India may be emerging as a significant contributor to a global effort to challenge China’s stranglehold on Rare Earths – a group of 17 elements that are key to modern technology.

India may be emerging as a significant contributor to a global effort to challenge China’s stranglehold on Rare Earths – a group of 17 elements that are key to modern technology.

Their absence could, literally, bring to a halt global production of precision guided missiles, satellite and communication systems, smart phones, hybrid cars, energy efficient lighting, wind turbines and petroleum.

They are not really rare, but are seldom found in high enough concentrations for mining to be commercially profitable.

China commands 97% global monopoly on various stages of RE production, but has only 37% of global RE reserves (US Geological Survey, however, estimates China has half of the world’s reserves — 55 million tonnes).

World consumption, currently estimated to be 136,000 tonnes/year, is expected to reach 185,000 tonnes by 2015. According to USGS ‘Mineral Commodity Summaries, January 2012’, US is estimated to have close to 12% of global reserves — 13 MTs, Australia (1.6 MTs), Commonwealth of Independent States (19 Mts).

India has, so far, regularly attributed RE reserve figures of 2-3%. Latest Indian government statistics, however, show India may well have 9% of global RE reserves — 10.7 MTs.

In 2004, cheap Chinese RE supply had forced India to suspend production.

“We were producing oxide of RE Cerium at a price of Rs 600/kg. China was providing the same for $1.5/kg,” Dr RN Patra, CMD of Indian Rare Earths Limited – a government enterprise under the Department of Atomic Energy (DAE) — told DNA.

Two years prior to that, cheap Chinese RE’s had forced another closure — that of one of world’s largest rare earth mine: Mountain Pass, in California. Incidentally, India was world’s leading RE producer in the 1950s, followed by the US through the 1960s and 1980s.

By 2010, India was importing over 370 tonnes of RE compounds, which is not its actual consumption figure since most REs are imported as finished or semi-finished products.

The global frenzy on RE followed China’s decision in September 2009 to reduce its RE exports (2010-15), citing “environmental concerns” and “preservation of scarce natural resources”. From 65,580 tonnes in 2005 it came down to 30,246 tons in 2011.

China’s decision angered the world as RE prices shot through the roof creating a huge gap between China’s export and domestic prices. Cheap availability of RE in China has compelled a number of RE firms to move base to China.

It was, however, in September 2010 — when China temporarily suspended its RE exports to Japan over a maritime dispute — that the world began to realise the implications of Beijing’s monopoly in this vital sector.

This March, US, European Union and Japan took China to WTO over its RE export policies.

US energy policy specialist Marc Humphries, in a report to the US Congressional Research Service in September 2011, said China’s economic growth and increased demand has prompted it to ramp up for increased production of wind turbines, consumer electronics, and other sectors, which would require more of its domestic RE elements. China is already estimated to be consuming almost 65-70% of the global output of RE.

“In 2007 we had pointed out to the government that we should restart RE production,” said Patra. But DAE then wasn’t interested beyond the Thorium it was getting from Monazite’s.

That’s likely to change. US based Molycorp is reviving the Mountain Pass mine. Lynas Corporation is doing the same with Mount Weld mine in Australia.

By December India will have a Monazite mineral processing plant in Odisha. Monazite is found in beach sand, and is the chief source of RE in India. The government is also making a concerted effort to identify potential RE reserves in India. India is exploring joint development of REs with Japan and other countries.

Summing up the mood in New Delhi, a top strategic expert told DNA, “Whatever China did, it did... But it’s an opportunity for India.”

