Khanna’s book, “Billions of Entrepreneurs — How China and India Are Reshaping Their and Future and Yours”, has just been published.

“The US-based Indian management guru” has now become a respectable stereotype. Tarun Khanna, professor of strategy at the Harvard Business School, is part of this breed. Back in 1984, when it wasn’t this fashionable to go abroad to study, Khanna went to do his engineering in computer science at Princeton University. Says Khanna: “I just thought I was going to get a different experience, not better education. I really wanted to see things beyond Bombay and Bangalore.”

Khanna’s book, “Billions of Entrepreneurs — How China and India Are Reshaping Their and Future and Yours”, has just been published. He spoke to DNA Money’s Vivek Kaul about the book — and also about China and India. Excerpts:

First and foremost, what made you write this book?

One of the things we lack is a good understanding about China. The Chinese have always thought of India as being irrelevant and India has always thought of China being suspicious. The West, of course, has very strong preconceptions about China and India, which has been formed many decades ago. This book tries to offer a better picture.

Moreover, working on China and India together has an additional advantage because the two countries happened to develop in a way that are mirror inversions of each other. When you see India and China together, you appreciate our freedom of speech against its absence there. You appreciate our disaster on the infrastructure front against China’s sparkling new highways. In every dimension, it is yin and yang.

Unlike in India or most western nations, in China the government is the real entrepreneur. How does that help?

In India, if you look at all the successful companies, they are largely not in the state sector. In China, that is not the case. There are very few Chinese companies on the world stage that are not from the state.

In fact, if you have a successful private company in China, eventually the communist party will infiltrate. It will not take it over; it will just be there, as a guiding, helping and often a constructive hand. The government there is not a bad thing. A lot of people going into government service in China are very very bright. Also, what we call government in China are people who are incentivised very much like the private sector is in other places and that is the key. If you are a local body official or a head of a province or a city, you move up the hierarchy for generating local employment and for promoting economic growth and that is what you are rewarded for.

But till when can the government keep acting as an entrepreneur in China?

I don’t believe that entrepreneurship is suffering in China because the government is involved. However, it is true that the government’s problem in China is getting more and more interesting. Earlier the government in China would tell people “I will give you food, clothes and shelter and you don’t question my authority”. Then they said we will give you two-wheelers, then flat screen television and so on. Now it has run out of things to give, so now it is saying ok, you join the party. Earlier, peasants used to join the communist party. Now it is embracing people with successful businesses. Now it a capitalistic and bureaucratic party, which is called the communist party.

As you write in the book, one really cannot trust a lot of information about companies that comes out of China. So, why do we see western companies which keep talking about corporate governance in their own land, invest in China?

As far as the annual report information is concerned, you can now trust it a lot more than you could five years ago.

Western companies also talk about human rights in their own land, but it does not bother them when they are outside. I think this is a broader philosophical question, for which I do not have a good answer. However, the simple answer is that western companies care about their shareholder value. There shareholder value is enhanced by opening factories in China. In addition, the Chinese government is making it incredibly easy for them, by laying out state-of-the-art infrastructure. So western companies put aside bigger questions for being present in China. More than that, the benefits that are available to the foreign investor in China are not available to the local Chinese.

Where do you see companies making more money, India or China?

My intuition is that in the short run it is harder for foreign companies to break into India because the Chinese have made things very easy. However, in the longer run those who manage to settle down here have a better future. This is because in India you will only succeed if you have all aspects of the ecosystem working with you, so that the support base is very strong. On the other hand, in China you don’t need the people with you because you have the government on your side but you are vulnerable to all sorts of societal tumult.

The Chinese banking system is known not to be very strong. Having said that, some of the biggest IPOs to come out, have been those from Chinese banks. How do you explain that discrepancy?

The Chinese government is extremely serious about cleaning up its banking system, because it knows it is the Achilles’ heel. The reason that banks are in a bad shape is because they have been forced to bail out state-owned enterprises and they do not risk adjust the rates they charge on their loans. Therefore, what happens is that they have periodic injections of capital to clean up the bad loans or periodic movements of the bad loans into asset management companies.

