This means, online ad time auctions will take a long time to click in India.

MUMBAI: What’s the common currency shared by eBay’s e-Media Exchange, Google’s d’Marc, Enerva, and an international media agency in India? Well, all are pilot-testing online auctions to buy and sell TV ad time.

Electronic media transactions will have to log-in later, if not sooner, agree most media specialists. For now, though, scepticism reigns. Says Sam Balsara, managing director, Madison Group: “I think TV channels will not participate or encourage this, as of now, because of the “fear of the unknown”. They are so dependent on the ad revenue; it is too much of a risk for them.

“If and when ad revenue becomes less than 50% of the total revenue, the rest being contributed by the viewer for the pleasure of watching the programme, they may be more open to it.”

There are other reasons hobbling its feasibility here, he lists:

*Each channel feels that it is selling a very unique product, very different from what their competitor is offering. This would work well when channels feel they are offering a parity product.

*Media agencies and advertisers do all kinds of segmentation to buy a certain “kind” or “quality” of the GRP.

Expect walls of resistance from many advertisers, who ink out private deals with media owners, adds Balsara. Across the beam, broadcasters are even more skittish. Their contention: that different inventory have different value attached to them.

That the labyrinth of media negotiations are based on a myriad intangibles such as annual deals, advance rates, which can’t be nuanced in a sterile, trading system.

Sameer Nair, Star TV India, for one, is in wait-n-watch mode: “I don’t see auctions working well, because both sides don’t have those sophisticated computer systems.”

Prices to go up and down

Online auctions are seen as a bid by frustrated advertisers to reverse control from broadcasters back to them. When ad-time rates shoot beyond sanity will be the tipping point for auctions’ acceptance here, say some.

Kiran’s viewpoint: “It is true that this new initiative in the US has been started at least partly as a result of frustration and anger of some marketers against rising TV ad prices and also as a resistance to the US upfront market, which feeds nearly 75% of the annual inventory needs of advertisers. That said, I don’t think big media owners are wary yet.

However, if the early testing of the system against the US cable and scatter market is successful, networks will need to recognise that reality and come up with a strategy to adapt to it.”

Balsara reckons that from the supply side the market is controlled by a few and they will fear that this move will drive prices down or more importantly control would move away from them.

“But if this is to take place, then the creation of the perfect market place will push prices up and definitely for the top-end coveted properties, high TRP programmes and low-end products. In many highly advertised categories there are at least 2-3 competing advertisers and the fear of losing out will drive prices up (see what happened to cricket, also telecom licence fees, radio license fees!). This is even more so in current times when every advertiser is optimistic and wants to grow at 20 to 30% a year.”

Says Sameer Nair: “It is an erroneous assumption that ad prices will deflate since there are inherent flaws in our systems where we undersell our own products. And even if the product is the same (as a rival’s), its value perception will differ depending on branding efforts and spends, etc.”

Shrouded ad prices will also get unwrapped. Based on a piece of inventory available at that point, one could discern its supply-demand skew. Pricing becomes more understandable at that point. Let the bids roll.

![submenu-img]() Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..

Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..![submenu-img]() Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'

Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'![submenu-img]() Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...

Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...![submenu-img]() 9 killed, 24 injured as bus catches fire in Haryana's Nuh

9 killed, 24 injured as bus catches fire in Haryana's Nuh![submenu-img]() Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..

Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…

Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’

Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’![submenu-img]() Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'

Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'![submenu-img]() In pics: Sobhita Dhulipala looks 'stunning hot' in plum cordelia jumpsuit at Cannes Film Festival, fans call her 'queen'

In pics: Sobhita Dhulipala looks 'stunning hot' in plum cordelia jumpsuit at Cannes Film Festival, fans call her 'queen'![submenu-img]() Udaariyaan takes 15-year leap, these actors join Sargun Mehta, Ravi Dubey-produced show

Udaariyaan takes 15-year leap, these actors join Sargun Mehta, Ravi Dubey-produced show![submenu-img]() In pics: Urvashi Rautela sizzles in red strapless gown at Cannes Film Festival, fans call her 'Disney princess'

In pics: Urvashi Rautela sizzles in red strapless gown at Cannes Film Festival, fans call her 'Disney princess'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..

Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..![submenu-img]() Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'

Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'![submenu-img]() Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...

Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...![submenu-img]() Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..

Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..![submenu-img]() This film's budget was less than an iPhone, smashed box office records; became first industry hit, earned...

