Dow Jones wobbled on take-off Thursday, shedding more than 200 points despite partial clearance to the $700 billion bailout package by the US senate.

Valuations getting attractive, but buyers?

Success is not final; Failure is not fatal. It’s the courage to continue that counts."

—Winston Churchill

MUMBAI: Dow Jones wobbled on take-off Thursday, shedding more than 200 points despite partial clearance to the $700 billion bailout package by the US senate, which is desperately needed to unclog global credit markets.

Flat-to-positive Europe was quick to take cue, and immediately went into the negative.

The worries are valid: theoretically, the bailout package still needs clearance from the US house of representatives, which had rejected it on Monday.

Friday night (India time) thus becomes crucial for world markets. A rejection redux would be a terrifying proposition for all asset classes.

Remember, some house representatives are due for re-elections in November and are worried about retaining their seats. Supporting a bailout is not in their interests, therefore. Who’ll answer voters’ questions?

Will that fear translate into overbearing bear-hug at the local level?

The passage of the Indo-US nuclear deal is a positive (at least for the capital goods and power sectors), and the Senate passage of the bailout package affords hope.

Jayesh Shroff, fund manager-equity at SBI Mutual Fund said a successful bailout deal can offer a short-term positive trigger.

“When cleared, it should inject some liquidity. However, structural issues remain as do problems with rising bad loans in the US,” Shroff said.

If the credit markets get irrigated and more banks don’t go under in the US, the attention on Wall St will shift to unemployment, housing and GDP, feels the Street.

Naresh Kothari, co-head of Institutional equities, Edelweiss Securities expects a short-term relief rally locally. “A part of this we have already seen in the past two sessions.

But liquidity constraints need to stabilise in the US,” he said.

S Naganath, president and chief investment officer of DSP Merrill Lynch Mutual fund said while clearance to the bailout package will restore some confidence, the banking issues in Europe also need quick redressal.

“It is quite likely there could be an interest rate cut by the European Central Bank and by the Fed. The Fed is expected to meet in late October. Concerted rate cuts and liquidity injections across the globe alone can allay concerns about the system and hopefully restore confidence,” Naganath said.

But for a rally to occur, foreign institutional investor money is crucial. Analysts don’t see it coming anytime soon due to elevated levels of risk aversion.

There is another structural change —- key investment banks such as Goldman Sachs and Morgan Stanley have become Fed-regulated entities.

That means little or no leverage, going forward. Which, in turn, means the FII inflow of $17.2 billion seen in 2007 may remain the watermark to beat for a long time to come.

Yet, Credit Suisse analysts Nilesh Jasani, Arya Sen and Deepak Ramineedi find valuations turning attractive.

“Valuation attractiveness is in the eyes of the beholder, particularly both when prospects of future earnings and usable long-term cost of capital are difficult to ascertain even in a broad range. Yet, it is likely that history books will record some time around now as one of the best entry opportunities for long-term investors,” the trio said in a report last week.

The retail investor, however, is unlikely to take bait, singed as he is by the 9-month meltdown this year. He seems happy with the 10% rock-safe returns on fixed deposits.

That leaves domesticinstitutions as the lenders of the last resort for the Sensex.

Kothari of Edelweiss says the major local concern remains liquidity.

“If there is no return of Big Cash into the market, we are unlikely to see much upside. Domestic institutional investors have been lending a shoulder but major liquidity is not coming in from them. That’s because they are on wait-and-watch mode,” Kothari said.

Then, of course, there is the second-quarter results which start getting announced soon.

Though expectations are already low, negative surprises can prove nasty in these prickly times.

“Domestically the focus is going to be on results. The swing in currency and the cost of raw materials is definitely going to be reflected in the numbers. The effect will be felt across sectors,” said SBI Mutual Fund’s Shroff.

The key to longer-term upturn remains stability in the so-called developed markets.

But DSP Merrill’s Naganath portends fresh weakness in November.

“I think environment will remain volatile in terms of stock prices and credit. Not until first quarter of the next year can we say the worst is behind us. Thereafter will begin the rebuilding of confidence and risk appetite.”

![submenu-img]() Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..

Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..![submenu-img]() Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'

Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'![submenu-img]() Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...

Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...![submenu-img]() 9 killed, 24 injured as bus catches fire in Haryana's Nuh

9 killed, 24 injured as bus catches fire in Haryana's Nuh![submenu-img]() Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..

Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…

Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’

Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’![submenu-img]() Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'

Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'![submenu-img]() In pics: Sobhita Dhulipala looks 'stunning hot' in plum cordelia jumpsuit at Cannes Film Festival, fans call her 'queen'

In pics: Sobhita Dhulipala looks 'stunning hot' in plum cordelia jumpsuit at Cannes Film Festival, fans call her 'queen'![submenu-img]() Udaariyaan takes 15-year leap, these actors join Sargun Mehta, Ravi Dubey-produced show

Udaariyaan takes 15-year leap, these actors join Sargun Mehta, Ravi Dubey-produced show![submenu-img]() In pics: Urvashi Rautela sizzles in red strapless gown at Cannes Film Festival, fans call her 'Disney princess'

In pics: Urvashi Rautela sizzles in red strapless gown at Cannes Film Festival, fans call her 'Disney princess'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..

Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..![submenu-img]() Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'

Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'![submenu-img]() Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...

Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...![submenu-img]() Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..

Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..![submenu-img]() This film's budget was less than an iPhone, smashed box office records; became first industry hit, earned...

This film's budget was less than an iPhone, smashed box office records; became first industry hit, earned... ![submenu-img]() Do you know which God Parsis worship? Find out here

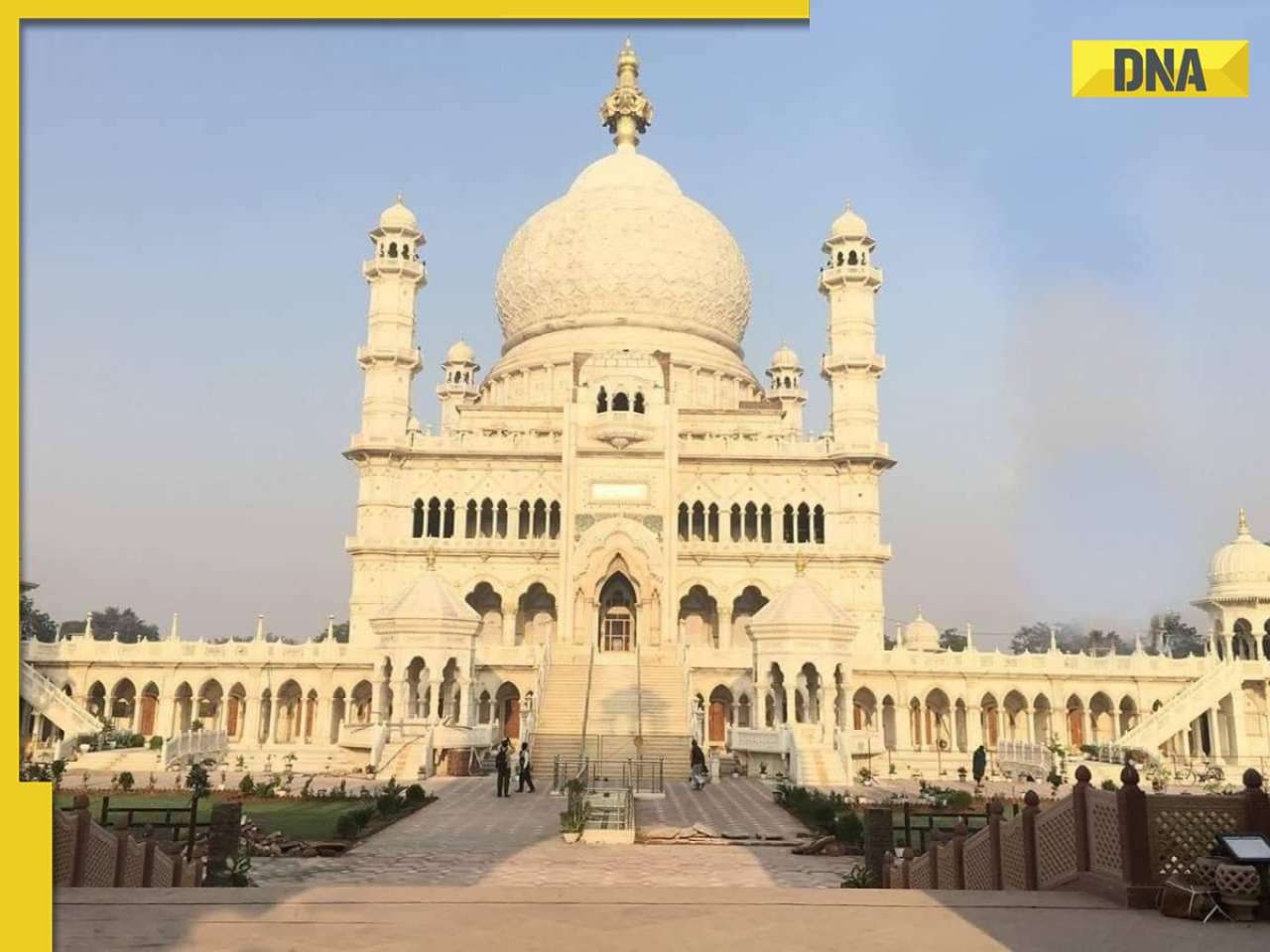

Do you know which God Parsis worship? Find out here![submenu-img]() This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete![submenu-img]() 'If only we are smart enough...': Narayana Murthy was asked how AI will hurt job prospects

'If only we are smart enough...': Narayana Murthy was asked how AI will hurt job prospects![submenu-img]() Viral video: Gujarat man converts Honda Civic into 'Lamborghini' for just Rs 12.5 lakh, watch

Viral video: Gujarat man converts Honda Civic into 'Lamborghini' for just Rs 12.5 lakh, watch![submenu-img]() Man who disappeared 26 years ago found in neighbour`s cellar, just 100 metres from home

Man who disappeared 26 years ago found in neighbour`s cellar, just 100 metres from home

)

)

)

)

)

)