Therefore, until unless state-owned enterprises are reformed and fixed, the banks will continue to suffer.

Many Chinese companies are trying to go global and so are many Indian companies. How do you see that panning out?

You can say several things. One is that in both cases you will see many companies going global. However, the important difference between Chinese and Indian acquisitions is that Indian ones are market driven, that is individual entrepreneurs making their own decisions. In China, it is the bidding of the state. Generally, they will not be as successful as the Indian ones.

You see more Indian companies being successful abroad?

Yeah. That’s right. They are market-oriented and partly because of that, since their own money is at risk, they are doing things in byte sizes first, to learn the ropes, which is exactly how you should think. First, you know how to crawl and then walk and then you run. The Chinese tried to do big politically sensitive large things, got slapped around and came back. In China, there is so much foreign investment coming in, but it is much weaker in terms successful companies going out.

Both in China and India, there seems to very little respect for Intellectual Property Rights (IPR). Do you see that changing as both the countries start generating more IPR?

India is a lot better than China. China has never had any indigenous enterprise and therefore there has never been any local demand for IPR. If the only person who has intellectual property is the foreigner, why not rip him off. By the way this is not uniquely Chinese or Indian, the US did this when it was developing country, by copying technology from UK and France. Look at Kiran Mazumdar Shaw at Biocon. She is leading the charge for IPR in this country and trying to get it enforced because it benefits her to have it enforced She can make money out of patents. Similarly, Chinese companies are doing the same thing. So I think the scenario will change over time.

k_vivek@dnaindia.net

![submenu-img]() This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...

