That, however, is not the case when it comes to borrowing money. Most would ask — how does it matter whether the institution one borrows from is trustworthy or not?

Harsh Roongta

In a trait commonly found across nationalities and communities, people typically consider the trustworthiness of banks and other companies when it comes to depositing their hard-earned money.

That, however, is not the case when it comes to borrowing money. Most would ask — how does it matter whether the institution one borrows from is trustworthy or not?

I was a part of this school of thought until a few months ago. But, some recent events have forced me to rethink.

Incident 1

I had signed as a guarantor for an education loan taken by my brother from a leading housing finance company, which also has a relatively lesser known education loan programme, for pursuing an MBA at the Indian School of Business (ISB), Hyderabad. The loan did not require any repayment (either of interest or principal) during the first 15 months.

However, towards the end of his one-year programme, my brother informed me that there was a problem. A lot of his fellow students had taken loans from the same institution and it seems its “system” could not handle the repayment holiday built into the structure of this loan (probably since it was built for home loan and not education loan) and continued to generate bills for the interest month after month.

And since the bills were generated but not paid, given the repayment holiday, they showed up as overdue (obviously since the education loan agreement clearly provided for the payment holiday) and eventually got reported as a default to the Credit Information Bureau (India) Ltd (Cibil). Incidentally, the loan request of another student’s guarantor had been turned down on account of this “default,” my brother informed.

I have always understood the importance of a good credit record and have taken great care to maintain a spotless repayment record. Hence, I was shocked by this.

Fortunately, my brother and his fellow affected students took up the matter strongly with the lender and given the clout of ISB, the lender took these complaints seriously. It promised to officially inform the credit bureau of the “system” error and ensure that the so called “default” was wiped off the records for both the student as well guarantor.

In practice, however, they just got the credit report of my brother. They dismissed the requirement for my credit report saying their “system” showed they had not reported the “default” in my account to the credit bureau.

However, I insisted on getting the report and despite their reluctance — perhaps because it cost Rs 50 or so to get one - they obliged. Fortunately, the credit report itself was clean, but I had spent a good four weeks being tense over it.

Incident 2

A bulky open envelope of my home loan lender with my name and address on it was handed over to the watchman of my building by a passerby who claimed to have found it on the road near my house. The watchman promptly delivered the envelope to my home.

I was horrified upon examining the contents - it had the entire documentation (fortunately, only photocopies) of my loan-against-property account, besides my income-tax returns and bank statements. What’s more, there were similar papers for seven other borrowers of the same bank. What were they doing in an envelope with my name on it? Who in the bank had access to these papers and what were they doing on the roadside? Did anyone in the bank miss those papers at all?

What would have happened if the papers had fallen into unscrupulous hands? There was no way I could have known.

What links these two incidents is operational failure. The operation-preparedness of most lenders has lagged their appetite for making advances. And yet, the lack of stringent punitive provisions helps them get away with violations.

An aggrieved consumer can complain to the Reserve Bank. However, the regulator lacks adequate teeth.

One could also approach the consumer courts, but that is time consuming. Besides, the compensation provided is peanuts.

The Credit Information Companies Regulation Act provides that banks will exercise due caution in reporting the correct figures to the bureau. Unfortunately, even this Act does not lay down any remedy the consumers can pursue directly against the lenders for wrong reporting of information.

However, the regulatory environment is now far more sensitive to these concerns and we should see gradual progress in ensuring lenders adopt the required operational procedures to minimise the occurrence of such incidents. A small beginning has already been made with the appointment of the banking ombudsman.

Harsh Roongta is the CEO of Apnaloan, which runs India’s largest market place for loans where banks compete for your loan.

![submenu-img]() Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...

Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...![submenu-img]() Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged

Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged![submenu-img]() Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'

Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...

Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...![submenu-img]() UGC NET June 2024: Registration window closes today; check how to apply

UGC NET June 2024: Registration window closes today; check how to apply![submenu-img]() Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...

Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

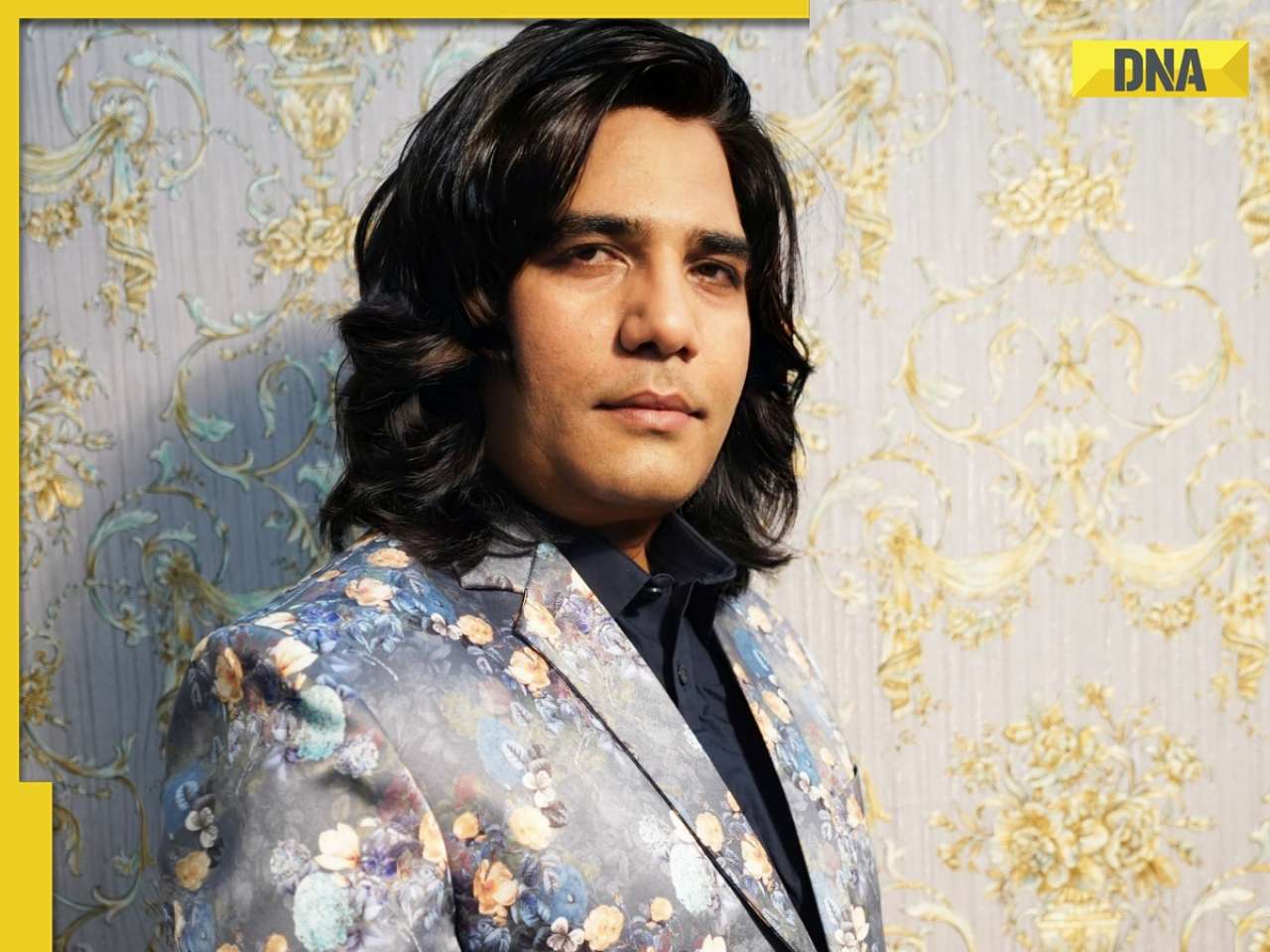

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

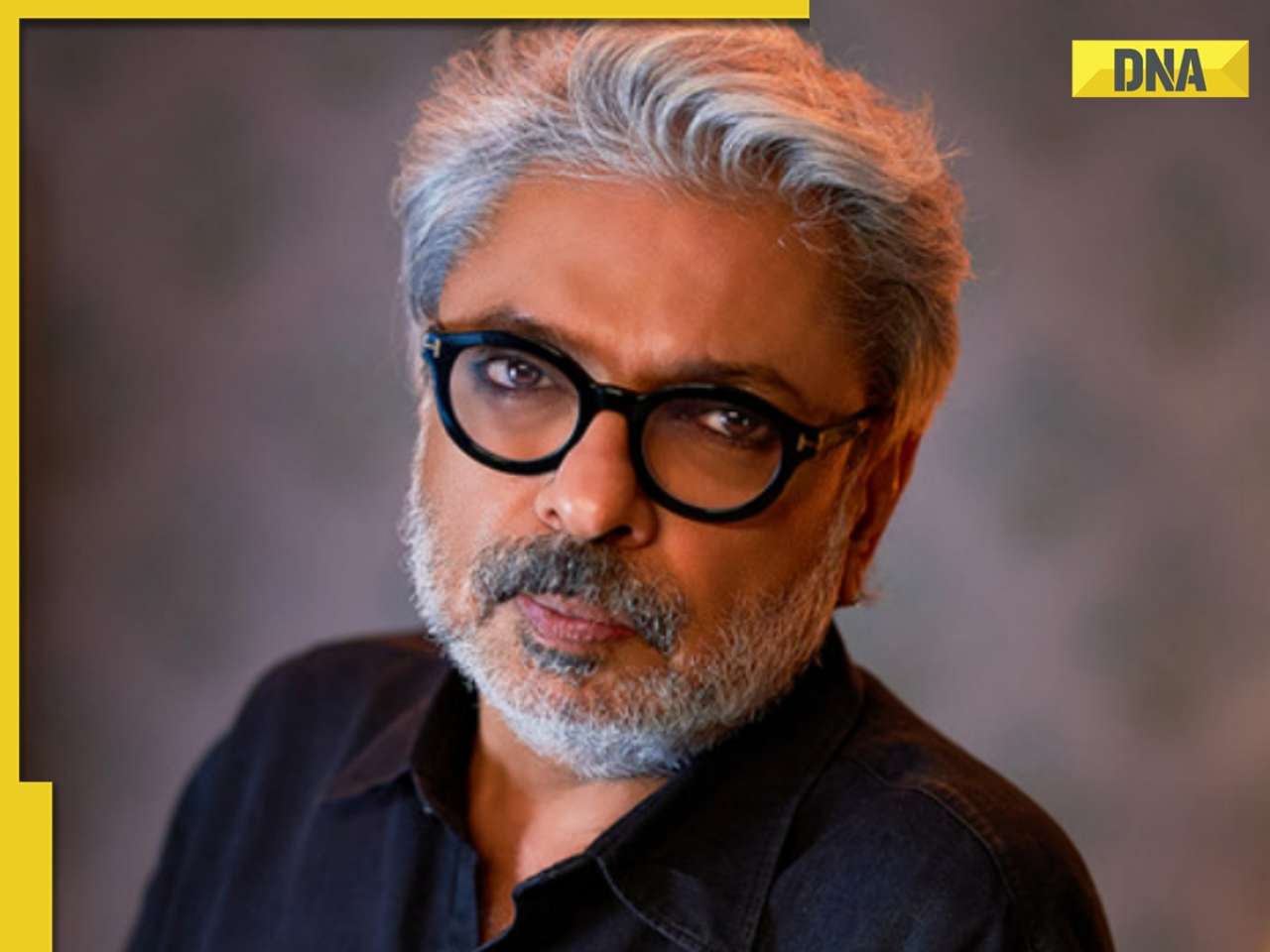

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'

Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'![submenu-img]() Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits

