Demonetization will continue to excite commentary for a long time to come. Given that it was perhaps the biggest ‘natural experiment’ (as data crunchers would describe it) ever carried out, it will probably take several years before the outcomes can be evaluated with analytical rigour. However, one area where there has been an unmitigated positive impact of demonetization is a sharp move towards financialisation of household savings in India. What has been the impact till now? And why is financialisation of savings a desirable outcome for development?

The shift in savings behaviour is starkest when evaluated in terms of the savings mix – physical versus financial savings. Households save in both financial products (bank deposits, insurance, mutual funds, equities etc.) as well as in physical products (primarily real estate). For only the second time in nearly two decades, the share of financial savings has outstripped physical savings in financial year 2017. This of course can be attributed to multiple reasons – the slowdown in real estate being a crucial one – but the trend-break on account of demonetization has been rather stark to be merely a coincidence.

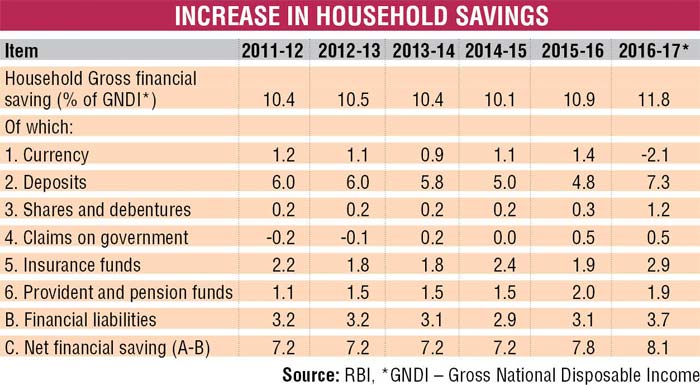

Next, let’s look at the shift in both the headline numbers as well as the mix in household financial savings.

As can be seen in the table above, household financial savings, that had been stuck at 10% range (of Gross National Disposable Income, GNDI) for a long time, have perked up smartly by a full 1% to 11.8% for the financial year ending March 2017. The big shift has been in deposits, as can be expected post-demonetization. But there has also been a massive shift in the ‘Shares, Debenture and Mutual Funds’ category, from 0.3% to 1.2%. Micro-level data on Mutual Funds, Alternative Investment Funds (AIF) and Portfolio Management Services (PMS) flows suggest that there has been an even greater pickup in flows in financial year 2018.

Total Assets under Management (AUM) of Mutual Funds grew from Rs 16 lakh-crore in Oct 2016 (the demonetization month) to Rs 23 lakh-crore today, a growth of nearly 50%. Cumulative insurance premium collections — during November 2016 to January 2017 — increased by 46 per cent over the same period of the previous year. A very large number of new investors in MF have come from what are described as Class B and C cities/towns in the country, reflecting the emergence of a new generation and class of financial market participants.

In short, what the financial sector saw post demonetization wasn’t a one-time event, but a structural break-out that has deepened and widened the financial market in India. Both the key outcomes — greater financialisation of savings and the shift within financial savings to capital market instruments (equities, bonds, mutual funds) — have far-reaching impact in the manner in which India funds its growth. To take one example, Systematic Investment Plans (SIP) in Mutual Funds, whose numbers and value went up dramatically after demonetization, today generate domestic equity flows of Rs 5,000-6,000 crore every month, or Rs 75,000 crore every year.

That is greater than the quantum of FII (Foreign Institutional Investors) flows typically in a normal good year. By itself, such a large captive source of risk capital throws up interesting opportunities for businesses looking to fund their investment plans. In the past, fortunes of Indian equity markets have been largely determined by FII interest — therefore susceptible to global events and shocks that impact FII allocations to riskier emerging markets. With a large stable pool (SIP are typically retail in nature, and hence not prone to large volatilities in flows linked to market sentiments) of domestic capital, India’s capital market fortunes are now substantially in Indian hands. In some ways, Indians have started putting their money where their mouths are!

While mutual funds represent the conservative end of risk capital, AIF represent the sophisticated, riskier-end. Total commitments raised in various categories of AIF have doubled in one year since demonetization– from Rs 70,000 crore in December 2016 to Rs 1.4 lakh crore in Dec 2017 (the latest data available with SEBI). Now, not all of this is a result of demonetization, but the sharp increase in growth rates since the event is rather discernible to be of mere coincidence. The strong growth of AIF presents interesting opportunities and a firm base for Indian capital to start funding new Indian ideas. The next generation of new, exciting Indian start-ups is likely to be substantially funded by Indian money, rather than offshore risk capital as has been the case till now.

Glass-half-full analysis are never quite revealing. However, the impact of demonetization on financialisation of savings is a case of a glass that may be half full, but one where the water is rapidly replacing the air in the remaining half!

The author is Managing Partner of ASK Wealth Advisors. Views expressed are personal.