![submenu-img]() DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details

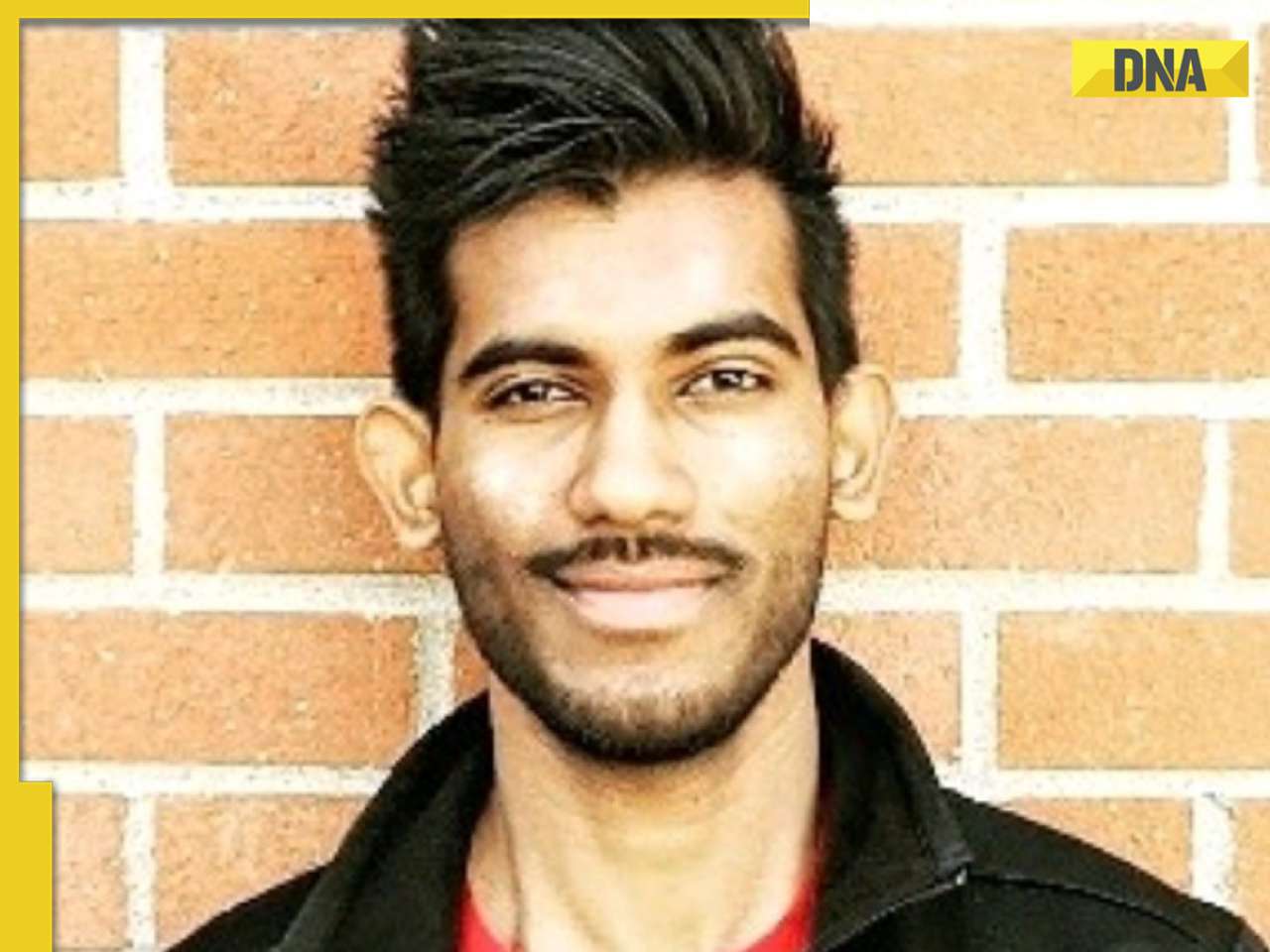

DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details![submenu-img]() Guardians of Cybersecurity: Inside Santosh Kumar Kande's Mission to Protect Corporate Networks

Guardians of Cybersecurity: Inside Santosh Kumar Kande's Mission to Protect Corporate Networks![submenu-img]() Meet man who leads Rs 642000 crore govt company, not from IIT, IIM

Meet man who leads Rs 642000 crore govt company, not from IIT, IIM![submenu-img]() Former RBI Governor Raghuram Rajan to join Congress? He says, ‘Rahul Gandhi is…’

