The South African rand rose on Thursday and local bond yields fell to three-week lows, helped by slowing inflation, the government's rejection of nationalisation and the tailwind of a weaker dollar.

The rand firmed 0.7 percent against the dollar to a three-week high and the 2026 benchmark government bond yield fell after consumer inflation eased in March and Finance Minster Malusi Gigaba dismissed calls from one of his own advisers for the nationalisation of banks and mines.

The average yield spread paid by South African sovereign bonds over U.S. Treasuries on the JP Morgan EMBI Global Diversified also narrowed 6 basis points (bps) to 278 bps, a two-week low, outperforming the broader index.

South African assets have weathered a turbulent period, hit by two credit ratings downgrades to junk following the sacking of business-friendly finance minister Pravin Gordhan. Gigaba's comments show an attempt to calm investors.

But S&P Global Ratings warned on Wednesday that South Africa's credit rating could get downgraded deeper into junk territory if ongoing political uncertainty stalls the reforms needed to grow the economy.

"Of the big countries, that's the one that has more risk attached to it politically, even more so than Turkey," said Daniel Moreno, an emerging markets debt fund manager at Rubrics Asset Management.

"In Turkey there is certainty, in South Africa there isn't. They need a very stable government with a very clear policy and they don't have that. As long as we have a country that is driven by internal politics at the ANC, I don't see how it can get any better."

With the dollar slipping 0.3 percent against a basket of currencies, most other emerging currencies also made gains.

The Turkish lira firmed 0.7 percent, having steadied since the April 16 referendum that granted President Tayyip Erdogan sweeping new powers. A Reuters poll indicated, however, that the economy was unlikely to see much of a tailwind this year.

The government says the constitutional changes will make it easier to push through investor-friendly reforms to labour and tax laws, boosting growth. But investors are concerned about Erdogan tightening his grip on monetary policy and the economy.

The Russian rouble also firmed 0.3 percent as oil prices steadied after falling 3.5 percent on Wednesday.

MSCI's benchmark emerging equities index rose 0.3 percent, with Asian markets rebounding after a turbulent few days.

Emerging Europe delivered a more mixed performance, with Turkish and Hungarian stocks up 0.5-0.8 percent, but Russian shares fell 0.7 percent.

Investors have been rattled by uncertainty over the upcoming French presidential election, and tensions with North Korea, with the United States piling on the pressure following the reclusive state's failed missile test on Sunday.

But South Korean stocks closed up 0.5 percent at a near two-week high, Hong Kong shares rose almost 1 percent and Chinese mainland stocks gained 0.5 percent after a four-day losing streak.

China's yuan steadied after the country's foreign exchange regulator said capital outflows had eased sharply in the first quarter.

Banking sources said the central bank had relaxed some of its curbs on cross-border capital outflows, suggesting it feels more confident about the yuan.

The Indonesian rupiah fell 0.2 percent against the dollar to a two-week low, as polls showed foreign-friendly candidate Basuki Tjahaja Purnama had lost his bid for re-election as governor of Jakarta.

Indonesian prosecutors have called for a one-year jail term for Purnama on blasphemy charges.

The Bank of Indonesia is expected to keep its key interest rate unchanged at 4.75 percent on Thursday.

For GRAPHIC on emerging market FX performance 2017, see http://tmsnrt.rs/2e7eoml For GRAPHIC on MSCI emerging index performance 2017, see http://tmsnrt.rs/2dZbdP5

For CENTRAL EUROPE market report, see

For TURKISH market report, see

For RUSSIAN market report, see)

