Punjab National Bank on Thursday said it would cut overall interest rates again if inflation eases further.

Ruling out the possibility of matching home loan rates offered by the country's largest lender SBI, Punjab National Bank on Thursday said it would cut overall interest rates again if inflation eases further.

"If inflation comes down further, we will cut rates again," PNB chairman and managing director K C Chakrabarty said on the sidelines of a function announcing implementation of core banking solution (CBS) across its network.

The country's second largest public sector lender last reduced its rates from February 1 when it slashed benchmark lending rate by 50 basis points to 11.50 per cent. At the same time, it also reduced rates on home, car, education as well as personal loans by up to 50 basis points.

Inflation for the week ended January 24 eased to nearly one year low of 5.07 per cent.

Terming its home loan rate competitive, Chakrabarty said, "Though SBI is our big brother we have no intention to match eight per cent home loan rate scheme."

SBI reduced its housing loan rate to eight per cent for the new borrowers for a period of one year irrespective of the loan amount.

The new scheme of eight per cent interest rate will be offered for loans availed between February 2 and April 30, 2009.

After the freeze period, SBI would reset the rate as originally applicable under respective schemes.

PNB is offering floating rate housing loans in between nine per cent and 10.25 per cent depending upon tenors and amounts.

Talking about implementation of CBS, Chakrabarty said, the project has been completed four months ahead of schedule.

All its 4,604 branches and 249 extension counters are running through Finacle Universal Banking solution since November 2008.

The challenges of the financial sector can be met with the total connectivity and the centralisation of the banking operation, he said, adding it not only ensures standardisation of products, but also enables quick launch of the new and innovative financial products ensuring sufficient lead time to market it.

Chakrabarty said the bank is planning to set up a wholly owned subsidiary in line with its UK operation in Canada.

The subsidiary is likely to come up by the end of this year, he said, adding only last month PNB opened a representative office in Oslo, Norway.

PNB had also expanded UK subsidiary by opening a branch in Leicester. The subsidiary already had two branches at Gresham Street and Southall.

![submenu-img]() Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'

Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'![submenu-img]() Wayanad or Raebareli? Congress Leader Rahul Gandhi likely to decide on Monday

Wayanad or Raebareli? Congress Leader Rahul Gandhi likely to decide on Monday![submenu-img]() PM Modi to flag off 2 new Vande Bharat trains on this date, check route, timetable, and other details

PM Modi to flag off 2 new Vande Bharat trains on this date, check route, timetable, and other details![submenu-img]() Manipur: Major fire breaks out in abandoned building near CM Biren Singh's residence

Manipur: Major fire breaks out in abandoned building near CM Biren Singh's residence![submenu-img]() Fixed deposits: Which bank is offering highest FD interest rates post RBI's new guidelines?

Fixed deposits: Which bank is offering highest FD interest rates post RBI's new guidelines?![submenu-img]() Meet MIT graduate who secured 42nd rank in UPSC, is now suspended due to..

Meet MIT graduate who secured 42nd rank in UPSC, is now suspended due to..![submenu-img]() Railway Recruitment 2024: Sarkari Naukri alert for 1104 posts, check eligibility and selection process

Railway Recruitment 2024: Sarkari Naukri alert for 1104 posts, check eligibility and selection process![submenu-img]() NEET-UG exam row: 'Transparent process will be...,' assures Education Minister Dharmendra Pradhan to students, parents

NEET-UG exam row: 'Transparent process will be...,' assures Education Minister Dharmendra Pradhan to students, parents![submenu-img]() Meet man, a tailor's son from Latur, who cracked four competitive exams, aims to become...

Meet man, a tailor's son from Latur, who cracked four competitive exams, aims to become...![submenu-img]() Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...

Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew

In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew![submenu-img]() How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer

How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer![submenu-img]() In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'

In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'

