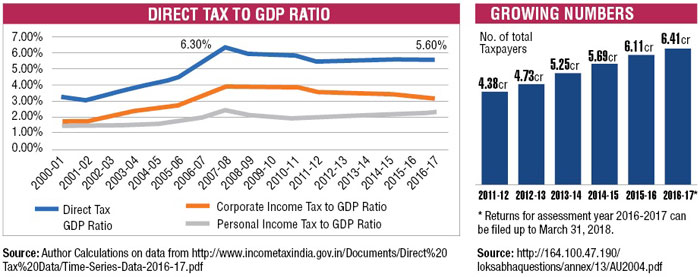

In the recent past there has been a lot of talk about the number of income tax payers going up, in comparison to the past. As per a question answered by minister of state for finance Ponguleti Srinivasa Reddy in the Lok Sabha on December 29, 2017, the number of income tax payers has grown at a reasonable rate, over the last few years. Let’s take a look at the Table titled Growing Numbers.

Between assessment year 2011-2012 and 2016-2017, the number of taxpayers has grown at a rate of 7.9 per cent per year. The assessment year is essentially the year following the financial year. The income earned during the financial year is evaluated during the assessment year. So, the income earned in 2015-2016, would be evaluated during 2016-2017.

Also, as the income tax department points out the above data is based on “the number of income-tax returns entered in the system plus number of cases where tax has been deducted at source from the income of the taxpayer but the taxpayers [have] not filed the return of income.”

Basically, the Table clearly tells us that the number of income tax payers has been going up. This includes the individual income tax payers, who now form close to 95 per cent of total income taxpayers, having risen from 94 per cent in assessment year 2011-2012. The number of individual income taxpayers has grown at a slightly faster rate of 8.1 per cent per year.

This is good news. But as they say, the proof of the pudding is in the eating. This increase in the number of income tax payers should also translate into an increase in the total direct tax collected by the government. Direct tax includes income tax paid by corporations on the profit they make, personal income tax (i.e. income tax paid by individuals) and other direct taxes. If we look at the direct tax in absolute terms, collections have gone up. The total direct tax collected by the government in the financial year 2010-2011 was Rs 4,45,995 crore. By 2016-2017, this had jumped by close to 90 per cent to Rs 8,49,818 crore. If we go back further in time, the increase would be even more.

But this is not the right way to look at the increase in collection of direct tax. As the size of the economy grows, so should the tax collected by the government. Hence, it is important to always measure the tax collected by the government as a proportion of the size of the economy i.e. the gross domestic product.

How do things look on this front? Take a look at Figure 1, which basically plots the direct tax to GDP ratio over the years.

The direct tax to GDP ratio peaked in 2007-2008. Over the last few years, it has largely remained flattish. In 2016-2017, the ratio stood at 5.6 per cent, which was a slight improvement over 2015-2016, when it had stood at 5.47 per cent. This miniscule improvement was on account of the two black money amnesty schemes offered by the government in 2016-2017. Without this, the direct tax to GDP ratio would have been more or less similar to that in 2015-2016.

A major reason to worry for the government is that the corporate income tax to GDP ratio has been falling over the years, despite the fact that the economy has constantly expanded. In 2010-2011, the ratio was at 3.89 per cent of the GDP. It has since fallen to 3.19 per cent of the GDP. The personal income tax to GDP ratio during the same period has improved from 1.91 per cent of GDP to 2.3 per cent of GDP.

On the whole, the direct tax collections as a part of total taxes collected by the Union government have fallen from 60.8 per cent in 2009-2010 to 49.7 per cent in 2016-2017. Hence, despite the number of income tax payers going up, the total direct tax as a proportion of total tax collected by the government, has fallen.

Further, total direct tax collected by the government as a proportion of GDP has remained flattish, after peaking in 2007-2008. What does this basically tell us? It reminds of something that the Red Queen tells Alice in Lewis Carroll’s Through the Looking Glass: “A slow sort of country!” said the [Red] Queen. “Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”

The Red Queen effect, if at all there is an effect like that, has been impacting the direct tax collections in India. We have been running to stay in the same place. One of the conclusions that can be drawn is that more income tax payers are actually filing returns than paying taxes. Hence, they are not really income tax payers in the strictest sense of the term.

The writer is the author of India’s Big Government—The Intrusive State and How It is Hurting Us