Real estate companies are clearly not having a good time. Peninsula Land, a Mumbai-based developer, is no exception to this rule.

MUMBAI: Real estate companies are clearly not having a good time. Peninsula Land, a Mumbai-based developer, is no exception to this rule. It has delayed its new project launches in Nashik, Pune and Hyderabad by 6-12 months.

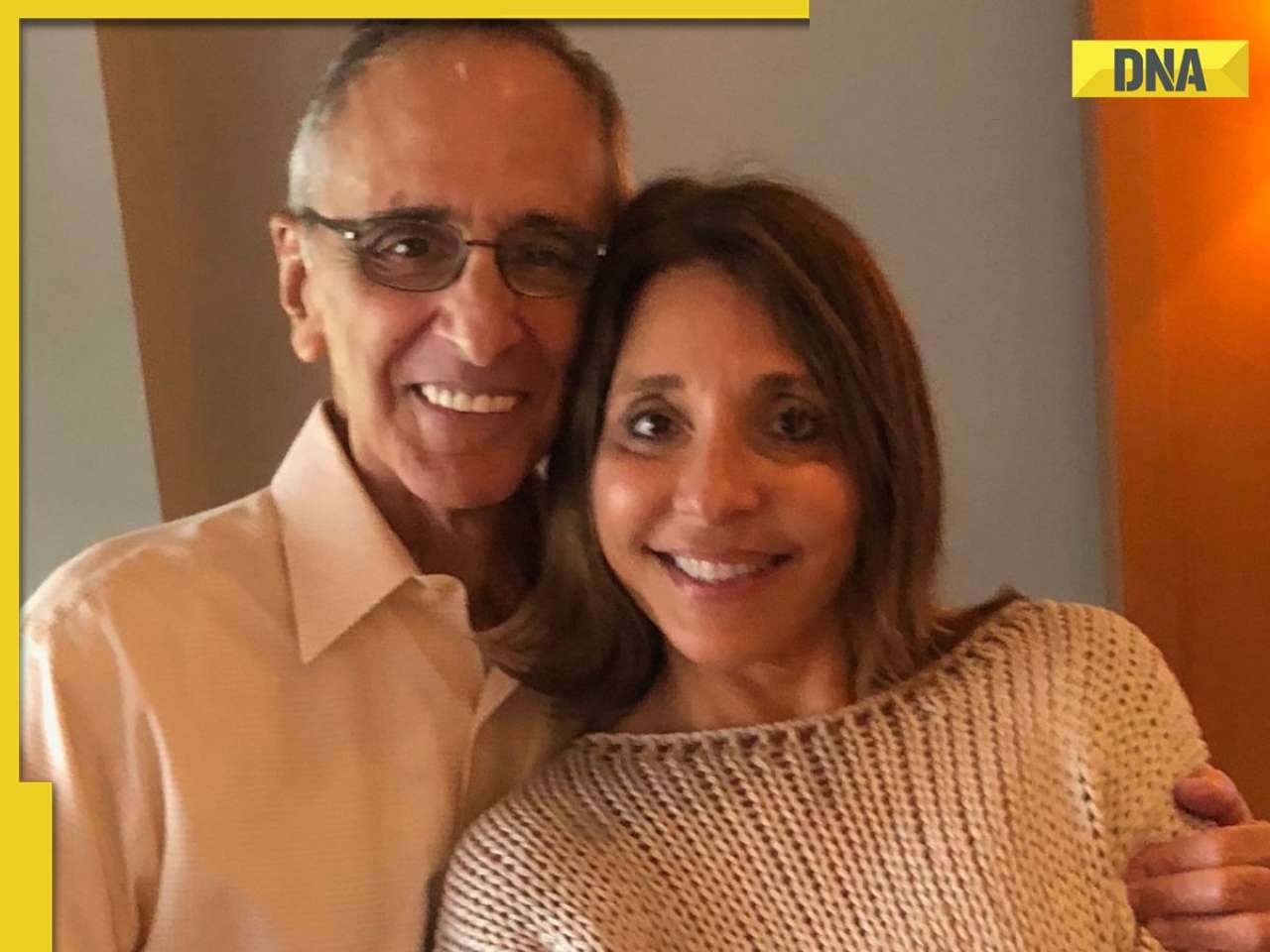

“Projects outside Mumbai will be ready for launch in the next 12 months. We are in the pre-development phase and plan to start the project in the first half of next year,” says Rajeev Piramal, executive vice-chairman, Peninsula Land.

