Some optimism returns, finally. The bygone week saw hopes overwhelm reality as the market started to price in increasing prospects of agreement on trade issues between the US and China before the March 1 deadline, or at worst, an extension of the deadline. US President Donald Trump's statement that he is open to extending the deadline was a cue that financial markets didn't miss.

Poor retail sales data and continuing poor economic data from Europe were endorsements that the eleven-year itch is back to haunt financial markets. The south-east-Asian crisis of 1997, the credit and housing crisis of 2008 and now 2019.

The return of Chinese investors after a week-long New Year celebrations bolstered risk assets to start the past week. However, data from Europe where Germany avoided a technical recession after fourth-quarter growth came in at zero and speculations on Brexit vote were reasons enough to bring back pessimism. China data was redeeming with stronger exports data for January. However, retail sales data from the US, which showed the largest monthly drop after September 2009 raises the spectre of recessionary fears and confirms the yield curve inversion that was a hot topic late last December.

In response, the 10-year US Treasury yield increased modestly over the week despite a sharp decrease on Thursday following the release of the unexpected drop in December retail sales. Additionally, inflation data continued to show limited upward pressure on prices as the latest release showed a nominal annual increase of 1.6%. The January producer price index declined 0.1% sequentially over December. Overall, this could be a year of large uncertainties.

In response, the 10-year US Treasury yield increased modestly over the week despite a sharp decrease on Thursday following the release of the unexpected drop in December retail sales. Additionally, inflation data continued to show limited upward pressure on prices as the latest release showed a nominal annual increase of 1.6%. The January producer price index declined 0.1% sequentially over December. Overall, this could be a year of large uncertainties.

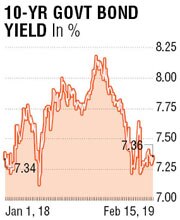

Indian markets remain mixed with the equities continuing to remain weak while bonds choppy in a 10-basis range. The Indian rupee weakened towards the end of the week responding to sell-off in asset classes and rising crude prices. Retail Inflation (CPI) numbers came in at a 19-month low and well below most estimates at 2.05% while industrial production data came in a tad better sequentially at 2.4%. On the trade data front, the deficit widened in January over the previous month on higher imports. Trade gap now stands at $14.75 billion, which is marginally lower over last year same period. Overall, the data bag looks weak and the prospects of a back-to-back rate cut are high now.

Liquidity continues to be negative and one wonders if the open market operation (OMO) will be a lasting solution, given that a new financial year is just six weeks away and the new supply calendar would overwhelm the liquidity infusion from bond buybacks. The economy may witness many headwinds with an election midway in the year and the pre-election spending likely to distort growth trajectory. Falling inflation, Reserve Bank of India's (RBI) policy-stance change and a less-hawkish Federal Reserve of US are enablers for growth.Benchmark bond yields moved lower in a knee-jerk reaction to lower inflation number. However, supply concerns returned and bonds sold off. The new benchmark is a value buy at around 7.45-7.50% while the better-preferred trade is in the 5-year tenor where corresponding swap curve is close to overnight repo rate. 7.47-7.57% range for the old benchmark in the truncated week.

The writer is a market expert