The BSE Sensex hiked smartly 726.87 points after hitting an all time high of 17,361.47, on the back of strong capital inflows from FIIs, brokers said.

MUMBAI: The Bombay Stock Exchange (BSE) Sensex hiked smartly 726.87 points or 4.39 per cent to 17,291.10 in the week ending on Friday, after hitting an all time high of 17,361.47, on the back of strong capital inflows from foreign institutional investors (FIIs), brokers said.

"The market rallied further last week with the barometer index crossing 17,000 mark and Nifty 5,000 level as investors bet on another cut in interest rate by the US Federal Reserve next month after data showed sluggish housing sales and consumer confidence in the US. Strong FII buying boosted bourses. Sensex moved up in all the five trading sessions in the week,'' market analysts said.

The National Stock Exchange (NSE) S&P CNX Nifty hardened by 183.8 points or 3.79 per cent at 5,021.35 in the week and hit an all time high of 5,055.80 on Friday.

BSE Mid Cap rose 222.51 or 3.09 per cent to 7,422.43, while the BSE Small Cap index rose 204.63 points or 2.3 per cent to 9,099.93 in the week. Both these indices underperformed the Sensex.

Annual inflation based on the wholesale price index (WPI) has further fallen to 3.23 per cent in the week ended Sept 15 from 3.3 per cent in the previous week. The market estimate was 3.47 per cent for the week ended Sept 15. Inflation was at 5.27 per cent in the corresponding week last year. The fall in inflation is driven by decline in prices of fruits and vegetables, eggs, fish-marine and pulses.

The 30-scrip Sensex hit 17,000 on Wednesday. It took just 5 trading sessions for the Sensex to reach 17,000 from 16,000 after the barometer index first struck 16,000 on Sept 19. The Sensex's

1,000-point surge was the fastest ever. The previous record for the shortest 1,000-point journey was 19 days when the Sensex soared from 11,000 to 12,000 in March 2006.

Among sectoral indices, BSE Realty index tanked, while BSE Auto Index, BSE Capital Goods Index, BSE Oil and Gas Index, BSE TecK index, BSE Consumer Durables index, BSE FMCG Index and BSE Health Care Index edged up. They however, underperformed the Sensex. But the BSE Bankex, BSE IT Index, BSE PSU index and BSE Metal Index surged ahead to outperform the market in the week.

The BSE Sensex rose by 281.60 points to 16,845.83 on Monday, on steady buying demand for index pivotals throughout the day, Turnover was healthy and it crossed Rs 7,500 crore on BSE.

It then gained 53.71 points at 16,899.54 on Tuesday. The benchmark index was up 21.85 points at 16,921.39 on Wednesday, settling with small gains on selective buying in index pivotals. It was then up 229.17 points at 17,150.56 on Thursday, as the market surged at the fag end of the trading session to touch new all time high, on short-covering ahead of expiry of this month's derivatives contracts.

Finally, the Sensex was up 140.54 points at 17,291.10 on Friday, following a strong rollover from this month's futures to next month's futures and a greater than expected fall in inflation figures.

eliance Energy (REL), NTPC, Maruti Suzuki India, Bharti Airtel, Bhel, Reliance Industries (RIL), Satyam Computers, Infosys, TCS, Wipro, Tata Steel, SBI, ICICI Bank and Hindalco Industries were the other gainers from the Sensex pack.

![submenu-img]() T20 World Cup 2024: Bangladesh keep Super 8 hopes alive with 25-run win over Netherlands

T20 World Cup 2024: Bangladesh keep Super 8 hopes alive with 25-run win over Netherlands![submenu-img]() DNA TV Show: Will Modi govt review Agnipath scheme following Army survey?

