Analysts polled by Reuters had expected exports to fell 5.0% in May from a year ago, following a surprising 6.4% fall in April, and predicted imports would fall 10.7%, versus a 16.2% slide in April.

China's exports in May fell less than expected but a double-digit drop in imports will likely keep the pressure on Beijing for more stimulus to avert a sharper economic slowdown.

China's exporters have been struggling to cope with weak overseas demand, rising labour and currency costs, exacerbating downward pressure on the world's second-largest economy.

Exports in May fell 2.5% from a year earlier and imports slid 17.6%, data released by the General Administration of Customs on Monday showed.

That left the country with a near record trade surplus of $59.49 billion for the month.

Analysts polled by Reuters had expected exports to fell 5.0% in May from a year ago, following a surprising 6.4% fall in April, and predicted imports would fall 10.7%, versus a 16.2% slide in April.

"A slightly improved export figure does not mean the condition is substantially better. Chinese companies still lack bargaining power in global markets due to the relative strength of the Chinese currency," Liu Yaxin, macro strategist at China Merchants Securities in Shenzhen.

"Overall, the data shows the Chinese economy is still in the process of seeking a bottom. We expect trade conditions to continue to be sluggish in the following 4-5 months, with more government policy rolling out to stabilise (the economy)."

The yuan has gained against major non-dollar currencies in recent months, leading to its rise on a trade-weight basis, but Premier Li Keqiang has ruled out a devaluation.

China's trade grew 3.4% in 2014, missing the government's growth target of 7.5% by more than half. The government has lowered its growth target for 2015, with combined imports and exports expected to rise around 6 percent.

The government is due to release inflation data on Tuesday and industrial output, investment and retail sales numbers on Thursday.

Economists polled by Reuters expected some signs of steadying in the economy thanks to stimulus measures, but analysts say more support is needed to counter headwinds from a property downturn and patchy exports.

China cut interest rates for the third time in six months in May - on top of two reductions in the amount of money banks must keep in reserve - in a bid to lower borrowing costs and stoke a sputtering economy that is headed for its worst year in a quarter of a century.

Many analysts have already penciled in sub-7% growth for the second quarter, raising the risk that the government will not meet its full-year growth target of around 7%.

