More equity investment is good for younger people, while adults need bigger insurance covers and balanced investing

Rishi Nathany

Pradeep Kumar is a 50-year-old running a machine spares business. He is married and has three children - two daughters (aged 22 and 16, respectively) and a son (20). He also has his father, a widower (80), living with them. The whole family is in very good health, except for his father who suffers from seasonal, age-related health issues.

His needs

Pradeep is a self-made man who set up his business from scratch and rose from very humble beginnings. His business is doing moderately well and he expects to consolidate at this level. He is not looking for much aggressive growth.

- He expects this plan to help him free up some working capital from business. Also, surplus profits will not be required for business growth and funds from both these avenues can be channelised into investments to provide for the marriage of his children, which is a major concern for him at present. He dreams of grand weddings for his children and also wants to gift them a respectable investment portfolio.

- At the same time, he wants to keep aside enough for his retirement and also wants to travel and go on pilgrimages once all his children are married.

Financial situation

Pradeep has over the years been very wise and has put aside a tidy sum of money, amounting to Rs 80 lakh in various investments. Since his income from business is quite variable in nature, he has at times resorted to using the income from his investments to support his family and business expenses. Coming from humble beginnings, he lives quite simply and his family expenses amount to Rs 20,000 per month,

He has another Rs 30 lakh invested in his business and earns about Rs 6 lakh per annum, net after taxes, from his business. Whatever he saves over his expenses, he invests. He has mainly invested his money in GOI Relief Bonds and LIC Bima Nivesh, which were giving higher than the present market rates of interest as they were done some time ago, but a bulk of which is about to mature.

However, he has shares, allotted in IPOs, worth about Rs 6 lakh at current value. Some of the shares have appreciated substantially, whereas some are worthless paper. He lives in a self-owned apartment in the suburbs and his office is rented. Besides the flat, he does not have any other investment in real estate. He plans to pass on this flat and business to his son, though he has not made a Will as yet.

Pradeep’s father does not possess any substantial assets and is dependent on him. His life insurance policies have all matured. He has a personal life insurance cover of Rs 5 lakh in money back and endowment policies. No other family member has life insurance, though there is a medical insurance cover of Rs 50,000 for each family member. Pradeep has now approached a certified financial planner to help him plan his financial life and help him to successfully achieve his twin dreams of providing for his children’s marriages and leading a relaxed retired life, while taking care of his elderly father.

Analysis and recommendations

Financially, Pradeep seems to be in a rather comfortable situation. However, he does need to strike a balance between providing for his children and his retirement. After detailed discussions with his certified financial planner and with his help, Pradeep has been able to quantify his dreams for his children and his retirement:

- He wishes to spend Rs 5 lakh in today’s terms on each daughter’s wedding and gift them assets of Rs 10 lakh each. He also plans to spend Rs 5 lakh on his son’s wedding and gift jewellery worth Rs 5 lakh to his daughter-in-law. The balance Rs 40 lakh will form his retirement kitty.

- He plans to get his eldest daughter married as soon as possible. Therefore, it is recommended that he keep aside Rs 5 lakh for her wedding expenses in very liquid investments like short-term floating rate debt funds.

- The portfolio of Rs 10 lakh he wants to gift his eldest daughter can be invested as follows: Rs 8 lakh in long-term debt funds with a systematic transfer plan of Rs 20,000 per month into diversified equity funds. Since she is young, she is being given higher exposure to equities, which is the best performing asset class over the long run and which will build up over the next few years as it seems unwise to invest all her money in equities at one go when the markets are at an all-time high. This method will ensure she has a good average rate of purchase for her equity portfolio. Around Rs 1.5 lakh can be invested in the Post Office Monthly Income Scheme, which will provide her with a monthly income. Also, Rs 50,000 should be invested in a short-term floating rate income fund to provide her with liquidity for emergencies and protect against adverse interest rate swings.

- For his second daughter, Pradeep can follow the same investment pattern with a corpus of Rs 15 lakh, as has been done for his elder daughter, considering she has 5-6 years before getting married. Therefore, he can invest more in equities to get better returns over this time.

- As for his son, who he expects to marry off in 3-4 years, he can follow the same method of investments as he is doing for his second daughter. However, one difference here can be an investment of 5 grams of gold per month by buying gold bars from his bank. This will help him build up a stock of gold for his daughter-in-law’s jewellery and also get him a good average price for his gold purchase, especially when the bullion markets are rising every day.

- This would leave Pradeep with about Rs 6 lakh in shares and the balance Rs 34 lakh in other fixed investments. He is very conservative and does not want much risk. Therefore, it is suggested that he liquidate his portfolio of shares and invest the amount in a diversified mutual fund. It is obvious that he is a passive investor who never manages his portfolio. Therefore, it will be better for him to let professional fund managers manage his money, which will help him get better returns.

- Since he is 50 and has 5 years to go before he retires, Pradeep can raise his equity exposure by another Rs 4 lakh on a very conservative level, to a total of Rs 10 lakh, which is 25% of his retirement savings. The balance Rs 30 lakh can stay in GOI Relief Bonds and 25% in ELSS schemes of mutual funds. This will give him good returns as well as tax breaks under section 80C. He should invest the balance in PPF and floating rate debt funds. PPF will provide tax relief u/s 80C and interest is tax-free. Investment in floating rate debt funds will give volatility insulated fixed returns and will provide liquidity in emergencies and for his travelling.

