In this battle, Artificial Intelligence (AI) emerges as a powerful ally, offering state-of-the-art solutions to combat fraud and secure business assets.

In the ever-evolving digital landscape, businesses face unprecedented security challenges. The tactics of malicious actors, constantly evolving to exploit vulnerabilities for financial gain, necessitate the adoption of robust security measures. In this battle, Artificial Intelligence (AI) emerges as a powerful ally, offering state-of-the-art solutions to combat fraud and secure business assets.

Artificial intelligence (AI) has revolutionized the fields of security and fraud detection, equipping businesses with powerful tools to safeguard their assets and combat fraudulent activities. By leveraging sophisticated algorithms and machine learning methodologies, AI enables organizations to proactively identify and mitigate risks, ensuring a robust defense against evolving threats.

How is AI Used in Fraud Detection?

AI is a pioneering force in fraud detection, introducing a paradigm shift towards proactive defense mechanisms. In contrast to conventional approaches that heavily depend on predetermined criteria and thresholds, Automated fraud detection using AI leverages the capabilities of machine learning algorithms to scrutinize extensive volumes of data and discern patterns that serve as indicators of fraudulent behavior.

Upon detecting fraudulent activity, AI models can promptly intervene by either completely blocking transactions or flagging them for additional scrutiny, all the while designating a fraud probability score. Furthermore, AI systems can acquire ongoing knowledge from domain experts while evaluating and validating dubious transactions. This process iteratively improves the model's understanding and eliminates patterns that lack a correlation with fraudulent activities. As a result, artificial intelligence has developed into an essential resource for enhancing enterprise fraud prevention mechanisms.

This shift in paradigm empowers artificial intelligence (AI) systems to adapt and evolve dynamically, staying updated on emerging threats and complex fraudulent schemes that may evade traditional detection methods. AI enables organizations to identify anomalies and suspicious patterns with exceptional precision and effectiveness, from transaction monitoring to behavior analysis. This lays the foundation for robust fraud prevention strategies, instilling a sense of security and protection.

Fraud Types Detected by AI

AI-powered fraud detection systems are versatile and adept at identifying fraudulent activities across various domains. From identity theft to credit card fraud, AI can identify and prevent a wide range of fraudulent behaviours, making it a valuable asset in the fight against fraud.

Identity Theft

One of their primary advantages is their capacity to identify instances of identity theft, which occur when malevolent actors assume the persona of authorized users to execute fraudulent transactions or obtain illicit access to resources. To detect identity theft, artificial intelligence examines many data points, such as geolocation, biometric information, transaction history, and device biometrics. Anomalies in these variables, such as abrupt personal information or transaction alterations, may elicit notifications mandating additional scrutiny.

Credit Card Fraud

AI can identify unauthorized or dubious credit and debit card transactions through the analysis of spending behavior, transaction location, and card usage patterns. The system detects anomalies in the cardholder's customary expenditure patterns and alerts regulatory bodies to transactions with atypical attributes, such as substantial value or execution in geographically remote areas. Fraudsters do not manually compromise credit cards. Conversely, they utilize automated programs to execute their unlawful operations. These automated systems frequently execute brute force assaults, which strain payment gateways considerably.

Account Takeover Fraud

Furthermore, systems propelled by artificial intelligence are adept at identifying atypical activities that diverge from established patterns, such as attempted account takeovers, insider threats, and fraudulent insurance claims. AI systems monitor user behavior to detect abrupt alterations in logon locations, devices, or behavior patterns, which could signify a takeover attempt. Anomaly detection and multi-factor authentication are essential components in the fight against ATO deception.

Money laundering

Financial transaction analysis by AI to identify patterns suggestive of money laundering. The system detects transactions encompassing substantial monetary values, frequent account transfers, and atypical transaction paths—all prevalent indicators of money laundering schemes.

Phishing and cyberattacks

Phishing emails and malicious URLs can be identified by AI-powered systems by examining email content, sender behavior, and website attributes. Training AI models to identify patterns frequently linked to phishing endeavors diminishes the likelihood of users succumbing to cyberattacks.

By capitalizing on advanced methodologies, including neural networks and deep learning, artificial intelligence (AI) augments the effectiveness of fraud detection endeavors, empowering organizations to counter various manifestations of fraudulent behavior with accuracy and adaptability.

Benefits of Fraud Detection Powered by AI

The implementation of AI-powered fraud detection and security yields numerous advantages that substantially bolster an organisation's security stance and preventive capabilities.