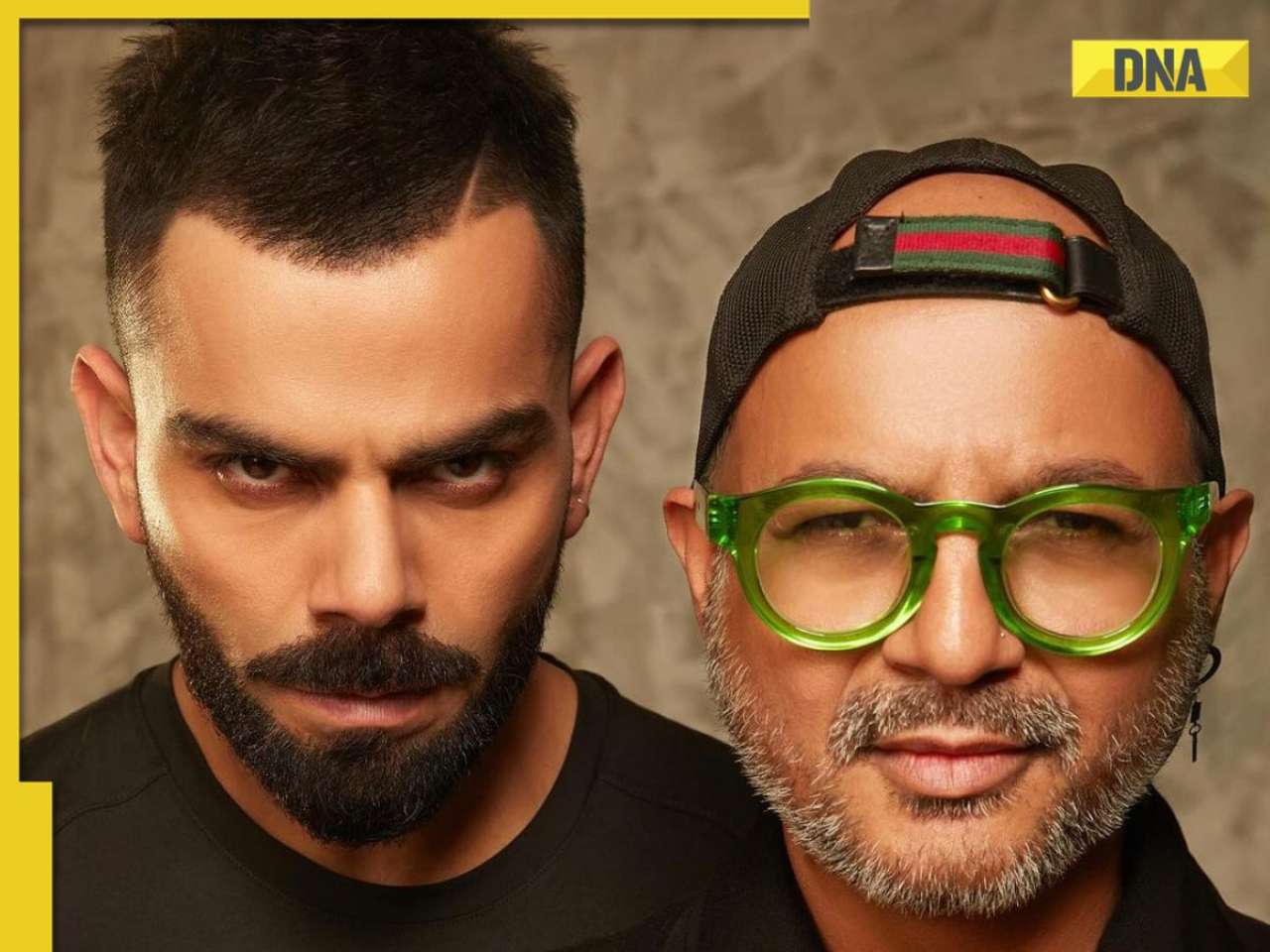

This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...![submenu-img]() Virat Kohli’s new haircut ahead of RCB vs CSK IPL 2024 showdown sets internet on fire, see here

Virat Kohli’s new haircut ahead of RCB vs CSK IPL 2024 showdown sets internet on fire, see here![submenu-img]() BCCI bans Mumbai Indians skipper Hardik Pandya, slaps INR 30 lakh fine for....

BCCI bans Mumbai Indians skipper Hardik Pandya, slaps INR 30 lakh fine for....![submenu-img]() 'Justice must prevail': Former PM HD Deve Gowda breaks silence in Prajwal Revanna case

'Justice must prevail': Former PM HD Deve Gowda breaks silence in Prajwal Revanna case![submenu-img]() India urges students in Kyrgyzstan to stay indoors amid violent protests in Bishkek

India urges students in Kyrgyzstan to stay indoors amid violent protests in Bishkek![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…

Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

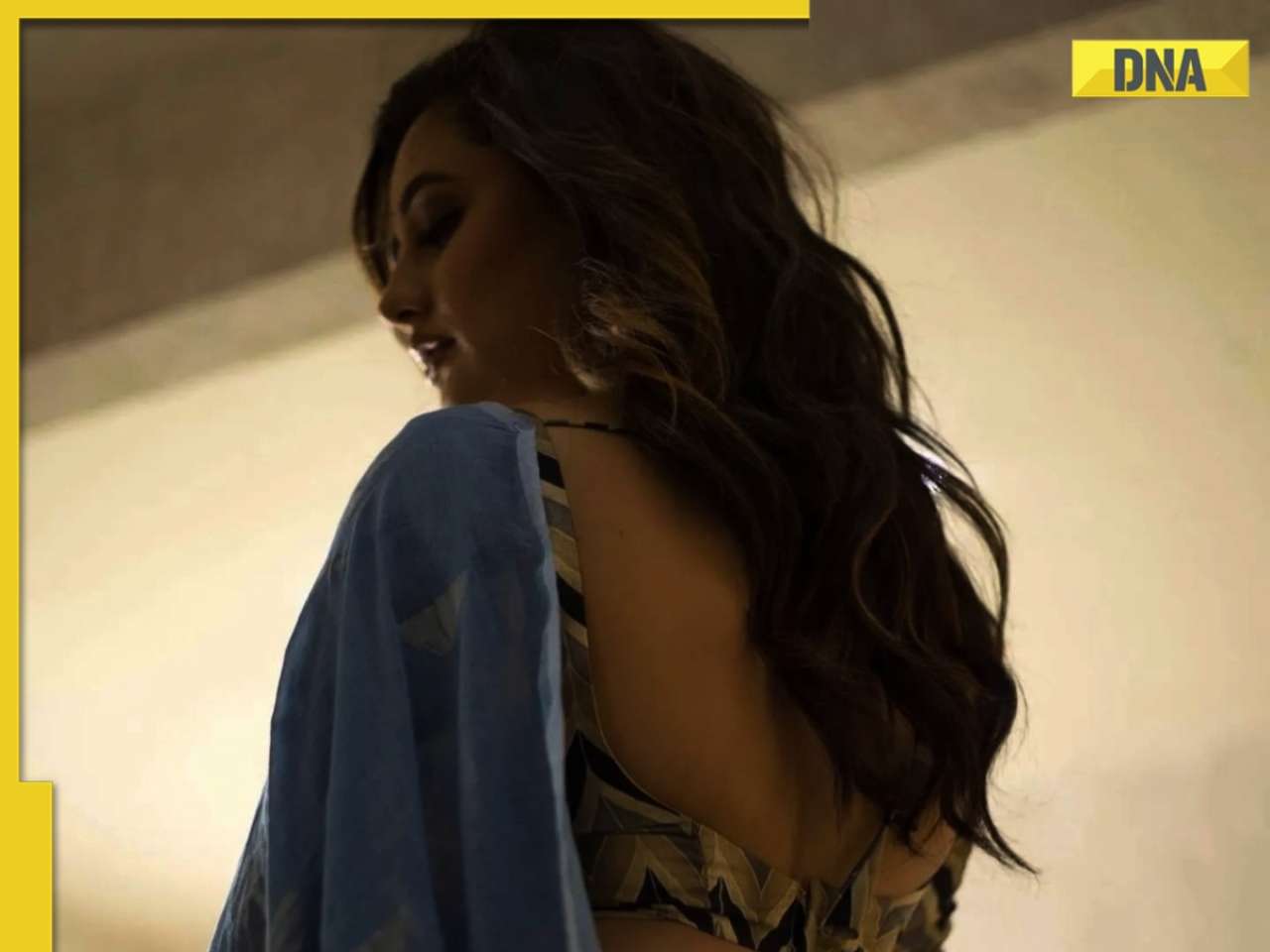

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’

Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’![submenu-img]() Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'

Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...

This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...![submenu-img]() This film had 3 superstars, was unofficial remake of Hollywood classic, was box office flop, later became hit on...

