Delhi-based Petronet LNG Ltd (PLL) was incorporated in 1998 for setting up liquefied natural gas (LNG) terminals in the country.

Delhi-based Petronet LNG Ltd (PLL) was incorporated in 1998 for setting up liquefied natural gas (LNG) terminals in the country.

A joint venture between government of India and four oil companies — GAIL, IOC, ONGC and BPCL — the objective of the entity was to meet the demand-supply deficit in natural gas through imported LNG. Today, PLL supplies about 23% of the natural gas consumed in the country.

Business

In 2004, PLL commissioned India’s first LNG receiving and regasification terminal, which had a capacity of 5 million tonnes per annum (mtpa), at Dahej in Gujarat. The company is planning another terminal at Kochi in Kerala. PLL is a bulk supplier of imported LNG, which is regasified and delivered to GAIL’s HVJ pipeline. Most of the natural gas is supplied to customers of GAIL, IOCL and BPCL, while a small share goes to spot sales and other customers.

PLL has also tie ups with global energy players — GAZ de France, the French national gas company, is its strategic partner. PLL has a sale and purchase agreement with Ras Laffan Liquefied Natural Gas Company Ltd, Qatar. PLL utilises two LNG tankers on time charter basis. It has a long-term agreement with a shipping consortium for exclusive use of these tankers. While these tankers have a capacity of 1,38,000 scm each, a third tanker with capacity of 1,55,000 scm is being hired to meet capacity expansions at Dahej. PLL’s support activities are outsourced through port operations agreements.

All activities related to tugboats, marine crafts, personnel, operation, management and maintenance, as well as piloting, berthing, and mooring of LNG tankers, are handled by port operators.

Investment rationale

Out of India’s total natural gas requirement, power and fertiliser sectors consume 40% and 29%, respectively. As part of the 11th Plan, 4577 mw of gas-based thermal power capacities are under construction. Out of these, 3,447 mw would be on the HVJ pipeline, which will drive demand for natural gas.

Natural gas is the most cost-effective and a major feedstock for the production of ammonia for use in fertiliser production. Since the government gives subsidies on fertiliser, it’s important that the cost of production is low. The government is also looking to revive the closed fertiliser plants. All these factors will keep driving demand for natural gas. The demand is growing for LPG, city gas, industry fuel, sponge iron units, etc.

The demand-supply gap for LNG has augured well for PLL. The company is now doubling its Dahej capacity to 10 mtpa. It is also setting up another unit at Kochi. The cost of this project will be Rs 3,400 crore, which is being financed in the debt-equity ratio of 70: 30, respectively. PLL has already tied up Rs 1,800 crore through banks. This project will be completed by FY12.

As for offtake of gas from this plant, GAIL’s Kochi-Bangalore-Mangalore pipeline is also likely to be completed by the same time. Both Karnataka and Kerala are high demand markets. Karnataka faces acute power shortage and there is also a huge demand for city gas.

PLL has a spot supply agreement with Ratnagiri Gas & Power Pvt Ltd (RGPL). This was exceptionally a fixed-price contract, owing to RGPL’s weak financial position and acute power shortage in Maharashtra. PLL’s contract with RGPL is ending this September and will be replaced by the 1.67 mtpa contracts from GAIL.

PLL increased its regasification charges from January 1, 2009 by 5%. Also, lower spot prices of LNG helped it earn robust marketing margins on spot LNG sales. This drove margins in the fourth quarter. Volumes also increased 3.3% in the fourth quarter. The long-term contract prices, being linked to Japanese crude cocktail prices and depreciation of rupee, led to higher LNG prices, driving revenues.

PLL’s business model remains risk free with long-term contracts for sales and purchases. There is no risk from the ongoing slowdown or improved availability of domestic supplies as sale and purchase agreements are tied up till 2028. Further, any price variations can be passed on and working capital cycles are very short.

PLL has also entered into a joint venture agreement with Adani Group for setting up a solid cargo port at Dahej. This port will be another revenue contributor for the company.

Concerns

Capacity expansions at Dahej are on the verge of completion, but long-term contracts are still in the process of being tied up. However, looking at the demand-supply scenario, these contracts should be in place soon.

Valuations

PLL’s topline increased 26.64% to Rs 8,428.70 crore in FY09, beating the street expectation of around Rs 7,900 crore. The company had reported a topline of Rs 6,655.31 crore in FY08. Volumes at 6.5 million tonnes remained almost flat. Volumes are likely to go up in FY10E as PLL has supply contracts of 7.4 million tonnes.