An aspect of significance is the exceptional precision AI fraud detection and security systems provide in contrast to conventional methodologies. AI can effectively identify subtle patterns and anomalies in data by utilizing sophisticated algorithms and machine learning techniques. This capability reduces the occurrence of false positives and guarantees that valid transactions are not erroneously identified as fraudulent.

In addition, artificial intelligence facilitates the prompt identification and resolution of fraudulent incidents, enabling organizations to reduce potential losses and minimize harm. AI allows for the continuous monitoring and analysis of transactions and user behavior. With the ability to quickly respond, any suspicious activities can be identified immediately, effectively stopping potential losses at the early stages of an attack.

AI enables predictive analytics, empowering organizations to proactively detect and prevent future fraudulent activities by identifying emerging trends and patterns before they escalate. AI can establish standard behavioral profiles for users and transactions, comparing current activities against these profiles to identify deviations that could indicate fraud. This approach is highly effective in identifying new instances of fraud that have not been encountered before, giving businesses a sense of control and proactivity.

In general, the utilization of AI in fraud detection equips organizations with unprecedented levels of precision, velocity, and proactivity, thereby situating them at the vanguard of the fight against fraudulent activities.

Setting Up AI Security Infrastructure for Your Business

A proficient AI fraud detection system necessitates meticulous deliberation of the foundational infrastructure to guarantee maximum efficiency and dependability. An essential element entails carefully selecting a sophisticated dedicated server for AI specifically designed to handle AI workloads efficiently. Devoted servers provide the computational capabilities and scalability to efficiently handle substantial amounts of data and implement intricate algorithms with pinpoint accuracy. In addition, implementing a resilient server configuration tailored explicitly for AI applications expedites the detection of fraudulent activities and improves overall performance. Furthermore, organizations must allocate resources toward acquiring sufficient data storage and processing capacities to efficiently manage the surge of information produced by AI-powered fraud detection systems. By emphasizing the implementation of dedicated hosting servers and refining server configurations, organizations can establish a robust artificial intelligence security framework that can efficiently protect against fraudulent activities.

Conclusion

The integration of AI automation into fraud detection and security systems marks a significant turning point in the ongoing endeavor to combat fraud in the twenty-first-century digital environment. By leveraging AI-driven algorithms and machine learning techniques, companies can fortify their security protocols, anticipate fraudulent activities in advance, and safeguard their assets from malicious actors. Beyond straightforward detection, artificial intelligence (AI) has a significant impact.

With the use of predictive analytics, real-time information, and improved decision-making skills, it gives enterprises the ability to proactively counter emerging risks. Organizations using AI technology need to prioritize protecting their assets, minimizing vulnerabilities, and maintaining consumer trust and confidence due to the ever-changing threat environment. Adopting AI-powered fraud detection can help businesses guarantee a profitable future by empowering them to manage the complexities of the digital era with resilience, agility, and confidence.

FAQ Section:

What is automated fraud detection?

Automated fraud detection pertains to the procedure wherein sophisticated technologies, including machine learning and Artificial Intelligence (AI), are employed to detect and mitigate fraudulent activities within a business setting. Automated systems examine extensive volumes of data, identify patterns that suggest fraudulent activities, and promptly report suspicious transactions or activities, empowering organizations to react efficiently and effectively to potential risks.

How does AI improve fraud detection compared to traditional methods?

Artificial intelligence improves fraud detection by using advanced algorithms and machine learning methods to examine extensive datasets and detect intricate patterns that indicate fraudulent behavior. AI systems can evolve and adapt in real-time, surpassing conventional approaches that depend on predetermined rules and thresholds. As a result, they remain updated on emergent threats and sophisticated fraudulent schemes. Moreover, fraud detection enabled by artificial intelligence provides enhanced precision, velocity, and the capacity to reduce false positives, thus empowering organizations to manage risks and safeguard their assets against fraudulent endeavors more efficiently.

What types of fraud can AI systems detect?

AI systems possess the ability to identify a wide range of fraudulent activities spanning multiple domains, encompassing the following, among others:

Identity theft occurs when malevolent actors assume the persona of trustworthy individuals to obtain resources or carry out fraudulent transactions illicitly.

AI-powered systems promptly identify suspicious transactions and patterns suggestive of fraudulent activity, thereby preventing credit card fraud.

AI demonstrates exceptional proficiency in identifying abnormal activities such as attempted account takeovers, insider threats, and fraudulent insurance claims.

What do I need to implement AI fraud detection in my business?

