If levies and taxes are reduced, telecom tariffs will fall further. That’s the argument the telecom industry is offering while demanding lower taxes.

The telecom industry’s demands remain more or less the same as in the previous two budgets as they had disappointed the service-providers. The industry’s main demand is to replace multiple levies with a single levy

MUMBAI: If levies and taxes are reduced, telecom tariffs will fall further. That’s the argument the telecom industry is offering while demanding lower taxes. The industry demands remain more or less the same as those in the previous two years as the Budget had disappointed the players in the recent past. So, they continue to demand that multiple levies should be replaced by a single levy.

The industry wants the revenue-share licence fee to be reduced to 6% as in the case of national long distance (NLD) and international long distance (ILD) services. At present, the maximum fee in the telecom sector is 10%.

In its budget submission for 2008-09, the Cellular Operators’ Association of India (COAI), which represents global systems for mobile communications (GSM) players like Bharti, Vodafone Essar, Idea Cellular and Aircel, has said: “Our long-pending request continues to be the lowering of revenue- share licence fee to a uniform 6% (including the 5% USO or Universal Service Obligation levy), as is applicable in the case of NLD/ILD licence.”

COAI director general TV Ramachandran, in a recent letter to the Telecom Commission chairman, argued that the Telecom Regulatory Authority of India (Trai), in its various recommendations from time to time, has said that the licence fee should be lowered to 6% of the adjusted gross revenue (AGR).

According to Ramachandran, “Lowering of levies will not only lead to lower tariffs and affordable services but also leave more funds for expansion with service providers.”

The industry is also reiterating that all multiple levies on the sector, which act as a bottleneck and stifle growth, “should be rationalised in a phased manner and we should have in place a simple industry-friendly and investor-friendly tax structure”.

Association of Unified Telecom Service Providers of India (AUSPI), which represents code division multiple access (CDMA) players like Reliance Communications and Tata Teleservices, has also demanded that licence fee revenue share be limited to 6% of the AGR, inclusive of the USO Fund levy.

According to the AUSPI proposal, if the end-user tariffs are high, it may stifle growth and reduce the spread of telecom services.

“Therefore, there is need for a critical examination of the philosophy of application of duties and levies on telecom, which is an important requirement for ensuring sustainable and accelerated growth of the sector,” AUSPI stated.

At present, the annual revenue-share licence fee is 10% for metros and category A circles, 8% for category B circles and 6% for category C circles. In 2006, the government had reduced the revenue-share licence fee, including the USO contribution for long-distance services (NLD and ILD), to 6%, from the earlier level of 15%.

The AUSPI pre-budget proposal pointed out, “It is of utmost necessity to reduce the licence fee since, at present, in addition to the licence fee (6-10%) and spectrum fee (2-6%), the service providers pay service tax of 12%.

Earlier, the Department of Telecom (DoT) had recommended a simpler and reduced tax structure to the finance ministry, but the telecom sector’s wishes were not fulfilled last year.

The industry is reiterating that India has the lowest telecom tariff and has to bear the highest taxes and levies.

For getting the taxes and duties slashed, the telecom industry has also been citing the good performance of the telecom sector, especially the mobile segment.

The average monthly addition in mobile subscriber numbers has been over 8 million in the recent past, and the total wireless base has touched 234 million, as on December 31, 2007.

The mobile services industry generates an annual GDP contribution of Rs 71,000 crore, according to industry figures. It is believed that a 1% increase in teledensity will lead to a 3% increase in the rate of growth of GDP.

Commenting on the potential of the sector, Bharti group chairman Sunil Mittal recently said, “Led by a buoyant economy, demand for telecom services continues to be robust across all segments.

In particular, the wireless segment has seen record additions and we believe that this trend is likely to continue.”

But spectrum scarcity is a concern. The resources (read spectrum) available with the service-providers are not in sync with the growth, Ramachandran had recently said.

Inadequate spectrum will invariably lead to congestion. Therefore, adequate spectrum allocation is also a demand.

The telecom industry representations have been pointing at the difference between the fees/taxes charged in India and in other Asian economies.

