The ongoing bad loans issue is giving NBFCs an opportunity to increase their presence in the lending space.

With public sector banks battling mounting non-performing assets and losing risk appetite, non-banking financial companies have a big opportunity knocking at their doors, says a report.

"With ongoing stress in public sector banks due to mounting bad debt, their appetite to lend (especially in rural areas) is only going to deteriorate, thus providing NBFCs with the opportunity to increase their presence," the paper brought out by Assocham and PricewaterhouseCoopers (PwC) noted.

Stressed assets of banks, mostly in public sector, are estimated to have touched Rs 10 lakh crore at the end of fourth quarter of 2015-16, according to a recent Assocham report.

In the backdrop of large exposure of banks to sectors suffering the most such as steel, infrastructure and power, their risk aversion is understandable, the report noted.

"So far, NBFCs have scripted a great success story. Their contribution to the economy has grown leaps and bounds from 8.4% in 2006 to above 14% in March last year.

In terms of financial assets, NBFCs have recorded a healthy compounded annual growth rate (CAGR) of 19% over the past few years, comprising 13% of financial assets and expected to reach nearly 18% by 2018 19," the report pointed out.

It attributed the success of NBFCs to their better product lines, lower cost, wider and effective reach, strong risk management capabilities to check and control bad debts and better understanding of their customer segments.

"Going forward, the latent credit demand of an emerging India will allow NBFCs to fill the gap, especially where traditional banks have been wary to serve.

"Additionally, improving macroeconomic conditions, higher credit penetration, increased consumption and disruptive digital trends will allow NBFCs' credit to grow at a healthy rate of 7 to 10% (real growth rate) over the next five years," said the report.

"In order for NBFCs to realise their true potential, the regulatory framework must succeed in walking the thin line between under-regulation and over-regulation.

"With this objective, RBI has brought about a spate of reforms in the NBFC regulations... It will be interesting to see how the NBFC sector and the regulator work with each other to usher in an era of financial inclusion," PwC said.

![submenu-img]() Weather update: IMD predicts light to moderate rain, thunderstorms in Delhi-NCR; check forecast here

Weather update: IMD predicts light to moderate rain, thunderstorms in Delhi-NCR; check forecast here![submenu-img]() 'I can't breathe': Black man in Ohio pleads as police officers pin him to floor, then...

'I can't breathe': Black man in Ohio pleads as police officers pin him to floor, then...![submenu-img]() Delhi HC raps CM Kejriwal, accuses him of prioritising political interest by continuing as CM after arrest

Delhi HC raps CM Kejriwal, accuses him of prioritising political interest by continuing as CM after arrest![submenu-img]() Manipur: Two CRPF personnel killed in Kuki militants' attack in Naransena area

