The CMD of GTL Infrastructure hasn’t forgotten the old days when GTL (now the holding company) share price plunged from great heights to scrape the bottom.

Wants GTL Infra to become the global leader in network solutions

MUMBAI: The CMD of GTL Infrastructure hasn’t forgotten the old days when GTL (now the holding company) share price plunged from great heights to scrape the bottom as the dotcom bubble burst and the share prices and the business models of GTL along with its peers crashed.

“When a crisis hits you, the biggest worry for institutional investors is whether the management can withstand it,” Manoj Tirodkar told DNA Money.

Many investors perceived that GTL was ‘buckling’ under the crisis. Reminiscing of the painful days, Tirodkar admitted that GTL then was focused on too many businesses.

“I think we paid for it.” The stock which commanded a market cap of $2 billion was floored and had the ignominy to scrape the bottom with a valuation of $50 million.

Investors, primarily foreign, have now pulled up the group valuations to $1.7 billion. IDFC is a shareholder with 5% stake in GTL Infrastructure and KFW, the German financial powerhouse, has an indirect stake in the company.

GTL holds about 40% of the equity in the network solutions and tower business company.

When quizzed about the painful period, he is prepared for the question. Looking back on those precarious days, he recounted:

“As the largest shareholder, I stepped in. We acted on their (investors) suggestions and took all their criticism and categorised it.”

The foremost complaint was that his business consisted of many segments. GTL was then into IT, software, BPO and KPO. So investors did not understand the business model.

Tirodkar began to simplify the business model by exiting non-core areas.

We are now based only in processes, systems and knowledge management. The painful restructuring saw the company get rid of 75-80 managers. The focus to change came about after investors dumped the company during the dotcom bust.

GTL is a ‘virtually rebuilt company’ in the last five years. It is in India, Middle East, and Africa and he admits that he can no longer enjoy 25% margins as in the IT industry.

For the next 5-7 years, Tirodkar expects five or six players in the telecom services field alongwith GTL Infra.

Tirodkar is ambitious, and the only promoter on the board. “We’ll grow in the telecom services space the way L&T is growing in the construction space,” the young CMD in his forties said.

GTL Infra will work in unison with telecom service providers. The restructuring was very painful, as 5,000 employees were “placed out” and 85 managers got the pink slip.

He realised, “that when the markets did well, conglomerates fly, when the markets are soft, investors want companies to be focused.”

While the telecom sector commanded $100 billion, the revenue is pegged at $15 billion. It will however grow 40% annually.

He still retains the bravado of a young entrepreneur. He wants GTL Infra to become the global leader in network solutions. He talks of leaders in the space as his rivals- “Nokia, Motorola, Ericsson not a single global player can dominate the market.”

The company also did a buyback, in addition to an annual dividend of Rs 30-40 crore, he pointed out. To top it, he made an open offer, which he touted as the ‘single largest open offer’ by any promoter in India.

He talks about the potential. “I think you have not even seen 1/10th of our potential. The sector is hot.”

![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Delhi-NCR schools receive bomb threat call, evacuated

Delhi-NCR schools receive bomb threat call, evacuated![submenu-img]() AstraZeneca admits Covishield vaccines raises rare side-effects risk. How worried should you be?

AstraZeneca admits Covishield vaccines raises rare side-effects risk. How worried should you be?![submenu-img]() Meet Mukesh Ambani’s ‘brother’, left his own firm to join Reliance, not Anil Ambani, his son now has Rs 650000000000…

Meet Mukesh Ambani’s ‘brother’, left his own firm to join Reliance, not Anil Ambani, his son now has Rs 650000000000…![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

