It's a deal running into thousands of crores of rupees, but the bank entrusted with safekeeping of Tech Mahindra's payment for buying out Satyam will be paid just Rs 1,000.

It's a deal running into thousands of crores of rupees, but the bank entrusted with safekeeping of Tech Mahindra's payment for buying out scam-hit Satyam Computer will be paid just Rs 1,000 as its fee.

As per the deal reached between the two parties, Tech Mahindra has agreed to deposit Rs 1,756 crore in an escrow account towards the purchase of shares amounting to a 31 per cent stake in Satyam.

Pursuant to their agreement, which has also been approved by the Company Law Board, Satyam and Tech Mahindra have jointly appointed Hongkong and Shanghai Banking Corporate Ltd (HSBC) as the 'escrow agent' for safekeeping of this payment.

As part of the agreement with HSBC, the global banking major would open a "no-lien, non-interest bearing account in the name of Satyam-Bidder Escrow Account." In M&A deals, such accounts are meant for safekeeping of payments made by the bidder till the time the deal is closed, after which it is released to the other party.

"In consideration of undertaking the obligations under this agreement, the escrow agent shall be entitled to receive an amount of Rs 1,000 (one thousand only) as its fees (escrow fee)" solely by the bidder, says the agreement.

Besides, a delayed payment of escrow fee would not entitle HSBC, which has agreed to open such an account at one of its Indian branches, to terminate the agreement.

HSBC's sole responsibility would be "for the safekeeping and disbursement" of Tech Mahindra's payment for a 31 per cent equity in Satyam "and to the extent that such disbursement shall not cause the escrow account to become overdrawn."

The agreement mandates that the account should be opened specifically for the purpose of Tech Mahindra's payment for 31 per cent equity purchase in Satyam through a preferential allotment of shares and both the companies would have to comply with all the 'know your client (KYC)' norms of HSBC.

HSBC can terminate the agreement with a 15-day notice if KYC documents submitted by Satyam and Tech Mahindra were not to its satisfaction. In such a case, the two firms would have to appoint another 'escrow agent' on identical terms.

As per the deal, Tech Mahindra has agreed to deposit the payment within four business days of being declared the successful bidder.

HSBC would have to remit the entire amount in escrow account to Satyam's bank account immediately (and no later than one business day) on receipt of documents from Satyam and Tech Mahindra showing closure of the share subscription agreement.

The deal would be considered to be closed after Satyam has confirmed receipt of payment in the account, Tech Mahindra has paid all related expenses, Satyam has convened a board meeting to issue and allot shares to Tech Mahindra and to appoint the latter's nominees as its additional directors.

Upon release of the amount, HSBC would have to close the escrow account.

![submenu-img]() Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading

Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading![submenu-img]() Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers

Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers![submenu-img]() Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!

Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!![submenu-img]() Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews

Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here![submenu-img]() IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…

IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here![submenu-img]() Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...

Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...![submenu-img]() IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…

IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() ‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024

‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024![submenu-img]() Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections

Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections![submenu-img]() Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details

Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details ![submenu-img]() 86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters

86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters![submenu-img]() Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react

Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react![submenu-img]() Real story of Lahore's Heermandi that inspired Netflix series

Real story of Lahore's Heermandi that inspired Netflix series![submenu-img]() 12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside

12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside![submenu-img]() Viral video: Pakistani man tries to get close with tiger and this happens next

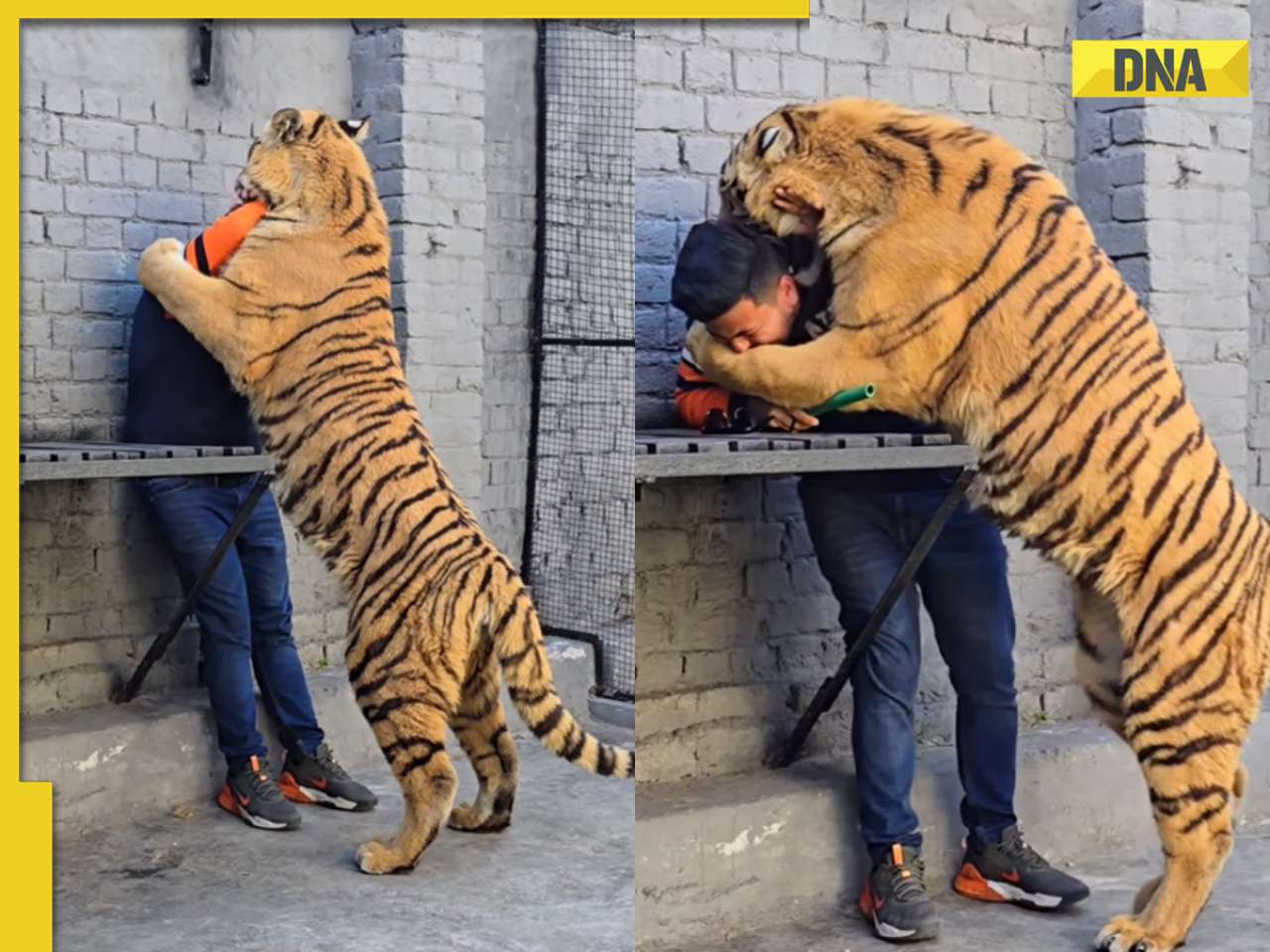

Viral video: Pakistani man tries to get close with tiger and this happens next![submenu-img]() Owl swallows snake in one go, viral video shocks internet

Owl swallows snake in one go, viral video shocks internet

)

)

)

)

)

)