While FMCGs may be cagey about putting money into Twenty20, telecom, insurance and finance firms may do so

While FMCGs may be cagey about putting money into Twenty20, telecom, insurance and finance firms may do so

NEW DELHI: The advertising trend is set to undergo a change with the Indian

Premier League (IPL), the brainchild of the Board of Control for Cricket

in India (BCCI), getting into action with its Twenty20 matches starting in April.

A closely fought bidding war recently saw business tycoons and film stars putting in big money to buy the eight IPL teams for anything between Rs272 crore and Rs441 crore.

The next round of auction on February 8 will determine which cricketers will join which team. Media planners are keenly watching the development, and would decide their exact game plan soon. But they are already saying that the advertising pie will grow with IPL coming in.

Ravi Kiran, CEO-South Asia of the Starcom MediaVest Group, said the media advertising budget will grow by around 2% post-IPL.

Currently, the total ad pie in India is estimated at Rs 16,000 crore. And, an additional budget of 2% would mean that the ad pie would grow by anything between Rs300 crore and Rs400 crore because of the IPL matches.

But Ravi Kiran didn’t term it as a dramatic impact on the advertising budget.

Mona Jain, executive vice-president at India Media Exchange (Publicis Group), also

indicated that the ad pie is expected to increase post-IPL, but refused to hazard a guess on the extent of impact it could have.

According to Jain, with so much money gone into bidding, the ad rates will be high for the IPL matches. While FMCGs may be a bit sceptical of advertising in the league matches, those likely to put in their money are companies in the telecom, insurance and finance sectors, Jain said.

For India’s tour to Australia, the ad rates on television for test matches have been anything between Rs 50,000 and Rs 75,000 per 10 seconds. One-day matches command much more — around Rs1.5 lakh to Rs1.6 lakh per 10 seconds.

Media analysts that DNA Money spoke to denied that other sports would suffer because of the ad pie getting split even further.

“People are earning more and spending more. With the economy booming and the ad spend growing significantly, there’s no reason that one should lose because another is gaining,” said Ravi Kiran. On the other hand, other sports may benefit indirectly after IPL, because sports consciousness is growing in the country, he said.

Another media analyst pointed out how the Bharti group had recently announced its support for football, despite the fact that cricket is attracting so much corporate money.

On television alone, the annual ad spend is estimated at Rs5,500 crore to Rs6,000 crore. Of this, cricket captures around 8 to 10% a year on an average. However, in a Cricket World Cup year, the cricket ad spend goes up by around 5%.

BCCI recently notched up over Rs7,000 crore from bidding for eight IPL teams and selling broadcasting rights to Sony. Reliance Industries’ Mukesh Ambani paid the highest at Rs441 crore for the Mumbai team. Other winners were Vijay Mallya, Shah Rukh Khan, Preity Zinta, Deccan Chronicle, GMR, India Cements, and UK’s Emerging Media.

m_nivedita@dnaindia.net

![submenu-img]() Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading

Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading![submenu-img]() Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers

Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers![submenu-img]() Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!

Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!![submenu-img]() Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews

Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here![submenu-img]() IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…

IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here![submenu-img]() Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...

Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...![submenu-img]() IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…

IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() ‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024

‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024![submenu-img]() Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections

Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections![submenu-img]() Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details

Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details ![submenu-img]() 86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters

86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters![submenu-img]() Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react

Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react![submenu-img]() Real story of Lahore's Heermandi that inspired Netflix series

Real story of Lahore's Heermandi that inspired Netflix series![submenu-img]() 12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside

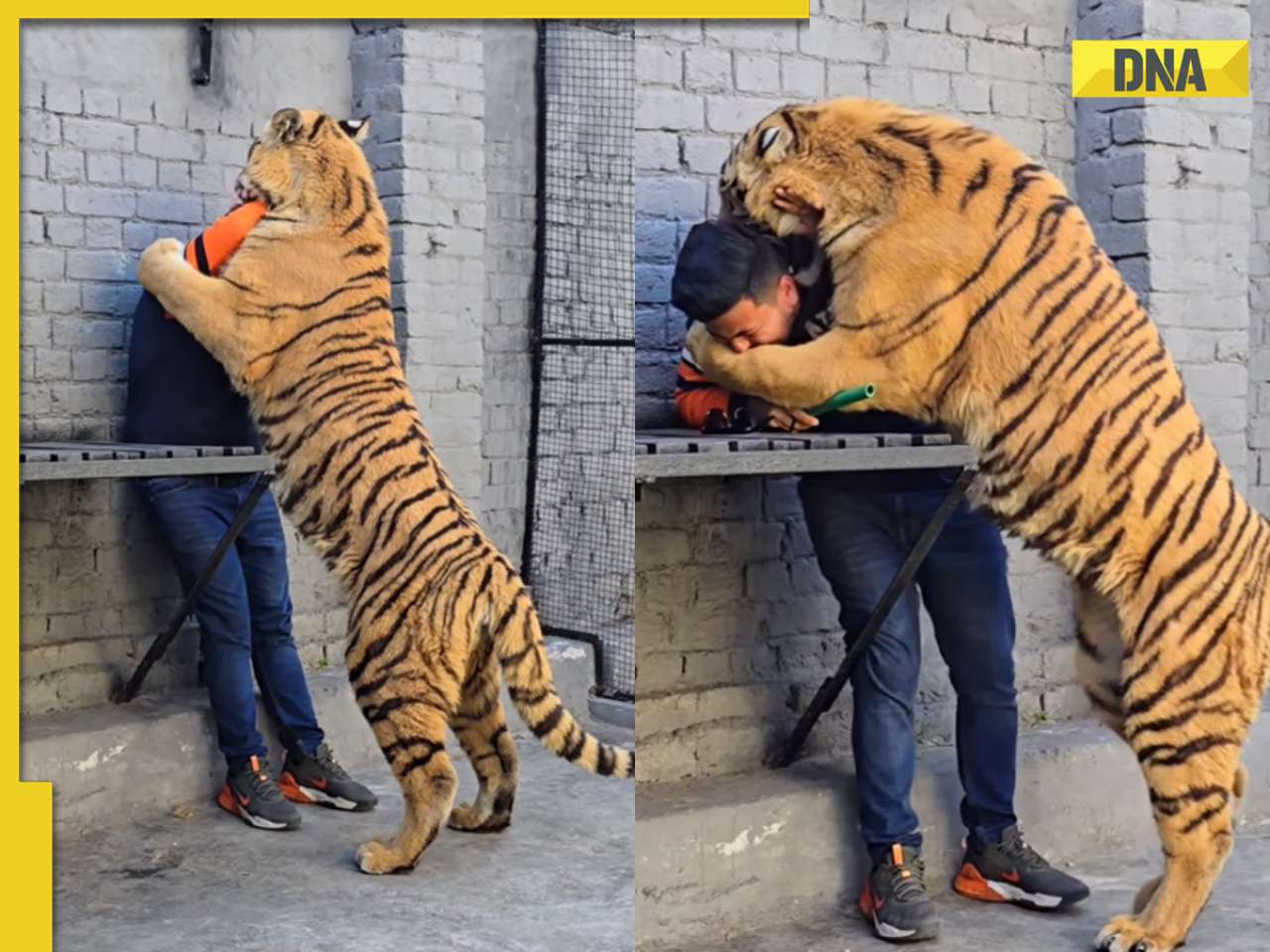

12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside![submenu-img]() Viral video: Pakistani man tries to get close with tiger and this happens next

Viral video: Pakistani man tries to get close with tiger and this happens next![submenu-img]() Owl swallows snake in one go, viral video shocks internet

Owl swallows snake in one go, viral video shocks internet

)

)

)

)

)

)