The successful integration of AI fraud detection into a business necessitates meticulous preparation and deliberation of various elements, such as:

Infrastructure: To efficiently support AI workloads, the infrastructure should consider investing in sophisticated dedicated hosting servers and optimizing server configurations.

Capabilities for data storage and processing: guaranteeing the availability of sufficient resources to manage the surge in data produced by fraud detection systems powered by artificial intelligence.

Integration: Smoothly incorporating AI technologies into pre-existing systems and workflows to optimize efficiency while reducing interruptions.

Training and expertise: furnishing personnel with training and resources to guarantee their comprehension of the optimal way to employ AI-driven fraud detection tools and accurately interpret the outcomes.

Disclaimer : Above mentioned article is a Consumer connect initiative. This article is a paid publication and does not have journalistic/editorial involvement of IDPL, and IDPL claims no responsibility whatsoever.

![submenu-img]() Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...

Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...![submenu-img]() Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged

Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged![submenu-img]() Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'

Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...

Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...![submenu-img]() UGC NET June 2024: Registration window closes today; check how to apply

UGC NET June 2024: Registration window closes today; check how to apply![submenu-img]() Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...

Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

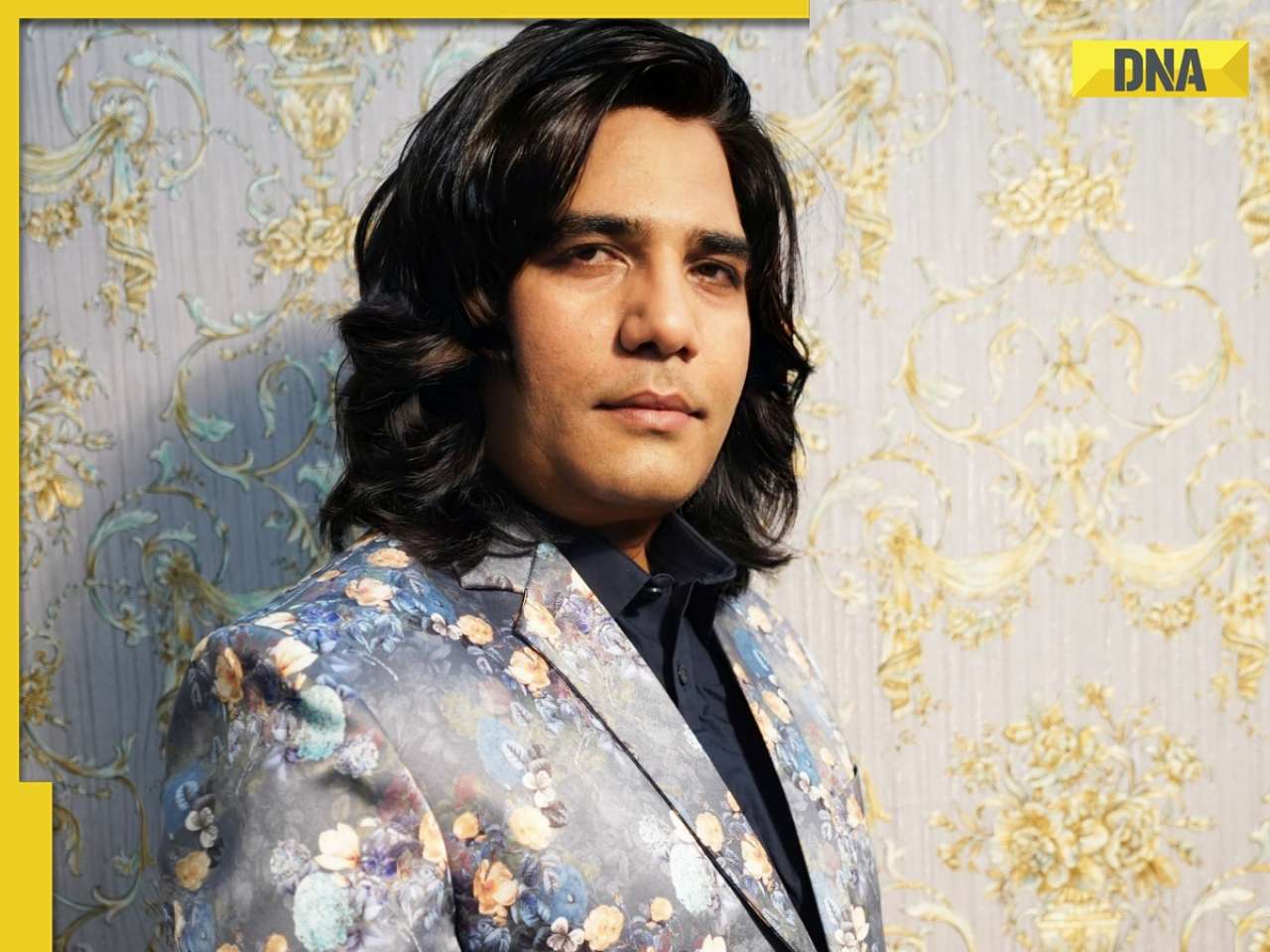

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'