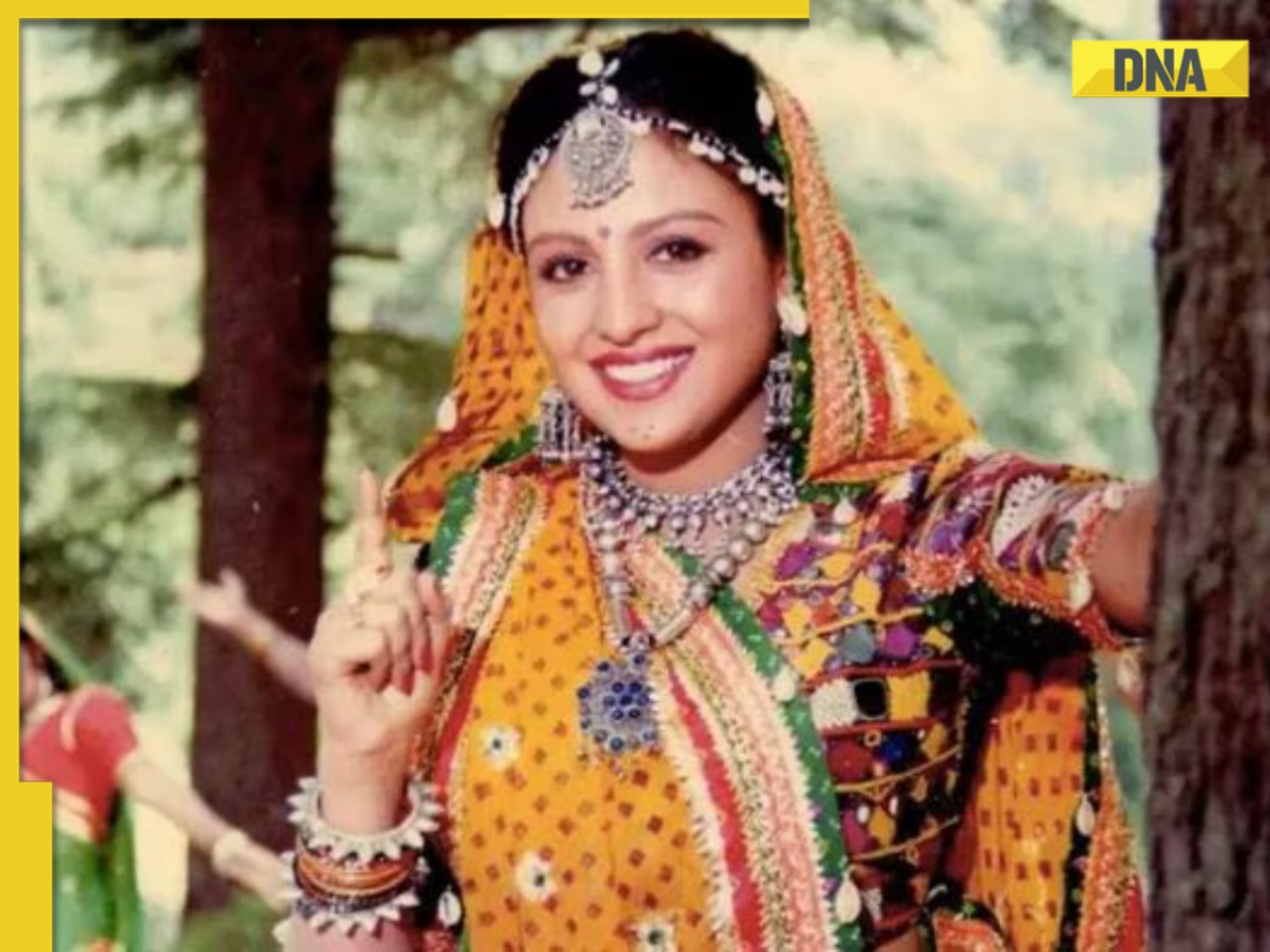

Former RBI Governor Raghuram Rajan to join Congress? He says, ‘Rahul Gandhi is…’![submenu-img]() Maharagni teaser: Kajol looks badass, beats up goons in action-packed first look, fans call her 'lady Singham'

Maharagni teaser: Kajol looks badass, beats up goons in action-packed first look, fans call her 'lady Singham'![submenu-img]() DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details

DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details![submenu-img]() Meet IAS officer, who became UPSC topper in 1st attempt, sister is also IAS officer, mother cracked UPSC exam, she is...

