Most of them are flying straight into turbulence, but industry’s promise is too tempting for the new players.

MUMBAI: What is one to make of an industry where the largest player has to sell assets to make profits appear better than they are? Or when an aggressive player enters the capital market by promising another year-and-a-half of losses, but still wants to sell his shares at 15 times face value?

It’s either an industry that doesn’t believe in economic logic or one that is on the threshold of such massive growth that such short-term realities don’t matter.

Both images are true of the Indian aviation industry, which is bleeding profusely as costs soar and airfares continue to stay firmly down due to competition. The main listed company and market leader, Jet Airways, has just turned in fourth quarter results for fiscal 2005-06 where earnings before interest, tax depreciation and amortisation (Ebitda) fell 51% when turnover grew 35%. This is the result of selling the bulk of its tickets at discounted rates. To rescue the bottomline, Jet sold five aircraft and leased them back. With its recent acquisition of Air Sahara, which is steeped in losses, Jet is, if anything, going to fly deeper into turbulence.

Air Deccan, the country’s original cut-price airline, has just lowered ambitions of selling its equity at fanciful prices of Rs 300-500 apiece. Its initial public offer, slated to open on May 18, asks for a price in the range of Rs 150-175 when the airline has reported a net loss of Rs 121 crore in the first eight months of 2005-06 (till November).

The red ink, though, isn’t frightening anyone. If anything, the scent of fast-paced growth is only attracting more competitors. After SpiceJet Ltd (May), Kingfisher Airlines (May), Paramount Airlines (September) and GoAir (November) launched their services in 2005, another half-a-dozen are waiting in the wings to take off.

What commercial logic is driving businessmen to aim for a piece of the Indian sky?

“There is still a huge untapped potential in this sector. Today, all Indian airlines put together are serving only around 25 million passengers annually in a country with a population of over 1,000 million. They are catering to only 2.5% of the population. Singapore Airport alone handles over 32 million passengers while Europe’s largest low-cost airline, RyanAir, flies over 38 million passengers. So, you can imagine the potential that is waiting to be tapped in India,” says Air Deccan managing director GR Gopinath.

“When I decided to start an airline, there was only one low-cost carrier (Air Deccan). Now there are three of us, but the rate at which the air traffic is growing, there is profit for all of us to be made,” says Jeh Wadia of GoAir.

Clearly, long-term growth potential is blinding everyone to the losses. According to figures put out by the Centre for Asia Pacific Aviation (CAPA), India’s air traffic in the domestic sector grew from 19.5 million in the last fiscal (2004-05) to 25 million this fiscal. This is a growth of 28%. And, according industry players, this is just the beginning. They say this level of growth is sustainable for at least the next five years.

Uttam Kumar Bose, president and CEO of feeder airline Jagson Airlines, which has announced plans to launch its own low-cost airline some time this year, believes that there is huge scope for new airlines to make a profit.

“Indian airlines will be able to make the same kind of windfall from aviation business that Chinese airlines did in the first 15 years after the aviation sector took off in China. A lot would depend on how innovative and creative you are with your business model. When we launch, we are planning to come out with a new concept which will ensure commercial viability,” says Bose.

Bose won’t quite tell what his “new concept” will be, but it had better be something that brings in higher margins. CAPA chief executive Kapil Kaul says that the current average margin in the aviation industry ranges from 4% to 8%. “Indian companies, however, are still far away from profitability. Except for Jet, which has been consistently making profits since its inception, none of the others are making profit,” says Kaul.

Industry experts say that operating margins in the airline business do not tend to be huge, but on high volumes even small margins translate into substantial profits. And these profits are proportional to the shortfall in capacity. Most airlines make their best profits when this gap between demand for airline seats exceeds supply. At present, India is passing through that phase.

Rising income is swelling demand for air travel. Airlines are trying to fill the supply gap by expanding their seat capacity. Over the last one year, Indian carriers have ordered over 300 aircraft. Despite such orders, India’s fleet strength would still lag behind China’s fleet of 1,000 aircraft.

“There is scope for adding more aeroplanes. Now, whether it is the same company adding it or there are different players adding it, we need to understand its impact on profit. If many of them are adding capacity, then overheads get duplicated and can impact the industry’s profitability adversely,” reasons SpiceJet Ltd CEO Siddhanta Sharma.

But even as entrepreneurs make a beeline to enter the sector, rising costs of aviation fuel, employees, and aircraft lease rentals are squeezing margins when airfares refuse to rise in line. In the last two quarters of fiscal 2005-06, market leader Jet Airways has taken a big hit on profits, which have tumbled over 50%. But it is not just Jet whose margins have been squeezed. The same cost-fares pincer has crimped the yields of all seven domestic Indian carriers (Jet, Indian Airlines, Kingfisher, Air Deccan, SpiceJet, GoAir and Paramount).

One result has been a pushback in the breakeven dates of many start-ups. Take the case of SpiceJet, which was expecting to break even with 7-8 aircraft. Now that competition has intensified, its gestation period has got stretched.

According to Air Deccan’s CFO Mohan Kumar, it takes about one year for any particular flight route to become profitable. Air Deccan currently makes money on only 60 of its 250 flights.

