Marion Arathoon & Anushree Madan Mohan

MUMBAI: Denial may be the better part of valour. Or the plain truth.

But on the heels of Sony-Dentsu denying that there was ever a deal forged twixt the two involving Dentsu underwriting cricket ad-time inventory for certain properties, a flurry of questions has surfaced from the ad business.

Such as, would this alleged Dentsu deal really have been unprecedented in nature - or has it been around in different shades in the media business?

And wasn’t it anti-competitive in itself to use lobby power to squelch any such underwriting deals/rumours, related to what some may see as mere business evolution of a fragmenting TV market?

Isn’t this tantamount to cartelisation on both sides, query some.

Sure, hypothetically, a Dentsu - via any alleged deal with a broadcaster - may get ‘special’ discounts by bulk-buying cricket inventory and then selling it piece-meal to advertisers outside their agency roster.

But in the same coin, don’t mega media-buying houses also implicitly leverage their buying muscle to get special deals for their big and other clients? ask some observers.

“Even if agency-specific deals are on paper frowned upon, don’t many media agencies overtly or covertly swing special deals with media owners based on their ‘potential’ buying power? So, are some media houses safeguarding potential threat to their own interests and commissions by rallying behind a body?

What’s to stop any interested media agency in the future from picking up huge coveted broadcast properties and retailing the same using the backdoor route—via `other’ fronts like independent marketing agents, or new agency fronts?’’ queries one media specialist.

A sense of déjà vu

A critical poser: if a name bigger and with more media-buying fire than a Dentsu was involved in such an alleged deal, would the Advertising Agencies Association of India (AAAI) or any body even have the teeth to actually stop them?

Also, a media veteran states that various, less than traditional media deals here have failed to come under media scrutiny.

She says: “When the last World Cup took place, Mindshare scooped most parts of the ad inventory on the basis of an ‘understanding.’ Madison has also had tie-ups with various channels on prized entertainment properties.

Of course, they didn’t market it to advertisers outside, but they did monopolise the business. Unfortunately the Sony-Denstu understanding came under the media spotlight, and both parties had to scrap it.”

Adds another media light: Such deals always involve large amounts of inventory, high value to be utilised in a short span of time. But there is no confidentiality in this industry. Even if you keep three filters in between, or you keep everything at an arm’s length, everyone would get to know about it.

But would they want to talk about it? For example, a sports-content major has formed alliances with agencies and acted as a marketing force, for prized properties.

There’s another charge by certain industry professionals: that bodies like the AAAI are not in step with the times.

They cite the body’s active resistance to changing remuneration systems in the early days; while the world was moving from fixed 15% ad commission on media placement to ad fees, advertisers like Videocon were pilloried for daring to have their own in-house agencies or wanting to pay in fees, cites another professional.

The bodies have a point, too In western markets, media conglomerates have partnered with broadcasters over prized exclusive media properties. Replies Sunder Swamy, AAAI chief: “Well, this is India. We work differently, and if there is anything that contradicts everyday business practices, we would need to be kept abreast of what’s going on.”

Says Punitha Arumugam, CEO, Madison Media: “A media buyer cannot also be a media supplier; that’s a different model.”

Shashi Sinha, president, Lodestar Universal, defends both AAAI and IBF. “Both are respected bodies and they have every right to question the actions of certain members, if the actions have repercussions on the industry as a whole. I do not think that their attitude is partisan; they just needed to be kept in the loop of industry developments.”

Meenakshi Madhvani, managing partner, Spatial Access Solutions points out, “If you asking me if such a deal is in violation of industry ethics, the answer is yes. The advertiser, at the end of the day, depends on the media to give him a completely unbiased recommendation.

If the agency has committed upfront a certain guarantee to the broadcaster, it has to fulfill that commitment, whether or not it is relevant to the client.

The client interests ought to be primary for any agency, but in such a scenario, there would be a conflict of interests.” She adds: If there’s a flip-flop from Denstu and Sony’s side, it seems to be in direct response to the pressure of the two bodies-AAI and IBF.

I think that we cannot hold the two forces in judgement, because they are best working for the larger interests of the industry. I just hope that they get more teeth in such matters, for a lot of media deals go by without this kind of attention,”

Ultimately, there may be no even keel between what the industry demands and what its players feel they need to do to make money in a margin-squeezed world, in the grip of fragmenting media. End of the day, the same yardstick should be used to judge anti-industry practices across both sides of the fence.

![submenu-img]() Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..

Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..![submenu-img]() Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'

Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'![submenu-img]() Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...

Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...![submenu-img]() 9 killed, 24 injured as bus catches fire in Haryana's Nuh

9 killed, 24 injured as bus catches fire in Haryana's Nuh![submenu-img]() Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..

Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…

Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’

Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’![submenu-img]() Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'

Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'![submenu-img]() In pics: Sobhita Dhulipala looks 'stunning hot' in plum cordelia jumpsuit at Cannes Film Festival, fans call her 'queen'

In pics: Sobhita Dhulipala looks 'stunning hot' in plum cordelia jumpsuit at Cannes Film Festival, fans call her 'queen'![submenu-img]() Udaariyaan takes 15-year leap, these actors join Sargun Mehta, Ravi Dubey-produced show

Udaariyaan takes 15-year leap, these actors join Sargun Mehta, Ravi Dubey-produced show![submenu-img]() In pics: Urvashi Rautela sizzles in red strapless gown at Cannes Film Festival, fans call her 'Disney princess'

In pics: Urvashi Rautela sizzles in red strapless gown at Cannes Film Festival, fans call her 'Disney princess'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..

Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..![submenu-img]() Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'

Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'![submenu-img]() Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...

Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...![submenu-img]() Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..

Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..![submenu-img]() This film's budget was less than an iPhone, smashed box office records; became first industry hit, earned...

This film's budget was less than an iPhone, smashed box office records; became first industry hit, earned... ![submenu-img]() Do you know which God Parsis worship? Find out here

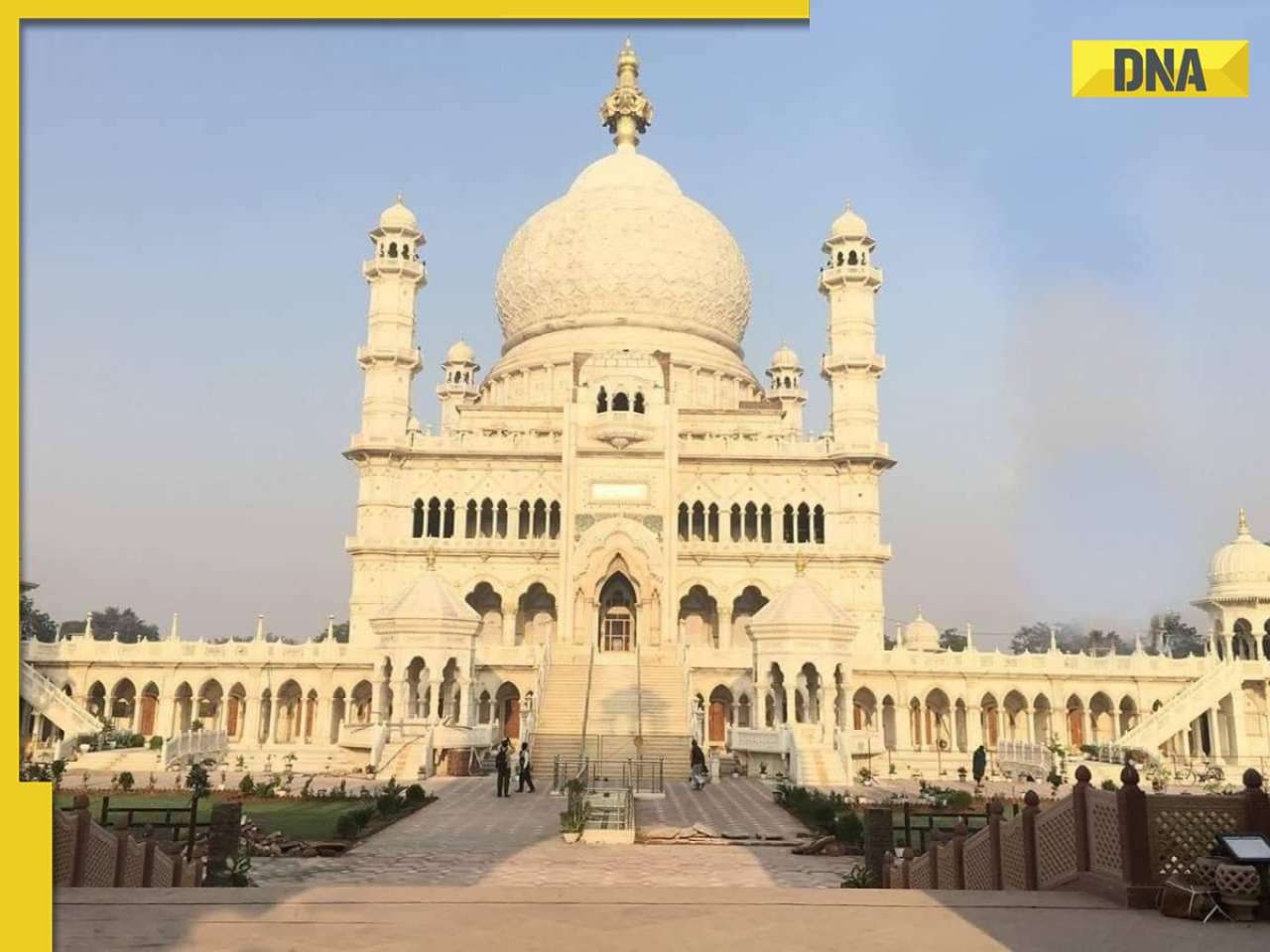

Do you know which God Parsis worship? Find out here![submenu-img]() This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete![submenu-img]() 'If only we are smart enough...': Narayana Murthy was asked how AI will hurt job prospects

'If only we are smart enough...': Narayana Murthy was asked how AI will hurt job prospects![submenu-img]() Viral video: Gujarat man converts Honda Civic into 'Lamborghini' for just Rs 12.5 lakh, watch

Viral video: Gujarat man converts Honda Civic into 'Lamborghini' for just Rs 12.5 lakh, watch![submenu-img]() Man who disappeared 26 years ago found in neighbour`s cellar, just 100 metres from home

Man who disappeared 26 years ago found in neighbour`s cellar, just 100 metres from home

)

)

)

)

)

)