The Ashok Piramal-backed realty group had announced plans to develop five projects outside Mumbai. This included one residential and one township project in Nashik which were to be launched in July 2008. The integrated township and IT park in Pune was to be launched in August 2008, while an integrated township-cum-IT park in Hyderabad was to be launched in the third quarter 2008. The total developable area for these projects is approximately 21 million square feet.

These projects were expected to be operational by 2013.

Sources say the delay in these projects has pushed back the realtor’s plan of entering Ahmedabad, Chennai, Mysore, Bangalore and Coimbatore by next year.

Delay in the realtor’s Mumbai based projects is also evident. “They have only sold 50% of the Peninsula Business Park at Dawn Mills in Lower Parel,” says a real estate analyst who does not want to be named.

“Our first priority is to complete the existing projects. The Ashoka Towers, the 30-storeyed building, would be ready in the next 6 months and the 50-storeyed tower would be ready in next 9 months,” says Piramal.

Ashoka Towers was originally expected to be complete by December 2008.

Peninsula’s hotel venture has also been put on hold for one year. “Next year we are looking at western and southern India for hotel development. These properties will come up largely in Tier I cities,” says Piramal.

Peninsula Land had earlier planned to develop 125 hotels across India in a joint venture with Arrow Webtex. In the first phase, it was to deploy Rs 100 crore to develop 10 hotels.

Analysts attribute these delays to the company’s business strategy of trying to pre sell half of the area in each of the projects during the project launch stage. This ensured enough cash flow for construction phase. With the real estate market looking rather dull right now, Peninsula has been unable to pre sell to get cash for the development phase.

The company was also supposed to get funding of $125 million from Lehman Brothers Real Estate Partners, the real estate fund of Lehman Brothers. According to sources, this funding is not coming through. But Piramal neither confirmed or denied the

development. “We had an understanding that Lehman will invest in Peninsula’s projects but they hadn’t committed anything. As and when we open our projects we will see the requirement of private equity. We are not looking at any funding as of now. Nothing is happening on those projects right now.”

Peninsula had signed a memorandum of understanding (MoU) with the fund which would hold minority stakes in Peninsula’s projects. The real estate fund of Lehman Brothers was going to take a maximum 40% stake in its Hyderabad project, where Peninsula had bought land parcel of 31 acre from Rallis India.

But another analyst adds, “Even though Lehman Brother’s funding is not coming to the company, they have secured bank loans and cash to invest in the projects. It is only the delay in the project development which is affecting the company.”

As analysts have different views to offer Peninsula officials had earlier told DNA Money that Lehman Brothers Real Estate Partners had raised money from non-Lehman sources and thud the company would not be affected.

According to Piramal, Peninsula is going to deploy the money from Indigo, the Rs 250 crore domestic real estate fund of the company.

“We are mainly looking at investing in the 6 cities we are presently in. We are also looking at opportunity picking up property through distress selling in these markets.”

![submenu-img]() T20 World Cup 2024: Bangladesh keep Super 8 hopes alive with 25-run win over Netherlands

T20 World Cup 2024: Bangladesh keep Super 8 hopes alive with 25-run win over Netherlands![submenu-img]() DNA TV Show: Will Modi govt review Agnipath scheme following Army survey?

