Manmohan Singh said developing countries need to re-balance their strategies to rely less upon experts and more on domestic demand.

Against the backdrop of some developed countries cutting back on public spending in the light of the Euro Zone crisis, India today warned that contractionary economic policies could trigger a "double dip recession" and pleaded for a "much more calibrated" exit from the global stimulus.

Speaking at the Working Session of the 4th G-20 Summit here, prime minister Manmohan Singh admitted that the global recovery "is still very fragile" and therefore there was need to give primacy to consolidating the recovery while taking measured steps to deal with the sovereign debt problems.

He also called for firmly resisting threats of new protectionist measures in industrialised countries and existing barriers to trade, especially those affecting developing countries.

Calling for a "much more calibrated" exit from stimulus, by other advanced countries, the economist-prime minister favoured a "carefully differentiated" approach reflecting the circumstances of individual countries saying "we have a much greater risk of deflation than inflation".

"The central problems we face today is how to ensure protection of global growth in a situation where markets have become very nervous about debt sustainability, especially in some countries in the Euro Zone.

"Concerns about debt sustainability normally suggest a need for fiscal contraction. But circumstances are not not normal. The recovery is still fragile and private demand in the industrialised countries simultaneously, could provoke a double dip recession," he said.

His speech was heard with rapt attention at the Summit being attended by world leaders including US president Barack Obama, French president Nicolas Sarkozy, German chancellor Angela Merkel, new British prime minister David Cameron and Chinese president Hu Jintao.

The prime minister's remarks assume significance in the context of excessive caution being adopted by countries in Europe who have started slashing their public spending budgets fearing sovereign debt crisis as evidenced by the Greek crisis.

Countries like France and Germany are pushing for a universal tax to fund bail out of banks while the US, still not not able to create adequate jobs, is in favour of continuance of stimulus agreed in London last year.

India is opposed to taxing the banks and favours a slow and calibrated exit from the stimulus.

Singh counselled against contractionary policies saying if followed by many industrialised countries simultaneously it could provoke a double dip recession.

"This would have very negative effects on developing countries and on the prospects for achieving the Millennium Development Goals (MDG)."

He said he recognised there are uncertainties and it is difficult to strike the right balance.

But on the whole, the prime minister said, "I feel the risks of destabilising the recovery of growth are too great. We have a much greater task of deflation than inflation. We must, therefore, give primacy to consolidating the recovery, while also taking measured steps to deal with sovereign debt problems."

Calling for careful coordination of policies among the G-20, he said it was precisely for this purpose that the G-20 countries agreed in Pittsburgh last September to work on a Framework to deliver strong and sustainable growth.

The outcome of the Phase of this process, now now before the leaders, shed valuable light on the policy responses needed in different groups of countries.

"Fiscal consolidation must obviously have high priority in those advanced deficit countries that are experiencing exceptional fiscal stress and where markets have signalled serious concern.

"However, other advanced countries should opt for a much more calibrated exit from stimulus. We should adopt a carefully differentiated approach, reflecting the circumstances of individual countries," he said.

Singh said the time phasing of fiscal action was also important.

Markets may well be reassured by credible steps by major industrialised countries, which impact the fiscal deficit significantly over time, even if the immediate impact was more limited.

Singh said developing countries need to re-balance their strategies to rely less upon experts and more on domestic demand.

In many developing countries, this is best done through increased investment directed to infrastructure.

This, he said, would sustain growth in the short run by offsetting the contractionary effect of lower experts.

It will also increase growth potential in the medium term by addressing the supply side constraints.

Singh said aiming at higher levels of investment despite lower export growth was likely to generate larger current account deficits.

This would help re-balance global demand, but it required an environment in which the higher current account deficits of developing countries could be financed.

This required an expansion in both multilateral and private capital flows.

"Growth in developing countries would be greatly helped if threats of new protectionist measures in industrialised countries are firmly resisted and existing barriers to trade, especially those affecting developing countries, are reduced. In this context, a successful completion of the Doha Development Round is imperative," he said.

The prime minister said the G-20 can claim some very important achievements since it last met in Pittsburgh less than a year ago.

"We have been able, through concerted action, to halt what at one stage looked like being a prolonged decline in output in industrialised countries. We have initiated a process of IFI reforms, which, though still incomplete, promises to be significant.