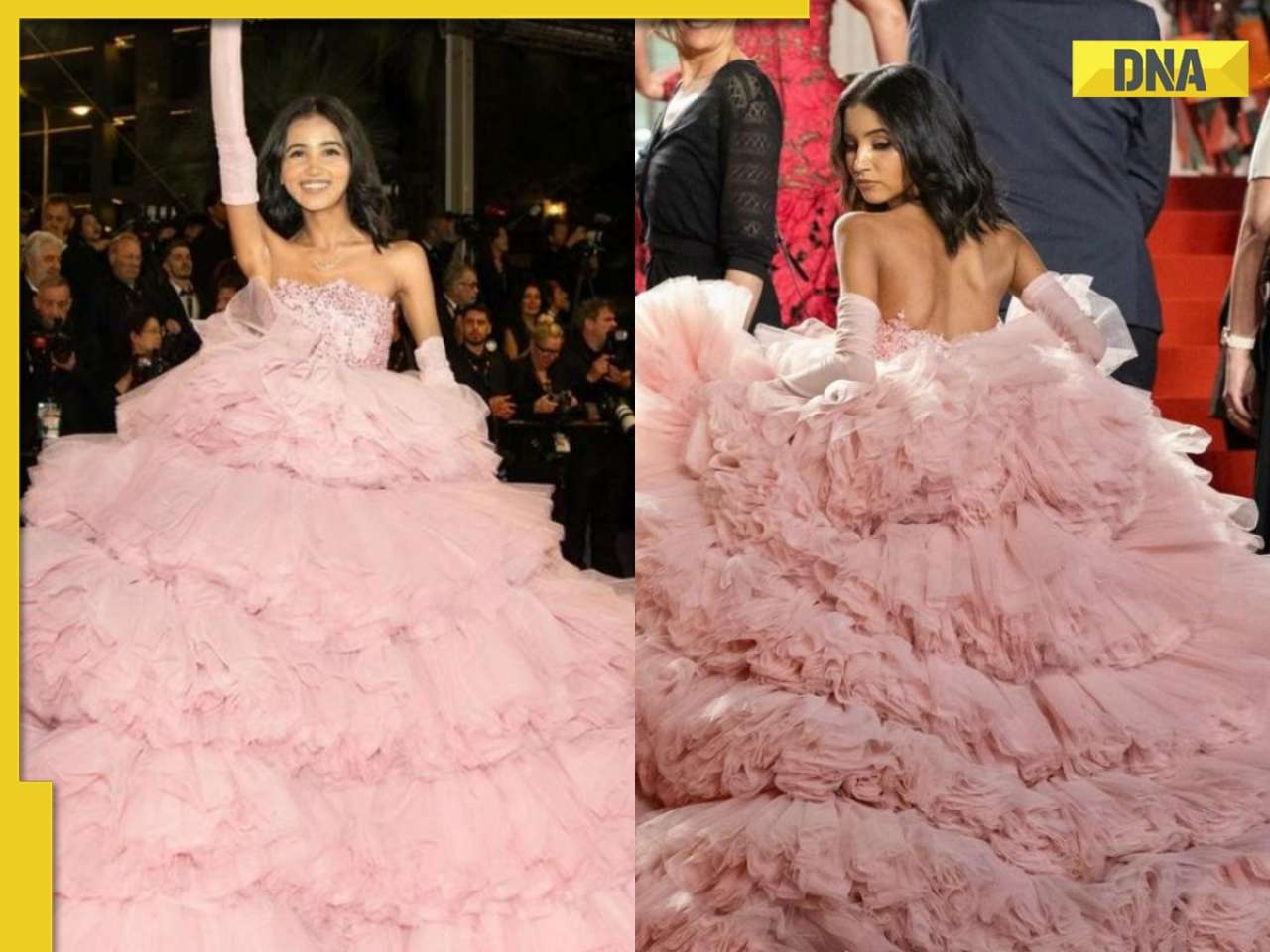

This film had 3 superstars, was unofficial remake of Hollywood classic, was box office flop, later became hit on...![submenu-img]() Meet Nancy Tyagi, Indian influencer who wore self-stitched gown weighing over 20 kg to Cannes red carpet

Meet Nancy Tyagi, Indian influencer who wore self-stitched gown weighing over 20 kg to Cannes red carpet![submenu-img]() Telugu actor Chandrakanth found dead days after rumoured girlfriend Pavithra Jayaram's death in car accident

Telugu actor Chandrakanth found dead days after rumoured girlfriend Pavithra Jayaram's death in car accident![submenu-img]() Meet superstar who faced casting couch at young age, worked in B-grade films, was once highest-paid actress, now..

Meet superstar who faced casting couch at young age, worked in B-grade films, was once highest-paid actress, now..![submenu-img]() Viral video: Flood-rescued dog comforts stranded pooch with heartfelt hug, internet hearts it

Viral video: Flood-rescued dog comforts stranded pooch with heartfelt hug, internet hearts it![submenu-img]() Dubai ruler captured walking hand-in-hand with grandson in viral video, internet can't help but go aww

Dubai ruler captured walking hand-in-hand with grandson in viral video, internet can't help but go aww![submenu-img]() IPL 2024: Virat Kohli drops massive hint on MS Dhoni’s retirement plan ahead of RCB vs CSK clash

IPL 2024: Virat Kohli drops massive hint on MS Dhoni’s retirement plan ahead of RCB vs CSK clash![submenu-img]() Do you know which God Parsis worship? Find out here