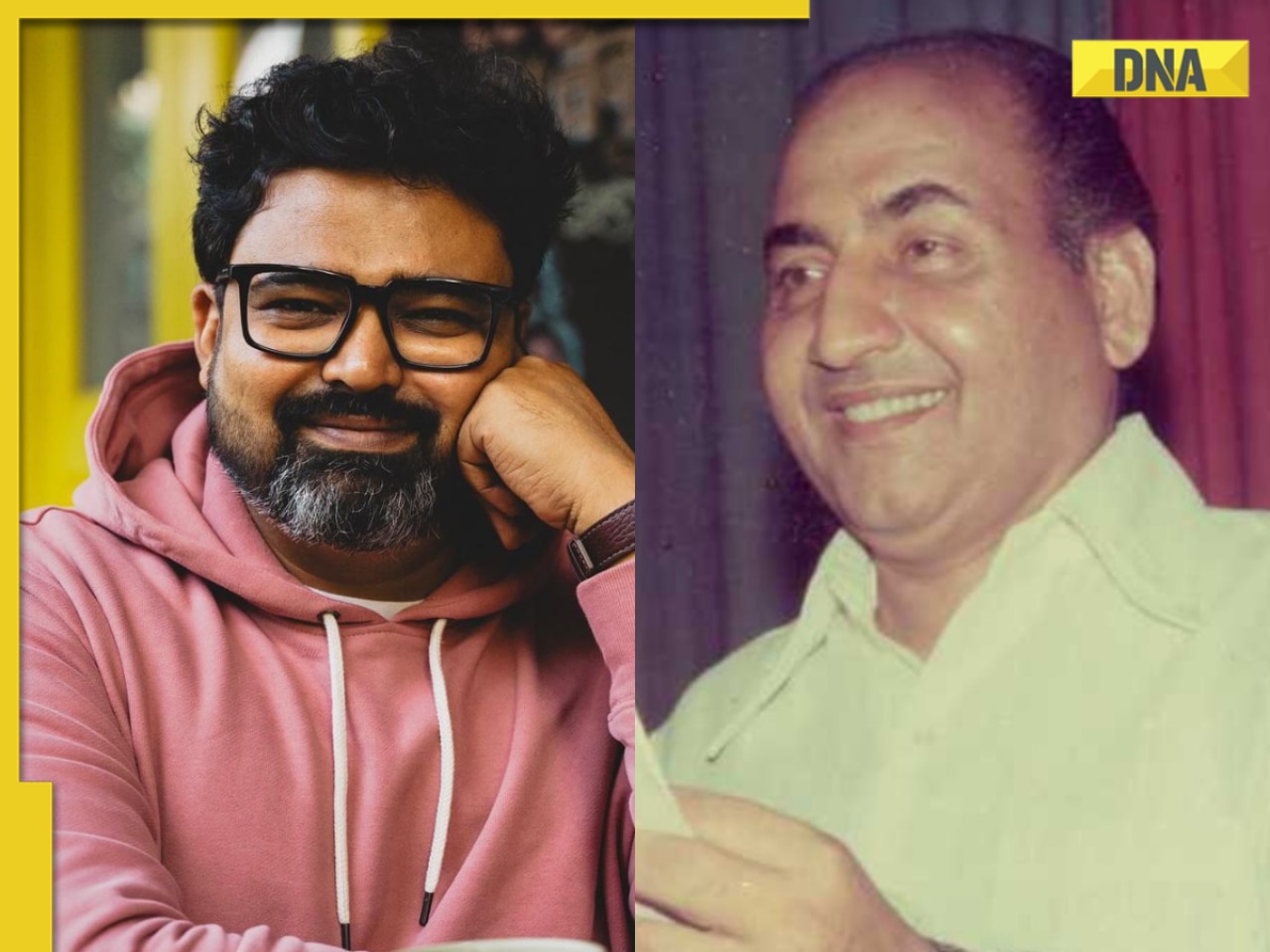

![submenu-img]() Raj Shekhar reacts to AI-generated Mohammed Rafi version of 'Pehle Bhi Main': 'I sent it to my father' | Exclusive

