In the past few weeks, two major themes have played out in markets. Firstly, trend toward monetary policy normalisation among developed countries. Secondly, the geo-political tensions on the Korean peninsula, following new UN sanctions on North Korea.

Markets now parse every policy maker-speak and economic data release to gauge influence on the slowing of ECB asset purchases, reduction of the US Federal Reserve (Fed)’s balance-sheet size among others.

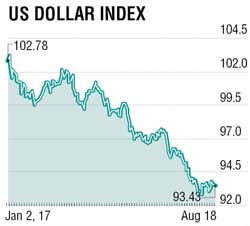

Minutes of US FOMC’s July 25-26 meeting suggest only “significant adverse developments” would stop the pre-announced changes to the Fed’s balance sheet reinvestment policy, pinning the dollar down.

This week, focus will be on the US-Canada-Mexico Nafta renegotiations, UK-EU Brexit talks, and the Jackson Hole Symposium.

Recently, the rupee first rose to 63.5550 /U$, a two-year high on strong corporate and FPI inflows. However, later it slipped to 64.33 /U$ on the fright in emerging markets.

Recently, the rupee first rose to 63.5550 /U$, a two-year high on strong corporate and FPI inflows. However, later it slipped to 64.33 /U$ on the fright in emerging markets.

Domestically, India’s July CPI also picked up to 2.36%, as vegetable prices rose, but remained under RBI’s target of 4%. “Core” inflation accelerated to 3.80%. While disinflationary tendencies had allowed RBI to cut its repo rate by 25 basis point to 6%, a pick-up in inflation would make RBI cautious. In response, the 10-year government bond yield hardened to 6.534%.

India’s July trade deficit narrowed to $11.4 billion as export growth (3.9%) slowed to $ 22.54 billion, the tenth consecutive month of annual increase. Imports grew 15.4% to $33.99 billion, led by the 95%yoy rise in gold imports to $2.1 billion.

Minutes of RBI August 2 MPC revealed members were concerned variously about inflation rising, weak potential growth and asset-price inflation.

Near-term, rupee weakness is seen to be contained in the 64.40-64.50 /$ area by covert intervention, and rupee strength to resume. However, if geopolitical events worsen, rupee could revisit the 65.08/$ recent high.

The writer is president and chief operating officer, Kotak Mahindra Bank