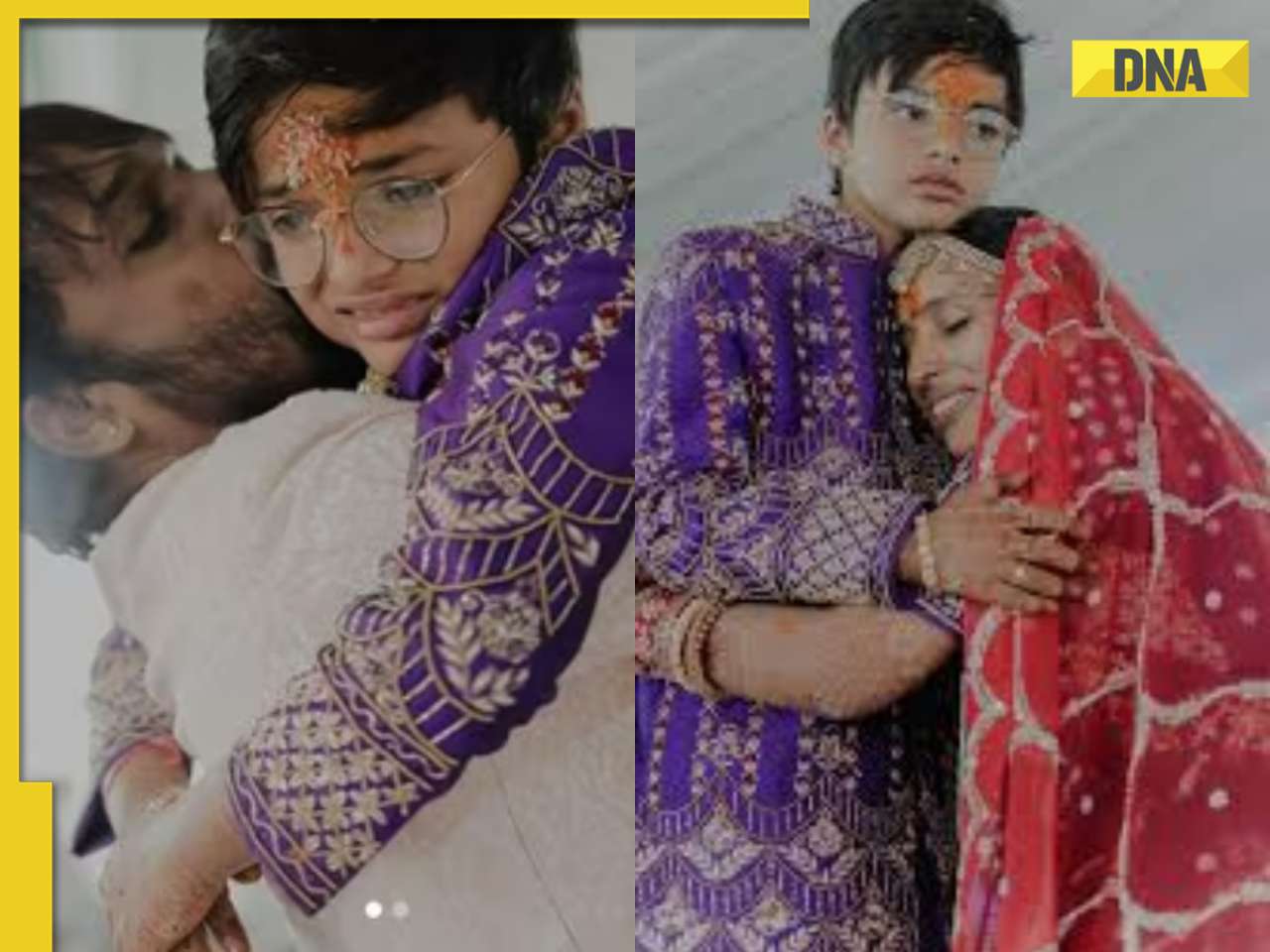

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() Mukesh Chhabra opens up about his fallout with Kriti Sanon, confesses to hurting her: 'I lied about her and then...'

