You should consider insurers with a grievance ratio to premium of less than 0.0015

Buying insurance is crucial for protecting your prized assets from any financial loss. Since insurance is essentially a contract between the policyholder and the insurance company, buyers must do the due diligence of the insurer, not just the product.

Buyers should pay close attention to grievance ratio, coverage strength and financial muscle of the insurer, before taking any decision. Let us find out more about how they can do this.

Grievance ratio: As a policyholder, you want a seamless experience during claims and also other times. If you are not happy, you can lodge complaints, but this route may take a lot of time for resolution.

The grievance ratio is a handy metric which tells you about the number of complaints received by the insurer to premium collected. One should opt for insurers with low grievance ratio to premium.

The larger an insurer, its premium collection may increase because of the ability to sell policies.

However, a consequent rise in complaints shows that dissatisfaction amongst consumers. Ideally, you should consider insurers with a grievance ratio to premium of less than 0.0015. Such low a ratio shows the insurance company is able to service customers’ needs proactively.

Coverage strength: Unlike pure life insurance when the insured and the insurer don’t speak during claims, service coverage becomes doubly important when it comes to non-life covers. General insurance consumers have a variety of requirements and only an insurer with proper coverage strength can step in to help every time with the highest level of service quality.

Consider an insurance company which has an adequate number of offices across the country and a high number of intermediaries working for it.

Besides online and tele-calling services, the insurer must be accessible in channels that you want and keeps customers as a focal point in all operations.

Financial muscle: An insurance company pays consumer claims based on its own financial assets. This is why adequate care should be taken in selecting an insurer with sufficient financial muscle.

What insurance buyers should look for are stable and robust investment returns and a strong capital buffer i.e. solvency ratio.

The latter metric measures the company’s ability to pay off its claims if all of them materialise at once.

HONOURING CLAIMS

- You should consider insurers with a grievance ratio to premium of less than 0.0015

- Consider a company which has an adequate number of offices across the country

The writer is ED & CEO of Reliance General Insurance

![submenu-img]() DNA TV Show: Will Rahul Gandhi be Leader of Opposition (LoP) in Lok Sabha?

DNA TV Show: Will Rahul Gandhi be Leader of Opposition (LoP) in Lok Sabha?![submenu-img]() T20 World Cup 2024: Nicholas Kirton, Jeremy Gordon star as Canada beat Ireland by 12 runs in New York

T20 World Cup 2024: Nicholas Kirton, Jeremy Gordon star as Canada beat Ireland by 12 runs in New York![submenu-img]() Not Shah Rukh, Deepika, Aamir, this Bollywood star has launched their own OTT platform, first film to stream on it is...

Not Shah Rukh, Deepika, Aamir, this Bollywood star has launched their own OTT platform, first film to stream on it is...![submenu-img]() New Vande Bharat bullet train soon, check route details, top speed to be...

New Vande Bharat bullet train soon, check route details, top speed to be...![submenu-img]() Amit Shah rejects Devendra Fadnavis's proposal to resign, asks him to continue as Maharashtra Deputy CM

Amit Shah rejects Devendra Fadnavis's proposal to resign, asks him to continue as Maharashtra Deputy CM![submenu-img]() Meet woman, an engineer who cracked UPSC without coaching to become IPS officer, also a social media star, got AIR...

Meet woman, an engineer who cracked UPSC without coaching to become IPS officer, also a social media star, got AIR...![submenu-img]() Physics Wallah's Alakh Pandey breaks silence over controversial NEET scores, says 'need more...'

Physics Wallah's Alakh Pandey breaks silence over controversial NEET scores, says 'need more...'![submenu-img]() NEET exam 2024: Students demand re-exam after 67 students score...

NEET exam 2024: Students demand re-exam after 67 students score...![submenu-img]() Meet IIT-JEE topper, scored 100 percentile in JEE Mains 2024, she is now planning to join...

Meet IIT-JEE topper, scored 100 percentile in JEE Mains 2024, she is now planning to join...![submenu-img]() NEET UG topper 2024: Meet boy who topped MBBS exam by securing 720 out of 720, he is Alakh Pandey's...

NEET UG topper 2024: Meet boy who topped MBBS exam by securing 720 out of 720, he is Alakh Pandey's...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() Lok Sabha Elections 2024: 6 states with highest number of seats

Lok Sabha Elections 2024: 6 states with highest number of seats![submenu-img]() Lok Sabha Election Results 2024: Key candidates to watch out for in South India

Lok Sabha Election Results 2024: Key candidates to watch out for in South India![submenu-img]() Lok Sabha Elections 2024: Key seats Exit Poll predictions

Lok Sabha Elections 2024: Key seats Exit Poll predictions![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() Not Shah Rukh, Deepika, Aamir, this Bollywood star has launched their own OTT platform, first film to stream on it is...

Not Shah Rukh, Deepika, Aamir, this Bollywood star has launched their own OTT platform, first film to stream on it is...![submenu-img]() This flop of Kangana Ranaut lost 90% of its budget, was removed from theatres in opening week, earned just...