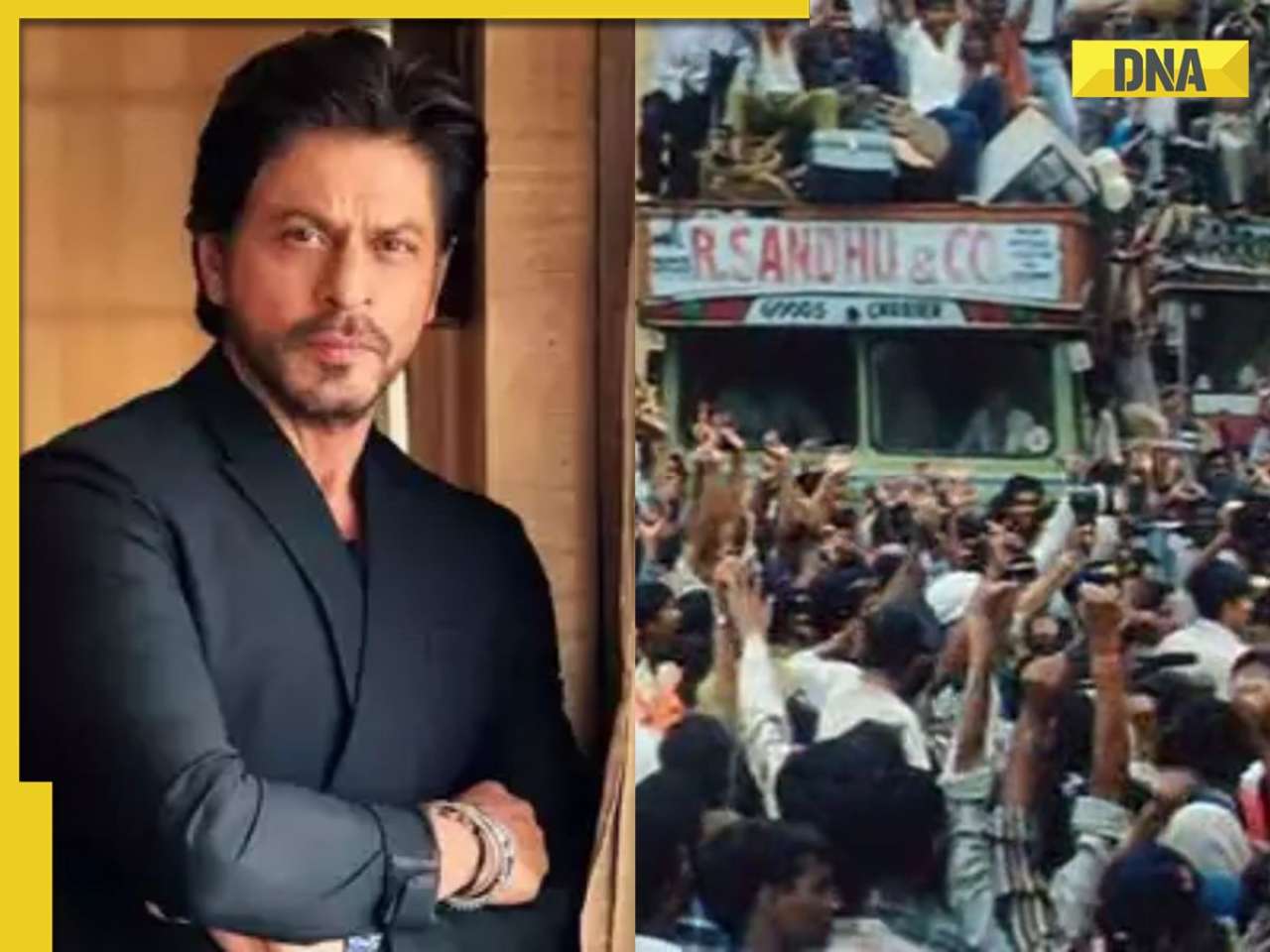

Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'![submenu-img]() Shah Rukh Khan took only Re 1 signing amount for this cult film, gave bulk dates to director, later rejected it for..

Shah Rukh Khan took only Re 1 signing amount for this cult film, gave bulk dates to director, later rejected it for..![submenu-img]() Made in Rs 9 crore, this film became blockbuster, was rejected by six actresses, won three National Awards, earned...

Made in Rs 9 crore, this film became blockbuster, was rejected by six actresses, won three National Awards, earned...![submenu-img]() 'Audience ko drama..': Shiv Shakti star Ram Yashvardhan on creative liberties taken in mythological series, films

'Audience ko drama..': Shiv Shakti star Ram Yashvardhan on creative liberties taken in mythological series, films![submenu-img]() Not Parveen Babi, Zeenat, Sharmila, Neetu, only Bollywood actress to attend Amitabh Bachchan-Jaya's wedding was...

Not Parveen Babi, Zeenat, Sharmila, Neetu, only Bollywood actress to attend Amitabh Bachchan-Jaya's wedding was...![submenu-img]() Stolen Titian Renaissance painting found at London bus stop, set to sell for up to..