Meet IAS officer, who became UPSC topper in 1st attempt, sister is also IAS officer, mother cracked UPSC exam, she is...![submenu-img]() Meet student who cleared JEE Advanced with AIR 1, went to IIT Bombay but left after a year due to..

Meet student who cleared JEE Advanced with AIR 1, went to IIT Bombay but left after a year due to..![submenu-img]() Meet man who used to walk to work, eat free meals, left high-paying corporate job at 29 due to...

Meet man who used to walk to work, eat free meals, left high-paying corporate job at 29 due to...![submenu-img]() Meet woman who left high-paying job as NASA scientist to crack UPSC exam twice, became IRS then IPS officer with AIR…

Meet woman who left high-paying job as NASA scientist to crack UPSC exam twice, became IRS then IPS officer with AIR…![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Maharagni teaser: Kajol looks badass, beats up goons in action-packed first look, fans call her 'lady Singham'

Maharagni teaser: Kajol looks badass, beats up goons in action-packed first look, fans call her 'lady Singham'![submenu-img]() Shikhar Dhawan on what made him turn talk show host for Dhawan Karenge, addresses Kapil Sharma comparison | Exclusive

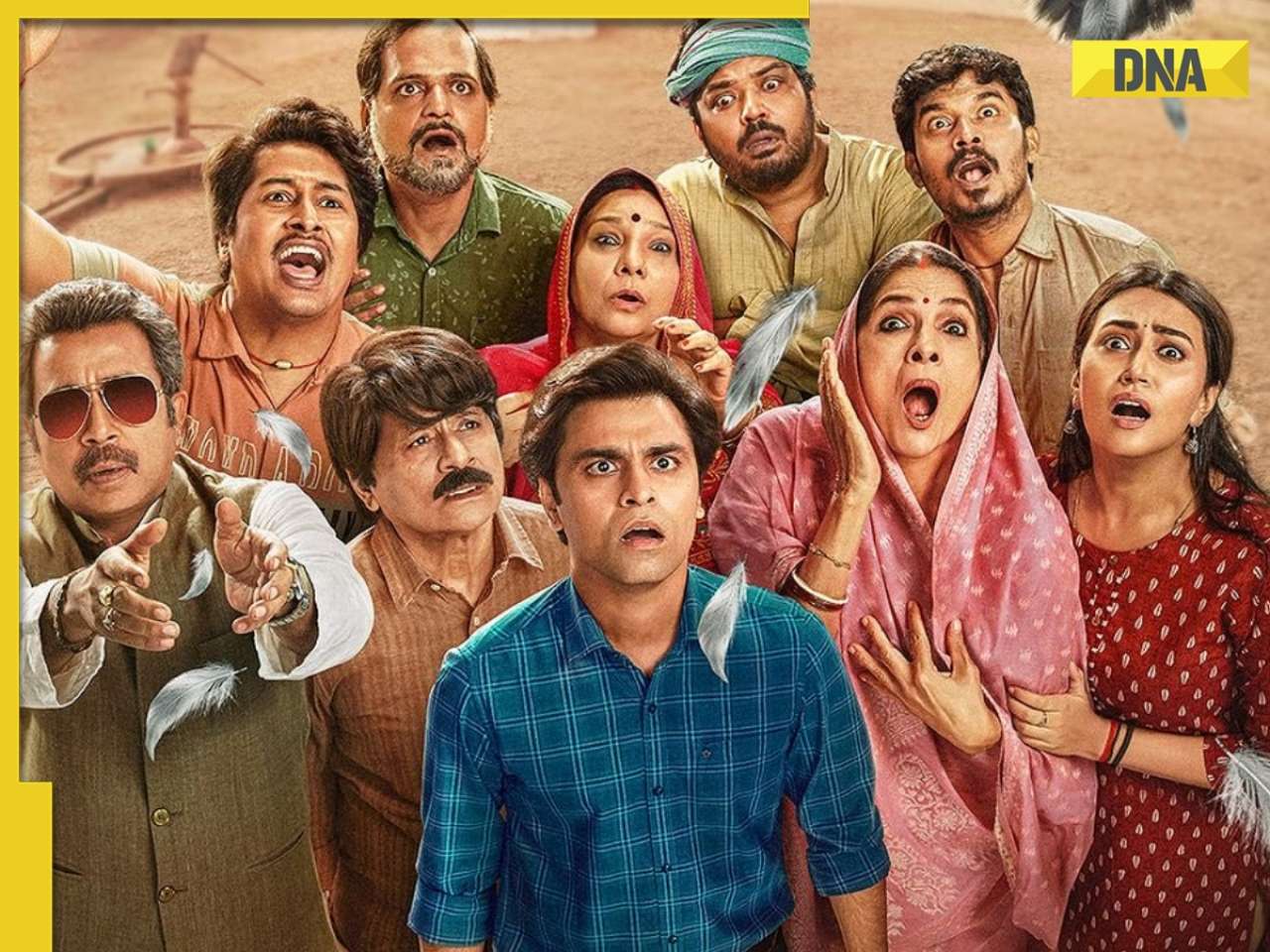

Shikhar Dhawan on what made him turn talk show host for Dhawan Karenge, addresses Kapil Sharma comparison | Exclusive![submenu-img]() Panchayat season 3 public review: Fans hail Neena Gupta, Jitendra Kumar's 'emotional, unbeatable series', call it banger

Panchayat season 3 public review: Fans hail Neena Gupta, Jitendra Kumar's 'emotional, unbeatable series', call it banger![submenu-img]() Meet superstar who gave Bollywood's first Rs 100 crore film, quit acting at peak of her career, married man with..