But that’s not the same as saying that investors are kissing goodbye to their money by investing in aviation. The CEO of Dubai-based private equity company Istithmar, Muneef Tarmoom, who has invested in SpiceJet, is not complaining about the lack of returns yet. “We are very pleased with our investment in SpiceJet,” he says. Tarmoom adds that Istithmar puts its funds only in projects that give returns of over 20%. “We are not interested in anything below that,” says the seasoned investor.

It will take a while for investors to find out whether their bets have been right or wrong. The message from international aviation, where airline after airline is slipping into bankruptcy, is troublesome. In the US, after United Airlines, two of its biggest rivals - Atlanta-based Delta and Minnesota-based Northwest - are also headed for restructuring under Chapter 11. Many other major airlines around the world have also hit air pockets and are either merging or entering into alliances to survive.

India cannot be entirely insulated from this reality. While the government has already announced an intention to merge Air India and Indian, Jet Airways has acquired Sahara. “Even as new airlines will appear in the Indian sky, we must not rule out mergers and acquisitions in the very near future as players try to consolidate,” forecasts Edelweiss Capital analyst Nikhil Garg.

In sum, the sector will continue to boom; but not everyone will be able to take the heat of competition. Only the fittest - and those with the fattest wallets - will survive.

![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

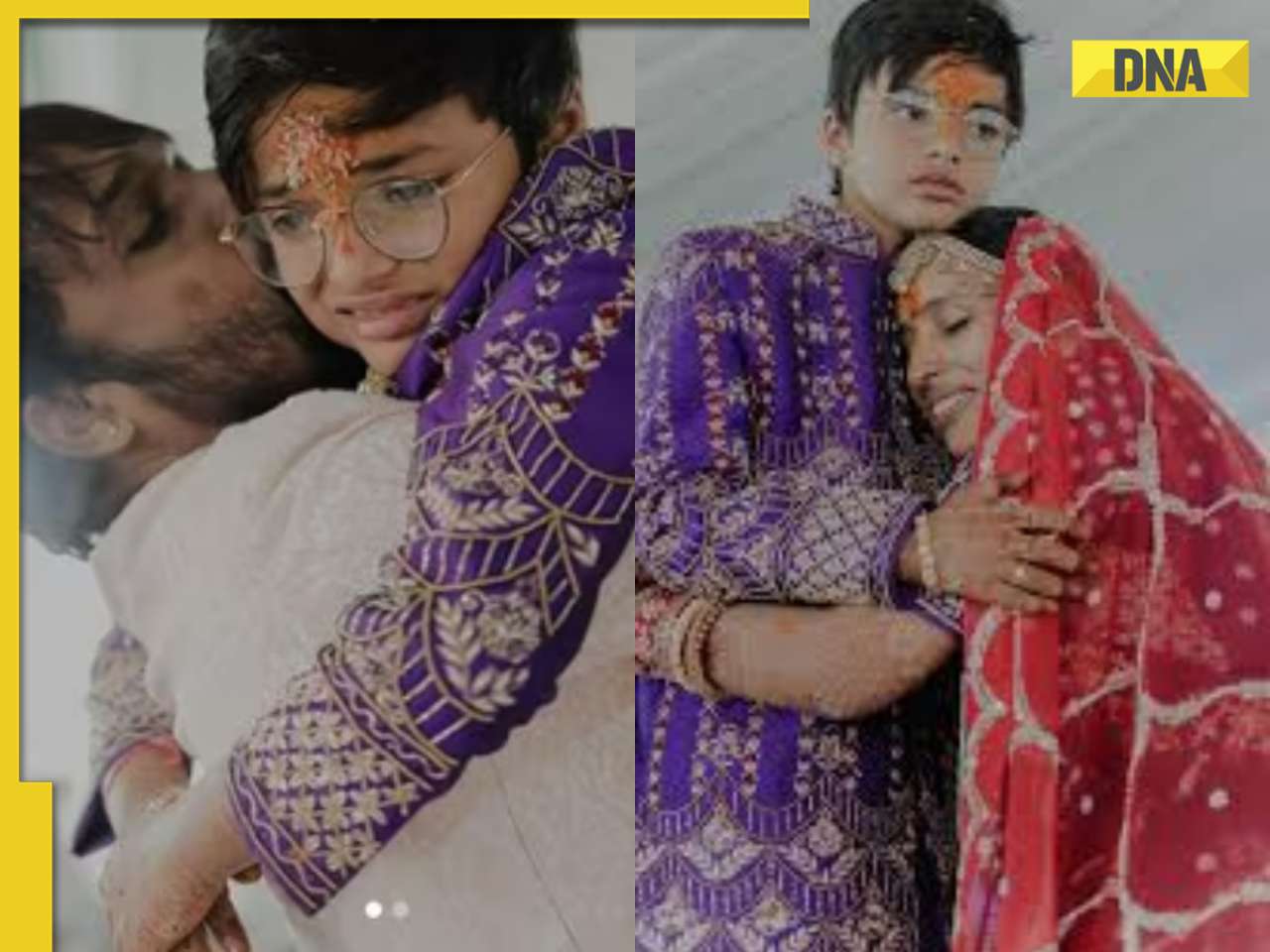

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)