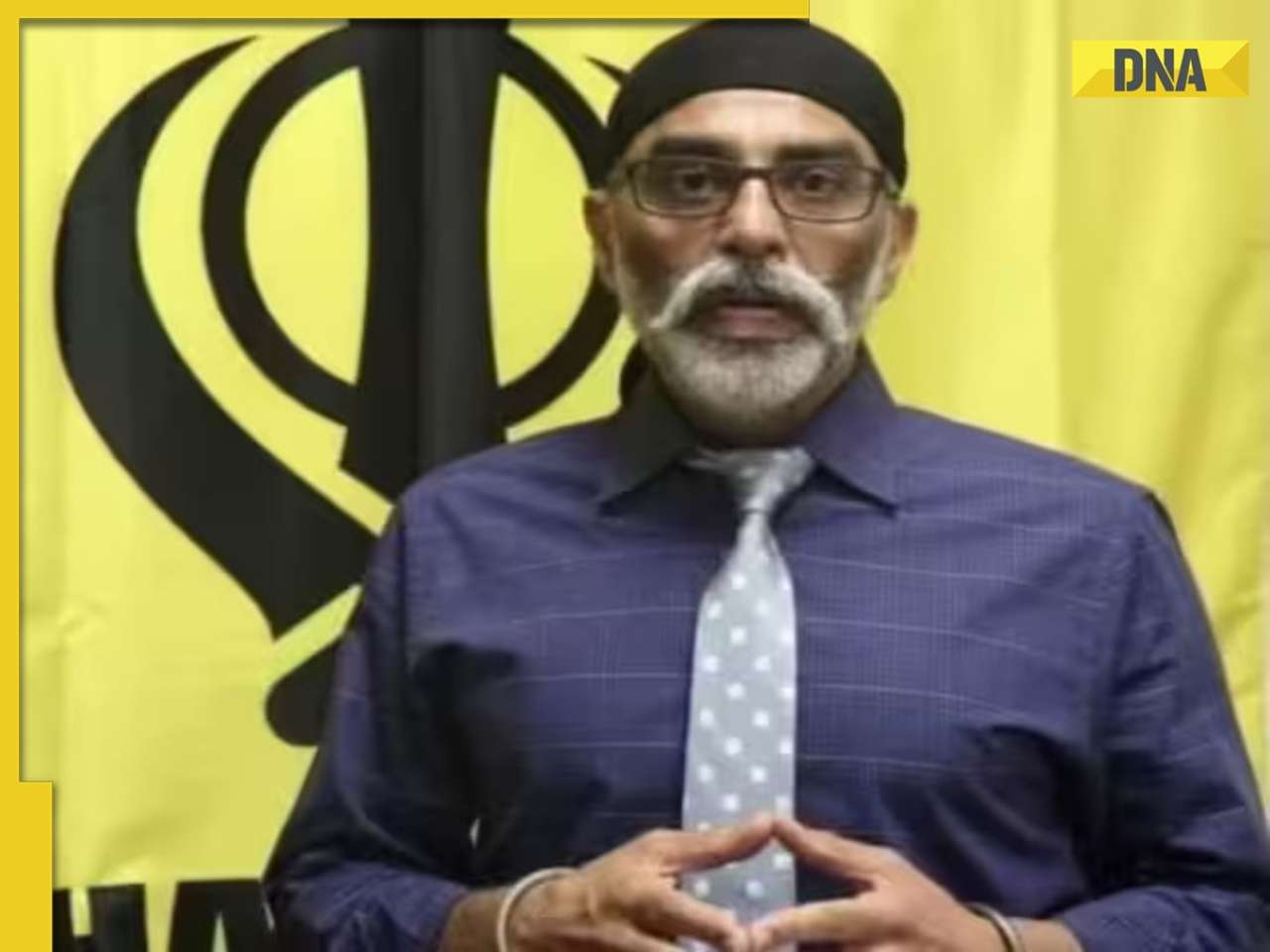

Raj Shekhar reacts to AI-generated Mohammed Rafi version of 'Pehle Bhi Main': 'I sent it to my father' | Exclusive ![submenu-img]() 'Unwarranted, unsubstantiated claims': India slams US media report on alleged Pannun murder plot

'Unwarranted, unsubstantiated claims': India slams US media report on alleged Pannun murder plot![submenu-img]() JD(s) to suspend NDA Hassan candidate Prajwal Revanna: Kumaraswamy

JD(s) to suspend NDA Hassan candidate Prajwal Revanna: Kumaraswamy![submenu-img]() AstraZeneca admits its COVID-19 vaccine Covishield can cause rare...

AstraZeneca admits its COVID-19 vaccine Covishield can cause rare...![submenu-img]() Shekhar Suman slams young actors who ‘want stardom overnight’: ‘Why do they act…’

Shekhar Suman slams young actors who ‘want stardom overnight’: ‘Why do they act…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Raj Shekhar reacts to AI-generated Mohammed Rafi version of 'Pehle Bhi Main': 'I sent it to my father' | Exclusive

