Financial market participants had more economic reasons than geopolitical ones to remain gloomy as they wound up for weekend with more uncertainties than ever before in the last many weeks. China and UK faced ratings downgrade, US Federal Open Market Committee left key rates unchanged while charting out its plan for balance-sheet unwinding, India reported a shock-widening of current account deficit for the first quarter and the government alluded of fiscal stimulus to tackle growth issues.

The week started with US Federal Reserve announcing it would leave its benchmark interest rates unchanged but suggested that a hike is likely by the end of the year followed by three more in 2018 and two in 2019. And as expected, the Fed also announced plans to start reducing its $4.5 trillion balance-sheet of Treasuries and mortgage-backed securities in October. It will roll off $10 billion initially and then increase the cap by $10 billion every quarter until the total reaches $50 billion. GDP was forecast to come in higher, inflation was expected to trend lower while unemployment rate was projected to trend lower. Global equities largely remained flat for the week, with the US 10-year Treasury note yield slightly higher at 2.24%. VIX index remained flat around 10 while commodities and metals remained choppy following a China downgrade.

The more sensational news over the weekend was an unexpected downgrade of UK’s sovereign ratings by Moody’s, from Aa1 to Aa2 on grounds that the country was more likely to default on its debt obligations despite Brexit. Moody’s also reasoned out that the prospects for the British economy are more uncertain in terms of growth, employment, corporate incomes and profits. Britain’s looming prospect of limited access to the single EU markets may have resulted in this downgrade, many opine.

Indian markets, however, were affected by more domestic factors than the Federal Reserve decision of a balance-sheet unwinding. Following a disappointing GDP data for first quarter, which has been attributed to a plethora of reasons like currency-ban effect, GST woes, poor demand, lack of private investment and higher interest rates, the government stepped in to hint at fiscal stimuli to address faltering growth. With nearly 90% of its budgeted expenditure done, the looming threat of a breach of the fiscal deficit targeted for fiscal 2018 rankles market participants. Empirical evidence suggests fiscal stimulus often ends up as short-term palliative without addressing structural issues and leave in its trail long-term issues. Rising core inflation will make it difficult for RBI to cut rates immediately and therefore monetary redressal may remain elusive.

Current account deficit widened sharply to $14.3 billion (2.4% of GDP), sequentially higher than the $3.4 billion in the fourth quarter of the last fiscal and $0.4 billion same period last fiscal. Moderating export growth, rising imports and an overall sharp surge in goods trade deficit are wider factors. A rise in foreign portfolio investments helped cushion what could have been an embarrassing data.

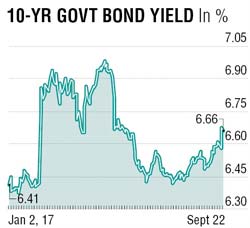

The rupee weakened past the 65 mark on concerns of widening fiscal deficit, which saw bonds selling off to multi-month lows, Ten year benchmark bond yields tested 6.67% as bond markets prepare for a no-change policy decision on October 4 Monetary Policy Committee meet. Announcements of increase in FPI limits (by virtue of removing masala bonds from the purview of debt investments and have it as an ECB funding) should be a short term positive.

With half-year end approaching and bond yields at multi-month lows, 10-year bond yield is at similar spread over overnight rates last seen before the August rate cut. Auction calendar (expected to be front loaded) for second half may not support sentiment. However, given the attractive carry and a better risk reward, a buying opportunity is seen at current levels. Range for the week is 6.70%-6.55%

The writer is executive director, Lakshmi Vilas Bank