This flop of Kangana Ranaut lost 90% of its budget, was removed from theatres in opening week, earned just...![submenu-img]() Meet actress, who was born in Europe, came to India to follow Osho, became overnight star after hit item song, is now...

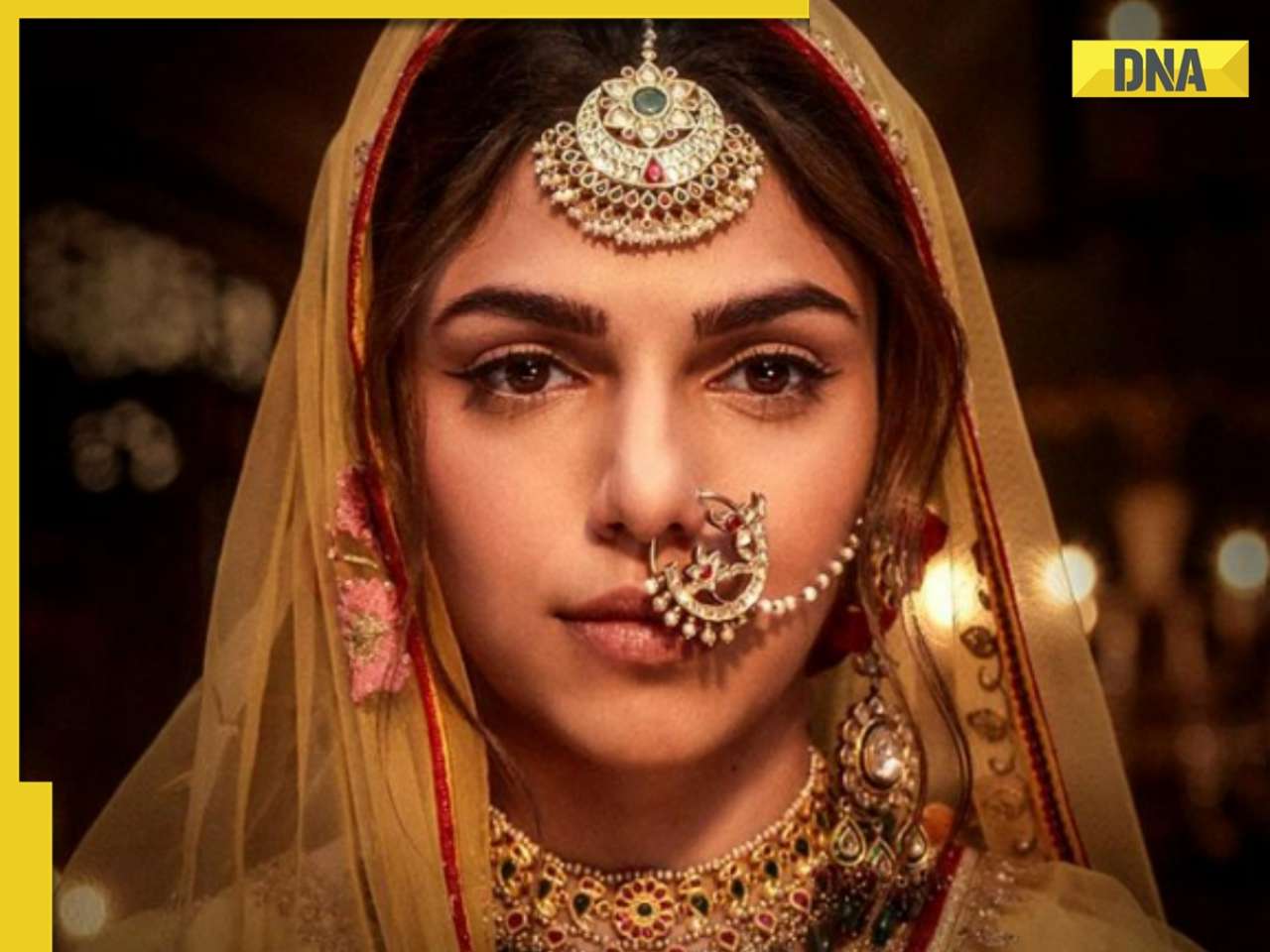

Meet actress, who was born in Europe, came to India to follow Osho, became overnight star after hit item song, is now...![submenu-img]() Sharmin Segal says her DMs are filled with love for her performance in Heeramandi: 'I was prepared for reactions...'