- His insurance is abysmally low and given his good health, he should not have any problem in getting more insurance. It should be increased to at least Rs 30 lakh, if not more, which is the earning value of balance 5 years’ working life. His son should also be insured for the same amount at present, which can be increased, once he starts running the business. Both should take out pure term insurance policies. Their medical cover should also be raised to Rs 2 lakh each, given the rising cost of medical treatment. However, Pradeep’s father will not be eligible to raise his limit, as he is overage. They should also take out accident and disability policies for the family, which has very reasonable premiums.

- Finally, Pradeep should make a Will and properly plan out how he wants to pass on his estate.

All these should ensure that Pradeep and his family enjoy the forthcoming weddings and their lives ahead with complete peace of mind, knowing they have a plan in place.

The author is a practising Certified Financial Planner and is director, Touchstone Wealth Planners Pvt Ltd. The views expressed above are those of the author and do not necessarily represent the views of FPSB India. Feedback may be mailed to myplan@fpsbindia.org

![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

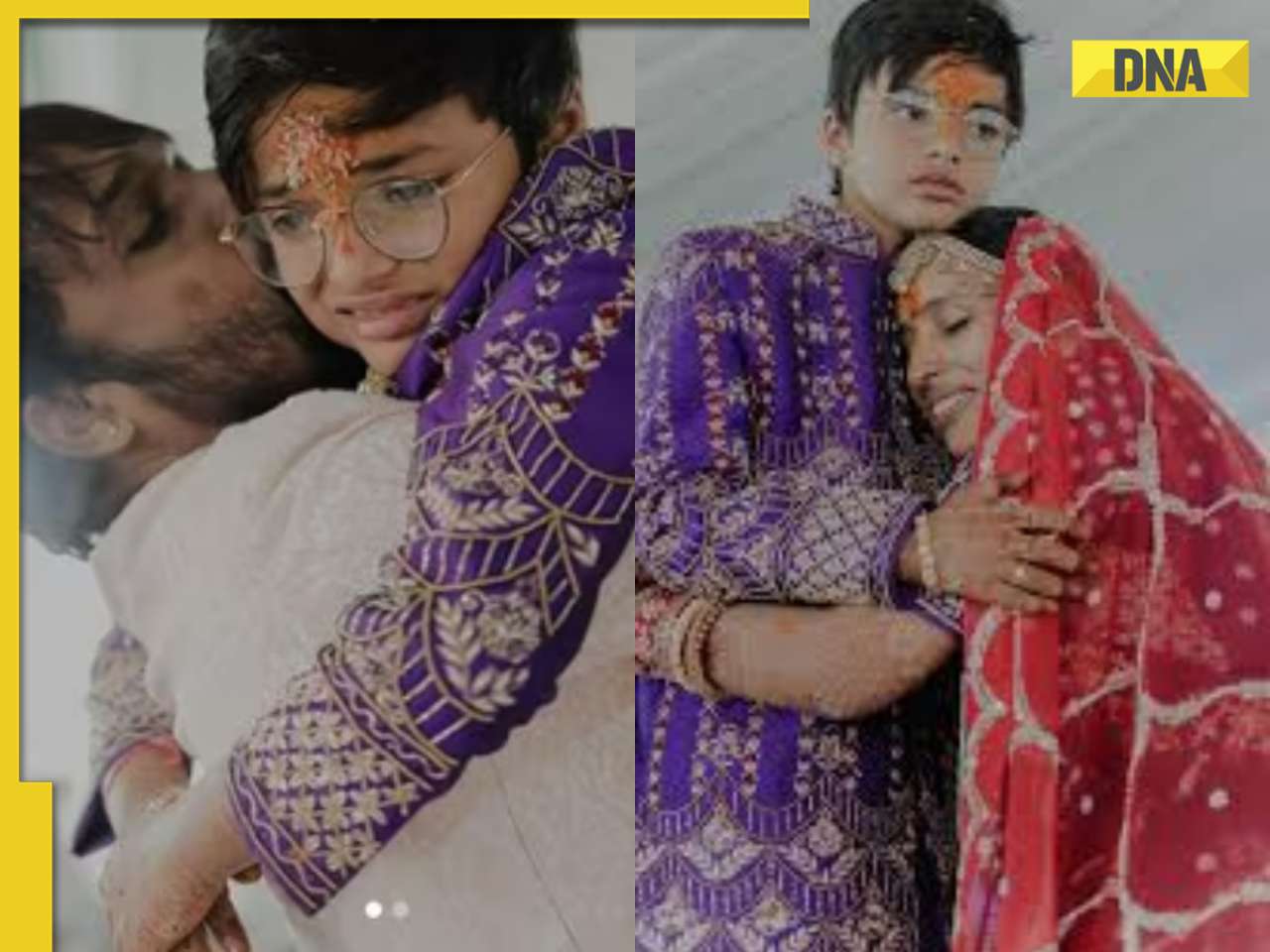

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)