My next-door neighbour is a financially astute man. He has the knack for spotting both strategic and tactical investment opportunities.

My next-door neighbour is a financially astute man. He has the knack for spotting both strategic and tactical investment opportunities and making good use of his investible surplus.

The other day, we were having tea at my place, while watching that incredible movie, Lage Raho Munnabhai, on TV. As the story progressed to the eviction of elderly men by a mentally ‘bimaar’ villain, my neighbour remarked how he had been very lucky (and smart!) in his house purchase.

While living in his own house in Mumbai, he had spotted a good investment opportunity in one of the suburbs and purchased a second apartment way back in 1995-96. A flat he had then purchased for merely Rs 10 lakh was worth over Rs 50 lakh today, after having earned him rent in the interim, and a tax rebate on the loan he had paid off in five years.

He went on to say how he would invest in a new house or land once every 7-10 years, once his savings reached a certain critical size. What better way to make your assets real and tangible by having them as property instead of paper debt or equity, he asked.

Spectacular returns?

I could not but admire his foresight. But being the finance man I am, my mind drifted off to perform a crude calculation of his return on investment over this period. Rents in this suburb (as with most of the country) yield ~3% per year, which comes down to ~2.5% after taxes, society charges and costs of periodic upkeep and maintenance like plastering, painting, waterproofing, etc.

His investment had roughly multiplied five times in 12 years - a good 14-odd percent annual return. Thus, in all, a handsome year-on-year growth of 17% or so — not a bad deal at all.

I then turned to the alternative avenues his money could have gone into. The Sensex was at 3,000 then - it is at 17,000 today. So if he had invested the Rs 8 lakh in the stock market then, he might have got a return of about 17% here, too, besides a dividend yield of 1.5-2%. Some of the mutual funds that have been in existence since then have given ~25-30% annualised return.

Thus, although his investment was good, it probably was not as spectacular as I had thought earlier. Yes, there is the tax break on loan repayment, but there is also the capital gains tax to be paid on profit in the event he sold the house.

The risk argument

I took the opportunity provided by a commercial break in the movie to run him through my thought process. Initially, he was a bit shocked by the numbers; he had only thought of returns as multiples of investment over the decade, not as annualised ones. But he recovered to argue that the risk was much higher in the stock market than in real estate. “Look at the daily volatility these days,” he said.

But isn’t that a fallacy brought about by the fact that stock prices are reported daily, while real estate movements are not? Real estate prices, too, are known to fluctuate wildly - Mumbai had the great slump after 1995-96 and recovered only in 2003.

Unfortunately, we do not have an index to track the daily real estate prices in the country. Real estate value, by its inherent nature, moves in a jerky and ad hoc fashion, but that does not make it any less volatile or risky. Moreover, his entire net worth is concentrated in real estate in and around Mumbai alone. An adverse movement there would destroy his wealth significantly.

I reiterated to him that I was not trying to belittle his success at investing or showing real estate in a poor light, but merely trying to put it in context and see that other investments could also have yielded similar or better returns.

Paper wealth vs. tangible wealth

“You are probably right,” he said, “but I feel comfortable having a tangible real estate holding than a paper portfolio of stocks or funds.” This thinking is prevalent. And it is not so much about equity versus real estate - such people would be as wary of investing in a real estate trust as they would be in equity - as much as it is about ‘paper’ wealth versus tangible assets.

The reasons are not hard to seek. Many of us have grown up at a time when equity markets were either non-existent, or were plagued by scams in the initial period of their development (circa 1992). On the other hand, ownership of a house has been considered a necessity almost since time immemorial, and there is nothing more comforting than having a roof over your head. Of course, this thinking got extended to investment assets as well - to houses that were not bought for self-use, but for appreciation.

However, I dare say the equation has reversed in India in the recent past. Over the last 10 years or so, market regulator Securities and Exchange Board of India (Sebi) has been remarkably successful in streamlining processes and plugging loopholes in the system.

Scams occur, but are few and far between, with Sebi handing down exemplary punishments to law-breakers. Investor education material on equities and funds is available in plenty, and the system has become efficient enough to bring transaction costs down by orders of magnitude.

If anything, it is the real estate sector that continues to languish in terms of corruption and lack of efficiency. Land deeds in several places are far from clear. The quality of construction in a lot of apartments leaves a lot to be desired. Transaction costs in terms of stamp duties, taxes, registration charges and broker charges add up to a sizeable fraction of the property value over time.

