As businesses grow and succeed, they generate profits, taxes, and other economic benefits that contribute to the nation's prosperity.

Entrepreneurial ventures have the potential to create wealth for both the founders and the nation. As businesses grow and succeed, they generate profits, taxes, and other economic benefits that contribute to the nation's prosperity. India has recently surpassed China to become the country with the largest population. While population can be considered a valuable asset, its true value lies in its productivity. Encouraging entrepreneurship in India can effectively channel skilled labour into productive ventures, ensuring that the population contributes meaningfully to the economy. Despite encountering numerous challenges, such as funding issues, Indian startups experienced remarkable growth in the past financial year.

As a result, India currently ranks third in the global startup ecosystem. The government's proactive measures to promote entrepreneurship, like by initiatives like the Startup India scheme, have been instrumental in fostering this success. Recognising the significant growth and contributions of the startup community to the Indian economy, Prime Minister Narendra Modi declared January 16 as 'National Startup Day'.

In spite of the focus on promoting entrepreneurship culture, Startups in India today still face multiple challenges. As per Dr Kislay Pandey, “Our current situation concerning the establishment and funding of startup incubators and accelerators, which offer mentorship, infrastructure, and networking opportunities, is not optimal.”

Dr Kislay Pandey further states that” The government should take a proactive role in spearheading the creation of innovation clusters and technology parks that serve as hubs for startups, investors, and industry experts. Until these foundational elements are in position, it is crucial to provide substantial financial incentives to startups. A tax rebate should be considered the minimum measure in this regard.”

Dr. Kislay Pandey is a corporate lawyer practising in the Supreme Court of India, and he serves as a legal consultant for both Corporates and Startups. What he states is true. Increased compliance, focus on governance and robust risk mitigation strategies make day to day functioning of Startups challenging. Retaining talent is another challenge which comes with high costs. The government can take several steps to reduce multiple challenges of entrepreneurs so that they can focus more on strategic aspects of business.

The costs are skyrocketing, and markets are becoming more competitive. As per 2022 data, Indian Startups got $42 billion in funding which was quite impressive considering data from previous years. But in the current year a few sectors have seen a decline in funding. Reduced tax burden and tax rebates may help to ameliorate some of the financial burden. Currently Startups receive tax exemptions as below:

-Tax holiday of 3 years

Startups established or officially formed from April 1, 2016, to March 31, 2022, qualify for this benefit. These startups are entitled to a full tax exemption on their profits for a three-year period within a span of seven years. Nevertheless, their total annual turnover must not surpass 25 crores. Insufficient funding poses a significant challenge for startup operations. A three-year tax break provides valuable support for startups to establish their ventures smoothly.

-Exemption on Long-Term Capital Gains through section 54EE

This section is for eligible startups only and can be claimed if the gains are invested in a fund specified by the central government within 6 months from the transfer date.

-Exemption on Investments Above FMV

These investments include investments by angel investors, investments by incubators, and investments by funds and individuals not registered as venture capital (VC) funds.

-Tax Exemption Under Section 54GB

As per Section 54GB of the Income Tax Act, if any individual/HUF sells a residential property and uses the amount to invest in SMEs or purchases 50% or more shares of eligible startups, they will be exempt from paying long-term capital gains. However, the exemption will be available only if the shares are not sold for 5 years from the date of acquisition.

-Set-off of Carry Forward Losses Allowed

As per section 79 of the Income Tax Act, a company can carry forward its losses if - Shareholders who possessed voting power during the year in which the loss occurred must still hold their shares on March 31st of the subsequent year in which the loss is to be carried forward. This provision applies to losses incurred within the first seven years of the company's incorporation.

In conclusion, Dr. Kislay Pandey asserts that, "India acknowledges the significance of the startup ecosystem and, therefore, offers a tax rebate for the first three years within the initial decade of incorporation and other exemptions. However, this may prove insufficient given the current challenges faced by startups”. One positive aspect for the tax regime is that the government is proactive in its engagement and listens to the needs of startups and other stakeholders. They continuously refine their support measures as needed.

