But some experts feel the entire procedure is bureaucratic in nature and not user-friendly.

While better living conditions, improved medication and advancing science have all helped in improving life expectancy of human beings, it is also true that the growing healthcare cost is leaving elderly people in a tricky situation.

In a bid to encourage the elders to be independent and address their financial needs, the National Housing Bank and Central Bank of India have introduced a revised version of the Reverse Mortgage Loan Scheme.

Officials of the two banks explained the scheme to the targeted beneficiaries at a workshop in Bangalore on Wednesday.

Reverse mortgage is a mortgage loan for senior citizens who are not eligible for any other forms of mortgage loans.

Under the scheme, the lender makes regular payments to the borrower. The payment stream is reversed as compared to the conventional mortgage.

If the borrower dies or decides to leave the property permanently, the loan is repaid along with the accumulated interest through the sale of the property. On adjusting the principal amount of the loan and accumulated interest, if there is a surplus, it will go to the estate of the deceased. The heir of the borrower can repay the loan with the accumulated interest and get the mortgage released without having to resort to selling the property.

Dr Radha S Murthy, founder and managing trustee of Nightingale Centre for Ageing and Alzheimer’s, said though the scheme was beneficial to the aged, it was relatively new in India and was not yet popular. “Even though many old people may have been abandoned by their children and are struggling financially, they would rather save their property, even at the cost of a comfortable life. This perspective needs to change,” she explained.

Sanjeev Srivastava of the National Housing Bank agreed that it was not easy to convince elderly people to go in for this scheme. “The challenge lies in changing the mindset of old people and making them understand that this will only stand them in good stead in future,” he said.

The problem arises from the fact that a majority of the elderly people do not have a regular source of income. “If they avail of this scheme, they can live with dignity, without having to depend on anyone,” said S Premkumar Raja, secretary and trustee of Nightingale Medical Trust.

A senior citizen who has availed of the scheme confessed that he did feel a sense of independence. Speaking on condition of anonymity, he said: “I took the decision of availing the reverse mortgage loan and I now receive a monthly income which takes care of all my expenses. I would recommend this to all those who want to provide for their own needs.”

But there are some who are sceptical about the scheme. Shiv Kumar, an advocate and convener of the elders’ helpline, was doubtful of the scheme’s viability.

“First of all, the kind of documents that the banks ask for are very complicated for the elderly to produce. Added to this, the entire procedure is bureaucratic in nature and not user-friendly. The amount of money that is given every month is fixed. In a particular month, a person may require more, either for emergencies or other personal needs. But the scheme has no provision for such a situation,” he said.

![submenu-img]() Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..

Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..![submenu-img]() Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'

Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'![submenu-img]() Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...

Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...![submenu-img]() 9 killed, 24 injured as bus catches fire in Haryana's Nuh

9 killed, 24 injured as bus catches fire in Haryana's Nuh![submenu-img]() Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..

Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…

Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’

Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’![submenu-img]() Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'

Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'![submenu-img]() In pics: Sobhita Dhulipala looks 'stunning hot' in plum cordelia jumpsuit at Cannes Film Festival, fans call her 'queen'

In pics: Sobhita Dhulipala looks 'stunning hot' in plum cordelia jumpsuit at Cannes Film Festival, fans call her 'queen'![submenu-img]() Udaariyaan takes 15-year leap, these actors join Sargun Mehta, Ravi Dubey-produced show

Udaariyaan takes 15-year leap, these actors join Sargun Mehta, Ravi Dubey-produced show![submenu-img]() In pics: Urvashi Rautela sizzles in red strapless gown at Cannes Film Festival, fans call her 'Disney princess'

In pics: Urvashi Rautela sizzles in red strapless gown at Cannes Film Festival, fans call her 'Disney princess'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..

Meet actress who is set to work in India's most expensive film, started career with superhit TV show, then gave..![submenu-img]() Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'

Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'![submenu-img]() Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...

Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...![submenu-img]() Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..

Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..![submenu-img]() This film's budget was less than an iPhone, smashed box office records; became first industry hit, earned...