Sharmin Segal says her DMs are filled with love for her performance in Heeramandi: 'I was prepared for reactions...'![submenu-img]() Bad Cop trailer: Anurag Kashyap's sinister gangster Kazbe is up against Gulshan Devaiah's twins - cop Karan, thief Arjun

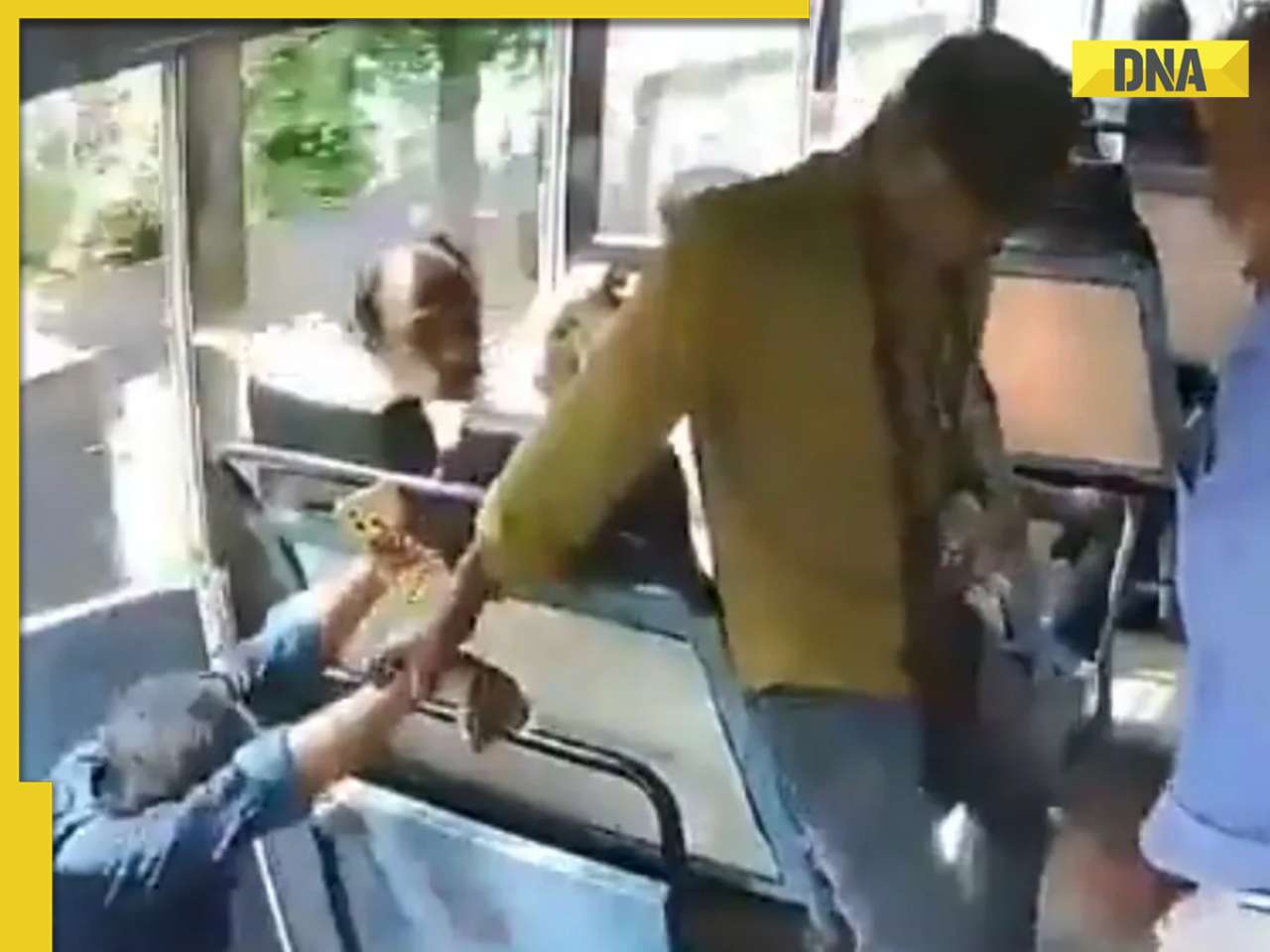

Bad Cop trailer: Anurag Kashyap's sinister gangster Kazbe is up against Gulshan Devaiah's twins - cop Karan, thief Arjun![submenu-img]() Viral video: Kerala bus conductor heroically saves man, internet calls him 'desi spiderman'

Viral video: Kerala bus conductor heroically saves man, internet calls him 'desi spiderman'![submenu-img]() Pakistani singer Chahat Fateh Ali Khan's viral 'Bado Badi' song with 28 million views deleted from YouTube due to..

Pakistani singer Chahat Fateh Ali Khan's viral 'Bado Badi' song with 28 million views deleted from YouTube due to..![submenu-img]() Viral video: Baboons' brave stand against leopard's savage assault stuns internet

Viral video: Baboons' brave stand against leopard's savage assault stuns internet![submenu-img]() Rajat Dalal arrested for abducting, torturing 18-year-old student, influencer forced him to…

Rajat Dalal arrested for abducting, torturing 18-year-old student, influencer forced him to…![submenu-img]() Indian-origin astronaut Sunita Williams dances with joy upon reaching ISS, video goes viral

Indian-origin astronaut Sunita Williams dances with joy upon reaching ISS, video goes viral

)

)

)

)

)

)

)