Panama Papers Leak: The largest leak of data in history.

This is the largest leak of data in history. 2,600 gigabits of data that goes all the way back to 1977, involving 12 former or current heads of state, 60 relatives of those so-called Statesmen. The leaks also exposed 500 banks and 15,600 shell companies that were used to launder money. Some of the monies have come from dictators accused of looting their own countries. The Panama story exposes how these rich and powerful thought that existing behind firewalls and secure banking systems would enable them to launder money into these tax havens and never be found.

Panama-India connection

Some 500 Indians are reported to figure in the documents. The list of the rich and (in)famous comprises a veritable who's who of Indian business, politics and films. It includes the Kushal Pal Singh, a property magnate and recipient of India's third highest civilian award, the Padma Bhushan; Vinod Adani, brother of industrialist Gautam Adani; Bollywood superstar Amitabh Bachchan and his daughter-in-law Aishwarya Rai Bachchan, who was a former Miss World before she took to acting. These high net-worth individuals have the late Mumbai gangster Iqbal Mirchi for company.

Ironically, the exposé comes at a time when the government headed by Prime Minister Narendra Modi is under fire for failing to keep his campaign promise of bringing back the black money stashed abroad. The government hurriedly instituted a probe soon after the documents, running into several millions, were made available to a German newspaper called Suddeutsche Zeitung, which shared them with the International Consortium of Investigative Journalists who in turn collaborated with select media outlets worldwide, including in India. However, cynicism rules; the government had announced an amnesty for tax evaders but the response to it has not been particularly encouraging.

Tax haven world

Globally, there have been sporadic attempts at winding up these tax havens, mostly after the Great Recession struck in 2008. While Swiss banks were once a favoured destination for stowing away such wealth, the active collusion of law firms such as Mossack Fonseca have made it easy for wealthy individuals to create offshore shell companies in these tax havens. Cayman Islands, British Virgin Islands (BVI) and Isle of Man, are now being used for conducting financial transactions and business deals.

India has allowed its citizens to set up companies abroad since 2004 only if they disclose all transactions. So the illegality uncovered by the Panama Papers relating to Indians forming off-shore companies will pertain to the period before 2004.

However, the larger question of whether off-shore companies evaded tax in India will require deeper investigations.

The US Congress passed the Foreign Account Tax Compliance Act to prohibit the outflow of undeclared money from the country into tax haven bank accounts. The General Anti-Avoidance Rule of 2012 is one of the key Indian laws dealing with tax evasion which penalises overseas transactions, intended to avoid paying Indian tax rates. However, this has been put in abeyance until 2017 because of flak from businesses.

Often, off-shore companies' accounts come under scrutiny when they indulge in transactions, as a result of which many such bank accounts lie idle. India has entered into tax disclosure treaties with a few tax havens, including the BVI, which figures prominently in the Panama Papers. It is incumbent on the finance ministry-appointed panel that will probe the Panama Papers to seek cooperation with the BVI to probe the companies and individuals who have formed shell companies there.

International consequences of Panama

The international fallout from the Panama Papers was the scandal's most shared news. If you heard about the story it was because the powerful got punished. That Iceland's President resigned was proof of the scandal's magnitude. Putin was connected to a shady $2-billion trail. Three of China's seven politburo members were sufficiently implicated to cause the country to blackout all internet mentions of the Panama Papers and, bonus, one of them was even linked to a murder. Stories of this nature got the most circulation. For good measure, the famous people implicated in the scandal weren't only politicians, but celebrities, global drug and weapon dealers, pedophiles, and other slime.

The heady mix of recognisable names and the sheer volume of the confidential leaks made this a hot story indeed but, as our eyes adjust, it's surprising how few politicians were implicated, and how lightly they were.

Not a single politician in the United States or Canada was named. In the UK, David Cameron is getting flak for remaining in denial for several days before finally acknowledging in a TV interview that he benefited from an offshore trust started by his father. But given this story's supposed immensity the amount of money associated with him (thirty-one-and-a-half thousand pounds) is absolutely piddling.

As world leaders piously praised the leak for shining light on illicit money for the betterment of society, they were only happy because it wasn't their sketchy offshore tax man who got caught. If the leak was what it seemed to be at first, there would hardly be a politician still standing.

How will such information be handled in the future?