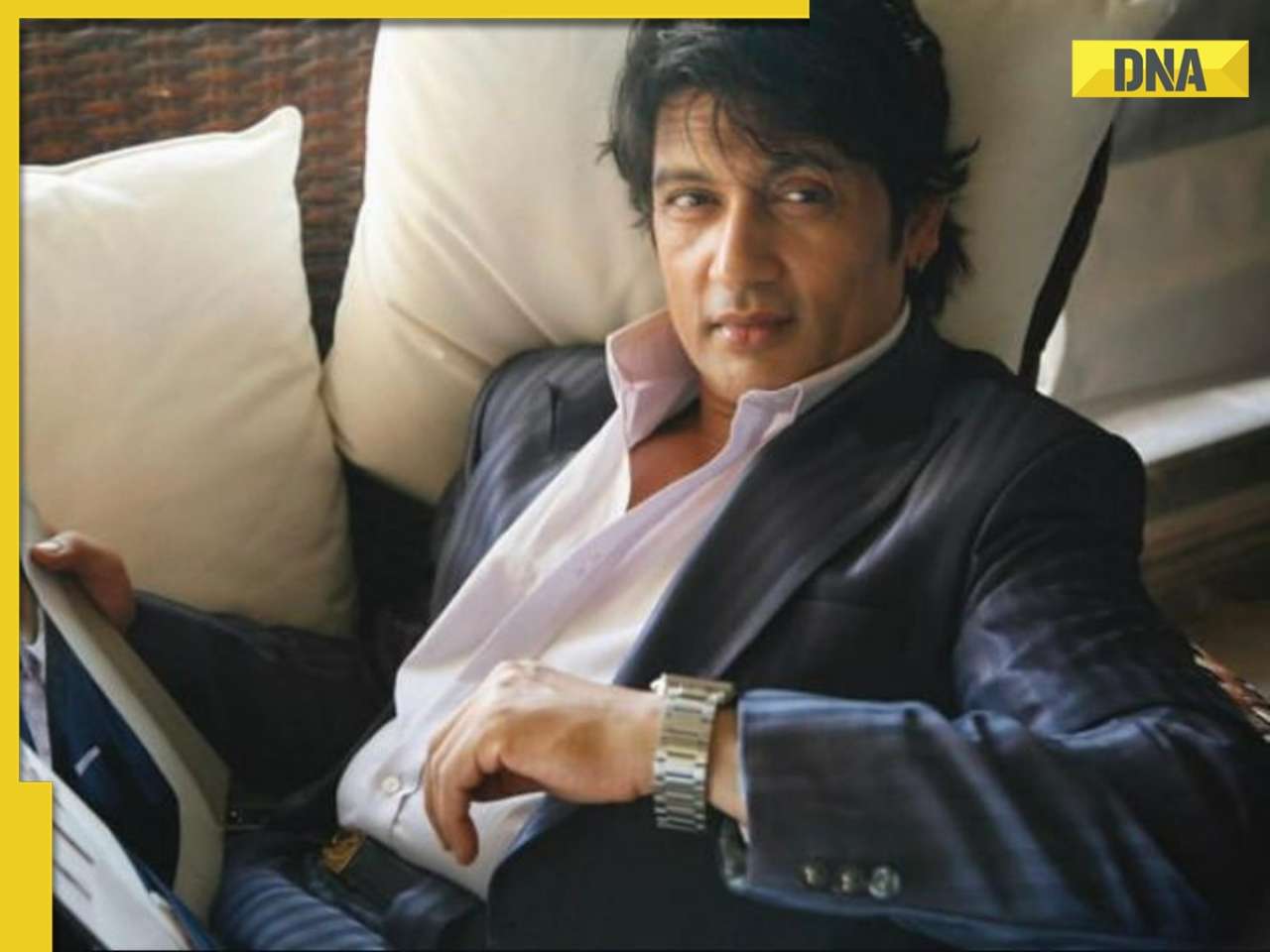

Raj Shekhar reacts to AI-generated Mohammed Rafi version of 'Pehle Bhi Main': 'I sent it to my father' | Exclusive ![submenu-img]() Shekhar Suman slams young actors who ‘want stardom overnight’: ‘Why do they act…’

Shekhar Suman slams young actors who ‘want stardom overnight’: ‘Why do they act…’![submenu-img]() Meet man who lived naked, alone, away from civilisation for 'cruel' reality show; remained in trauma for years, is now..

Meet man who lived naked, alone, away from civilisation for 'cruel' reality show; remained in trauma for years, is now..![submenu-img]() Meet actor, who became star overnight, was called superhero of children, later quit acting; he now works as...

Meet actor, who became star overnight, was called superhero of children, later quit acting; he now works as...![submenu-img]() This actor, who worked as AC mechanic, taught students for Rs 25, became superstar, gave multiple Rs 1000-crore films