Operating profits grew 4.3% to Rs 901.28 crore over last year, while its operating margin fell 252 bps. The spot supply agreement with RGPL was one of the factors for lower operating margin, while the other reasons being PLL’s expenditure on the Dahej capacity expansion and accounting measures (non-clarified by PLL management). PLL’s net profit grew 9.22% to Rs 518.44 crore from Rs 474.65 crore in FY08, but its profit margin fell 109 bps.

With growing volumes, improving margins, capacity expansions at Dahej and new capacities coming up at Kochi and attractive valuations, PLL is a good addition to the portfolio.

Disclosure: The writer does not hold any shares in the company

![submenu-img]() Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...

Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...![submenu-img]() Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged

Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged![submenu-img]() Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'

Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...

Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...![submenu-img]() UGC NET June 2024: Registration window closes today; check how to apply

UGC NET June 2024: Registration window closes today; check how to apply![submenu-img]() Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...

Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

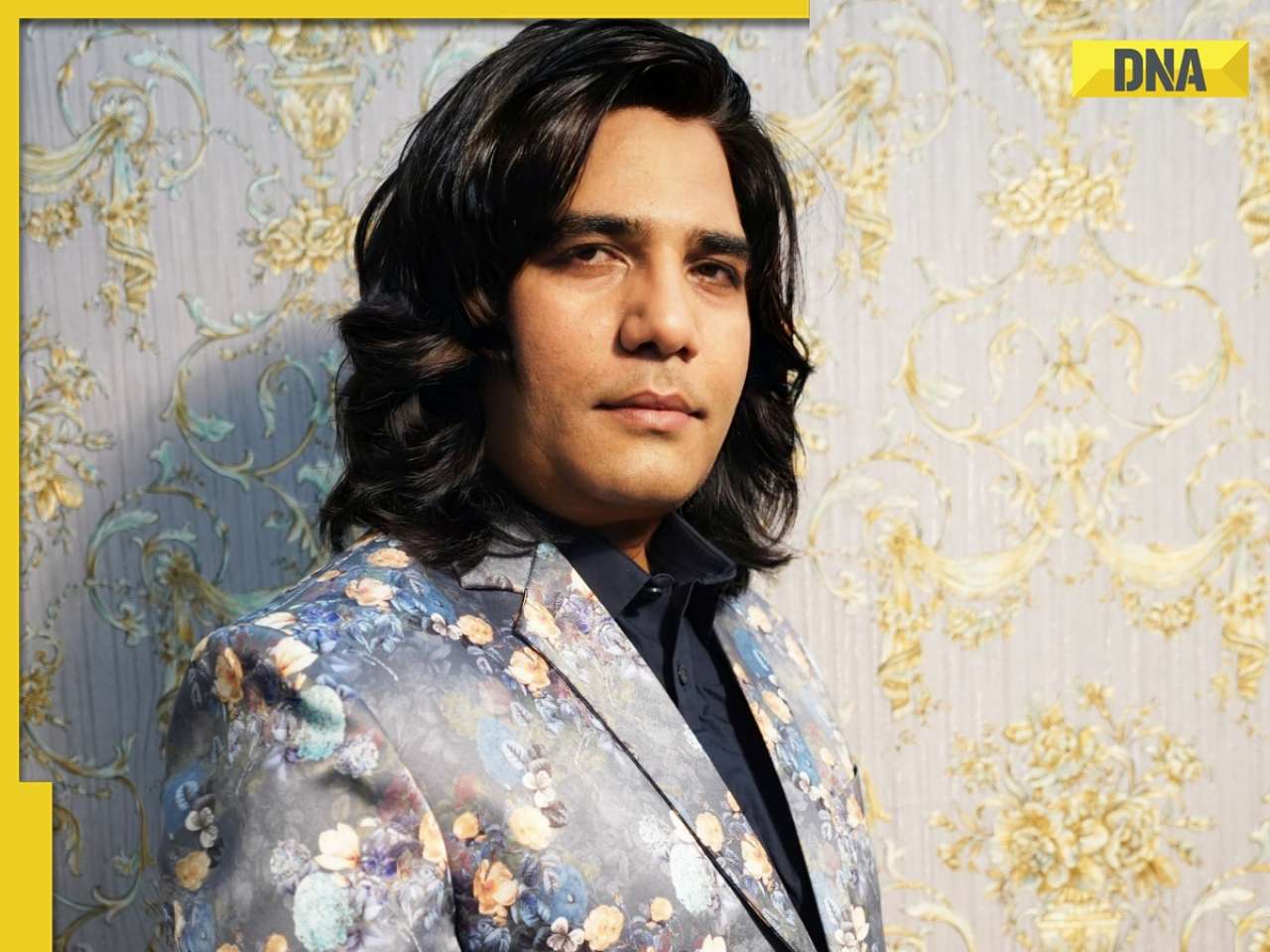

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

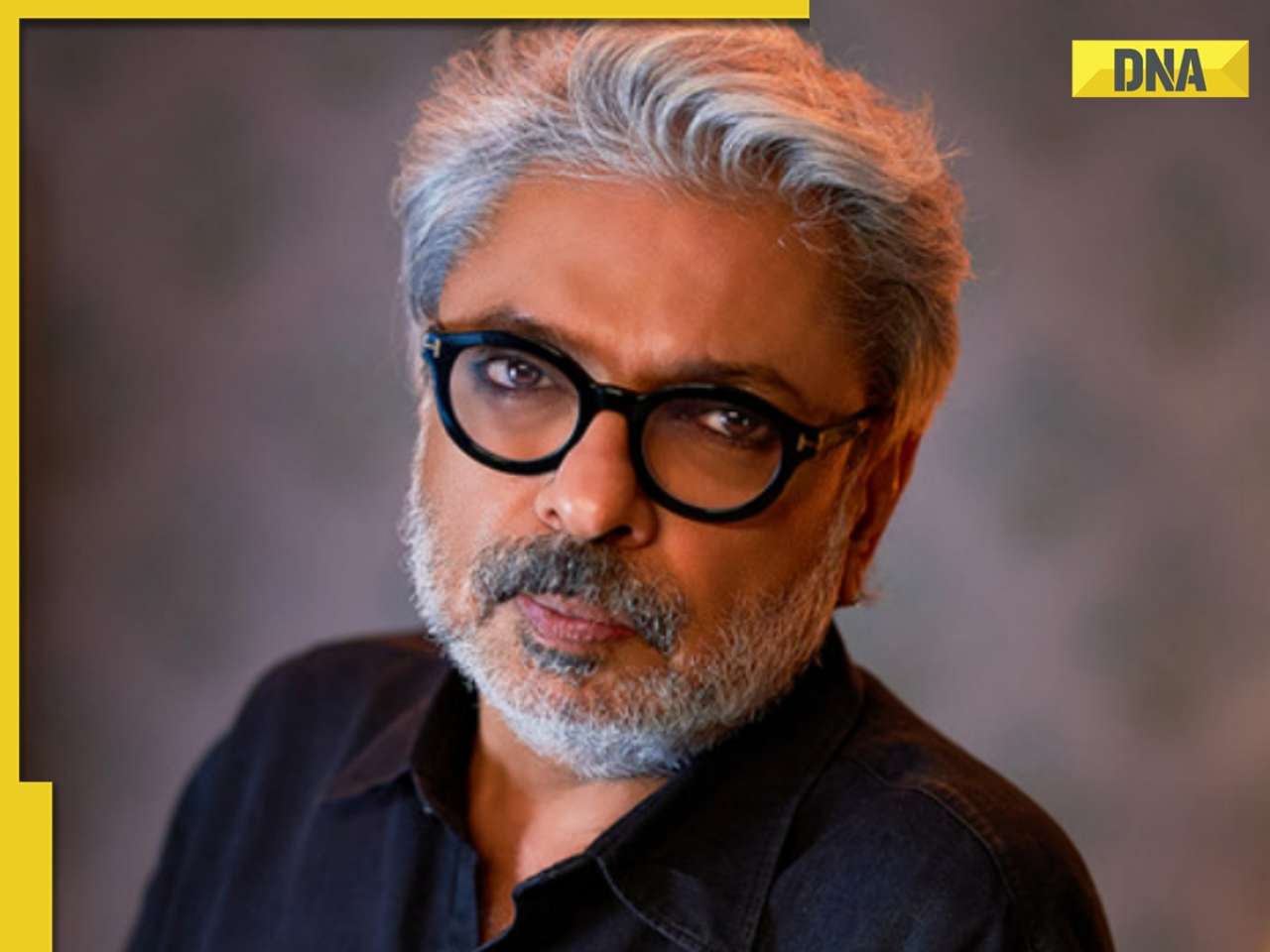

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'

Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'![submenu-img]() Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits

Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits![submenu-img]() Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved

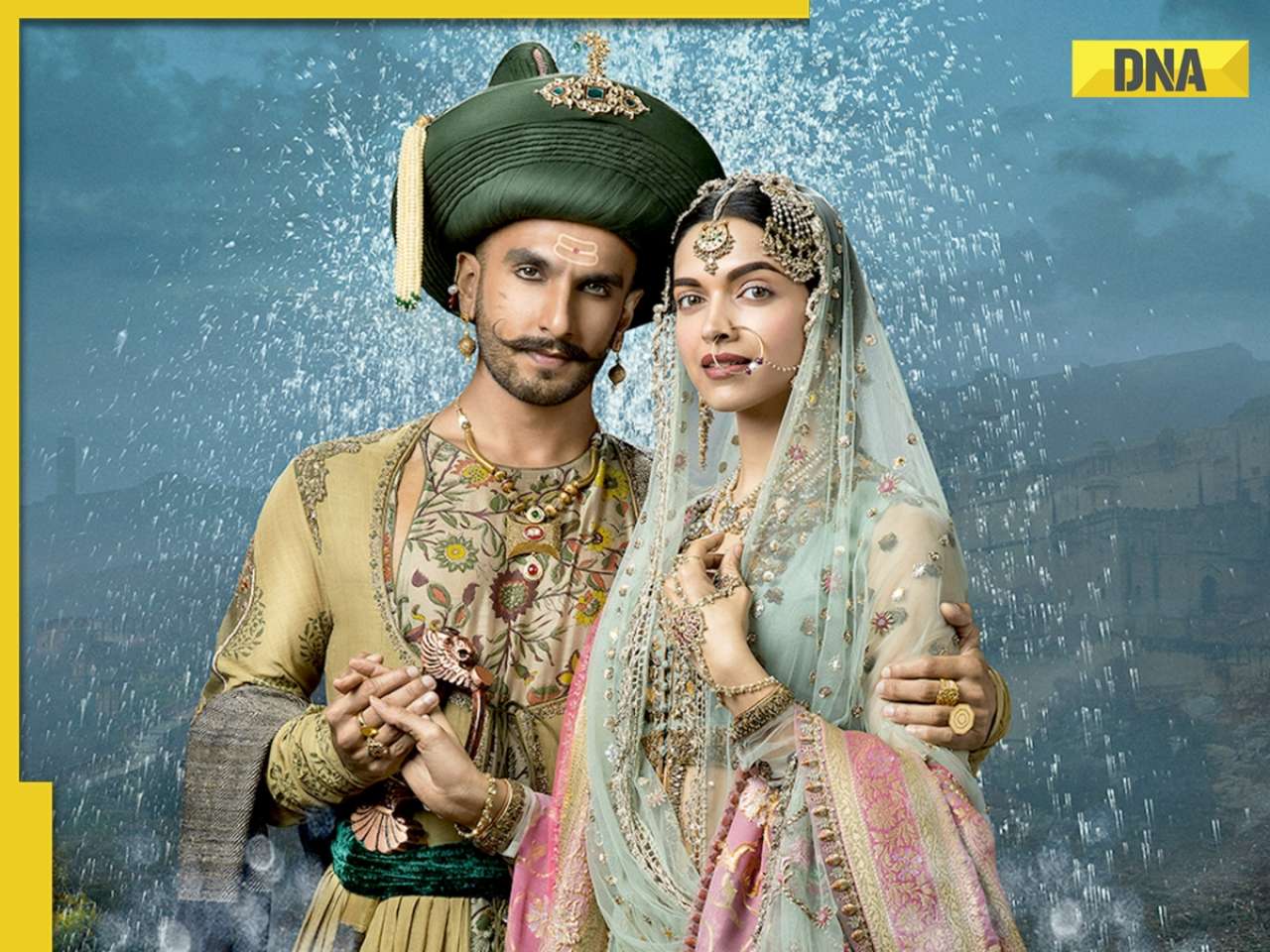

Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved![submenu-img]() Viral video: Donkey stuns internet with unexpected victory over hyena, watch

Viral video: Donkey stuns internet with unexpected victory over hyena, watch![submenu-img]() Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch

Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch![submenu-img]() Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...

Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...![submenu-img]() Cow fight injures two girls enjoying street snacks, video goes viral

Cow fight injures two girls enjoying street snacks, video goes viral![submenu-img]() Viral video: Man sets up makeshift hammock on bus, internet reacts

Viral video: Man sets up makeshift hammock on bus, internet reacts

)

)

)

)

)

)