DNA TV Show: Will Modi govt review Agnipath scheme following Army survey?![submenu-img]() Former champions Sri Lanka crash out of T20 World Cup 2024

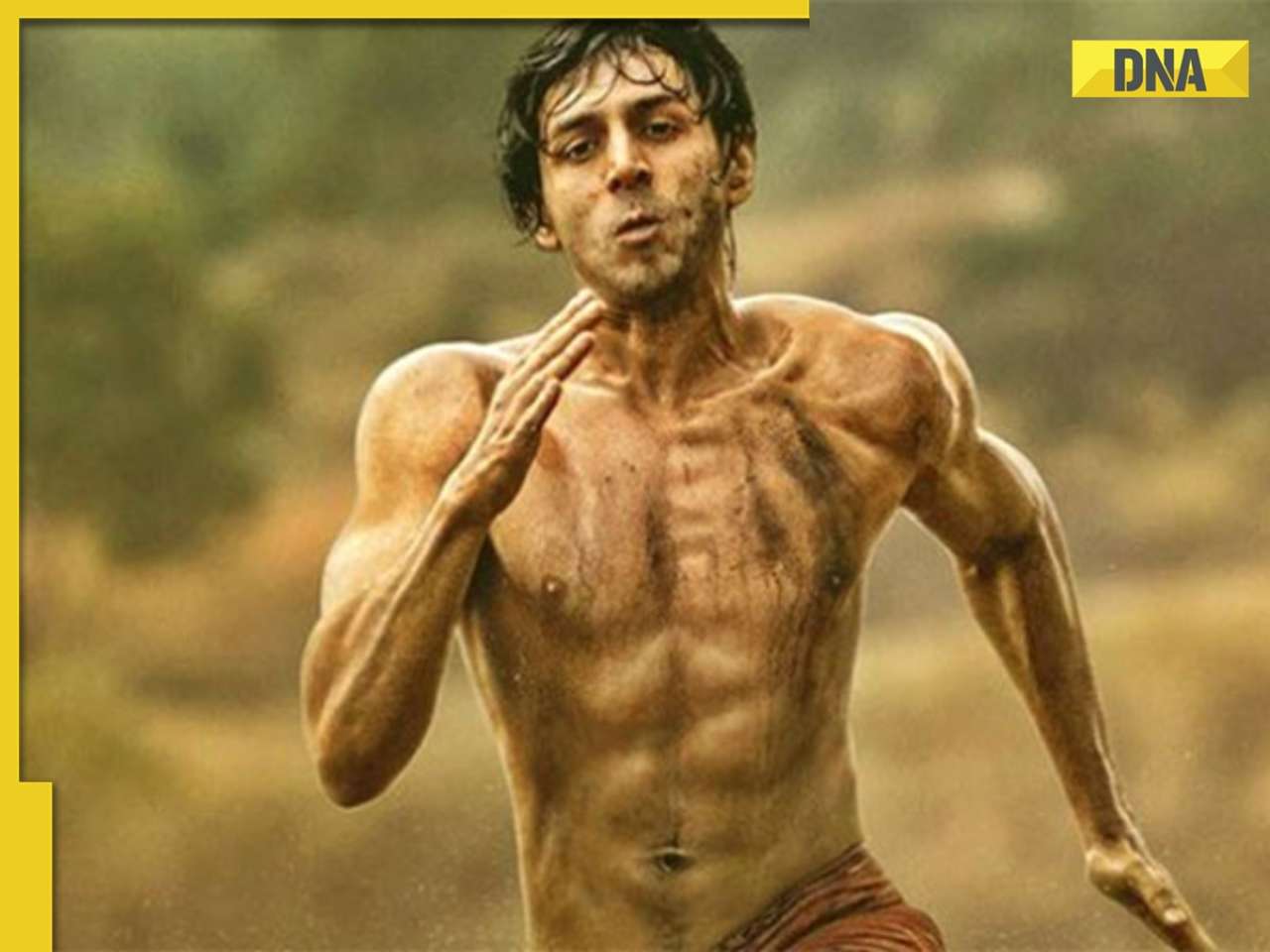

Former champions Sri Lanka crash out of T20 World Cup 2024![submenu-img]() Chandu Champion review: Kartik Aaryan gives a performance for the ages in Kabir Khan's moving ode to underdog champions

Chandu Champion review: Kartik Aaryan gives a performance for the ages in Kabir Khan's moving ode to underdog champions![submenu-img]() Pakistan likely to crash out of T20 World Cup 2024 due to....

