In yet another demonstration of continuing broad-based growth signals across sectors, US stocks ended the week near record highs after the November jobs report came in stronger than expected in endorsement of the economy’s strong fundamentals.

Global equities also firmed this week in the wake of progress being made on the US tax reforms and a seeming thaw in geo-political tensions. US bonds saw little net change on the week, Crude prices edged lower and the VIX, a broader measure of volatility, also moved below 10.

For the local market, Reserve Bank of India (RBI) left key rates unchanged and continued its stance on liquidity and inflation while slightly upping the vigil on inflation with a 10 basis nudge higher on inflation expectations. Indian bonds continue to trade weak as buying appetite is totally absent.

The key event in global market was data release from the US. Non-farm payrolls increased 22,800 in November, while the unemployment rate remained steady at 4.1%. The record-obsessed statistician will note November was the 86th straight month of net job creation, which factor should encourage Federal Open Market Committee (FOMC) to hike rates when the committee meets on Wednesday. Summing up, inflation has rebounded from mid-year lows, GDP has shown strong readings over past few quarters and labour market shows promise.

In other major development, British government and the European Union managed to come to an agreement at the end of the week on Brexit, just in time ahead of forthcoming EU summit. The pact protects the rights of EU citizens residing in the United Kingdom and further talks will now include future trade arrangements between the two sides. The other interesting event of some historic relevance is the gravity-defying surge of bitcoin prices. With both CBOE and CME allowing trading in futures from coming week, the crypto-currency has attracted unimaginable levels of fascination and speculation. Regulatory warnings have gone unheeded. One would keenly watch the developments ahead.

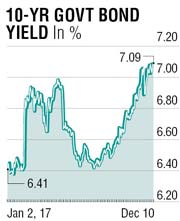

In Indian markets, as expected, RBI kept all rates unchanged in the policy review while retaining its neutral stance. With its formal adoption of inflation targeting as a principal objective of policy setting from mid-2016, the recent set of data amply suggested a status-quo from RBI and the market did not get disappointed. The extra vigil over inflation was evident with the notional increase in the inflation expectations range by 10 basis points (to 4.30-4.70 from an earlier band of 4.20-4.60). Given the probability that systemic liquidity will remain in large surplus mode well past FY 2018 and a possible hike is still way off, market appears to be overpricing risk. Perhaps bond markets drew some comfort from the overall policy tone that appeared to carry optimistic estimates of GVA for the remaining two quarters of this fiscal year, which should result in better tax collections and therefore keep the fiscal deficit under check. Yields fell a few bases points on the policy day.

However, yields on benchmark 10-year bond moved past 7.10% on Friday. With OMO sale out of reckoning and supply in general to abate, bond yields should correct soon. Given the wide-ranging changes happening on Banking space in general and in particular for the PSU banks which will get a strong dose of recapitalisation, alongside major changes in NPL recognition norms, the sustenance of higher yields may have deleterious effect on bank treasury performances and may risk them becoming cost-centers in the near future.

The week witnesses three monetary heavyweights gathering to set interest rates, While futures’ market is pricing in a 92% probability for Fed to hike rates on Wednesday, European Central Bank and the Bank of England are both expected to stay pat for some more time. Fed watchers will also keenly analyse the “dot plot” to gauge the number of rate hikes the US central bank expects to put into place in 2018.

Indian benchmark yield runs the risks of moving outside the 6.90-7.10 range and given the macroeconomic background, higher yields should not sustain, nor should the steepness of the curve.

The writer is a markets expert