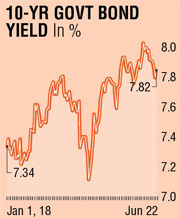

Another bout of trade-war tantrums haunts market sentiments as equities remain weaker and bond yields remain steady. More G20 central banks join the tightening camp while minutes of June Reserve Bank of India-Monetary Policy Committee (RBI-MPC) confirmed that the lone dove in the six-member committee switch sides and raise concerns on stubbornly elevated price pressures. Emerging market currencies continue to remain under pressure with the rupee bucking the trend and correcting strongly by a percent during the week.

The ongoing trade tensions cast a gloomy shadow on market sentiments with Trump administration threatening to impose an additional $200bn in tariffs on Chinese imports as China has retaliated over an earlier levy that comes into July 6. In other developments, Fed chairman pressed for more rate hikes.

Indian markets had their first taste of a sustained rally in bond prices as the first four days of the week saw prices firming up from recent multi-year lows. Minutes of RBI’s MPC meeting was perceived as less hawkish and in line. Gleaning into the finer points of the policy document reveals the total absence of any reference to WPI, which is a good measure of GDP deflator and underlying momentum. Core inflation is sticky and in an uptrend which could remain a medium-term concern. However, the base effect should help ease headline retail inflation numbers from the August reading.

With buying interest and risk appetite considerably low among the major PSU banks and the likely tweak in state loan valuation norms, banks are still grappling with stale longs and valuation losses. The concessions to amortise the valuation losses are a short-term reprieve and may not move to another financial year. Unless there is a pre-stated larger OMO purchase programme, bond yields will remain vulnerable to sell-off.

With buying interest and risk appetite considerably low among the major PSU banks and the likely tweak in state loan valuation norms, banks are still grappling with stale longs and valuation losses. The concessions to amortise the valuation losses are a short-term reprieve and may not move to another financial year. Unless there is a pre-stated larger OMO purchase programme, bond yields will remain vulnerable to sell-off.

Rupee’s rebound is a positive development and should ease some pressure off poor sentiment in the bond-street. Purely from numbers, Q1 2019 has been the least favourable for bond markets. Reckoning that average inflation for the FY will still be sub 4.75%, current spread of real rates make buying bonds in the front end of the rate curve. In the meanwhile, a range of 7.75–7.87% in benchmark 10y yields for the week ahead.

The writer is a market expert