In the long annals of financial market history, themes come and go. They don't last for more than a few seasons or few quarters. Brexit, however, has outlived those averages and continues to be the wind-bag of developed markets, with three years' of stalemate. With the European Union (EU) granting another six-month reprieve, the uncertainty continues.

Fed minutes yet again confirmed the rate-setting committee's patient approach. IMF cuts global growth outlook and the US-China trade enforcement mechanism reaches an agreement. Indian equity hover near life highs as corporate results should be a key factor for further direction. Inflation inches higher while Industrial Production falters. That's in a nutshell how the past week petered.

Minutes of the meeting of US FOMC confirmed that a large majority of voting members expect that risks to economic outlook may warrant a longer pause. They opined that inflation has not shown any signs of firming up despite strong labour market conditions or an attempted push to increase the price by tariff increases. Weekly data from the US showed jobless claims fell most in half a century. Volatility softened as seen in the VIX and crude prices rose a tad as Libyan supplies disrupt stocks.

In other developments, with an April 12 deadline looming, the European Council has granted the UK a longer extension this time, under Article 50. Britain now has until October 31 to advance through Parliament the agreement negotiated with the European Union to withdraw from it. The British Pound remained firm though flat. In the EU, the central bank left rates steady, at zero. Europe's struggle with growth and a recent downward revision of global growth by IMF will be factors to watch for the next few quarters.

In other developments, with an April 12 deadline looming, the European Council has granted the UK a longer extension this time, under Article 50. Britain now has until October 31 to advance through Parliament the agreement negotiated with the European Union to withdraw from it. The British Pound remained firm though flat. In the EU, the central bank left rates steady, at zero. Europe's struggle with growth and a recent downward revision of global growth by IMF will be factors to watch for the next few quarters.

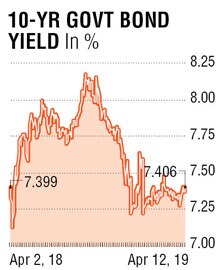

Indian markets remained relatively immune to global markets as the week saw the first phase of general elections, getting kicked off in 91 constituencies on Thursday. The next many weeks will likely be volatile. System liquidity continues to be negative in the 50-60k crore region and bond yields have nearly erased the gains that were seen before the rate cut. New supplies and some uncertainties on Reserve Bank of India (RBI) stance appear to be reasons for the poor sentiment.

On the data front, the week saw the release of retail inflation and industrial production numbers. Inflation, as expected, inched up and touched a five-month high as food and fuel contributed to the spike in the headline number. Although the rise in inflation is well below RBI's estimates, traders may not draw comfort and may stay light. The other key data, IIP for February, came in sharply lower, underlining the broader weakness in manufacturing growth.

Bonds have been trading in a narrow range although at elevated levels of yields. Benchmark (old) bond yield closed around 7.57% and the spread between the new and old benchmarks remained wider indicating a skewed preference to liquidity over value. In general, an environment like this makes investors choose shorter-term bonds as these are less sensitive to interest rate movements.

With the auction calendar likely to see more supply of floating and mid-segment (belly of the curve) bonds, it is likely that long tenor bonds remain offered. While 7.60% offered a good value buying in the old benchmark bond, a break above 7.65% would warrant caution. The range for the coming truncated week due to holidays should be 7.58 to 7.50.

The writer is a market expert