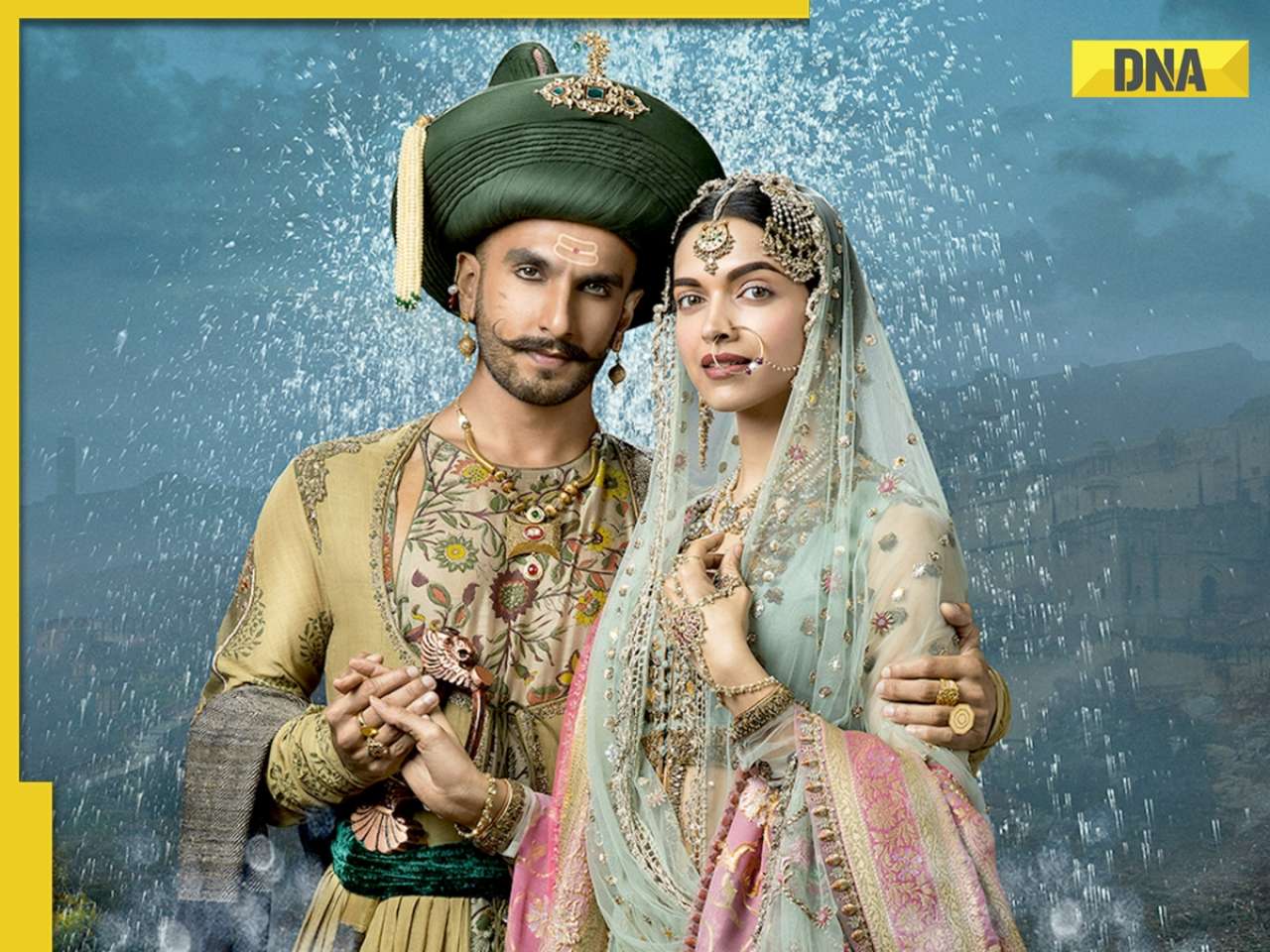

Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits![submenu-img]() Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved

Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved![submenu-img]() Viral video: Donkey stuns internet with unexpected victory over hyena, watch

Viral video: Donkey stuns internet with unexpected victory over hyena, watch![submenu-img]() Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch

Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch![submenu-img]() Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...

Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...![submenu-img]() Cow fight injures two girls enjoying street snacks, video goes viral

Cow fight injures two girls enjoying street snacks, video goes viral![submenu-img]() Viral video: Man sets up makeshift hammock on bus, internet reacts

Viral video: Man sets up makeshift hammock on bus, internet reacts

)

)

)

)

)

)