren Buffett, the 80-year-old 'Oracle of Omaha' and billionaire investor, released his closely watched annual letter to shareholders on Saturday.

Following are select quotes from the 26-page letter:

On investing in Burlington Northern for growth:

"The railroad will need to invest massively to bring about this growth, but no one is better situated than Berkshire to supply the funds required. However slow the economy, or chaotic the markets, our checks will clear."

On domestic opportunities:

"Money will always flow toward opportunity, and there is an abundance of that in America."

"The prophets of doom have overlooked the all-important factor that is certain: Human potential is far from exhausted, and the American system for unleashing that potential - a system that has worked wonders for over two centuries despite frequent interruptions for recessions and even a Civil War - remains alive and effective."

"Now, as in 1776, 1861, 1932 and 1941, America's best days lie ahead."

On acquisitions:

"Charlie (Munger) and I hope that the per-share earnings of our non-insurance businesses continue to increase at a decent rate. But the job gets tougher as the numbers get larger. We will need both good performance from our current businesses and more major acquisitions. We're prepared. Our elephant gun has been reloaded, and my trigger finger is itchy."

On housing:

"A housing recovery will probably begin within a year or so. In any event, it is certain to occur at some point."

"[A] house can be a nightmare if the buyer's eyes are bigger than his wallet and if a lender - often protected by a government guarantee - facilitates his fantasy. Our country's social goal should not be to put families into the house of their dreams, but rather to put them into a house they can afford."

On cash and interest rates:

"At yearend we held $38 billion of cash equivalents that have been earning a pittance throughout 2010. At some point, however, better rates will return. They will add at least $500 million - and perhaps much more - to our investment income. That sort of increase in money-market yields is unlikely to come soon."

On hiring a young, new investment manager, Todd Combs:

"Our goal was to find a 2-year-old Secretariat, not a 10-year-old Seabiscuit.