This film's budget was less than an iPhone, smashed box office records; became first industry hit, earned... ![submenu-img]() Do you know which God Parsis worship? Find out here

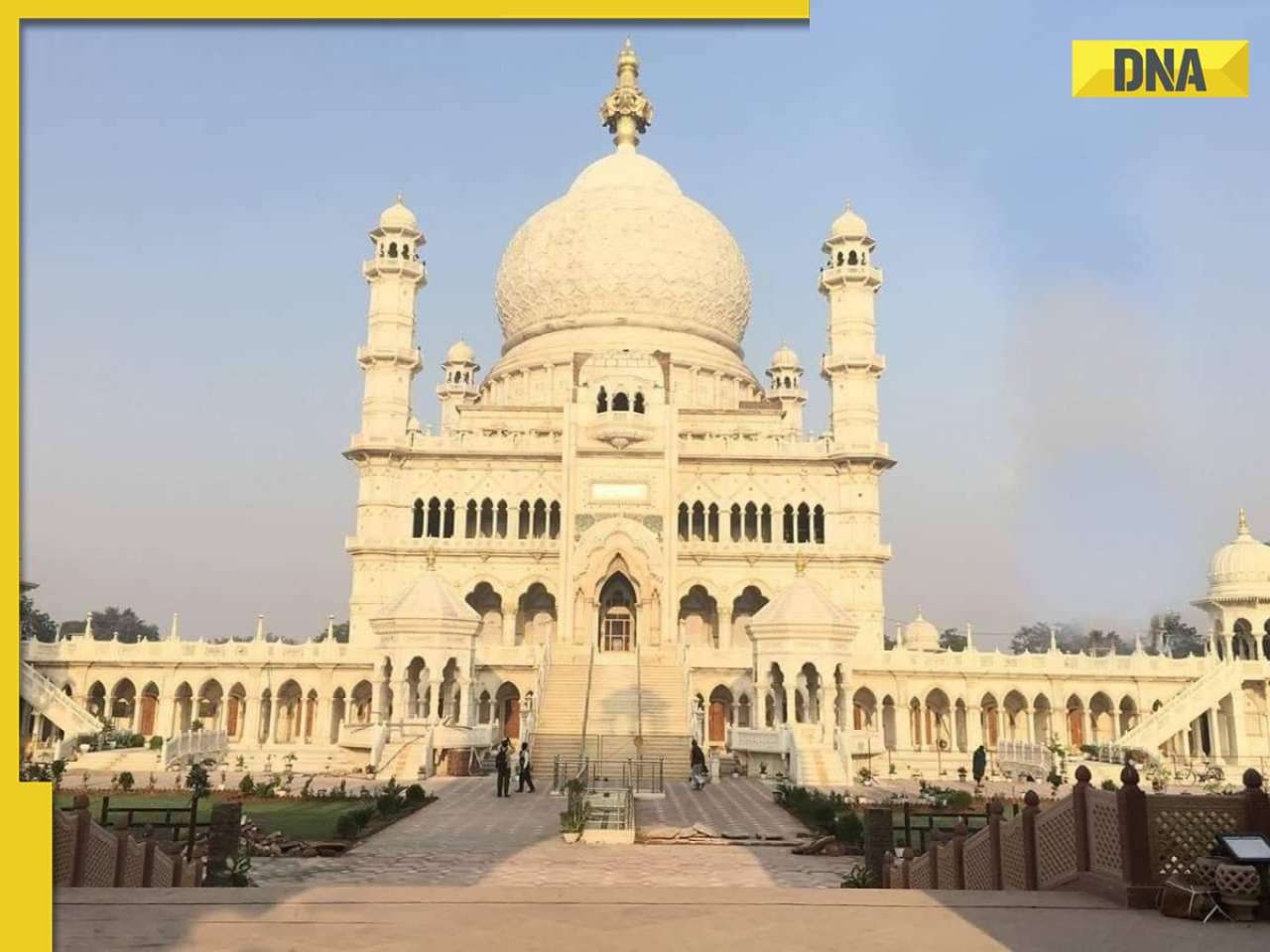

Do you know which God Parsis worship? Find out here![submenu-img]() This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete![submenu-img]() 'If only we are smart enough...': Narayana Murthy was asked how AI will hurt job prospects

'If only we are smart enough...': Narayana Murthy was asked how AI will hurt job prospects![submenu-img]() Viral video: Gujarat man converts Honda Civic into 'Lamborghini' for just Rs 12.5 lakh, watch

Viral video: Gujarat man converts Honda Civic into 'Lamborghini' for just Rs 12.5 lakh, watch![submenu-img]() Man who disappeared 26 years ago found in neighbour`s cellar, just 100 metres from home

Man who disappeared 26 years ago found in neighbour`s cellar, just 100 metres from home

)

)

)

)

)

)