DNA TV Show: Will Modi govt review Agnipath scheme following Army survey?![submenu-img]() Former champions Sri Lanka crash out of T20 World Cup 2024

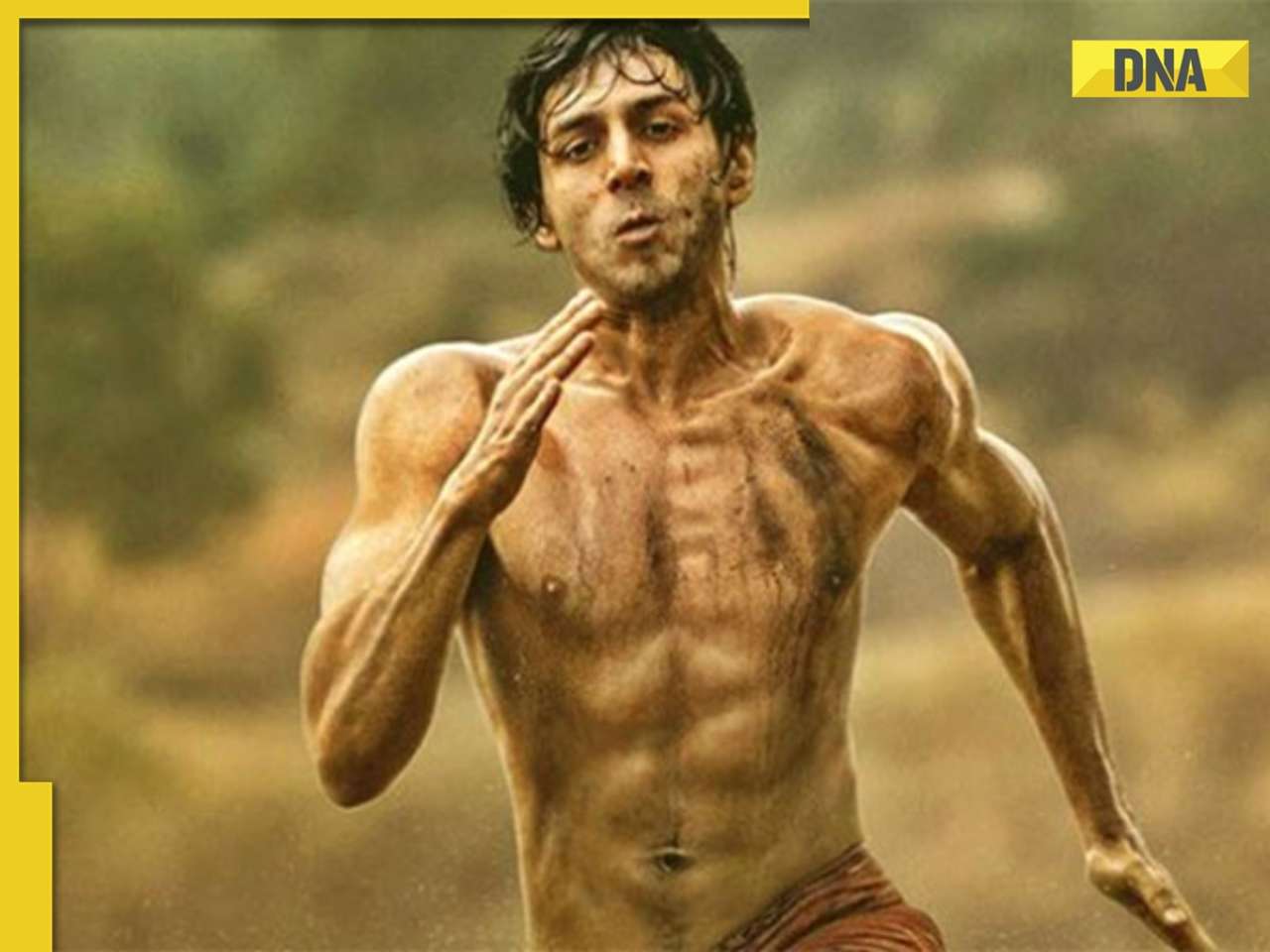

Former champions Sri Lanka crash out of T20 World Cup 2024![submenu-img]() Chandu Champion review: Kartik Aaryan gives a performance for the ages in Kabir Khan's moving ode to underdog champions

Chandu Champion review: Kartik Aaryan gives a performance for the ages in Kabir Khan's moving ode to underdog champions![submenu-img]() Pakistan likely to crash out of T20 World Cup 2024 due to....

