After suffering huge losses following the crash, jewellers are likely to adulterate your yellow metal.

Jewellers and traders have been caught at the wrong end of the stick after a stunning plunge in the prices of gold and silver over the last few days caused heavy losses.

“Their losses will be in crores, depending on how much their trade exposure was. Generally, 30% of gold trade in India pertains to hedging of positions, but many a time, greed overtakes (which spur one-sided bets), which leads to heavy losses,’’ says Vedant Jatia, director (sales) at Indian Institute of Jewellery.

Jewellers had anticipated prices to rise so they had stocked up on the metal for the festive season. But, to their utter shock, prices went the other way. The misery was compounded due to leverage, which eroded their capital in no time.

Traders so far had to pay a margin money of just 5% to take positions in gold and 6% in silver. Meaning, if they wanted to bet Rs100 on the way gold prices will swing, traders had to pay only Rs5. So, while a 5% rise in the price of gold doubled money (Rs5 invested, Rs5 gained), a similar swing the other way obliterated

the capital.

Due to huge volatility in the last couple of days, commodity exchanges like MCX increased the margin requirements to nearly 9% for gold and trebled it to 18% on silver.

Meaning, as prices continued to fall from last week, traders had to either book losses or pay more margins to keep their positions. This forced many to cancel trades and book losses.

To recoup losses, jewellers may be tempted to adulterate gold with other alloys which add weight and colour, experts warn. “One should avoid buying non-standardised gold for investment because it may be dubious in purity and so you’ll lose on resale value. Zinc and copper being the cheapest alloys, there are chances small jewellers may try to adulterate using that,’’ said Jatiya.

Partner, PN Gadgil Jewellers, Saurabh Gadgil advises customers to buy jewellery from trusted jewellers. “It is advisable to go for BIS-hallmarked jewellery. People sometime go to any jeweller just to save a few rupees. It is preferable to go to reputed jewellers who are known for their market standing. An ensured bill is a must before buying gold to avoid any kind of adulteration,’’ said Gadgil.

According to Gadgil, the rise and fall of prices did not affect the jewellers so much as they earned profits only on the making charges. “We buy the gold entirely by cash which is from designated banks,’’ Gadgil said.

On the other hand, Vastupal Ranka, director, Ranka Jewellers said, “Today, hallmarking of jewellery is done which ensures the purity of carats. Customers should buy hallmark stamped jewellery from reputed jewellers. There has been a major fluctuation in the prices due to the Multi Commodity Exchange (MCX), but we are not at all affected by the fluctuations. Out stocks are well maintained, so we buy and sell the gold at the same rate. If the prices go down, the we will have more turnover.’’

Zinc is used in gold to give a greenish tint, while copper is used to give a darker shade. Silver is used for whitish tone, while iridium and cadmium are usually mixed during the welding process to make bangles or join some parts of gold.

“Adulteration in gold continues across India, especially among small jewellers. Jewellery with gold mixed with cadmium can be hazardous on skin compared with iridium,’’ said Sandeep Kulhalli, vice president, retail & marketing at Tanishq, the Tata Group chain.

Not just wearers, such metals have ill-effects on those who are manufacture jewellery too, they are environment-unfriendly too. They cause skin and lung problems, said Jatia.

The best way to avoid all the hassles is to invest in gold exchange traded funds, where you own ‘paper gold’. There is no risk of adulteration, no risk of theft or loss, said experts.