Yes, there are good builders and good properties, but these require extensive research to locate and transact. If one puts in as much research into equities and funds, they too would yield comparable or better returns over time.

Implications for portfolio

It was time for my neighbour to leave, and he admitted that this discussion was as absorbing as the movie. “Circumstances have changed significantly, and the paranoia about ‘paper’ wealth is probably unfounded,” he admitted, adding, he would henceforth use his acumen to research and invest his future surplus in shares and funds, now that he had sufficient real estate holdings.

This, in my opinion, is the crux of the argument. Many of us sub-consciously think of ‘safety’ in tangible assets, and in the process end up concentrating almost the entire net worth in property.

A more rational analysis would reveal the drawbacks of this approach and suggest a more diversified portfolio. It would tell us that in a growing economy like India, equities have surpassed, and will continue to at least match, real estate in performance and returns over the medium to long term. Something you, too, could munch over leisurely the next holiday afternoon.

The author is a certified financial planner and a MBA from IIM, Ahmedabad. He is director, PARK Financial Advisors (www.parkfinadvisors.com), Mumbai. (info@parkfa.com)![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

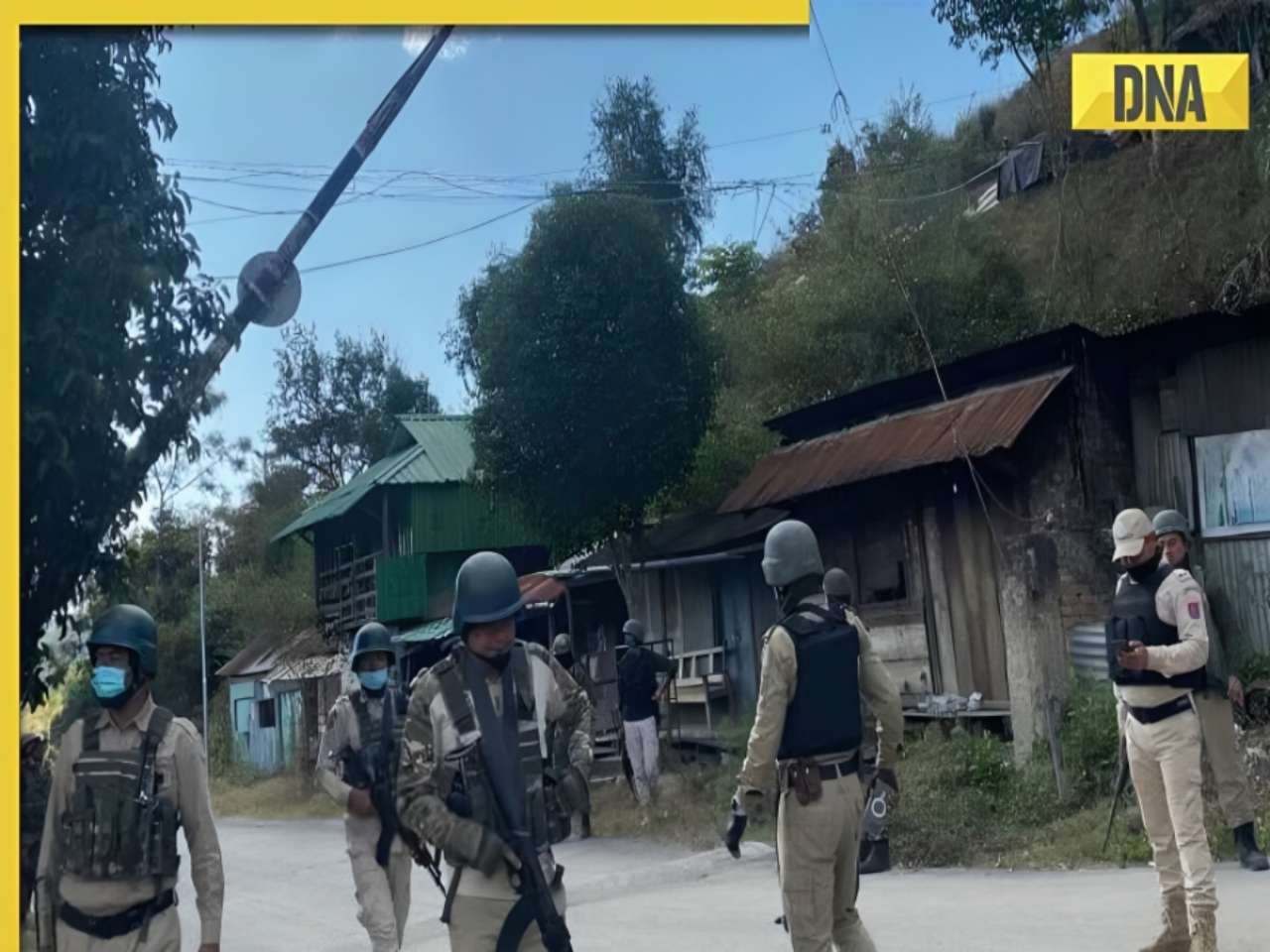

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

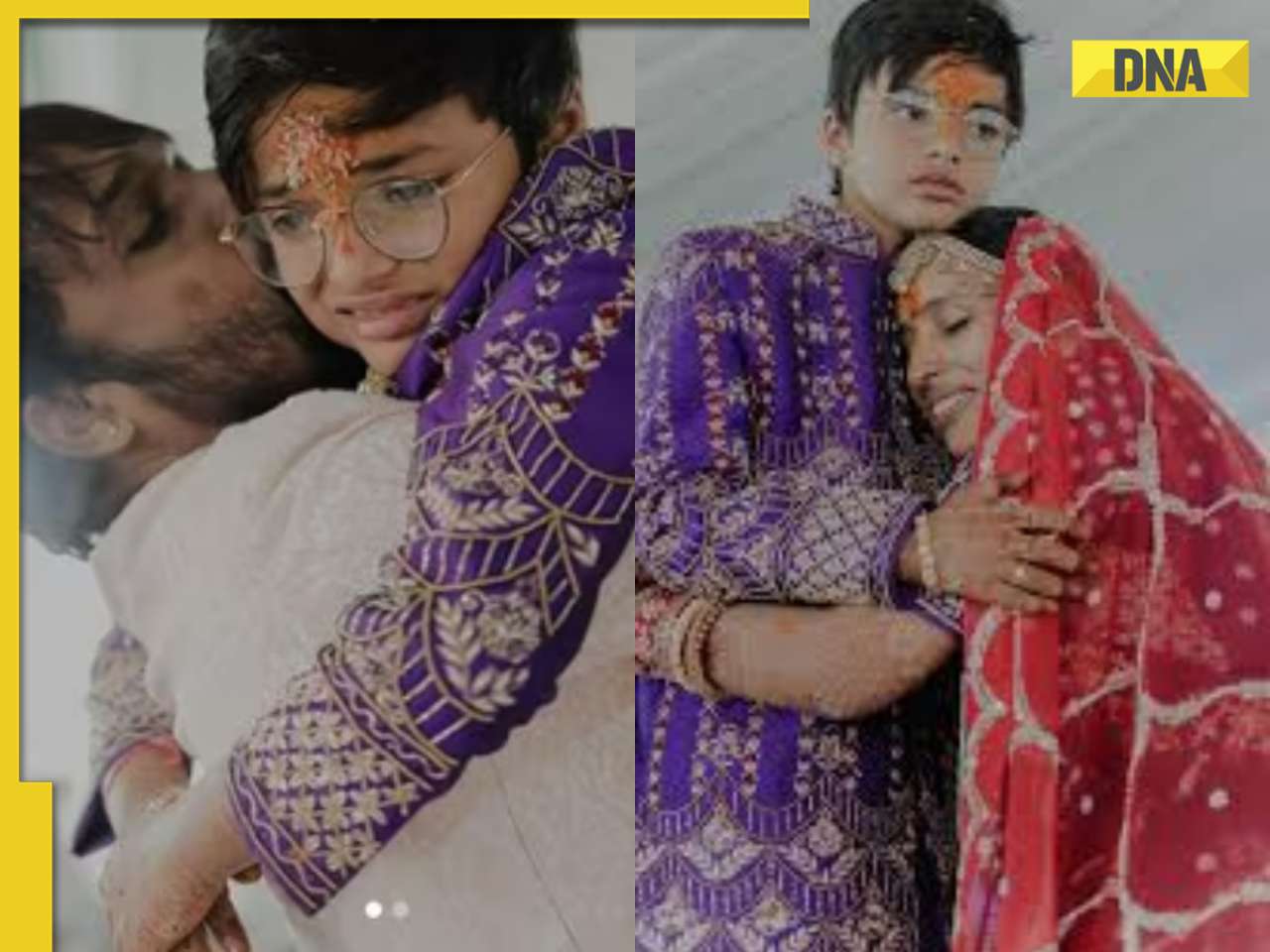

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)