Pakistan likely to crash out of T20 World Cup 2024 due to....![submenu-img]() Meet Indian genius who had 38 honorary doctoral degrees from universities in 19 countries

Meet Indian genius who had 38 honorary doctoral degrees from universities in 19 countries![submenu-img]() Meet woman who worked at RBI in day and studied at night, topped UPSC exam without coaching in 1st attempt, she is from…

Meet woman who worked at RBI in day and studied at night, topped UPSC exam without coaching in 1st attempt, she is from…![submenu-img]() Meet man, security guard’s son who cracked UPSC exam in first attempt by studying from borrowed books, he is posted as..

Meet man, security guard’s son who cracked UPSC exam in first attempt by studying from borrowed books, he is posted as..![submenu-img]() Meet woman who once worked as receptionist, cracked UPSC exam to become IPS officer, secured AIR...

Meet woman who once worked as receptionist, cracked UPSC exam to become IPS officer, secured AIR...![submenu-img]() Meet genius, only Indian nominated for Nobel by CV Raman, did not win due to...

Meet genius, only Indian nominated for Nobel by CV Raman, did not win due to...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer

How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer![submenu-img]() In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'

In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() Lok Sabha Elections 2024: 6 states with highest number of seats

Lok Sabha Elections 2024: 6 states with highest number of seats![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Chandu Champion review: Kartik Aaryan gives a performance for the ages in Kabir Khan's moving ode to underdog champions

Chandu Champion review: Kartik Aaryan gives a performance for the ages in Kabir Khan's moving ode to underdog champions![submenu-img]() Watch: Karan Johar reacts to Kangana Ranaut slap incident, says 'I do not...'

Watch: Karan Johar reacts to Kangana Ranaut slap incident, says 'I do not...'![submenu-img]() JD Majethia reveals 40 writers contributed in Wagle Ki Duniya, says 'TV these days lost...' | Exclusive

JD Majethia reveals 40 writers contributed in Wagle Ki Duniya, says 'TV these days lost...' | Exclusive![submenu-img]() Jigra: Alia Bhatt, Vedang Raina-starrer postponed; Vasan Bala directorial to now clash with Rajinikanth's Vettaiyan

Jigra: Alia Bhatt, Vedang Raina-starrer postponed; Vasan Bala directorial to now clash with Rajinikanth's Vettaiyan![submenu-img]() Chandu Champion: Makers of Kartik Aaryan-starrer make big move, announce tickets at just Rs...

Chandu Champion: Makers of Kartik Aaryan-starrer make big move, announce tickets at just Rs...![submenu-img]() 'Thought it was...': Mumbai doctor finds human finger in ice cream

'Thought it was...': Mumbai doctor finds human finger in ice cream![submenu-img]() Ghaziabad YouTuber booked for videos 'promoting child sex abuse'

Ghaziabad YouTuber booked for videos 'promoting child sex abuse'![submenu-img]() Mumbai man finds human finger in ice cream ordered online, details inside

Mumbai man finds human finger in ice cream ordered online, details inside![submenu-img]() Aadhar vs Green Card: Meme war erupts as India wins against USA in T20 clash

Aadhar vs Green Card: Meme war erupts as India wins against USA in T20 clash![submenu-img]() 'Aliens aren't from another world, they're...' Harvard scientists' unveil big secret

'Aliens aren't from another world, they're...' Harvard scientists' unveil big secret

)

)

)

)

)

)