On the equity mutual funds front, Trump's pointing the gun towards IT and pharma sectors

Not one day goes when the new US President Donald Trump is not in the news for his unconventional policies or controversial statements which have sent the global financial world cowering. So how Trump affect Indian personal finance?

Experts say Trump's attack on overseas infotech and generic pharma companies means sector-specific funds may be at risk. His energy policies could affect energy companies and funds with exposure. However, you can benefit from gold if you own it in physical or dematerialized form on account of volatility. Fixed income yields too could be under pressure.

Vinod K Sharma, head of business, private client group, HDFC Securities, said, "There is a lack of clarity on how Trump will tackle trade, tax cuts and infrastructure spending. This scenario augurs well for India. A relatively weaker dollar will do wonders for our markets and will increase the attractiveness for the FIIs." Indian investors will surely hope this situation plays out because initial signals are not good at all.

On the equity mutual funds front, Trump's pointing the gun towards IT and pharma sectors. These two sectors, which has companies with a fair share of investor money, are on Trump's radar for taking away American jobs.

On mutual funds betting big on IT sector, Sachin Jain and Vinav Kadel, analysts at ICICI Securities, maintain neutral stance as the industry could face challenges related to immigration rules post the election of US President Donald Trump, uncertainty around Brexit, growing protectionism around the world leading to marginal IT spending by companies. Software companies account for 9% of mutual fund industry money.

There is one investment asset which can benefit from Trump's approach. That is gold. Gold returns in India mainly track global price trends, which thrives when fear is at its peak. Chirag Mehta, senior fund manager-alternative investments, Quantum AMC, said, "There exist more uncertainties than certainties in the global macroeconomic environment of which Trump's presidency is a big unknown. We believe that barring the near term, gold prices should start moving gradually upwards in 2017."

Standard gold (99.5 purity) trades below Rs 29,000 per 10 gram in Mumbai. In the Indian context, gold also acts as a currency hedge; appreciating in value when there is a fall in the rupee vis-à-vis the US dollar. This is because the domestic price of gold is based on the international or US dollar gold price, excluding domestic taxes. Dhaval Kapadia, director portfolio specialist, Morningstar Investment Adviser India, said allocation to gold can be maintained at 5% to 10% of an investment portfolio. Gold ETFs due to various benefits like ease of holding, better liquidity, pricing transparency, etc, can be considered as an alternative to holding physical gold.

On the fixed income front, there are many different ways Trump can affect your money. Fixed income is not just the bank deposit. In today's world, fixed income or debt instruments are deeply affected by global developments and cross-country currency movements.

Lakshmi Iyer, CIO (debt) & head of products, Kotak Mutual Fund, told DNA Money: "Trump's policy with respect to the US interest rates is extremely important. This will effect fixed income in a big way. At this moment, we are still to understand his approach. Another thing that will have an impact on debt money is the rupee-dollar equation. A stronger rupee or a strong dollar will have a different set of effects of the fixed income market," said Iyer, who oversees over Rs 60,000 crore assets.

Ajay Bodke, CEO & chief portfolio manager – PMS, Prabhudas Lilladhar, said that global markets are underestimating geopolitical risks that Trump administration's first 100 day policies could unleash. Not only on immigration, tough talk on building a wall on Mexico border and trade front but also security front by making provocative statements against China are important signals. "The unleashing of rising tariffs and falling currencies war have the potential to cause major asset dislocation and flutter in the seemingly sanguine global asset markets," said Bodke.

![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

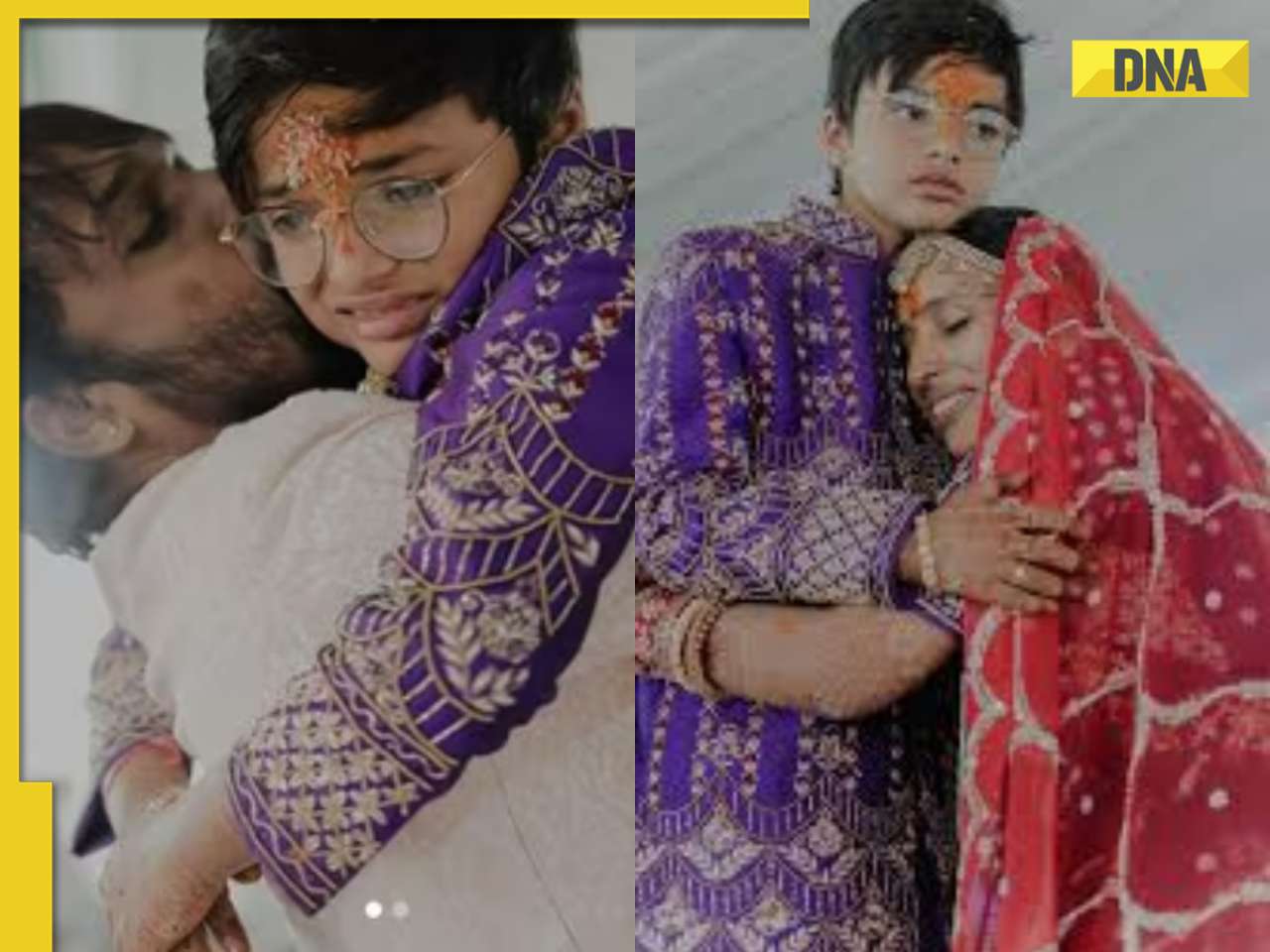

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)

)