Mukesh Chhabra opens up about his fallout with Kriti Sanon, confesses to hurting her: 'I lied about her and then...'![submenu-img]() Meet actress, who became a star at 19, got stuck with bold roles, sex scenes; quit films, now lives in poverty

Meet actress, who became a star at 19, got stuck with bold roles, sex scenes; quit films, now lives in poverty![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside![submenu-img]() Mukesh Ambani's son Akash Ambani visits Ram Temple in Ayodhya, pics surface

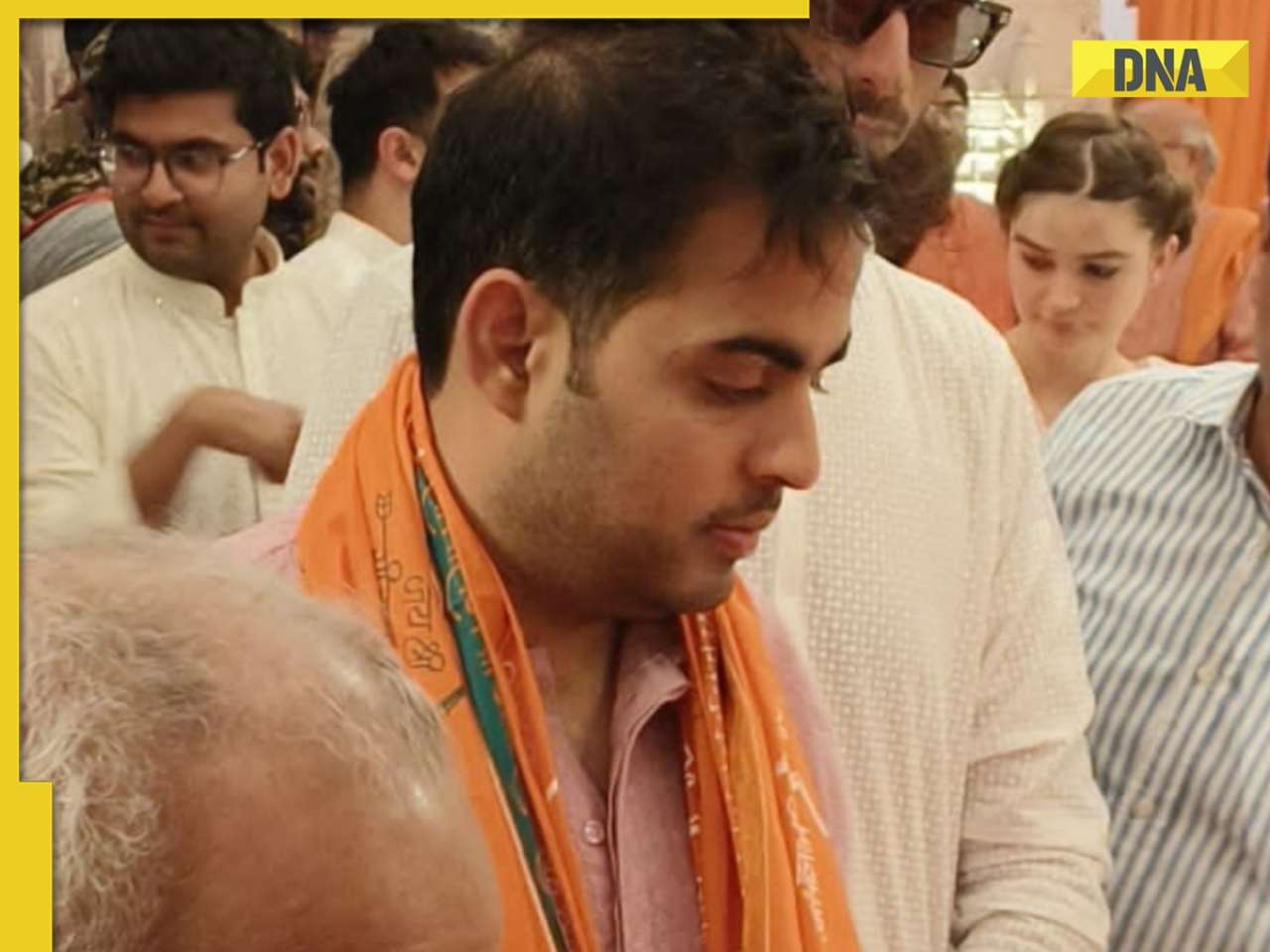

Mukesh Ambani's son Akash Ambani visits Ram Temple in Ayodhya, pics surface

)

)

)

)

)

)