The size of the leak make it impossible for any journalistic organisation or even an intelligence organization to handle this material. Even if it landed in the hands of one government it would be misused. The only way forward for leaks such as these is to crowd phish these documents. That means you take these documents and open them to anybody and everybody. Otherwise it may take years for 11 million leaked files to be uncovered.

Rohit Gandhi is the Editor-in-Chief of dna and ZEE's upcoming global English news channel WION.

![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

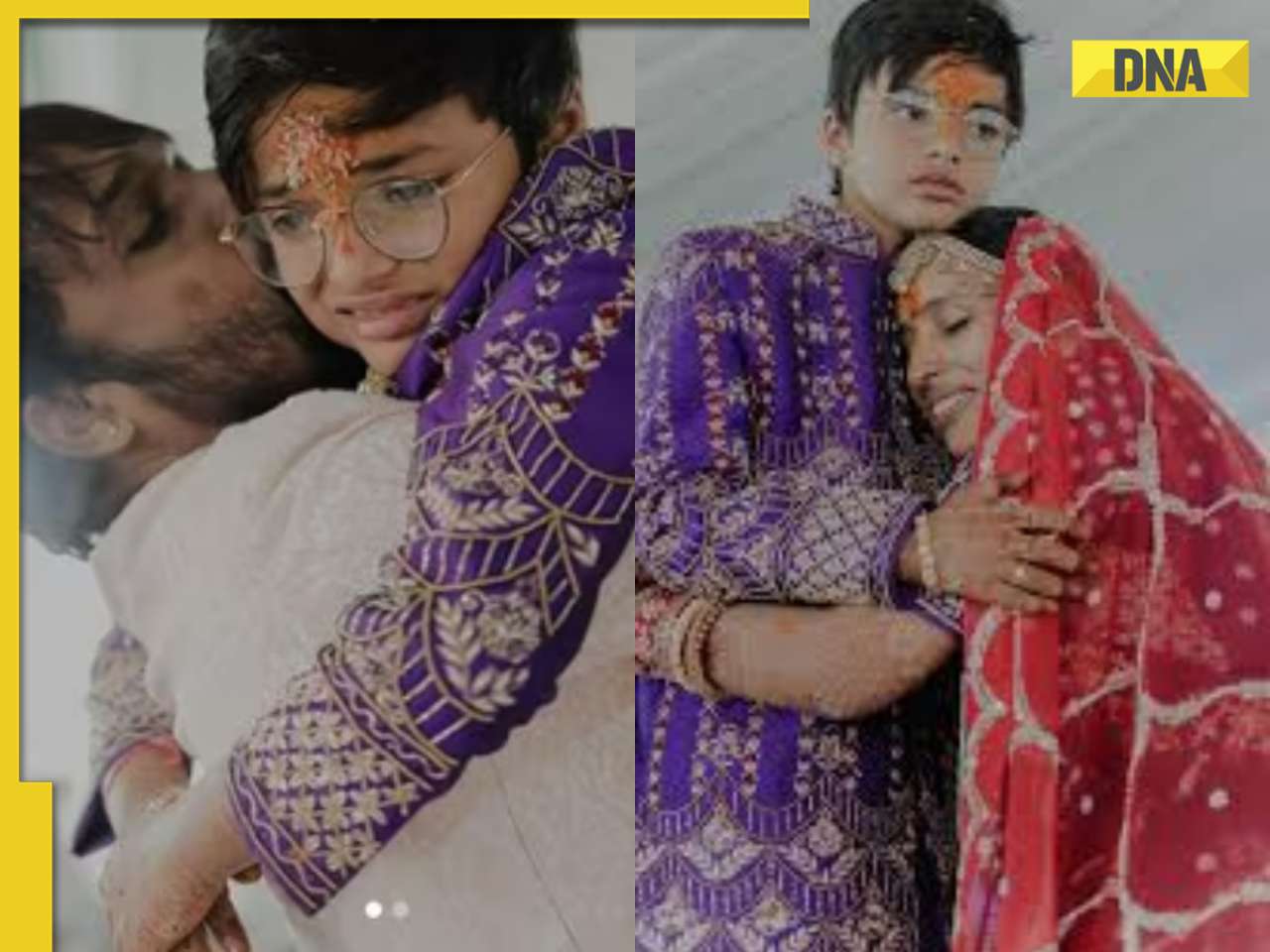

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)

)