MONEY MANAGEMENT: Setting up a festival fund, preparing a precise budget and sticking to it will help cut unnecessary expenses

Festive season puts everyone in a happy mood, making them more willing to indulge and splurge. From traditional purchases such as new clothes, consumer durables and jewelry, Indians are expanding their festive shopping lists to include aspirational and big-ticket transactions, such as fancy cars, lavish homes and exotic holidays. It would not be an exaggeration to call the festive season in India a 'Great Shopping Festival'.

Brands capitalise on this festive spirit to offer tempting deals and discounts, making it more attractive for consumers to loosen their purse-strings. No doubt, festive season turns out to be the most expensive time of the year for many, derailing them from the path of prudence and wise financial choices. If you face similar conundrum every festive season, below are a few simple measures that you can take to enjoy the festivities this year without straining yourself financially:

Stick to the budget

As the tendency to go overboard with spending is high during the festive season, it would be advisable to determine a budget to stay in check. Draw up a list of expenses that you deem absolutely necessary and be as precise as possible. For instance, if you are setting a budget aside for gifts, set a budget for each person on your list. Next, decide the amount that can comfortably spend based on your monthly income and expenses. Post this exercise if you realise that all your expenses are not fitting in your budget, try prioritising. Put necessities ahead of wants. Avoid spending on items which you can buy post the festive season as well. Try resisting the urge to use credit cards for indulgence, as high-interest on such transactions create a debt trap, causing much financial distress.

Shop wisely

A shopping list is a great way to avoid such impulse purchases. Once the list is ready, scout for relevant deals and offers. Do not fall prey to marketing gimmicks which entails first inflating the price and then offering a 'festive' discount on the same. Do a thorough research and read between the lines to avoid such traps. Online shopping can be a viable option to avoid the rush. It saves both time and money by allowing you to compare product features and price. Opt for cashback deals wherever possible. If you have accumulated loyalty points on your membership cards, redeem them.

Build a 'Festive Fund'

While waiting for the festive season to begin, how about setting aside a certain sum of money per month towards a special 'Festive Fund'? Creating such a fund will ensure that you have enough resources to foot your festive season expenses without unnecessary stress. Add a 20% mark-up to the expenses you incurred last year and divide this amount by 12 to arrive at the monthly figure that you must contribute towards this fund. You can also explore short-term debt funds as an investment option. By sticking to this fund for financing your expenses, you can keep your unplanned expenses in check.

Plan your big-ticket transactions

If you have set your mind on booking that house or buying your dream car during the festive season, make sure to work towards these goals in a systematic manner. The approach to big-ticket transactions is not much different from your run-of-the-mill shopping. Just the way you compare discounts, deals and freebies before making a purchase, do a thorough market research of what is on offer before signing any deal. Read the fine prints and seek advice from experts if you feel the need. Similarly, while applying for a loan, gain as much clarity as you can on your requirement and application process. To minimise your loan payments, maintain a healthy crdit score and negotiate with your bank for better rates.

All that glitters is not gold

Every year, the markets witness a surge in gold buying. This 'shopping' is termed as an 'investment' as many believe that the yellow metal is a hedge against future uncertainties. But gold offers no regular income other than value appreciation. Buying jewelry is advisable for consumption purposes but not investment. If you are looking at the yellow metal from an investment perspective then a smart alternative would be to buy gold ETFs which are traded on the exchange and offer returns as per the price of physical gold. It will also save you the cost of keeping your gold jewelry in safe custody.

Do save

Just because it's the festive season does not mean that you should break away from good financial habits. If you get any bonus during the festive season, ensure that you save and invest a chunk of it before spending. Be mindful of your finances to ensure that you do not jeopardise other financial goals due to overindulgence in the festive season.

The writer is MD & CEO, Axis Securities

![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

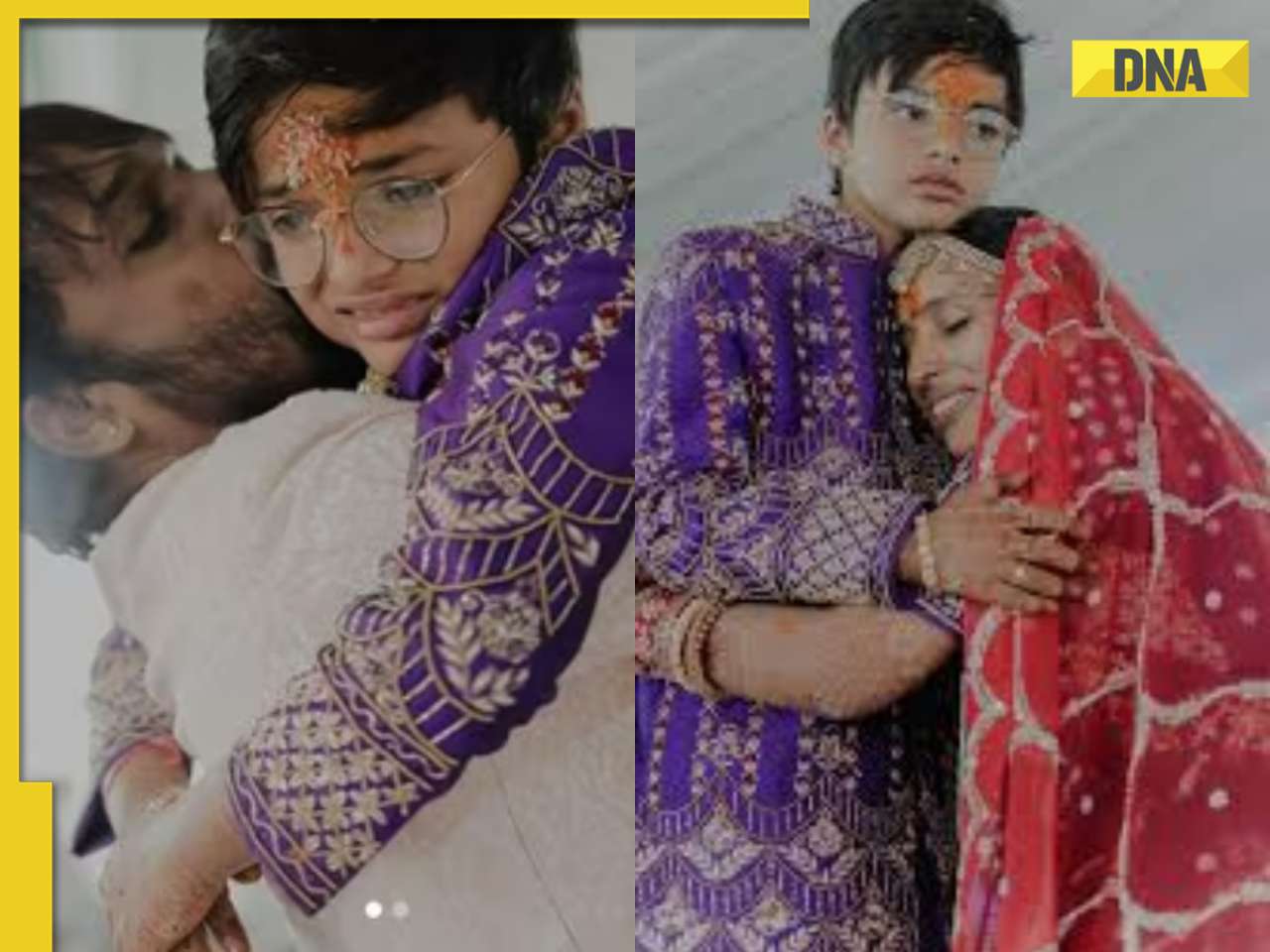

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)

)