— Inputs from Priyanka Naithani

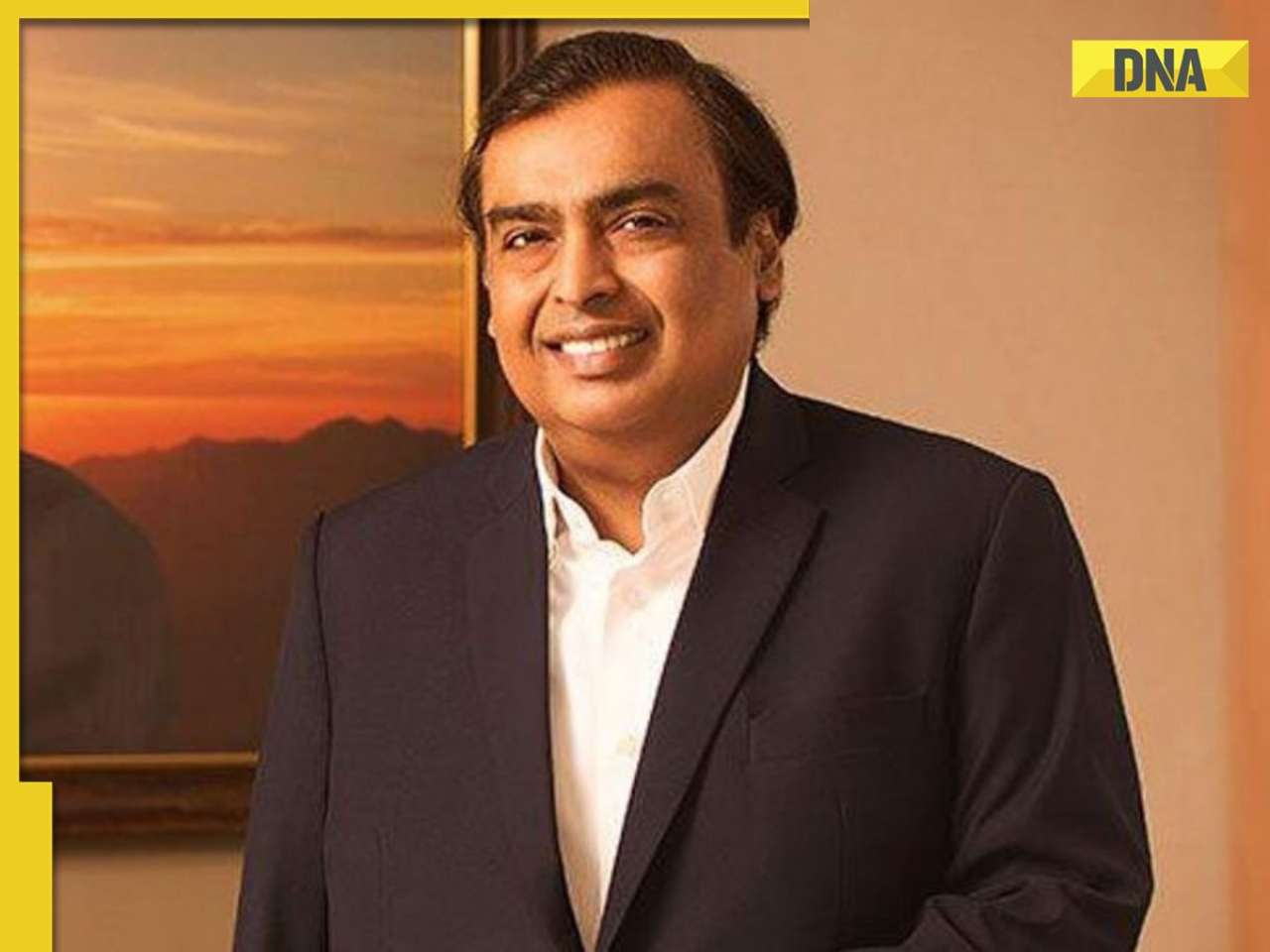

![submenu-img]() Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...

Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...![submenu-img]() Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged

Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged![submenu-img]() Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'

Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...

Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...![submenu-img]() UGC NET June 2024: Registration window closes today; check how to apply

UGC NET June 2024: Registration window closes today; check how to apply![submenu-img]() Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...

Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

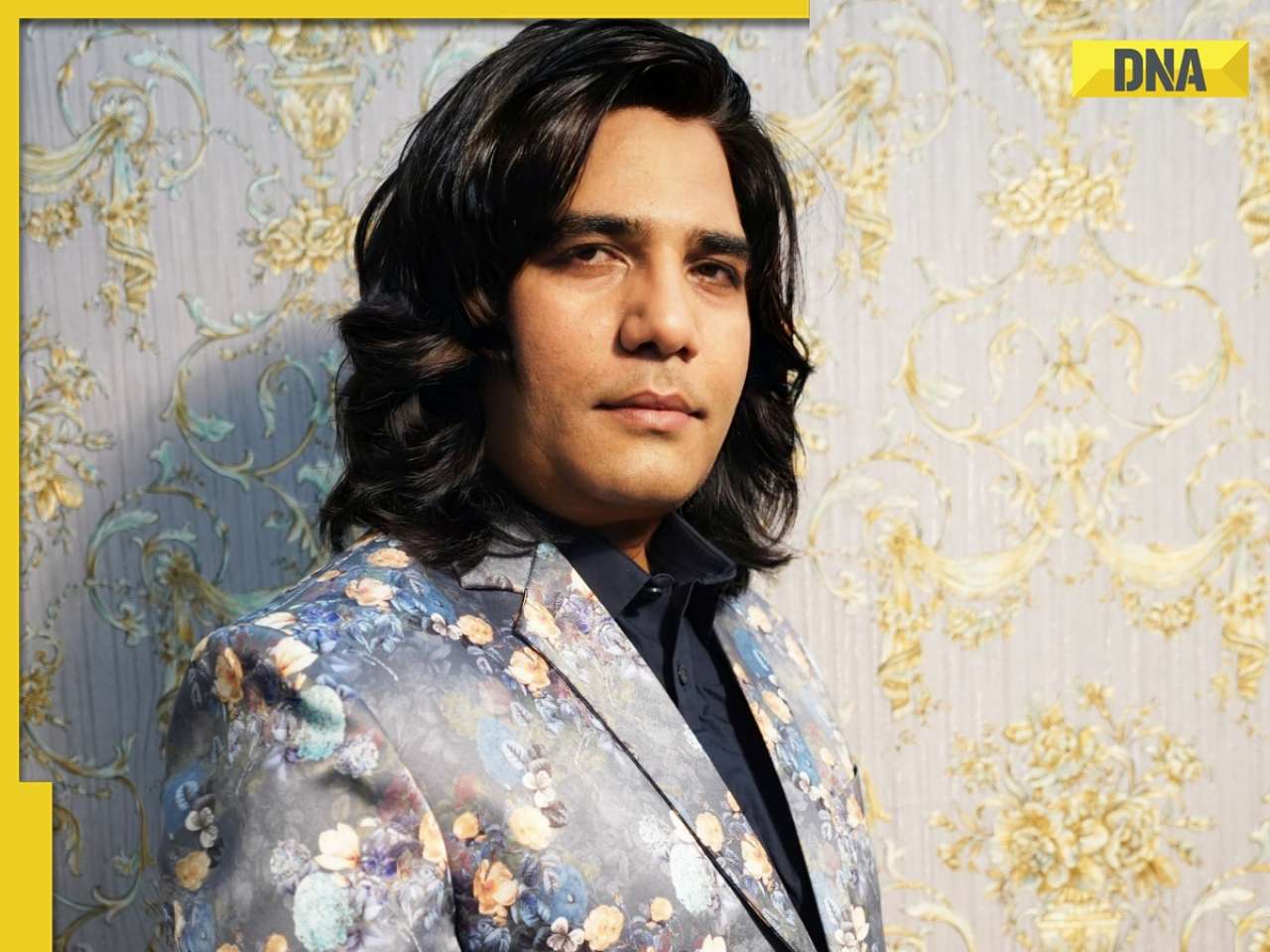

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

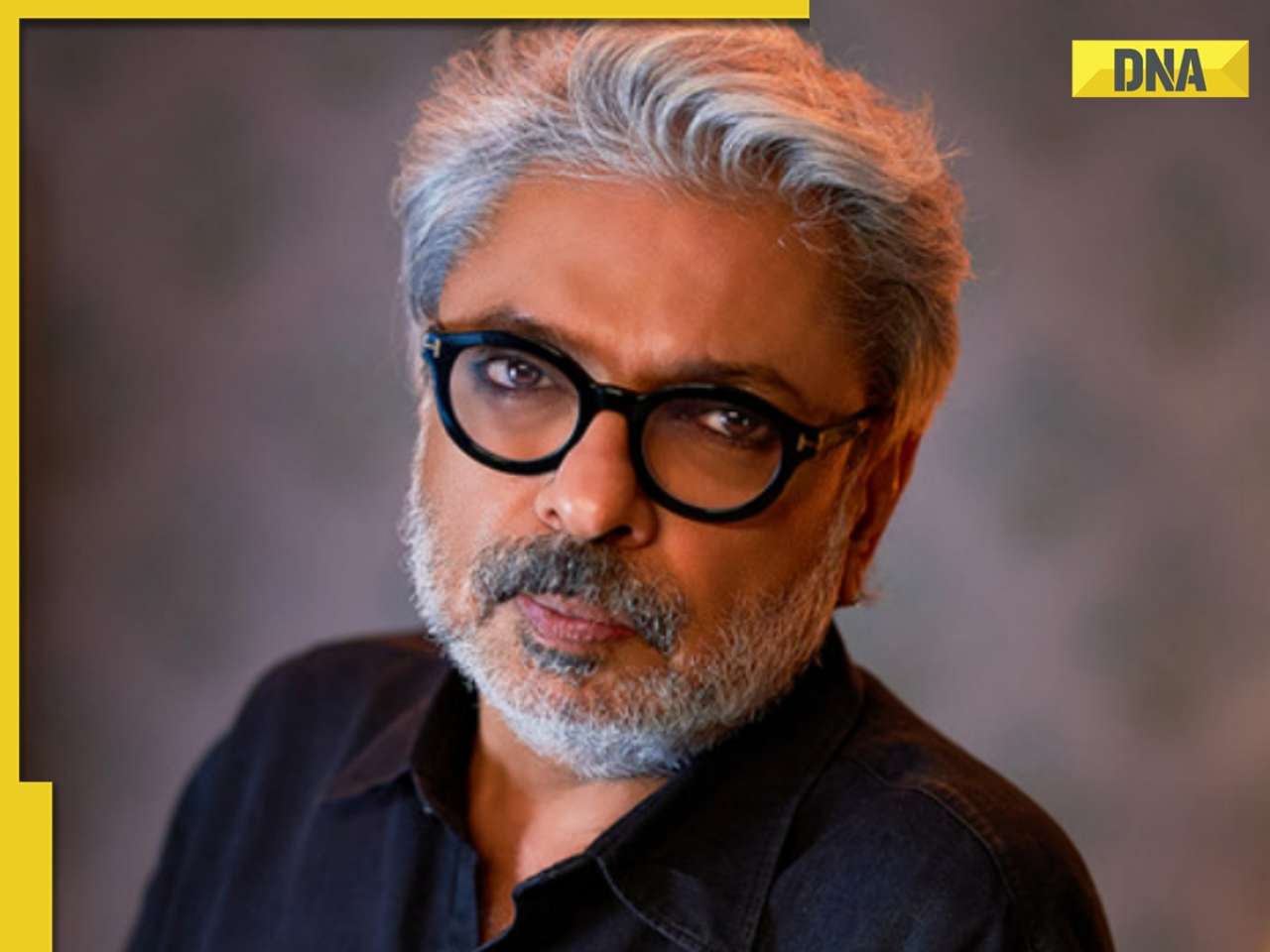

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'

Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'![submenu-img]() Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits

Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits![submenu-img]() Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved

