Sensex was not the only index that hit a record high today as other indices of bank stocks, PSUs, consumer durables, capital goods and mid-caps also touched their peaks on sustained buying.

MUMBAI: Stock market benchmark Sensex was not the only index that hit a record high today as other indices of bank stocks, PSUs, consumer durables, capital goods and mid-caps also touched their peaks on sustained buying.

However, metal, small-cap, healthcare and FMCG indices are yet to regain their peaks reached over an year ago in May 2006, according to data available with Bombay Stock Exchange.

The IT index, which comprises heavyweight stocks like Infosys and TCS, is far from its peak scaled during the tech boom in February 2000. The index today settled at 4,867.27 points compared to 8,678 on February 22, 2000.

Auto index had scaled its peak on February 9, while oil and gas index rose to an all-time on May 23 this year.

Bombay Stock Exchange's sensitive index Sensex on Monday added 13.75, or 0.09 per cent, to 14,664.26, beating its record close on February 8 this year. The Nifty on National Stock Exchange slid 4.55, or 0.1 per cent, to 4,313.75.

The Sensex took 95 trading sessions to hit the peak on steady inflow of buying in capital goods, auto, bank and metal stocks on rising sales of vehicles, falling inflation and rapidly expanding economy.

The final push to the Sensex also came in on reports the rupee posted heavy gains against the dollar. While rise in rupee value is, however, a major factor in weakness witnessed in stocks of IT companies, which derive more than half of their revenues in dollar terms from the US market.

As the infrastructure sector came in limelight, cement, metal and heavy construction machinery companies such as L&T stole the show and lent maximum support to key indices.

Marketmen said buying in bank stocks gained as concerns regarding increase in global interest rates waned after the US Federal Reserve last week kept key rates unchanged.

They also said sentiment in the domestic market improved as inflation fell to a 14-month low of 4.03 per cent, lowering pressure on Reserve Bank to hike borrowing costs.

Capital goods segment index in the last five months has risen to 12,429.15 points from 9,939.61 recorded on February 9. Banking index to 7,990.48 points from 7,560.31, while metal index climbed to 10,560.32 points from 9,114.05.

Auto sector has fallen since February 9 on weak sale growth in recent past but picked up subsequently as rising stock prices of Maruti Udyog, Mahindra and Mahindra and Tata Motors boosted the trend. Auto index stood at 4,791.06 points as compared with 5,750.52 set on February 9.

Oil and gas index rose to 7,597.30 points from 6,631.51 points, PSU index to 6,795.10 points from 6,302.72, healthcare index from 3,842.94 points to 3,849.59, consumer durable from 3,926.25 to 4,264.90 points.

However, IT segment has dipped to 4,867.27 points from 5,479.15 as rising rupee raised fears of a fall in earnings of software exporting companies.

![submenu-img]() Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading

Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading![submenu-img]() Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers

Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers![submenu-img]() Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!

Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!![submenu-img]() Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews

Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here![submenu-img]() IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…

IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here![submenu-img]() Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...

Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...![submenu-img]() IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…

IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() ‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024

‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024![submenu-img]() Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections

Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections![submenu-img]() Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details

Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details ![submenu-img]() 86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters

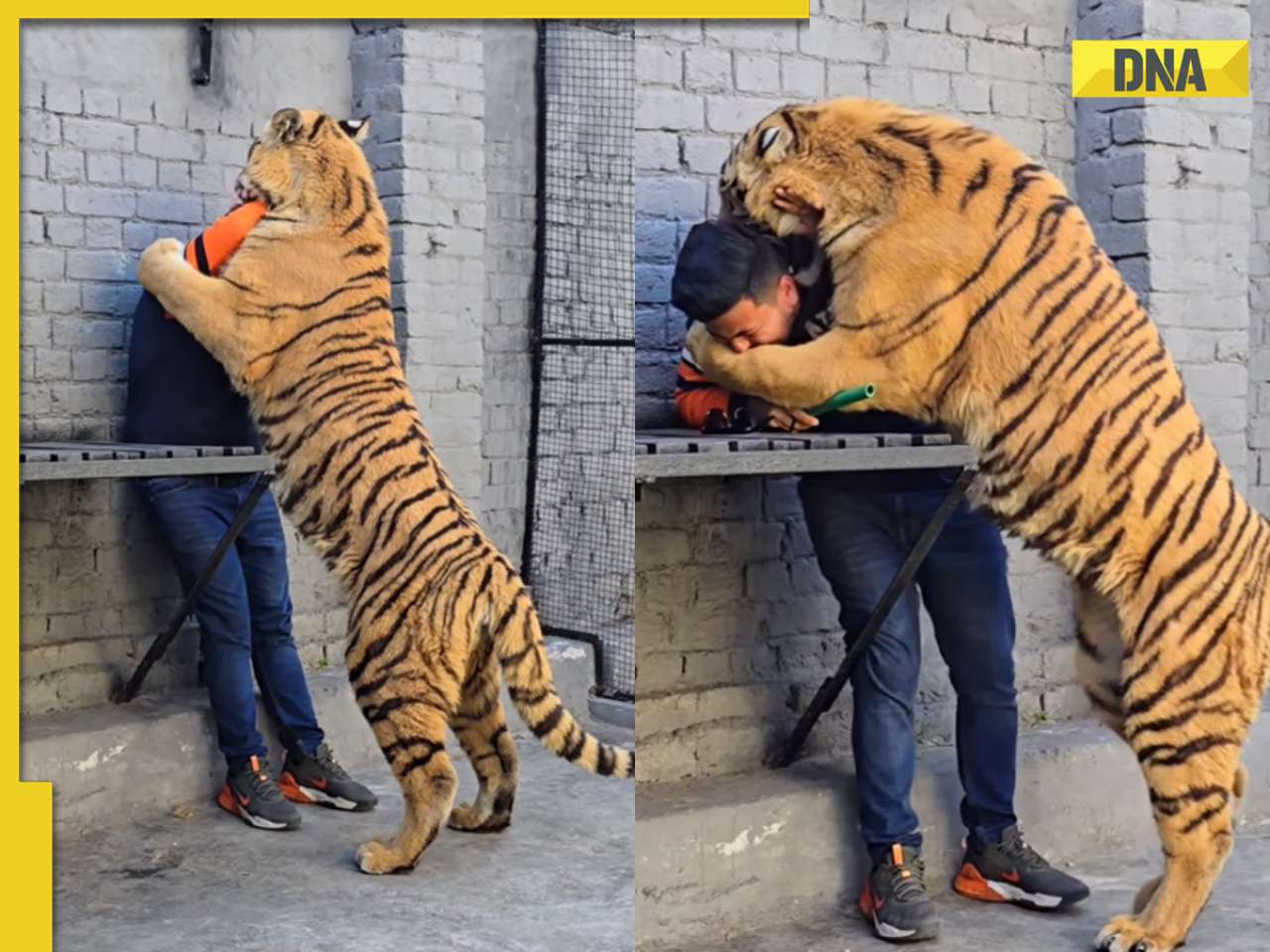

86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters![submenu-img]() Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react

Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react![submenu-img]() Real story of Lahore's Heermandi that inspired Netflix series

Real story of Lahore's Heermandi that inspired Netflix series![submenu-img]() 12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside

12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside![submenu-img]() Viral video: Pakistani man tries to get close with tiger and this happens next

Viral video: Pakistani man tries to get close with tiger and this happens next![submenu-img]() Owl swallows snake in one go, viral video shocks internet

Owl swallows snake in one go, viral video shocks internet

)

)

)

)

)

)