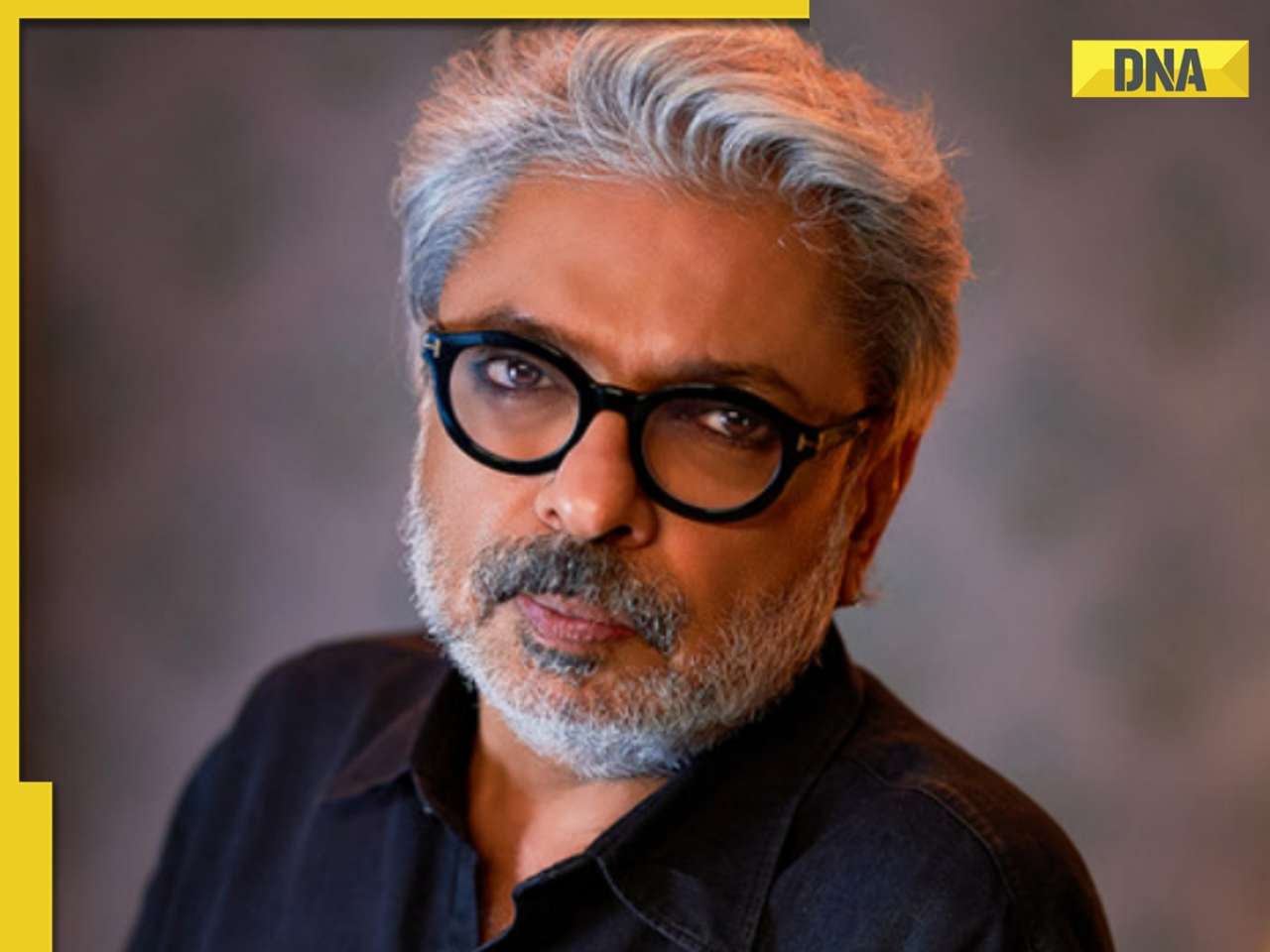

Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'![submenu-img]() Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits

Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits![submenu-img]() Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved

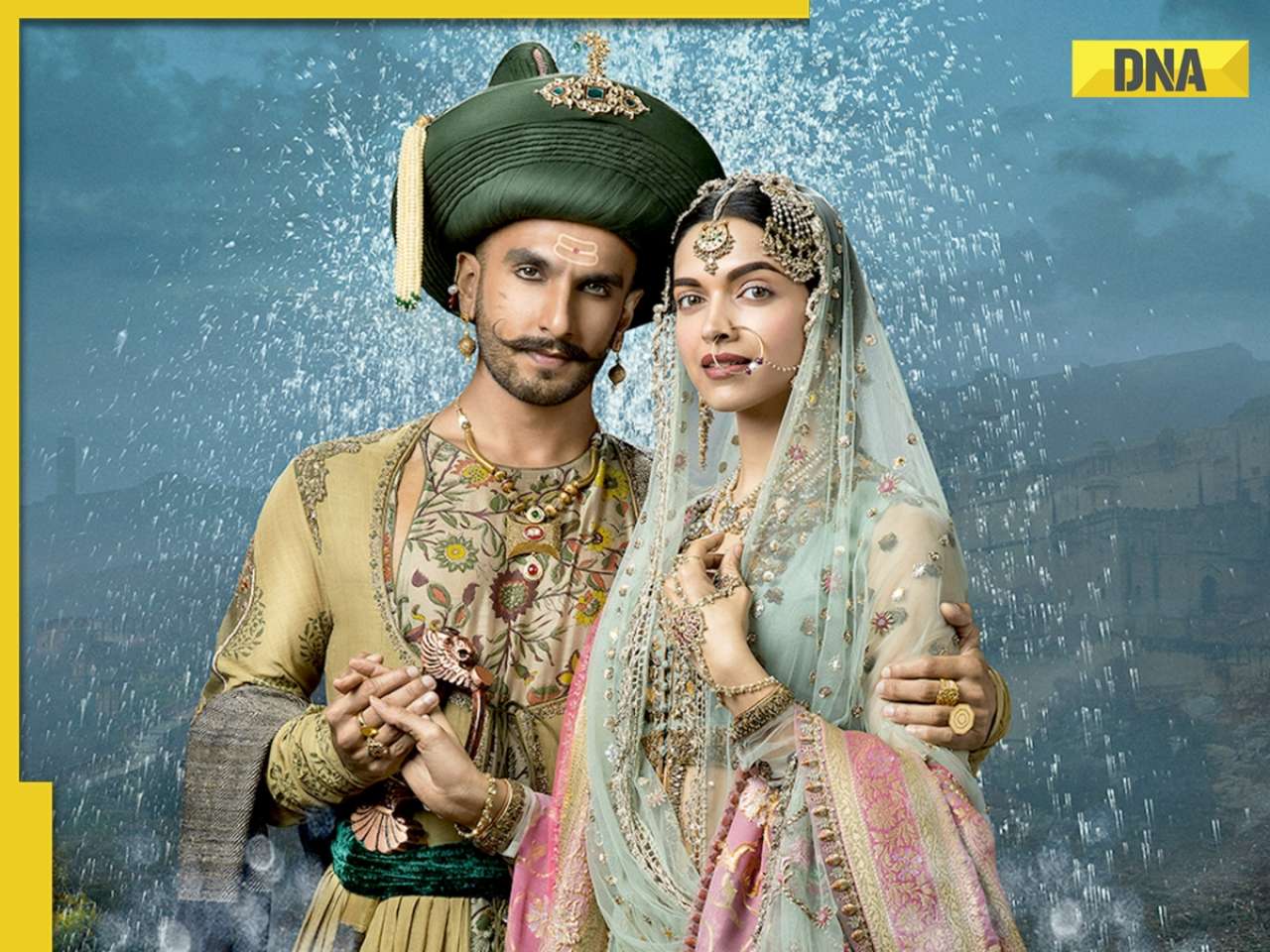

Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved![submenu-img]() Viral video: Donkey stuns internet with unexpected victory over hyena, watch

Viral video: Donkey stuns internet with unexpected victory over hyena, watch![submenu-img]() Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch

Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch![submenu-img]() Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...

Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...![submenu-img]() Cow fight injures two girls enjoying street snacks, video goes viral

Cow fight injures two girls enjoying street snacks, video goes viral![submenu-img]() Viral video: Man sets up makeshift hammock on bus, internet reacts

Viral video: Man sets up makeshift hammock on bus, internet reacts

)

)

)

)

)

)

)