![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

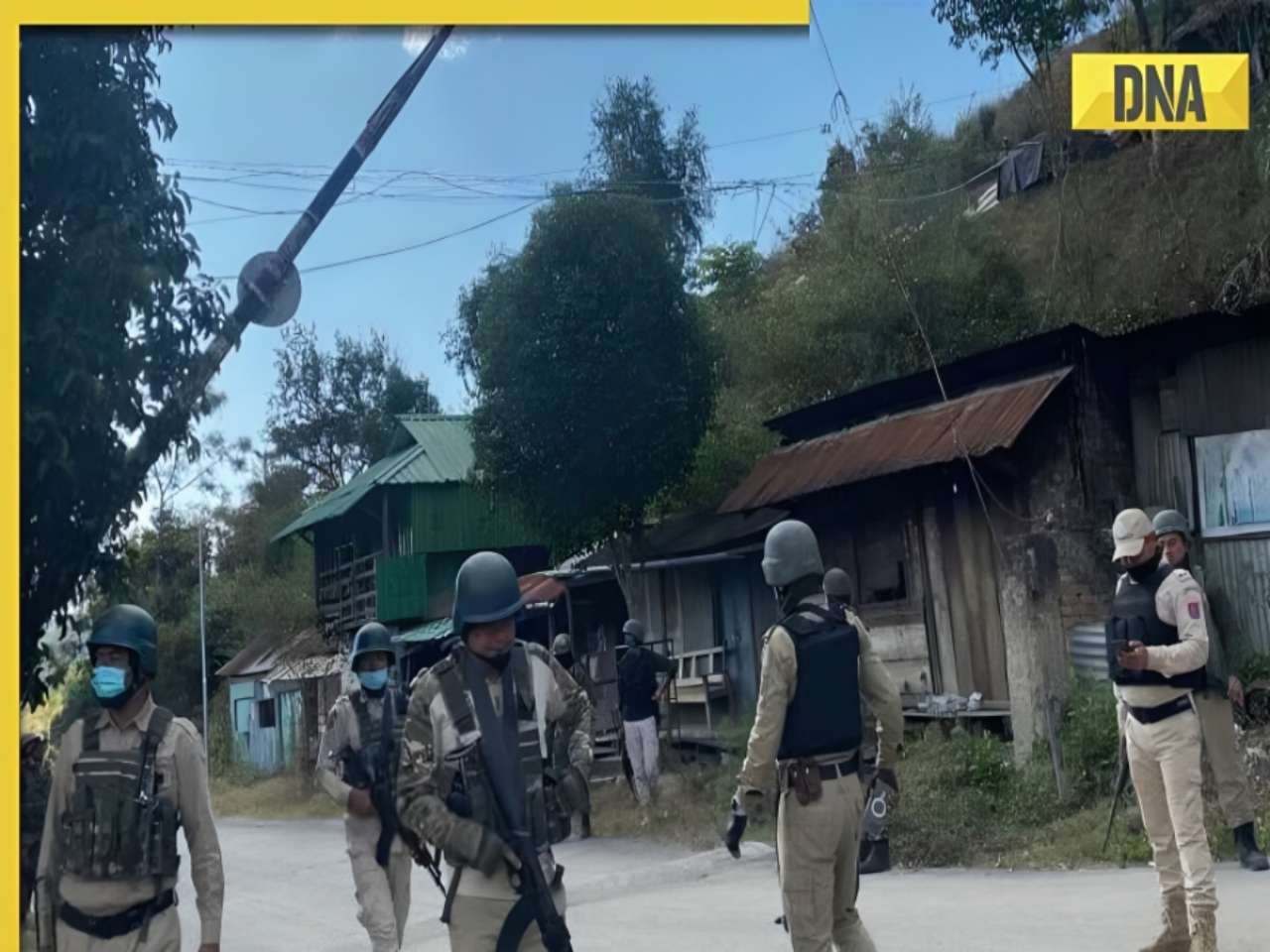

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

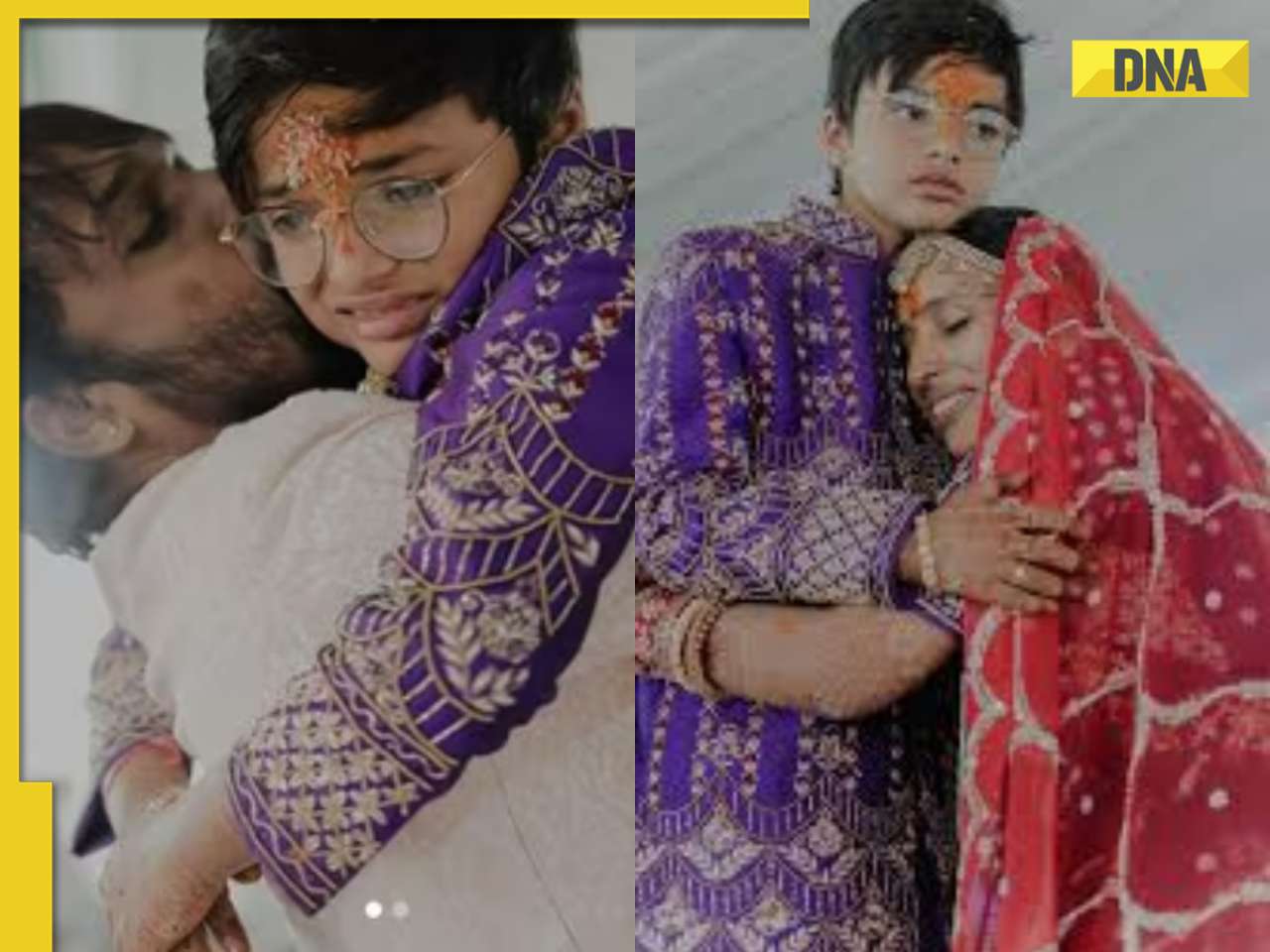

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)

)