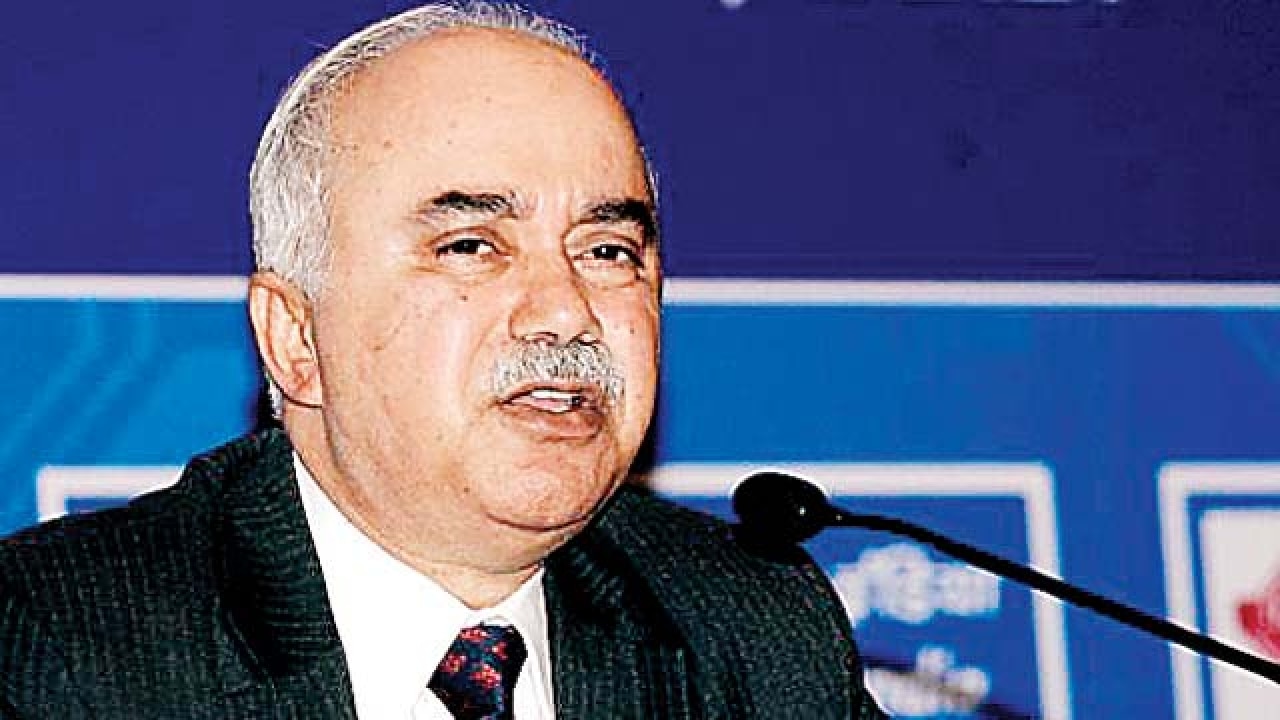

Rajeev Rishi, chairman and managing director of Central Bank of India, was given additional responsibility as head of the Indian Banks Association (IBA) on October 7. Little did he know then that a month down the line, he would be in the hot seat trying to oversee the biggest demonetization exercise that made 84.5% of our currency invalid. From co-ordinating with banks and the Reserve Bank of India (RBI), he has been tirelessly seeing to it that the implementation is smooth. In an interview to Manju AB, Rishi says the that the situation is gradually limping back to normal.

When an exercise of this magnitude is undertaken, certain inconveniences could be expected. The banking system had coped with the situation very well considering the enormity of the task at hand. In the next few weeks, all ATMs will start dispensing Rs 500 and Rs 1,000 notes once the ATMs are recalibrated. Banks have been working on holidays and ATM vendors are also working on a war footing to complete the exercise. These things, as you know, take time and we are trying to manage this in the shortest time possible.

From November 10, 2016, to November 27, 2016, total exchange is Rs 33,948 crore, total deposit stands at Rs 8,11,033 crore, while total withdrawal Rs 2,16,617 crore.

No, that is an unfair comment. All banks are given cash as per requirements. Each of the banks are linked to the currency chest and depending on the kind of customers you expect, you place your request. Depending on the network and the reach of a particular bank, the currency is distributed. There is sufficient currency but the logistics of distribution is taking time that also is being ironed out.

Currency is now being transported as air cargo to remote areas so that it can reach the rural branches. Branch managers are hiring known cab services and transporting cash from the currency chest.

The circulation of the Rs 500 notes have started. When cash arrives we are refilling the ATMs so that the crowd shifts from the branches to the ATMs. The printing of the notes is in full swing. Smaller currency like the Rs 100, Rs 50, Rs 20 and Rs 10 are in adequate quantities.

The Rs 2.5 lakh allowed for marriages in cash from bank accounts for marriages, saying the money can be withdrawn only from the credit balance as on November 8, the day demonetization was announced. The application for withdrawal should also provide names of bride and groom, their identify proofs, addresses and date of marriage. The amount can be withdrawn only if the date of marriage is on or before 30 December 2016.

No one should hoard currency because that can stop someone else in more need, from getting their money. The miscreants in the line, like who work as agents trying to exchange money, create more problem for the general public.

We start early at 8.30 am, find out the stock position at the central-room headquarters. Cash position at various centres, functioning of ATMs, etc. are monitored. Arrangements are made to conduct surprise checks at bank branches to see if things are moving smoothly and if branch managers are following the procedures.