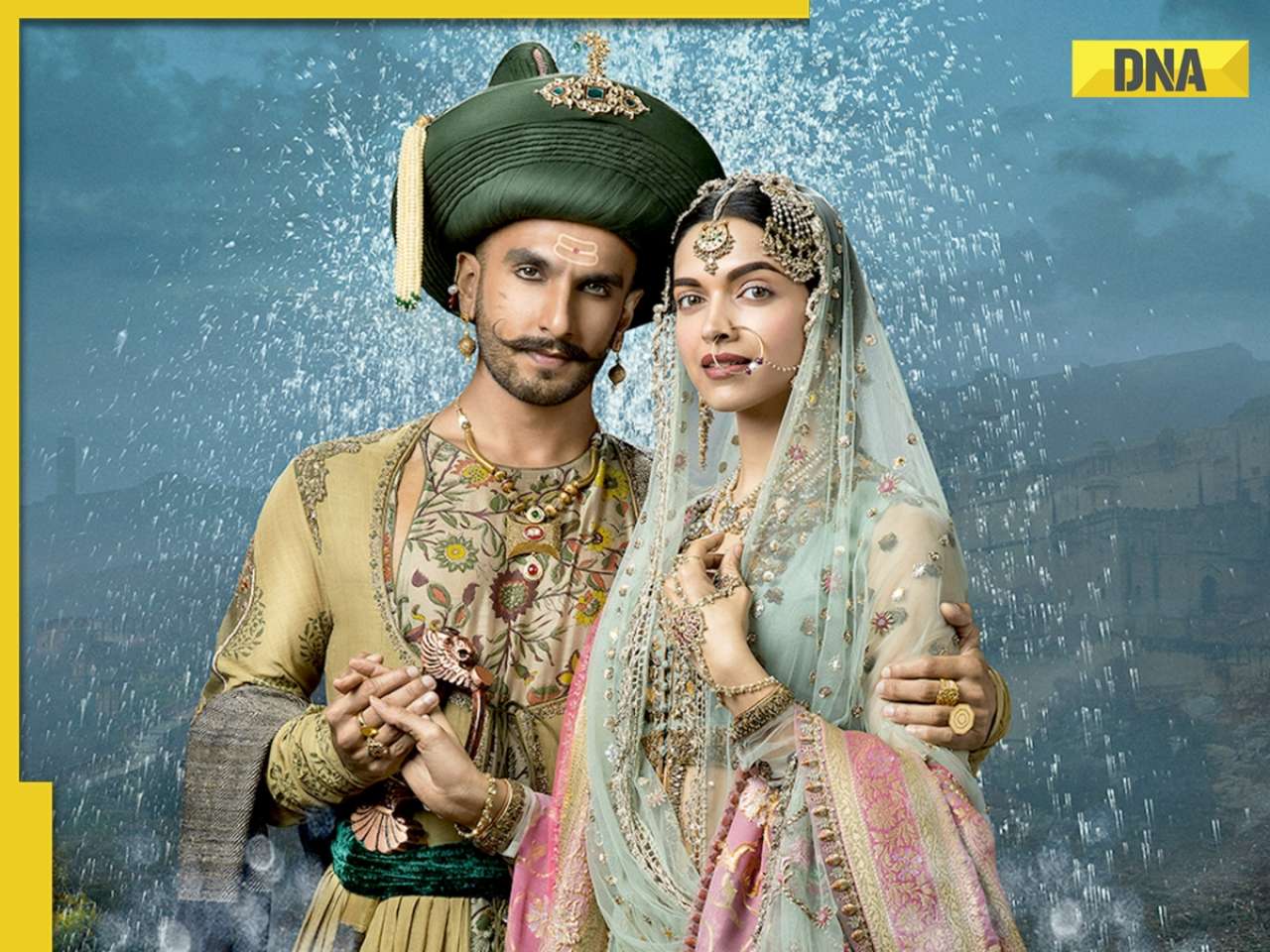

Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved![submenu-img]() Viral video: Donkey stuns internet with unexpected victory over hyena, watch

Viral video: Donkey stuns internet with unexpected victory over hyena, watch![submenu-img]() Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch

Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch![submenu-img]() Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...

Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...![submenu-img]() Cow fight injures two girls enjoying street snacks, video goes viral

Cow fight injures two girls enjoying street snacks, video goes viral![submenu-img]() Viral video: Man sets up makeshift hammock on bus, internet reacts

Viral video: Man sets up makeshift hammock on bus, internet reacts

)

)

)

)

)

)