Pakistan likely to crash out of T20 World Cup 2024 due to....![submenu-img]() Meet Indian genius who had 38 honorary doctoral degrees from universities in 19 countries

Meet Indian genius who had 38 honorary doctoral degrees from universities in 19 countries![submenu-img]() Meet woman who worked at RBI in day and studied at night, topped UPSC exam without coaching in 1st attempt, she is from…

Meet woman who worked at RBI in day and studied at night, topped UPSC exam without coaching in 1st attempt, she is from…![submenu-img]() Meet man, security guard’s son who cracked UPSC exam in first attempt by studying from borrowed books, he is posted as..

Meet man, security guard’s son who cracked UPSC exam in first attempt by studying from borrowed books, he is posted as..![submenu-img]() Meet woman who once worked as receptionist, cracked UPSC exam to become IPS officer, secured AIR...

Meet woman who once worked as receptionist, cracked UPSC exam to become IPS officer, secured AIR...![submenu-img]() Meet genius, only Indian nominated for Nobel by CV Raman, did not win due to...

Meet genius, only Indian nominated for Nobel by CV Raman, did not win due to...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer

How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer![submenu-img]() In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'

In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() Lok Sabha Elections 2024: 6 states with highest number of seats

Lok Sabha Elections 2024: 6 states with highest number of seats![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Chandu Champion review: Kartik Aaryan gives a performance for the ages in Kabir Khan's moving ode to underdog champions

Chandu Champion review: Kartik Aaryan gives a performance for the ages in Kabir Khan's moving ode to underdog champions![submenu-img]() Watch: Karan Johar reacts to Kangana Ranaut slap incident, says 'I do not...'

Watch: Karan Johar reacts to Kangana Ranaut slap incident, says 'I do not...'![submenu-img]() JD Majethia reveals 40 writers contributed in Wagle Ki Duniya, says 'TV these days lost...' | Exclusive

JD Majethia reveals 40 writers contributed in Wagle Ki Duniya, says 'TV these days lost...' | Exclusive![submenu-img]() Jigra: Alia Bhatt, Vedang Raina-starrer postponed; Vasan Bala directorial to now clash with Rajinikanth's Vettaiyan

Jigra: Alia Bhatt, Vedang Raina-starrer postponed; Vasan Bala directorial to now clash with Rajinikanth's Vettaiyan![submenu-img]() Chandu Champion: Makers of Kartik Aaryan-starrer make big move, announce tickets at just Rs...