![submenu-img]() Sonam Kapoor says she gained 32 kg during pregnancy, was traumatised: 'Never going to feel the same'

Sonam Kapoor says she gained 32 kg during pregnancy, was traumatised: 'Never going to feel the same'![submenu-img]() Weather updates: IMD issues severe heatwave condition in these states; check forecast here

Weather updates: IMD issues severe heatwave condition in these states; check forecast here![submenu-img]() Sahil Khan detained by Mumbai SIT in Mahadev betting app case

Sahil Khan detained by Mumbai SIT in Mahadev betting app case![submenu-img]() Bank Holidays in May 2024: Branches to remain closed for 10 days this month, check full list

Bank Holidays in May 2024: Branches to remain closed for 10 days this month, check full list![submenu-img]() Govinda had tears in his eyes on seeing Arti Singh as bride, Krushna Abhishek reveals: 'Agar woh thodi der...'

Govinda had tears in his eyes on seeing Arti Singh as bride, Krushna Abhishek reveals: 'Agar woh thodi der...'![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Sonam Kapoor says she gained 32 kg during pregnancy, was traumatised: 'Never going to feel the same'

Sonam Kapoor says she gained 32 kg during pregnancy, was traumatised: 'Never going to feel the same'![submenu-img]() Sahil Khan detained by Mumbai SIT in Mahadev betting app case

Sahil Khan detained by Mumbai SIT in Mahadev betting app case![submenu-img]() Govinda had tears in his eyes on seeing Arti Singh as bride, Krushna Abhishek reveals: 'Agar woh thodi der...'

Govinda had tears in his eyes on seeing Arti Singh as bride, Krushna Abhishek reveals: 'Agar woh thodi der...'![submenu-img]() Aamir Khan recalls ex-wife Reena Dutta slapping him when she was in labour: 'She even bit my hand'

Aamir Khan recalls ex-wife Reena Dutta slapping him when she was in labour: 'She even bit my hand'![submenu-img]() Britney Spears settles legal dispute with estranged father Jamie Spears over conservatorship, details inside

Britney Spears settles legal dispute with estranged father Jamie Spears over conservatorship, details inside![submenu-img]() IPL 2024: Sanju Samson, Dhruv Jurel fifties help Rajasthan Royals take down LSG by 7 wickets in Lucknow

IPL 2024: Sanju Samson, Dhruv Jurel fifties help Rajasthan Royals take down LSG by 7 wickets in Lucknow![submenu-img]() IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Mumbai Indians by 10 runs

IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Mumbai Indians by 10 runs![submenu-img]() CSK vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Jake Fraser-McGurk, Rasikh Dar power DC to 10-run win over MI

IPL 2024: Jake Fraser-McGurk, Rasikh Dar power DC to 10-run win over MI![submenu-img]() 'If I don’t get a chance despite...': Shubman Gill makes big statement ahead of T20 World Cup 2024

'If I don’t get a chance despite...': Shubman Gill makes big statement ahead of T20 World Cup 2024![submenu-img]() Viral video: Rediscover childhood bliss with this nostalgic 90s birthday party plate, watch

Viral video: Rediscover childhood bliss with this nostalgic 90s birthday party plate, watch![submenu-img]() Ever seen elephant playing cricket? This viral video will leave you stunned

Ever seen elephant playing cricket? This viral video will leave you stunned![submenu-img]() Mukesh Ambani lost 15 kgs without any workout, his secret diet plan includes...