Stolen Titian Renaissance painting found at London bus stop, set to sell for up to..![submenu-img]() Student fails Physics, Chemistry in class 12th, tops NEET 2024 exam; candidate’s scorecard goes viral

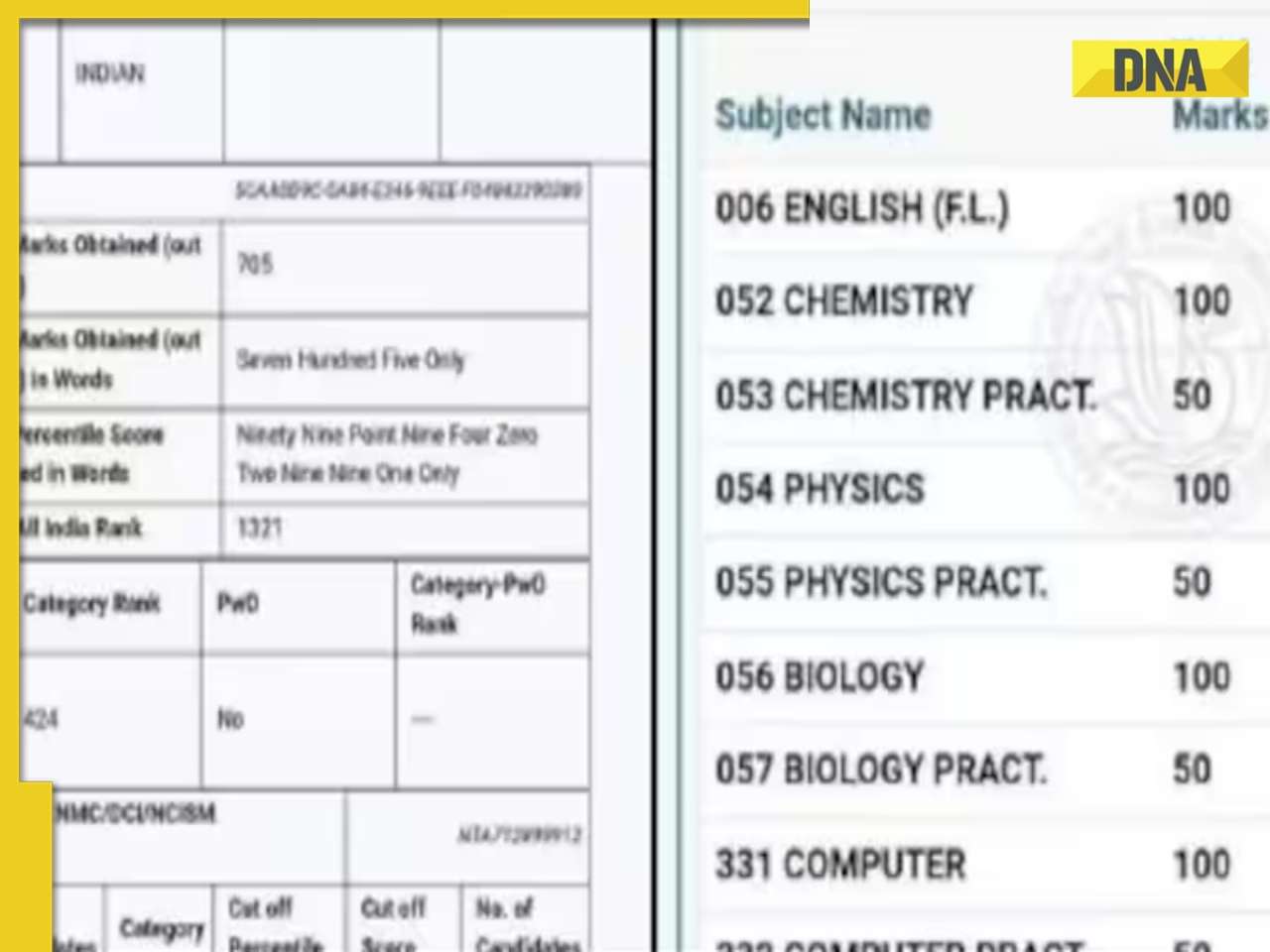

Student fails Physics, Chemistry in class 12th, tops NEET 2024 exam; candidate’s scorecard goes viral![submenu-img]() Watch viral video: Italy's PM Giorgia Meloni posts video with PM Modi with 'Melodi' reference

Watch viral video: Italy's PM Giorgia Meloni posts video with PM Modi with 'Melodi' reference![submenu-img]() Girl shocks internet by eating snake like snack in viral video, watch

Girl shocks internet by eating snake like snack in viral video, watch![submenu-img]() Brave or foolhardy? Woman bathes jaguar with pipe, video goes viral

Brave or foolhardy? Woman bathes jaguar with pipe, video goes viral

)

)

)

)

)

)