India makes KYC documents mandatory for new insurance policies.

India's Insurance Regulatory and Development Authority of India (IRDAI) has announced that Know Your Customer (KYC) documents will be mandatory for all new health, motor, travel, and home insurance policies purchased from 1 January 2023. This rule will apply to all types of insurance, including life, general and health insurance. Currently, KYC documents are only required when making a claim on a health insurance policy worth over INR1 lakh. The new rule will require customers to provide KYC documents when purchasing a new policy, rather than waiting until a claim is made.

For existing policyholders, the IRDAI has given insurance companies a specified time frame within which to collect KYC documents. This time frame is two years for low-risk policyholders and one year for other customers, including high-risk customers. Insurers will inform customers via SMS or email when it is time to submit their KYC details. Currently, it is not mandatory for existing policyholders to provide KYC documents when renewing their policy. However, if a policy is due for renewal after 1 January 2023, policyholders may be required to provide photo identification and proof of address to their insurer to become KYC compliant.

The new rule is expected to lead to faster claim settlement, as insurers will have a more detailed profile of their customers through KYC documents. This will help to prevent fraudulent claims and ensure that payments are made to the legal heirs of policyholders. It will also enable insurers to maintain a centralised database of policy records, which will be useful for all stakeholders in the insurance value chain.

Alao read: How to link your PAN with your Aadhaar before April 1, 2023 to avoid it from being inoperative

Providing KYC documents is currently a voluntary choice for customers when purchasing a new general insurance product. The new rule will make it mandatory for insurers to collect KYC documents from all customers purchasing a new non-life insurance policy, regardless of the premium amount. Policyholders who have not yet provided their KYC details to their insurer should contact the company and provide the necessary information as soon as possible. If they are unable to provide KYC documents, they may be unable to purchase or renew their insurance policy.

KYC documents may include photo identification and proof of address, such as a passport, driving licence or utility bill. Policyholders are currently required to provide a PAN card or Form 60 if the aggregate insurance premium is INR 50 thousand or more in a financial year. The IRDAI has further stated that for existing policyholders with insurance policies of not more than an aggregate premium of INR 50 thousand in a financial year, PAN/Form 60 must be obtained by a date to be determined by the Central Government.