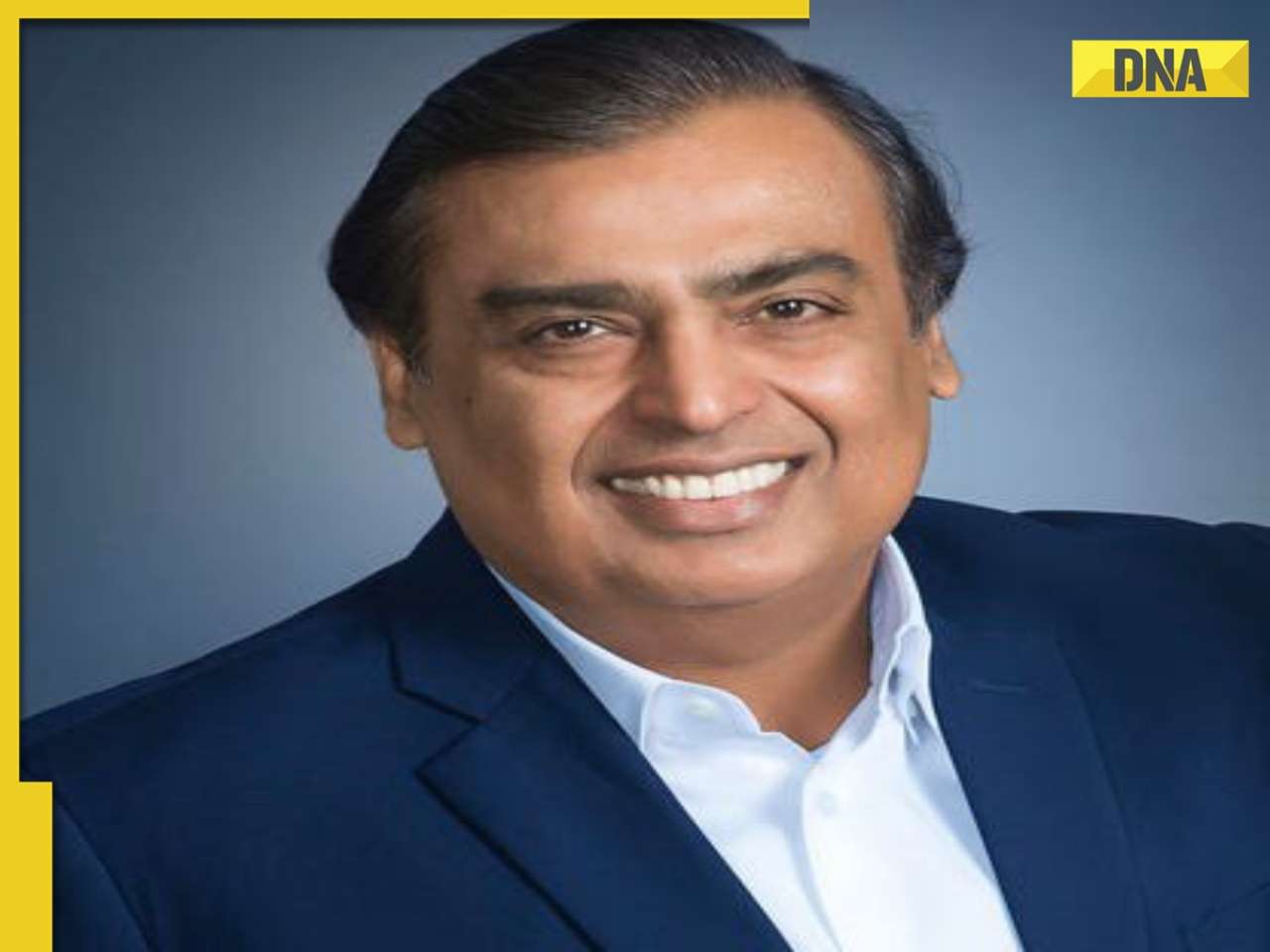

Mukesh Ambani lost 15 kgs without any workout, his secret diet plan includes...![submenu-img]() Viral video: Groom's daring leap during varmala ceremony leaves internet in stitches, watch

Viral video: Groom's daring leap during varmala ceremony leaves internet in stitches, watch![submenu-img]() Watch: Lioness teaches cubs to climb tree, adorable video goes viral

Watch: Lioness teaches cubs to climb tree, adorable video goes viral

)

)

)

)

)

)

)