The sound of music is not translating into the sweet jingle of coins, at least not fast enough.

With just 3.2% share of the spoils and revenue growth not meeting forecasts, sustainability worries rise

MUMBAI: The sound of music is not translating into the sweet jingle of coins, at least not fast enough.

Advertising revenue, the primary bread earner for private FM stations, is not flowing thick and fast and station heads are now in a fix over sustaining their business in small towns in the long run. Since the business model is not subscription-based, radio advertising is the main source of revenue for radio stations.

Growth in ad revenues for radio has not met industry predictions. According to the Ficci-PwC report 2008, India’s radio industry grew by 37% in 2004-07. However, radio advertising in 2007 grew by 24% over the previous year, significantly lower than the forecasted growth of 30%.

This, at a time when private FM radio, all set for its third round of expansion into smaller towns is expected to give local and national advertisers greater reach and mileage. Analysts say that similar sounding stations have made advertisers hesitant to invest more in radio, even though they are “currently paying peanuts to them.”

“When all stations begin to sound alike, the music turns into white noise,” says a senior media analyst.

One could point out the same about general entertainment channels on television, but media buyers say that emotional connect still cannot be established by an advertiser on radio. “Firstly, purely music-centric content by all stations has made audiences look at radio as a music-only medium. Therefore, as soon as ad pops up, they switch stations,” says Sejal Shah, vice-president, India Media Exchange (IMX), which buys traditional media for Starcom Mediavest Group and Zenith Optimedia.

Measuring radio audience is yet another issue.

Radio Audience Measurement (RAM), an initiative from TAM Media Research last year, is still to take-off fully and only covers cities like Delhi, Mumbai, Bangalore and Kolkata so far. “Moreover, there’s still no third party to verify how many calls and SMSes each station is receiving from listeners,” says Shah.

Admen say FM stations are using the measurement statistics to their own advantage. “Every station claims that it is number one. How do we trust the medium?” asks Ramanuj Shastry, chief creative officer, Rediffusion DYR.

Anand Chakravarthy, vice-president -marketing, Big FM, admits that some FM stations have been using the measurement system to their own advantage. “It shouldn’t be happening and this is making advertisers undervalue the radio business,” he says.

Out of the total ad spend, investment on radio is low. In terms of share of the ad pie, radio industry has been able to increase it to a mere 3.2% in 2007, from 3.1% in 2006. The quality of radio advertising hence, has taken a hit, say ad men.

Abhijit Awasthi, executive creative director - South Asia, Ogilvy & Mather, who was in the Radio and Radio Craft jury at the Goafest, says he “almost lost one ear listening to the 380-odd entries.”

“The quality of work has gone down. Primarily, compared to TV or print, radio advertising is not considered glamourous. Ad men think it’s not sexy enough.”

Most radio creatives, therefore, resort to short-cuts. “A Sholay spoof is the most popular cliche on radio. In fact, had there not been Sholay, there would have been no radio advertising today,” says Awasthi.

FM station owners, however, pass the buck to advertisers claiming that the radio, a medium that has been in India since more than 60 years, has not been understood yet by them and their ad agencies.

“It’s not about the money. It’s about the value they place on the medium,” says Anil Srivatsa, chief operating officer, Radio Today, which runs Meow FM, targeted at women listeners.

“Marketers need to get more involved in the medium rather than leaving it to the media agencies. The latter will obviously try to save most amount of money for their clients, rather than helping them find audiences. At the end of the day, an advertiser wants audiences,” he says.

Ashit Kukian, EVP and national sales head, Radio City says, “Educating advertisers is going to be a key focus area now. Involvement and stickiness with radio is much higher compared to other mediums.”

Some breakthrough has been achieved though. While, currently brand-related activities include contest-based tie-ups, promotions and ground events. Off-late simulcasting content in partnership with television channels is also gaining momentum.

c_arcopol@dnaindia.net

![submenu-img]() Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading

Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading![submenu-img]() Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers

Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers![submenu-img]() Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!

Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!![submenu-img]() Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews

Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here![submenu-img]() IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…

IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here![submenu-img]() Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...

Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...![submenu-img]() IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…

IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() ‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024

‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024![submenu-img]() Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections

Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections![submenu-img]() Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details

Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details ![submenu-img]() 86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters

86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters![submenu-img]() Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react

Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react![submenu-img]() Real story of Lahore's Heermandi that inspired Netflix series

Real story of Lahore's Heermandi that inspired Netflix series![submenu-img]() 12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside

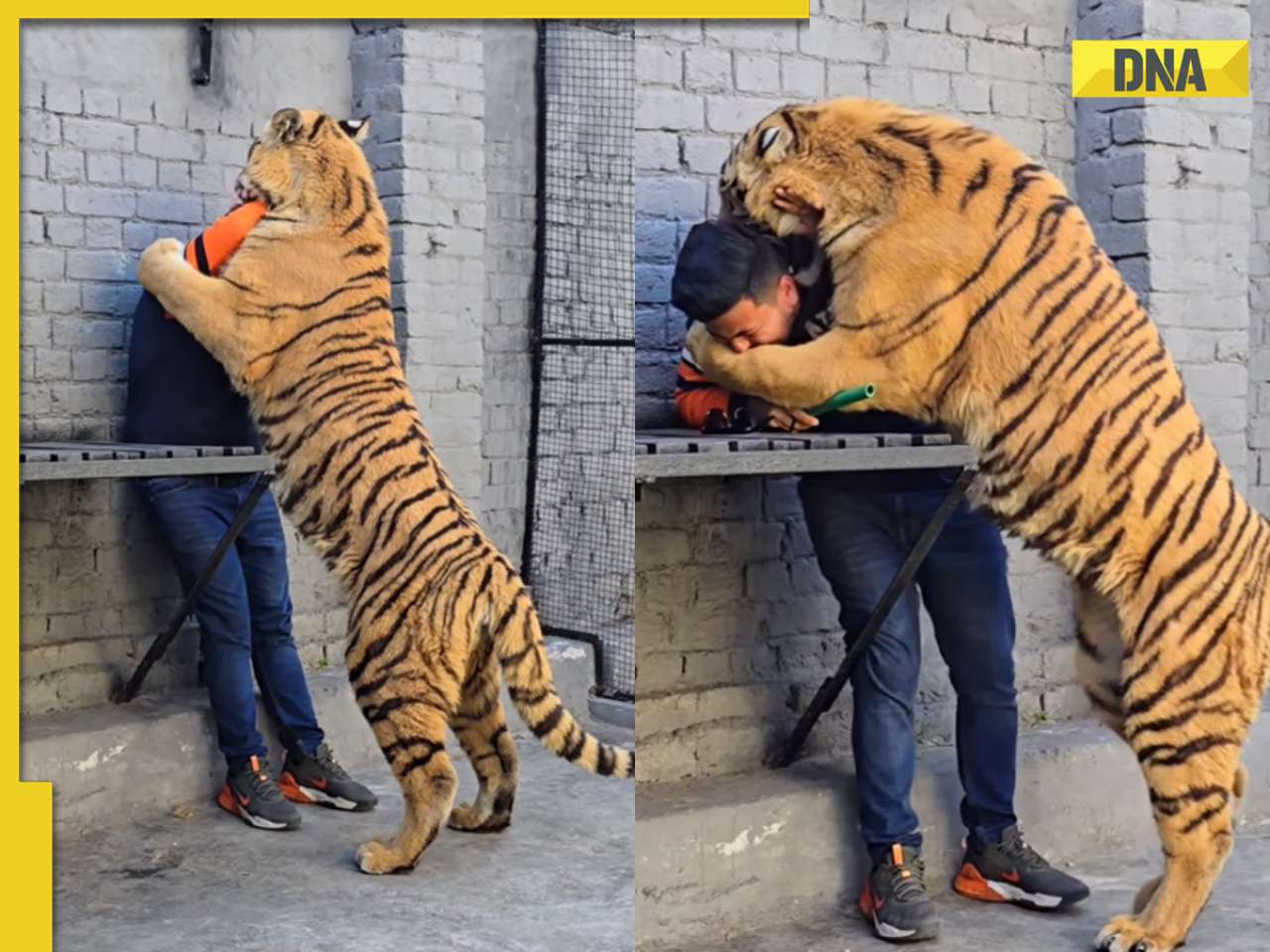

12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside![submenu-img]() Viral video: Pakistani man tries to get close with tiger and this happens next

Viral video: Pakistani man tries to get close with tiger and this happens next![submenu-img]() Owl swallows snake in one go, viral video shocks internet

Owl swallows snake in one go, viral video shocks internet

)

)

)

)

)

)