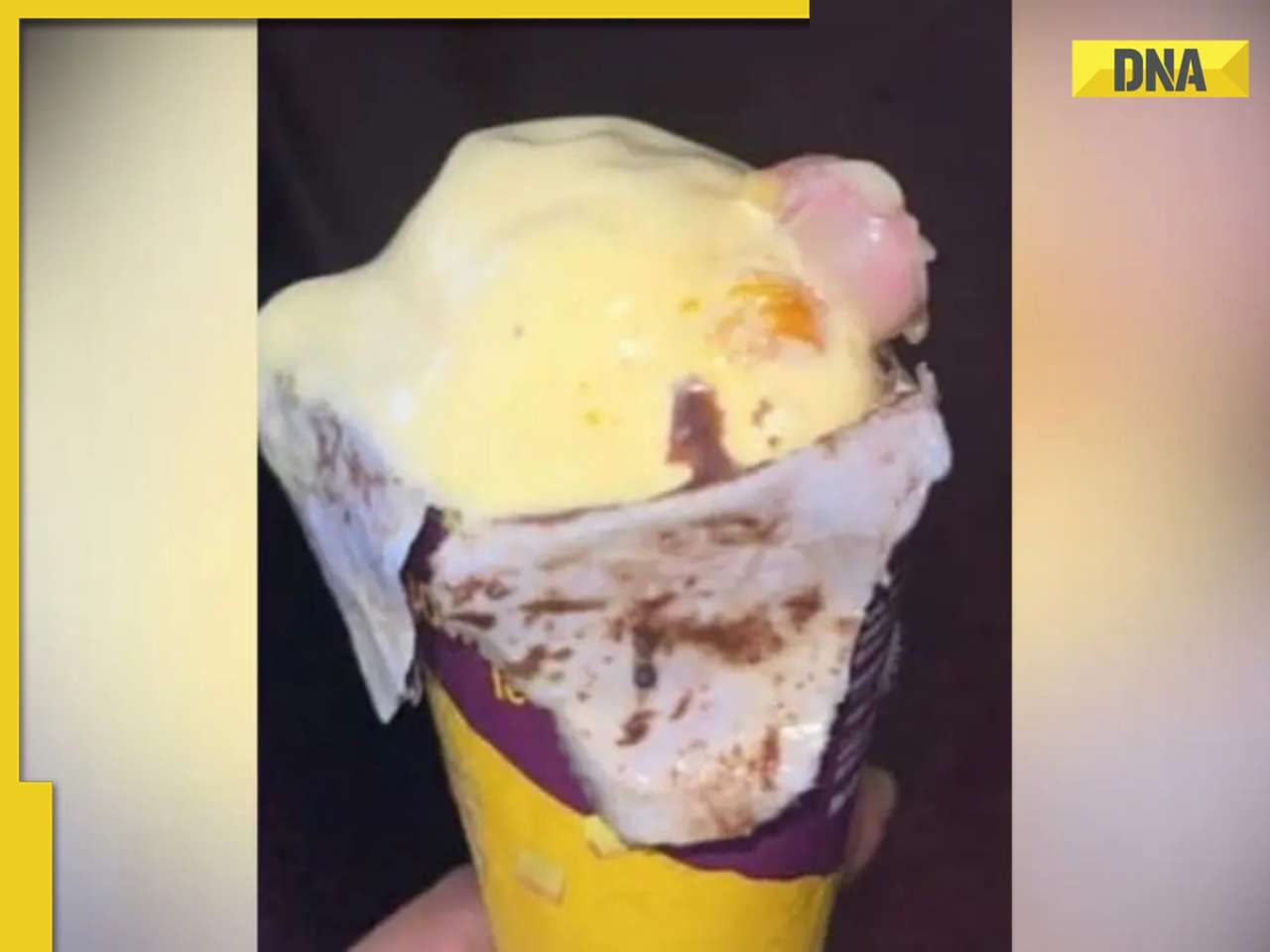

Chandu Champion: Makers of Kartik Aaryan-starrer make big move, announce tickets at just Rs...![submenu-img]() 'Thought it was...': Mumbai doctor finds human finger in ice cream

'Thought it was...': Mumbai doctor finds human finger in ice cream![submenu-img]() Ghaziabad YouTuber booked for videos 'promoting child sex abuse'

Ghaziabad YouTuber booked for videos 'promoting child sex abuse'![submenu-img]() Mumbai man finds human finger in ice cream ordered online, details inside

Mumbai man finds human finger in ice cream ordered online, details inside![submenu-img]() Aadhar vs Green Card: Meme war erupts as India wins against USA in T20 clash

Aadhar vs Green Card: Meme war erupts as India wins against USA in T20 clash![submenu-img]() 'Aliens aren't from another world, they're...' Harvard scientists' unveil big secret

'Aliens aren't from another world, they're...' Harvard scientists' unveil big secret

)

)

)

)

)

)