"We have also initiated a process to arrive a new architecture of financial sector regulation that will prevent excessive risk taking in future."

Notwithstanding these achievements, he said, the global economic situation posed some very difficult challenges.

The economic recovery, which began in the second half of 2009, was still fragile and its pace varied across countries.

Unemployment remained high despite rebound in output.

There is growing concern about the build up of debt: GDP ratios in many industrialised countries reflecting the effect of the exceptional stimulus of the past two years combined with a contraction in Gross Domestic Product last year.

Singh said "more recently, markets have become especially nervous because of the revelation of exceptional fiscal stress in some countries in the Euro Zone combined with doubts about the ability of these countries to undertake the adjustment required."

All these problems are compounded by the fact that financial systems in many industrialised countries suffer from structural weaknesses, which take time to repair, the prime minister said.

![submenu-img]() Weather update: IMD predicts light to moderate rain, thunderstorms in Delhi-NCR; check forecast here

Weather update: IMD predicts light to moderate rain, thunderstorms in Delhi-NCR; check forecast here![submenu-img]() 'I can't breathe': Black man in Ohio pleads as police officers pin him to floor, then...

'I can't breathe': Black man in Ohio pleads as police officers pin him to floor, then...![submenu-img]() Delhi HC raps CM Kejriwal, accuses him of prioritising political interest by continuing as CM after arrest