This film's budget was less than an iPhone, smashed box office records; became first industry hit, earned... ![submenu-img]() Do you know which God Parsis worship? Find out here

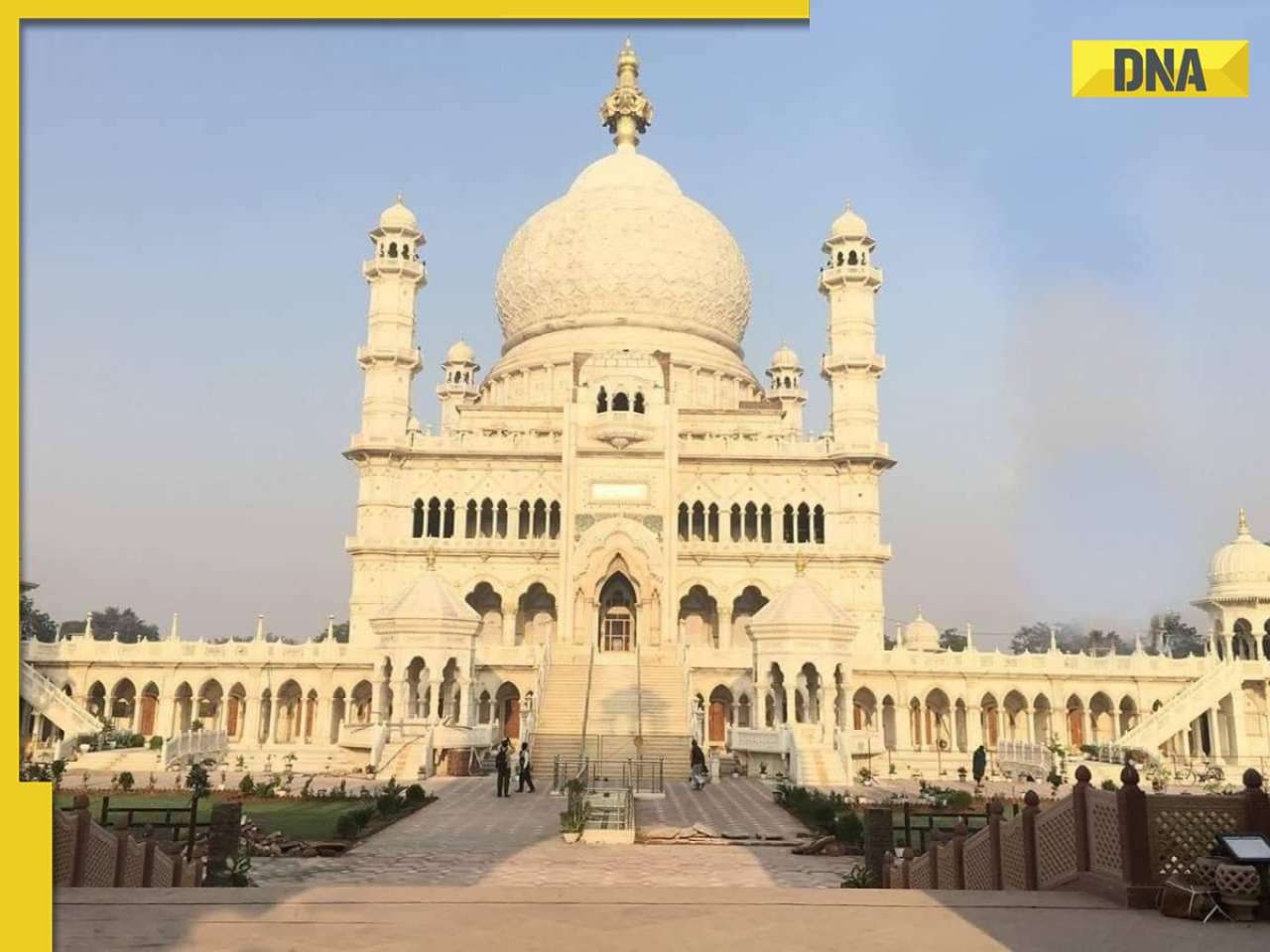

Do you know which God Parsis worship? Find out here![submenu-img]() This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete![submenu-img]() 'If only we are smart enough...': Narayana Murthy was asked how AI will hurt job prospects

'If only we are smart enough...': Narayana Murthy was asked how AI will hurt job prospects![submenu-img]() Viral video: Gujarat man converts Honda Civic into 'Lamborghini' for just Rs 12.5 lakh, watch

Viral video: Gujarat man converts Honda Civic into 'Lamborghini' for just Rs 12.5 lakh, watch![submenu-img]() Man who disappeared 26 years ago found in neighbour`s cellar, just 100 metres from home

Man who disappeared 26 years ago found in neighbour`s cellar, just 100 metres from home

)

)

)

)

)

)