The year gone by was quite interesting. Asset markets across the globe rallied, and in some cases, they touched either record highs or multi-year highs. On the interest rate front, a few central banks started to tighten liquidity. Commodity markets rallied and towards end of the calendar year, even global crude prices soared beyond $60 per barrel. The heightened tension due to Brexit and North Korea-US engagement also contributed to increased volatility.

In India, there were very interesting developments as the central government brought in goods and services tax. Retail inflation also started to move up after reaching multi-year lows. In an aside, the swansong of 2017 will be incomplete without mention of stellar rise in the value of bitcoin. This has now forced a fierce debate across central banks and the common man.

In all, 2017 has been a year to remember. As we march towards the last date in calendar 2017, it will be worthwhile to mull over what future could hold for us.

In the last FOMC meeting for 2017 and probably the last for the US Fed chairperson Janet Yellen, the US central bank raised interest rates by 25 basis points. This was widely expected by the markets. However, dot chart of the US Fed says more about the rate hikes in future. Also, it will be pertinent to remember that a new governor will be at the helm from January 2018 at the US Federal Reserve. Given this, and obviously looking at the dot charts, it is possible that there might be three more rate hikes coming in 2018 as far as the US is concerned. Personally, though, I believe there could be only two rate hikes of 25 bps each in the US through 2018 and two more coming in 2019. Obviously, my guess is based on current conditions and forward-looking guidance coming from data releases. The biggest news dominating markets in the wee days of the fading 2017 was that of US tax proposal. A lower rate of tax may unlock potential for higher investment spends. That also paves the way for speculation on how the deficit is going to be funded and what will be the impact of that.

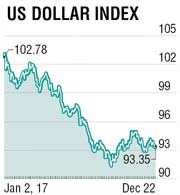

In 2017, the broader Dollar Index rallied to touch a high of 103.90 (multi-year highs) before coming down to form a base around 91.70. A glance at the monthly chart tells us that probably this level (91.70) would hold for the most part of 2018 and a Dollar rally towards 98.13 cannot be ruled out. In general, Europe suffered a setback following the start of Brexit negotiations. That was more psychological though as most part of industrialised Europe had started showing signs of growth. The year-end, German IFO business climate index data shows robust underlying confidence for growth. ECB, in the meanwhile, is still pursuing a liquidity infusion through 2017.

But 2018 could be a little different, if growth engines in Europe gain pace, ECB withdraws stimulus and starts preparing for an eventual rate hike cycle toward end of 2018 or beginning of 2019. This would bring back focus on Euro. The nascent rally that had started in 2017 could well sustain in the first half of 2018. Technically looking, Euro could move above 1.2150 in the first quarter of 2018 and probably peaking around 1.2500. As far as GBP-USD is concerned, the pair will still get mired by local politics regarding Brexit negotiations, multilateral trade talks. Hence, gains in GBP could be limited. In technical lingo, resistance lies at 1.3602 and then at 1.4285. Personally, I would be wary of any rally beyond 1.3600/1.4000. My strategy thus would be to “short” GBP around these levels.

In India, especially recently, the news was more on the elections in the state of Gujarat and Himachal Pradesh. The acrimonious Gujarat elections saw the incumbent party (BJP) returning to form the government albeit with reduced strength. This was pitched as a litmus test for the ruling party at the centre ahead of two more state elections in 2018 followed by general elections due in 2019. This news bolstered the asset markets, especially equity markets and a sense of continuity has returned. USD-INR pair, thus also got a boost from this fact and has been hovering around 64.00 base for some time now. Going forward, we could witness 64.00 giving way as USD-INR pair move towards 63.50 and below before reality takes over. Recent MPC minutes show rising concerns on inflation, and coupled with that, there is speculation about higher government borrowings. As a result, there has been a good rally in benchmark bond yields. I expect the 10-year yield to move higher a bit but will get limited at 7.25% in the near term.

The writer is senior regional head – treasury advisory group, HDFC Bank