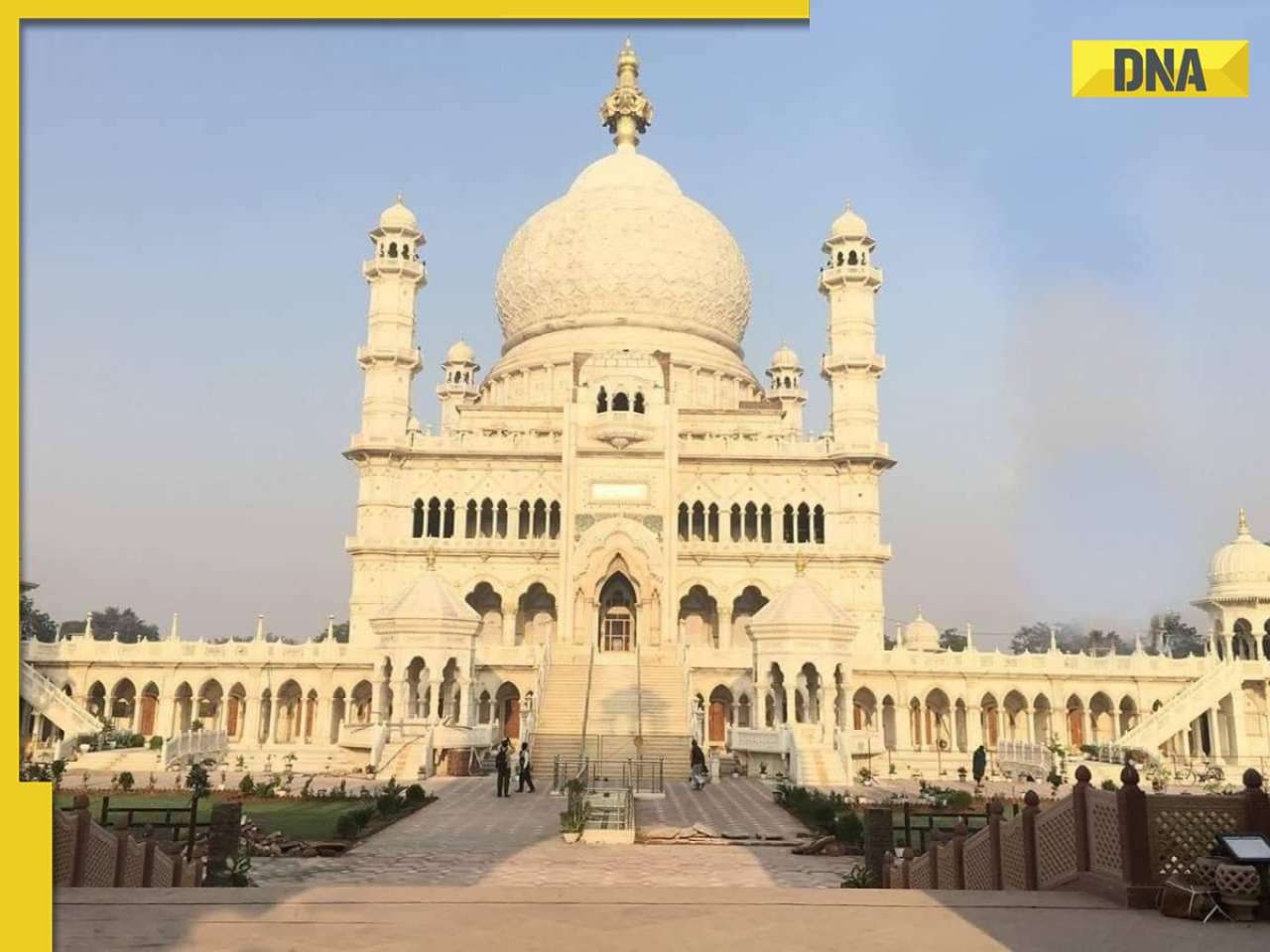

Do you know which God Parsis worship? Find out here![submenu-img]() This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

)

)

)

)

)

)