The Indian economy appears set to go the American commuters’ way and get off the 8%+ fast lane as fighting oil-fed inflation becomes the priority

MUMBAI: With the price of gas approaching $4 a gallon, more commuters are abandoning their cars and taking the train or bus instead.

— Clifford Krauss reporting for The New York Times from Denver on Saturday

The Indian economy appears set to go the American commuters’ way and get off the 8%+ fast lane as fighting oil-fed inflation becomes the priority for governments and central banks around the world.

Finance minister P Chidambaram and his election-mode, anti-incumbency-wary government certainly won’t mind sacrificing growth to pacify the divine electorate.

The market, as a thumb rule, discounts such possibilities in advance and is likely to sulk. Experts, therefore, predict a rangebound week.

Morgan Stanley analysts Ridham Desai and Sheela Rathi say the signs are ominous. In a strategy report on Friday, they wrote, “Over the past few days, the worst possible macro outcome for India seems to be unfolding with a depreciating currency and stronger commodity prices (notably oil). This macro outcome lends itself to higher inflation and thus a tighter monetary environment and creates downside risk to growth.”

According to the analysts, the factors that supported the one-month-long rally are no longer in play and a reversal is on the cards.

“Sentiment has recovered, valuations are off the lows, and India has started to outperform emerging markets.

The macro remains an important input and the trigger for a reversal in the rally could be a falling rupee and rising commodity prices.”

Manish Sonthalia, equity strategist, Motilal Oswal Securities, says oil is the biggest worrying point for the market. “Diesel shortage could be a reality and that is playing

on top of the minds of most players.”

The oil boil has caused a flight of FII money. Including provisional figures for Friday, overseas players sold equities worth Rs 1,733 crore last week.

During the Sensex speed drive from 15K to 20K levels late last year, rupee appreciation was one of the three angels (high interest rates, high growth and rising currency - known as the impossible trinity) that wooed an army of foreign investors to Indian shores.

Today, high interest rates have turned into a monster threatening to kill the growth angel and the rupee’s reversal marks the end of the fairy tale. The Indian currency saw its sharpest fall in ten years last week.

Sonthalia says, besides the oil, the falling rupee is another reason FIIs are on a selling spree. “Some forecasts put rupee going down to 42-43 levels against the dollar. That is forcing them to sell. Mutual funds are absorbing this selling to some extent.”

Though they have been sitting on huge cash, mutual funds were not big buyers last week. “Mutual funds may start nibbling technology, mobile telephony and to some extent commodities like metals at lower levels. Downside will not be very big. I expect the market to trade in the range of 16,800 and 17,500 for this week,” said Sonthalia.

However, rate-sensitive segments and oil companies may not see any respite, he added.

Vedprakash Chaturvedi, MD, Tata Mutual Fund, said, “My sense is that market will obviously react to the upward pressure on commodity prices, including oil and food prices. Given this reality, I feel inflation in India is still understated, meaning it’s more than what is reflected in the numbers.”

According to Chaturvedi, this could lead to an upward pressure on interest rates. In such a scenario, the market will put a question mark on the long-term growth story. “So, in the near term, market will remain in a trading band of 5-7% from the current levels.”

“While inflows have been good in the last two months, our aim is to deploy money carefully. In debt, the focus is on the shorter end. In equities, a lot of focus is on the sustainability of earnings growth and their certainty over years. We are looking for long-term stories with a 3-5 year perspective.”

Sitting on cash is not a strategy, he said, adding, the idea is to deploy gradually.

n_subramanian@dnaindia.net

![submenu-img]() Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading

Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading![submenu-img]() Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers

Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers![submenu-img]() Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!

Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!![submenu-img]() Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews

Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here![submenu-img]() IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…

IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here![submenu-img]() Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...

Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...![submenu-img]() IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…

IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() ‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024

‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024![submenu-img]() Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections

Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections![submenu-img]() Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details

Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details ![submenu-img]() 86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters

86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters![submenu-img]() Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react

Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react![submenu-img]() Real story of Lahore's Heermandi that inspired Netflix series

Real story of Lahore's Heermandi that inspired Netflix series![submenu-img]() 12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside

12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside![submenu-img]() Viral video: Pakistani man tries to get close with tiger and this happens next

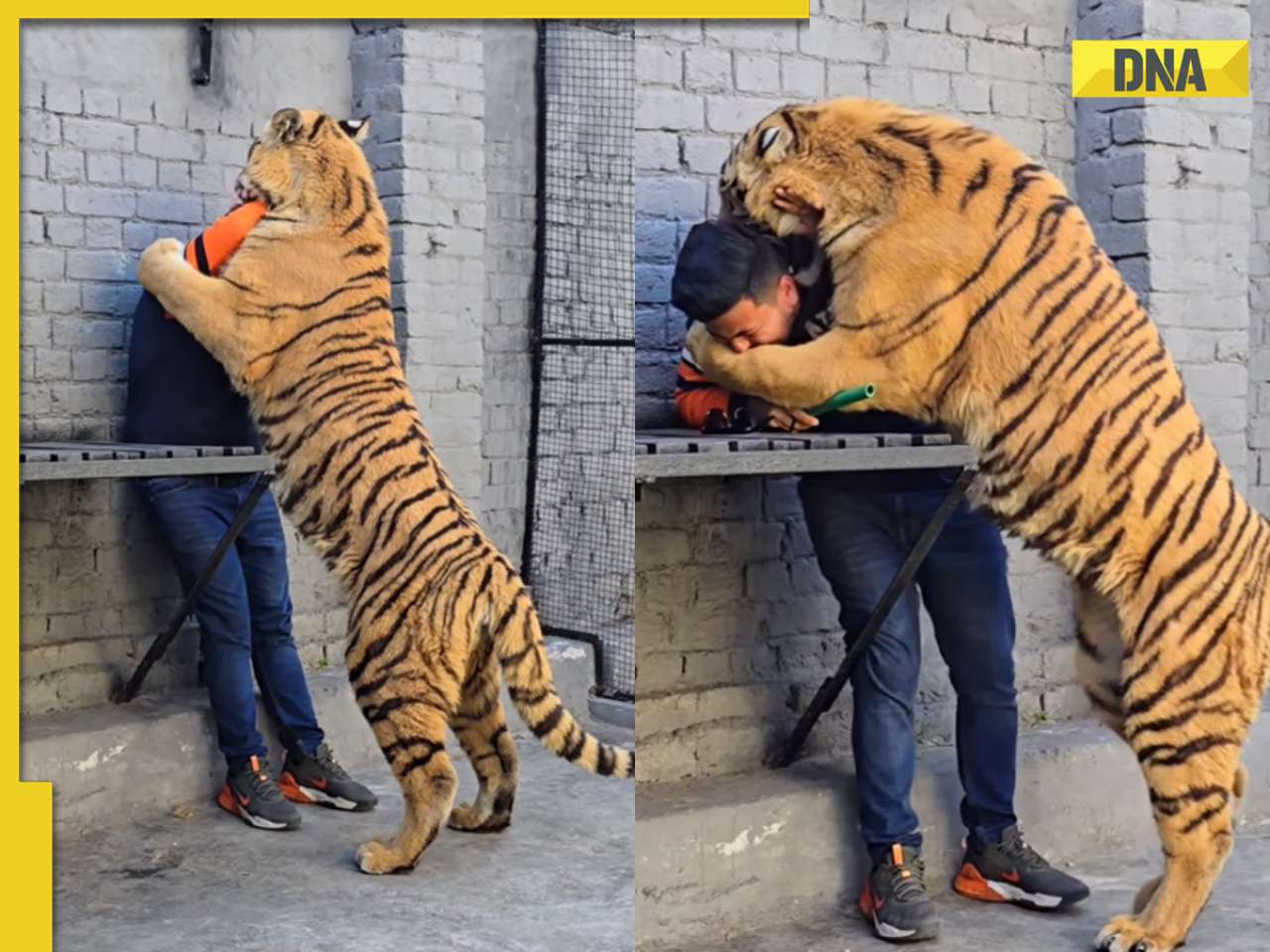

Viral video: Pakistani man tries to get close with tiger and this happens next![submenu-img]() Owl swallows snake in one go, viral video shocks internet

Owl swallows snake in one go, viral video shocks internet

)

)

)

)

)

)