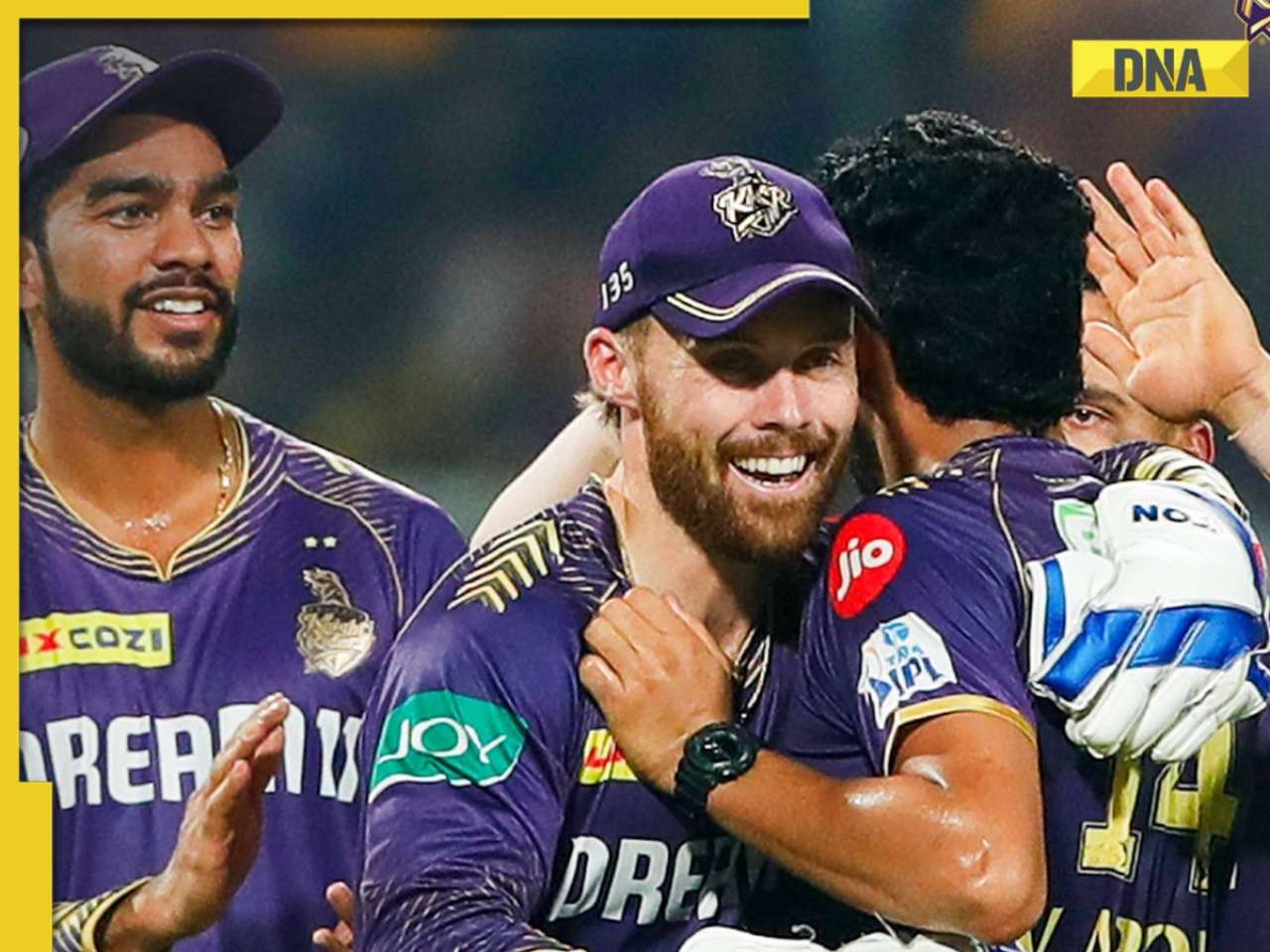

This actor, who worked as AC mechanic, taught students for Rs 25, became superstar, gave multiple Rs 1000-crore films![submenu-img]() IPL 2024: Varun Chakaravarthy, Phil Salt power Kolkata Knight Riders to 7-wicket win over Delhi Capitals

IPL 2024: Varun Chakaravarthy, Phil Salt power Kolkata Knight Riders to 7-wicket win over Delhi Capitals![submenu-img]() 'Won't find a place in my team': Virender Sehwag slams legendary India player for his comments on T20 cricket

'Won't find a place in my team': Virender Sehwag slams legendary India player for his comments on T20 cricket![submenu-img]() 'When people create imbalances....': Virat Kohli's sister reacts to RCB batter's strike rate chatter in IPL 2024

'When people create imbalances....': Virat Kohli's sister reacts to RCB batter's strike rate chatter in IPL 2024![submenu-img]() LSG vs MI, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs MI, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs MI IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Mumbai Indians

LSG vs MI IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Mumbai Indians![submenu-img]() Viral Video: 4 girls get into ugly fight on Noida road, fly punches, pull hair; watch

Viral Video: 4 girls get into ugly fight on Noida road, fly punches, pull hair; watch![submenu-img]() Private jets, pyramids and more: Indian-origin billionaire Ankur Jain marries ex-WWE star Erika Hammond in Egypt

Private jets, pyramids and more: Indian-origin billionaire Ankur Jain marries ex-WWE star Erika Hammond in Egypt![submenu-img]() Viral video captures mama tiger and cubs' playful time in Ranthambore, watch

Viral video captures mama tiger and cubs' playful time in Ranthambore, watch![submenu-img]() Heartwarming video of cat napping among puppies goes viral, watch

Heartwarming video of cat napping among puppies goes viral, watch![submenu-img]() Viral video: Man squeezes his body through tennis racquet, internet is stunned

Viral video: Man squeezes his body through tennis racquet, internet is stunned

)

)

)

)

)

)

)