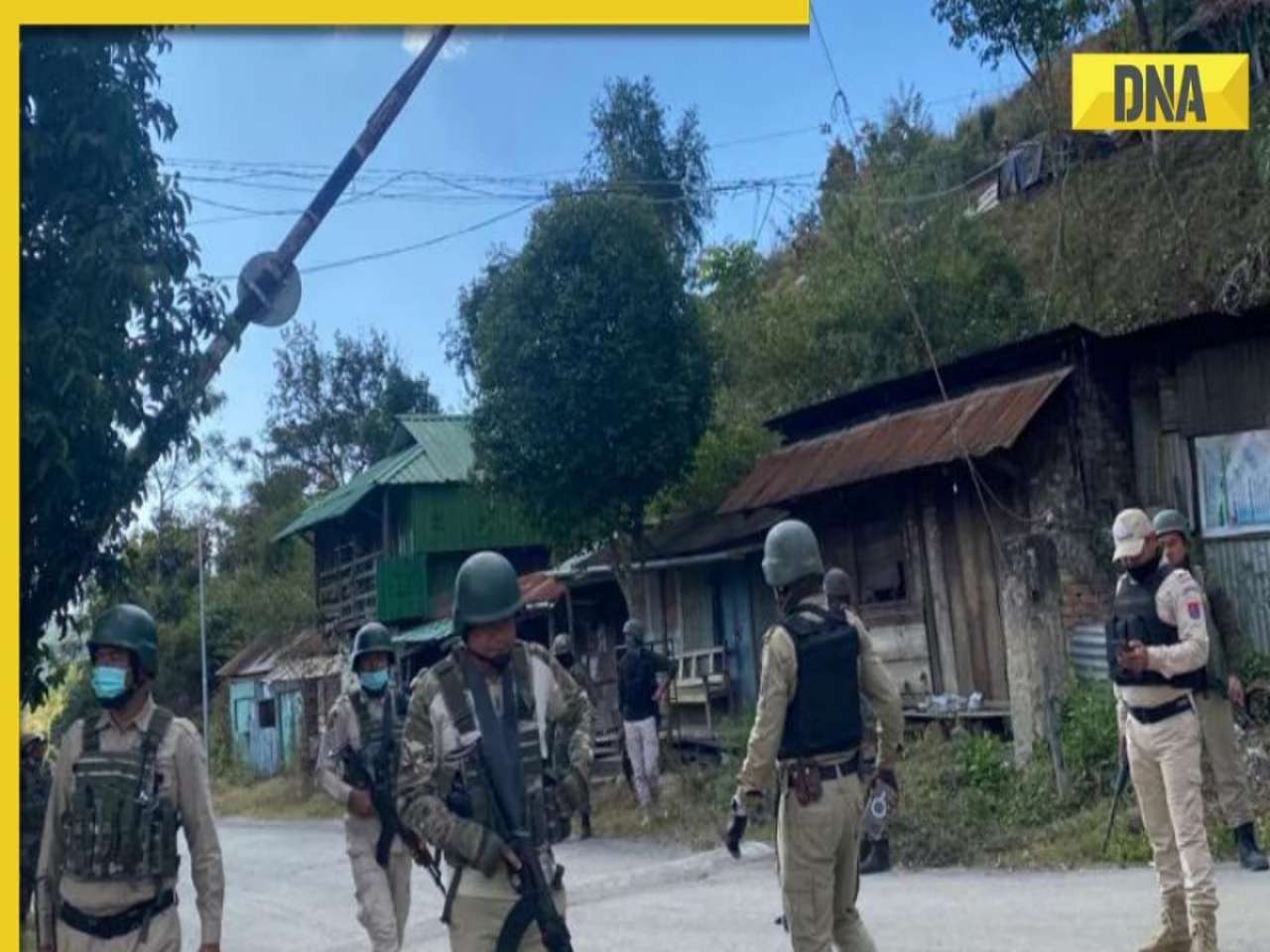

Manipur: Two CRPF personnel killed in Kuki militants' attack in Naransena area![submenu-img]() These 9 Indian dishes make it to the list of ‘best stews in the world’

These 9 Indian dishes make it to the list of ‘best stews in the world’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Krishna Mukherjee accuses Shubh Shagun producer of harassing, threatening her: ‘I was changing clothes when...'

Krishna Mukherjee accuses Shubh Shagun producer of harassing, threatening her: ‘I was changing clothes when...'![submenu-img]() Meet 90s top Bollywood actress, who gave hits with Shah Rukh, Salman, Aamir, one mistake ended career; has now become…

Meet 90s top Bollywood actress, who gave hits with Shah Rukh, Salman, Aamir, one mistake ended career; has now become…![submenu-img]() This actress, who once worked as pre-school teacher, changed diapers, later gave six Rs 100-crore films; is now worth…

This actress, who once worked as pre-school teacher, changed diapers, later gave six Rs 100-crore films; is now worth…![submenu-img]() 'There were days when I didn't want to probably live': Adhyayan Suman opens up on rough patch in his career

'There were days when I didn't want to probably live': Adhyayan Suman opens up on rough patch in his career![submenu-img]() This low-budget film with no star is 2024's highest-grossing Indian film; beat Fighter, Shaitaan, Bade Miyan Chote Miyan

This low-budget film with no star is 2024's highest-grossing Indian film; beat Fighter, Shaitaan, Bade Miyan Chote Miyan![submenu-img]() World wrestling body threatens to reimpose ban on WFI if...

World wrestling body threatens to reimpose ban on WFI if...![submenu-img]() IPL 2024: Jonny Bairstow, Shashank Singh special power Punjab Kings to record run-chase against KKR

IPL 2024: Jonny Bairstow, Shashank Singh special power Punjab Kings to record run-chase against KKR![submenu-img]() DC vs MI, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

DC vs MI, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() DC vs MI IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Mumbai Indians

DC vs MI IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Mumbai Indians![submenu-img]() Yuvraj Singh named ICC Men's T20 World Cup 2024 Ambassador

Yuvraj Singh named ICC Men's T20 World Cup 2024 Ambassador![submenu-img]() Watch: Lioness teaches cubs to climb tree, adorable video goes viral

Watch: Lioness teaches cubs to climb tree, adorable video goes viral![submenu-img]() Viral video: Little girl's impressive lion roar wins hearts on internet, watch

Viral video: Little girl's impressive lion roar wins hearts on internet, watch![submenu-img]() Who is Sangeet Singh? Man arrested for posing as Singapore Airlines pilot at Delhi airport

Who is Sangeet Singh? Man arrested for posing as Singapore Airlines pilot at Delhi airport![submenu-img]() One of India’s most expensive wedding, attended by 5000 people, 100 room villa, cost Rs…

One of India’s most expensive wedding, attended by 5000 people, 100 room villa, cost Rs…![submenu-img]() Viral video: Delhi's 'Spiderman' take to streets on bike, get arrested; watch

Viral video: Delhi's 'Spiderman' take to streets on bike, get arrested; watch

)

)

)

)

)

)

)