While in India spectrum charges are 2-6%, in China, it is 0.5%, and in Sri Lanka, it is 1.1% of the turnover.

![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

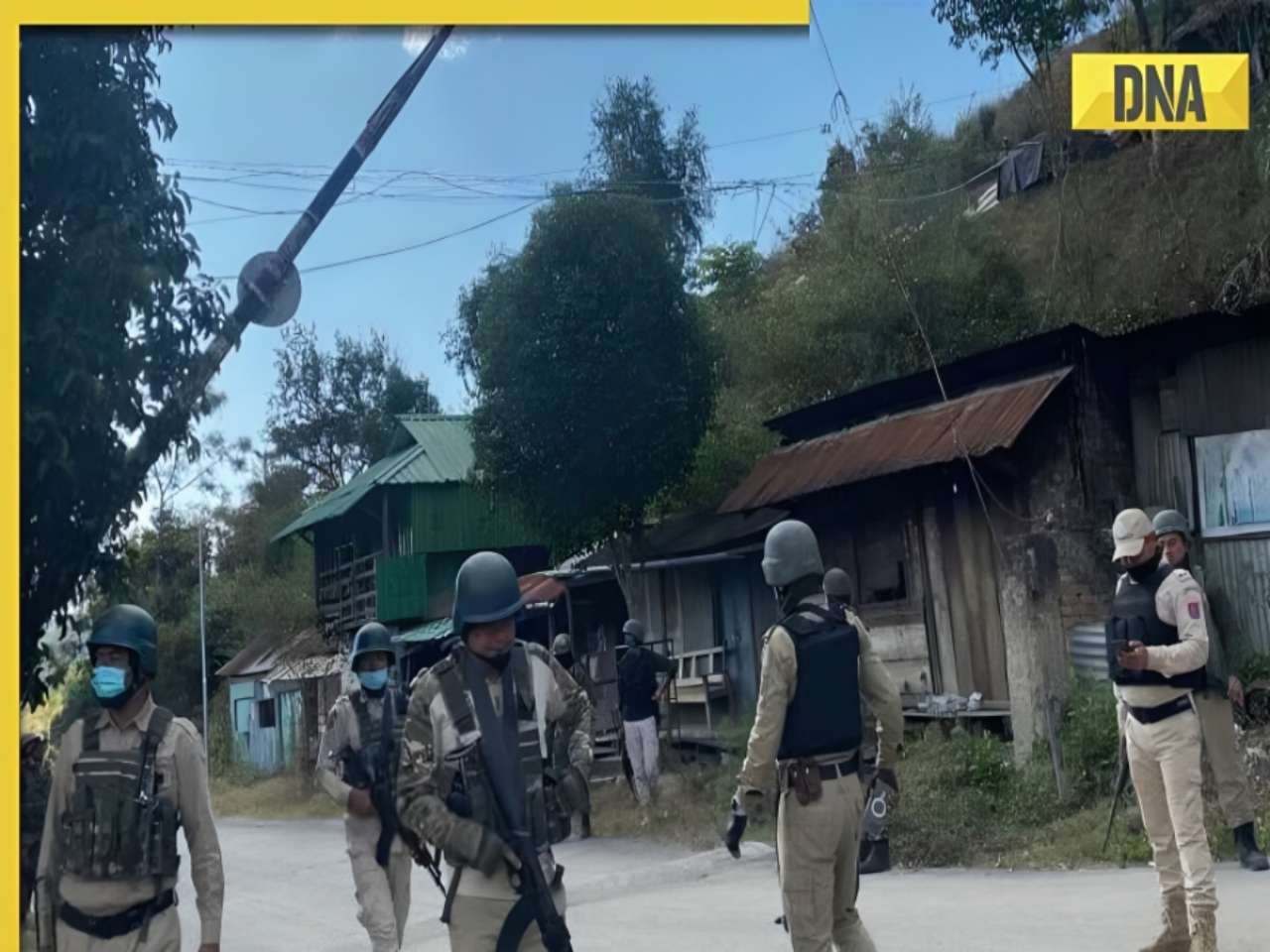

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

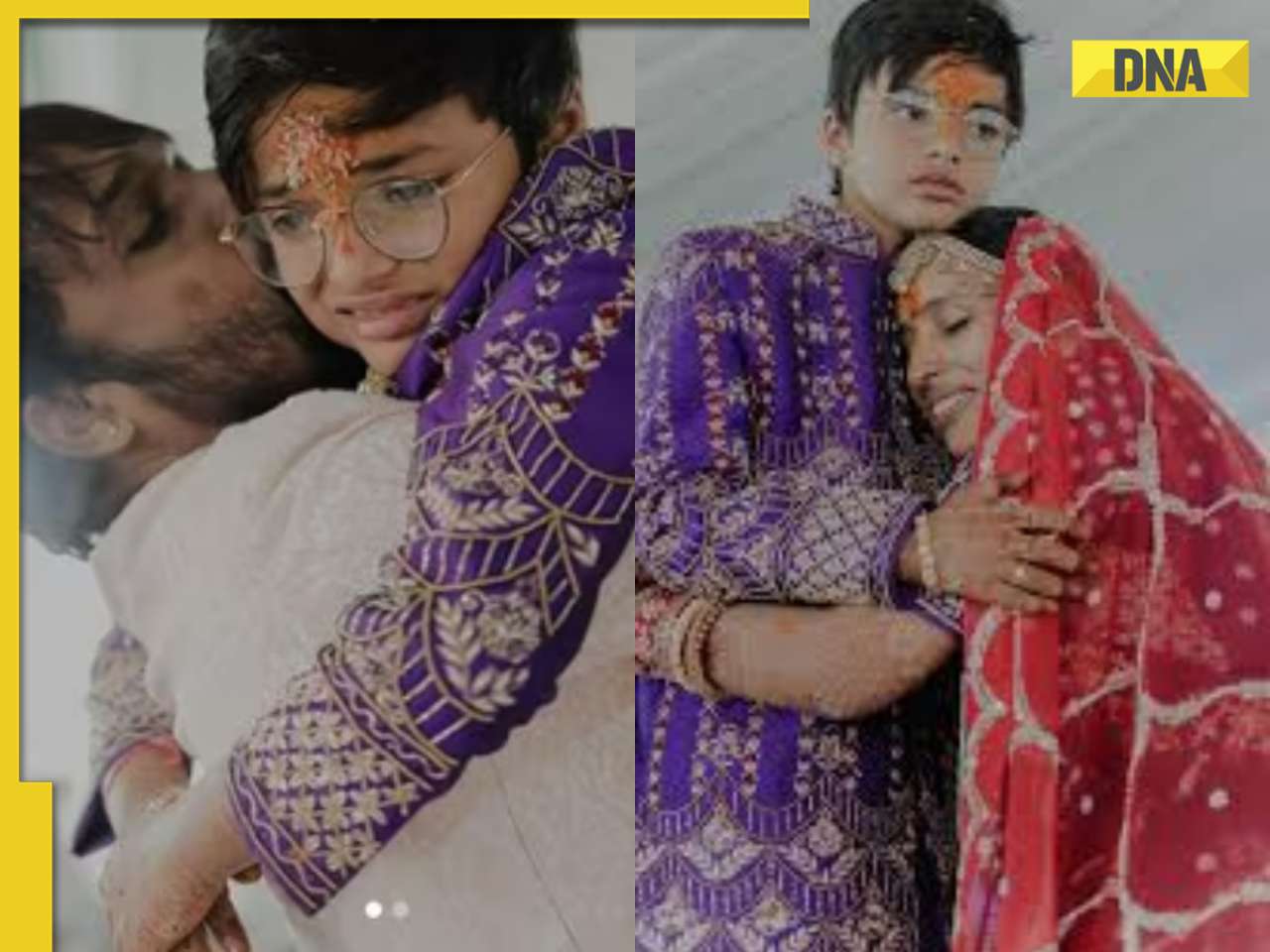

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)