Meet superstar who gave Bollywood's first Rs 100 crore film, quit acting at peak of her career, married man with..![submenu-img]() 'Is she engaged?': Avneet Kaur confuses fans as she flaunts ring, says 'can’t wait to tell the world about this union'

'Is she engaged?': Avneet Kaur confuses fans as she flaunts ring, says 'can’t wait to tell the world about this union'![submenu-img]() Anant Ambani-Radhika Merchant pre-wedding bash: Here's what Mukesh Ambani's guests will get to eat during ceremony

Anant Ambani-Radhika Merchant pre-wedding bash: Here's what Mukesh Ambani's guests will get to eat during ceremony![submenu-img]() Mukesh Ambani, Nita Ambani to celebrate Akash, Shloka's daughter Veda's birthday on cruise, check theme, other details

Mukesh Ambani, Nita Ambani to celebrate Akash, Shloka's daughter Veda's birthday on cruise, check theme, other details ![submenu-img]() Terra and Mare: Hidden meaning behind Mukesh Ambani's son Anant Ambani-Radhika Merchant's second pre-wedding bash theme

Terra and Mare: Hidden meaning behind Mukesh Ambani's son Anant Ambani-Radhika Merchant's second pre-wedding bash theme![submenu-img]() 'Simple, boring resume can get you...,' says former recruiter with Google, Apple, Samsung

'Simple, boring resume can get you...,' says former recruiter with Google, Apple, Samsung![submenu-img]() Mukesh Ambani's son Anant-Radhika Merchant pre wedding bash: Cruise set sails from Malta not from Miami due to...

Mukesh Ambani's son Anant-Radhika Merchant pre wedding bash: Cruise set sails from Malta not from Miami due to...

)

)

)

)

)

)