Emerging Markets Prices from Reuters Equities Latest Net Chg % Chg % Chg

on year

Morgan Stanley Emrg Mkt Indx 956.05 +3.13 +0.33 +10.88

Czech Rep 971.21 +3.67 +0.38 +5.38

Poland 2271.35 -3.34 -0.15 +16.60

Hungary 32924.75 +236.66 +0.72 +2.88

Romania 8195.74 -0.37 -0.01 +15.68

Greece 677.87 -1.09 -0.16 +5.32

Russia 1066.65 -1.90 -0.18 -7.44

South Africa 45595.25 -176.71 -0.39 +3.86

Turkey 91337.24 +533.11 +0.59 +16.89

China 3172.59 +1.90 +0.06 +2.22

India 29382.35 +45.78 +0.16 +10.35

Currencies Latest Prev Local Local

close currency currency

% change % change

in 2017

Czech Rep 26.92 26.88 -0.13 +0.33

Poland 4.26 4.26 -0.09 +3.38

Hungary 312.71 313.11 +0.13 -1.24

Romania 4.54 4.54 -0.01 -0.04

Serbia 123.48 123.52 +0.03 -0.11

Russia 56.34 56.51 +0.30 +8.74

Kazakhstan 312.51 311.53 -0.31 +6.76

Ukraine 26.75 26.74 -0.04 +0.93

South Africa 13.17 13.27 +0.76 +4.26

Kenya 103.27 103.30 +0.03 -0.87

Israel 3.66 3.67 +0.14 +5.15

Turkey 3.65 3.67 +0.67 -3.31

China 6.88 6.89 +0.03 +0.86

India 64.61 64.64 +0.05 +5.16

Brazil 3.15 3.15 +0.08 +3.31

Mexico 18.82 18.85 +0.12 +10.05

Debt Index Strip Spd Chg %Rtn Index

Sov'gn Debt EMBIG 333 -1 .01 7 77.19 1

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

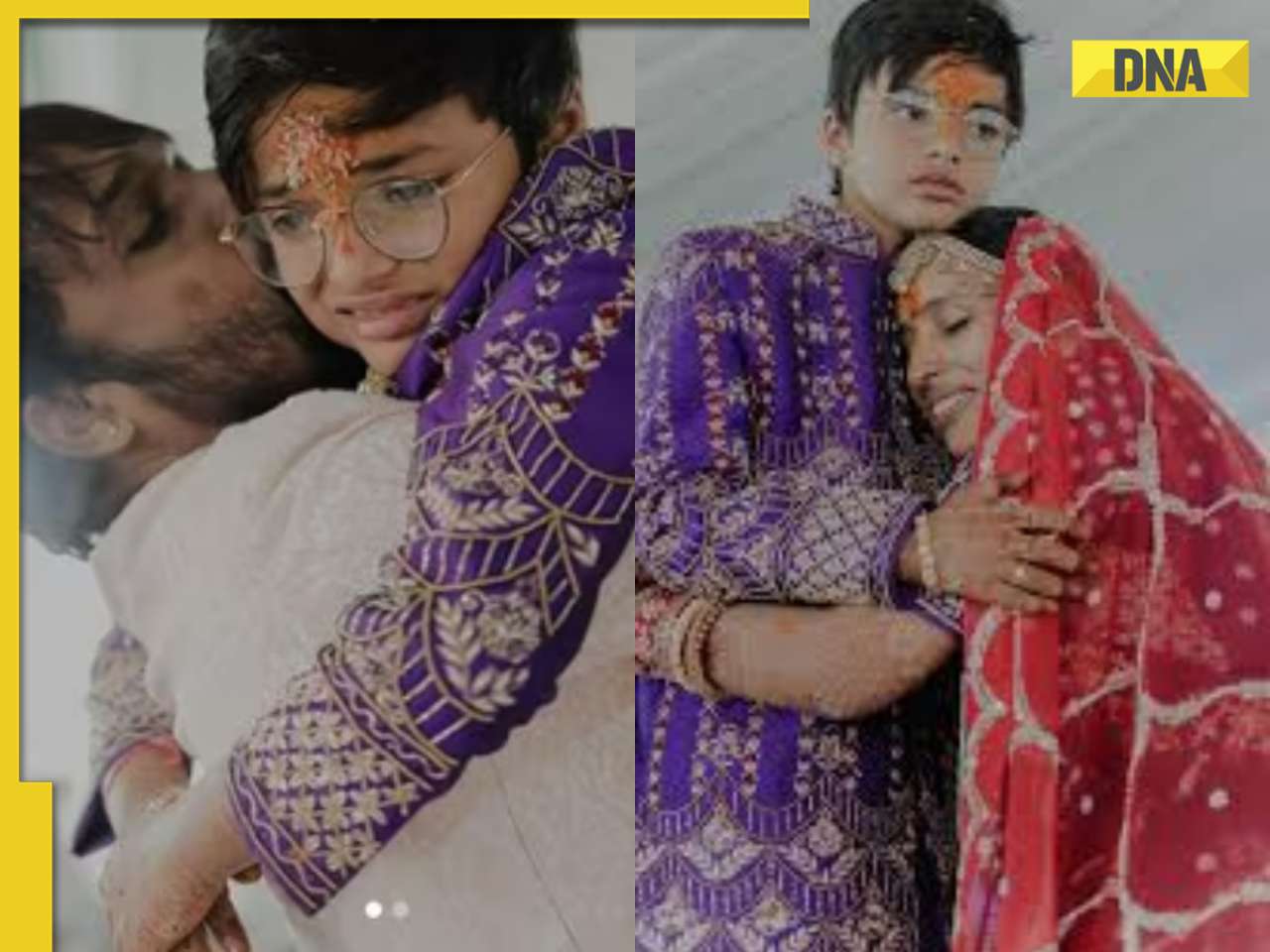

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)