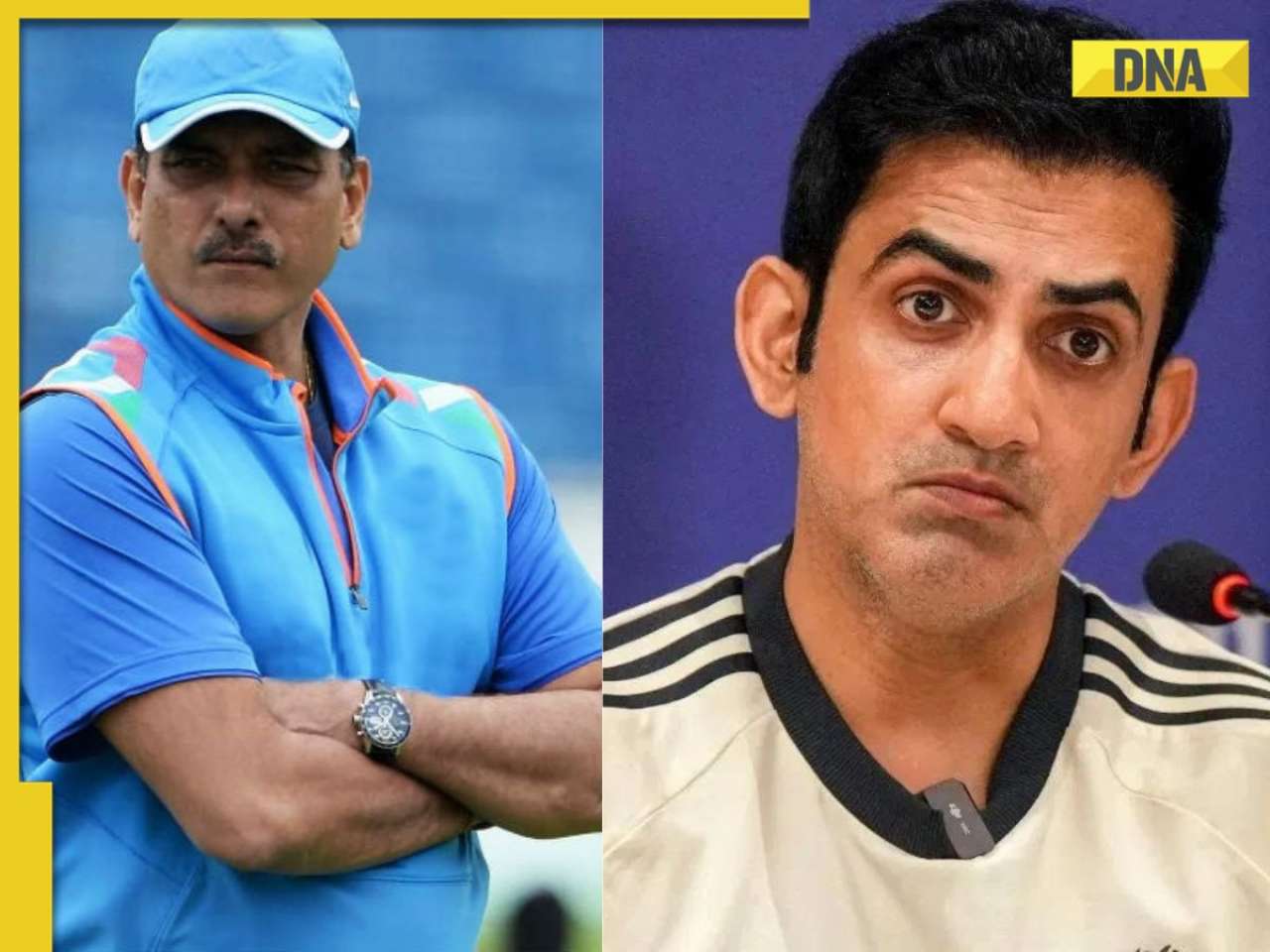

![submenu-img]() 'He's contemporary...': Ravi Shastri's 'no-nonsense' take on Gautam Gambhir as Team India head coach

'He's contemporary...': Ravi Shastri's 'no-nonsense' take on Gautam Gambhir as Team India head coach![submenu-img]() Karnataka cabinet renames Ramanagara district as Bengaluru South

Karnataka cabinet renames Ramanagara district as Bengaluru South![submenu-img]() Farah Khan, Sajid Khan's mother Menka Irani passes away at 79

Farah Khan, Sajid Khan's mother Menka Irani passes away at 79![submenu-img]() Meet man who quit high-paying job, mortgaged everything to build Rs 4186 crore firm, produced India’s first…

Meet man who quit high-paying job, mortgaged everything to build Rs 4186 crore firm, produced India’s first… ![submenu-img]() Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH

Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH![submenu-img]() Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...

Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...![submenu-img]() Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...

Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...![submenu-img]() Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..

Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..![submenu-img]() Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…

Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…![submenu-img]() Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...

Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...![submenu-img]() 5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024

5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024![submenu-img]() US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign

US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

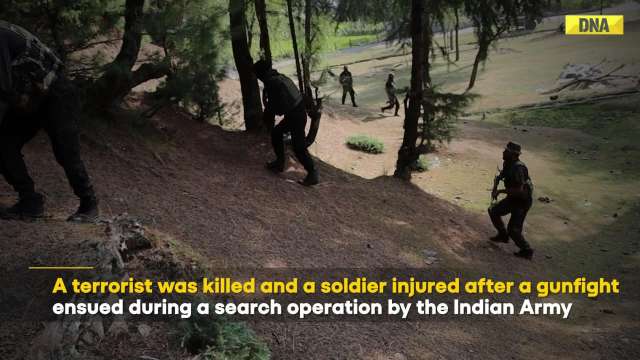

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara

J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() NASA images: 7 mesmerising images of space will make you fall in love with astronomy

NASA images: 7 mesmerising images of space will make you fall in love with astronomy![submenu-img]() 8 athletes with most Olympic medals

8 athletes with most Olympic medals![submenu-img]() In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor

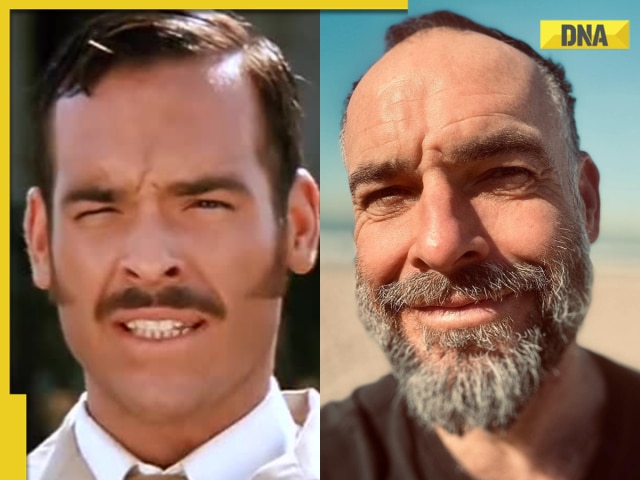

In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor![submenu-img]() Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now

Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now![submenu-img]() This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...

This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...![submenu-img]() Karnataka cabinet renames Ramanagara district as Bengaluru South

Karnataka cabinet renames Ramanagara district as Bengaluru South![submenu-img]() Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...

Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...![submenu-img]() Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed

Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed![submenu-img]() Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas

Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas![submenu-img]() Big rejig in BJP: New state chief for Bihar and Rajasthan named

Big rejig in BJP: New state chief for Bihar and Rajasthan named![submenu-img]() DRDO fortifies India's skies: Phase II ballistic missile defence trial successful

DRDO fortifies India's skies: Phase II ballistic missile defence trial successful![submenu-img]() Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing

Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing![submenu-img]() Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas

Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas![submenu-img]() Area 51: Alien testing ground or enigmatic US military base?

Area 51: Alien testing ground or enigmatic US military base?![submenu-img]() Transforming India's Aerospace Industry: Budget 2024 and Beyond

Transforming India's Aerospace Industry: Budget 2024 and Beyond![submenu-img]() Farah Khan, Sajid Khan's mother Menka Irani passes away at 79

Farah Khan, Sajid Khan's mother Menka Irani passes away at 79![submenu-img]() Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours

Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours![submenu-img]() Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped

Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped ![submenu-img]() 'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa

'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa ![submenu-img]() Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'

Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'![submenu-img]() Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH

Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH![submenu-img]() 'BMW, Mercedes, all gone’: Man's luxury cars worth over Rs 10000000 ruined, watch viral video

'BMW, Mercedes, all gone’: Man's luxury cars worth over Rs 10000000 ruined, watch viral video![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

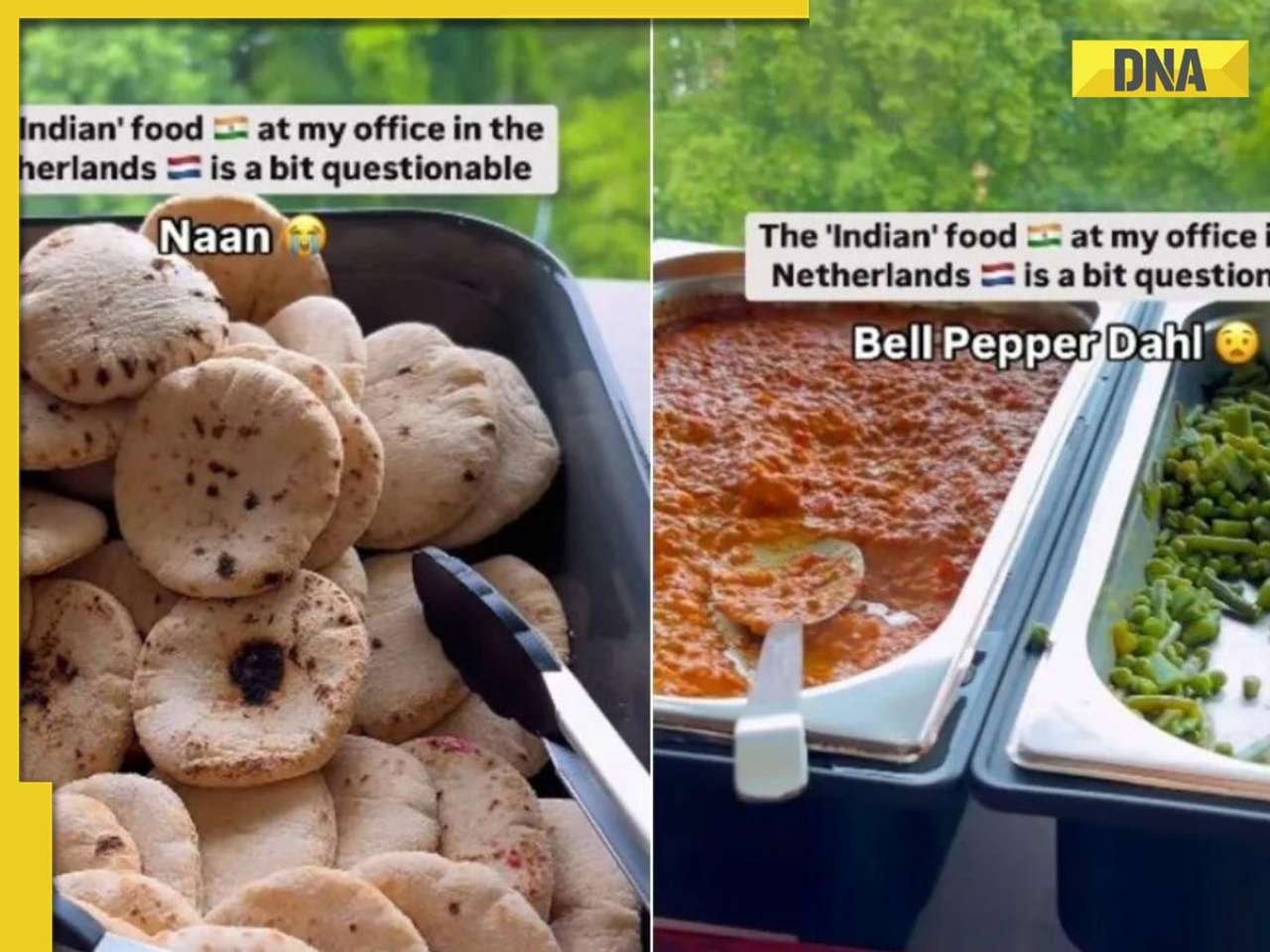

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() This small nation is most important country in world, plays huge role in shaping geopolitics, it is...