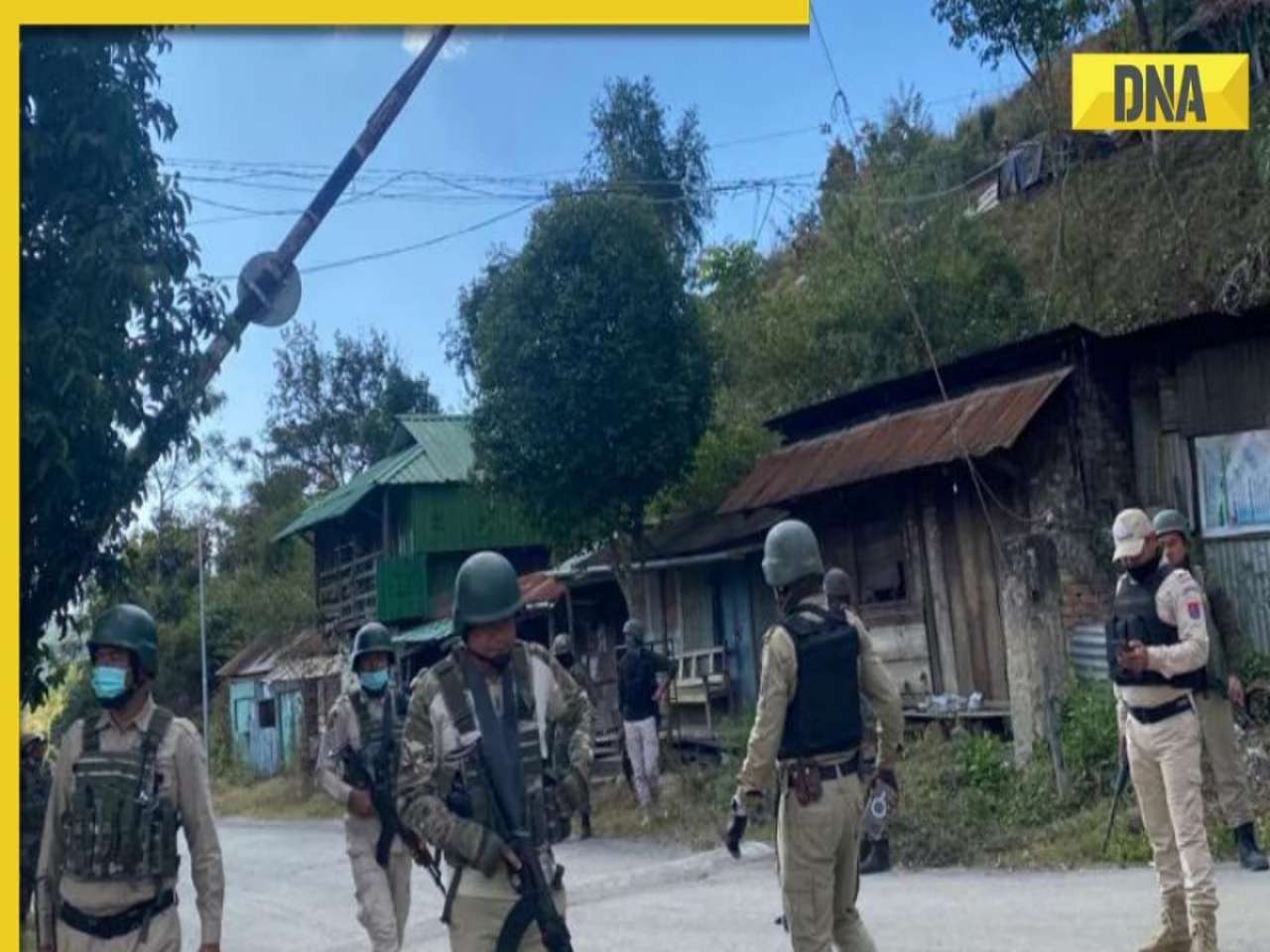

Delhi HC raps CM Kejriwal, accuses him of prioritising political interest by continuing as CM after arrest![submenu-img]() Manipur: Two CRPF personnel killed in Kuki militants' attack in Naransena area

Manipur: Two CRPF personnel killed in Kuki militants' attack in Naransena area![submenu-img]() These 9 Indian dishes make it to the list of ‘best stews in the world’

These 9 Indian dishes make it to the list of ‘best stews in the world’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Krishna Mukherjee accuses Shubh Shagun producer of harassing, threatening her: ‘I was changing clothes when...'

Krishna Mukherjee accuses Shubh Shagun producer of harassing, threatening her: ‘I was changing clothes when...'![submenu-img]() Meet 90s top Bollywood actress, who gave hits with Shah Rukh, Salman, Aamir, one mistake ended career; has now become…

Meet 90s top Bollywood actress, who gave hits with Shah Rukh, Salman, Aamir, one mistake ended career; has now become…![submenu-img]() This actress, who once worked as pre-school teacher, changed diapers, later gave six Rs 100-crore films; is now worth…

This actress, who once worked as pre-school teacher, changed diapers, later gave six Rs 100-crore films; is now worth…![submenu-img]() 'There were days when I didn't want to probably live': Adhyayan Suman opens up on rough patch in his career

'There were days when I didn't want to probably live': Adhyayan Suman opens up on rough patch in his career![submenu-img]() This low-budget film with no star is 2024's highest-grossing Indian film; beat Fighter, Shaitaan, Bade Miyan Chote Miyan

This low-budget film with no star is 2024's highest-grossing Indian film; beat Fighter, Shaitaan, Bade Miyan Chote Miyan![submenu-img]() World wrestling body threatens to reimpose ban on WFI if...

World wrestling body threatens to reimpose ban on WFI if...![submenu-img]() IPL 2024: Jonny Bairstow, Shashank Singh special power Punjab Kings to record run-chase against KKR

IPL 2024: Jonny Bairstow, Shashank Singh special power Punjab Kings to record run-chase against KKR![submenu-img]() DC vs MI, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

DC vs MI, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() DC vs MI IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Mumbai Indians

DC vs MI IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Mumbai Indians![submenu-img]() Yuvraj Singh named ICC Men's T20 World Cup 2024 Ambassador

Yuvraj Singh named ICC Men's T20 World Cup 2024 Ambassador![submenu-img]() Watch: Lioness teaches cubs to climb tree, adorable video goes viral

Watch: Lioness teaches cubs to climb tree, adorable video goes viral![submenu-img]() Viral video: Little girl's impressive lion roar wins hearts on internet, watch

Viral video: Little girl's impressive lion roar wins hearts on internet, watch![submenu-img]() Who is Sangeet Singh? Man arrested for posing as Singapore Airlines pilot at Delhi airport

Who is Sangeet Singh? Man arrested for posing as Singapore Airlines pilot at Delhi airport![submenu-img]() One of India’s most expensive wedding, attended by 5000 people, 100 room villa, cost Rs…

One of India’s most expensive wedding, attended by 5000 people, 100 room villa, cost Rs…![submenu-img]() Viral video: Delhi's 'Spiderman' take to streets on bike, get arrested; watch

Viral video: Delhi's 'Spiderman' take to streets on bike, get arrested; watch

)

)

)

)

)

)