This small nation is most important country in world, plays huge role in shaping geopolitics, it is...![submenu-img]() El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

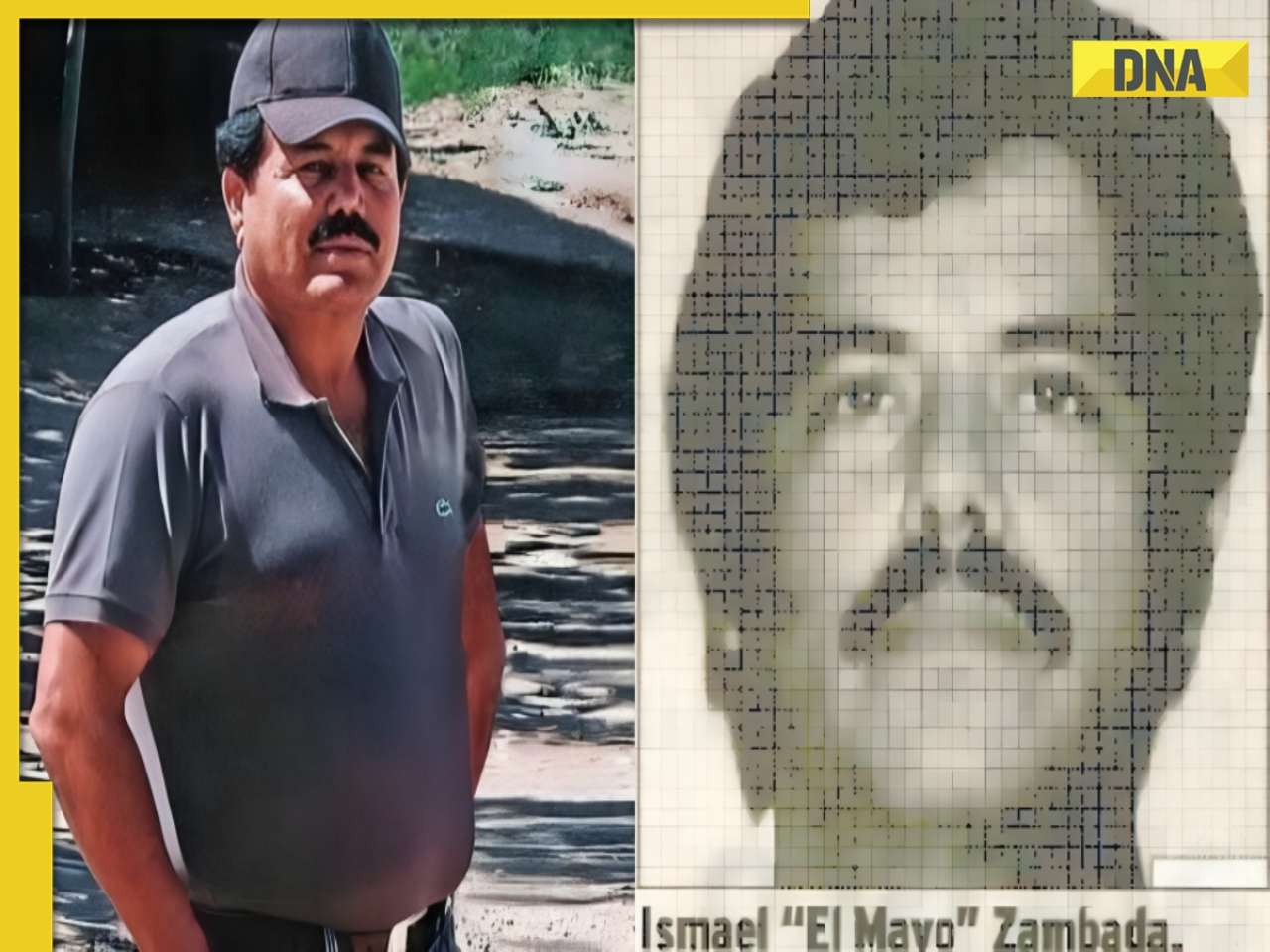

El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

)

)

)

)

)

)

)