Targeting mainly millennials and people with low income, insurance firms are now offering micro covers for risks as diverse as vector-borne diseases, accidents for specific travel periods, motor insurance based on vehicle utilisation, to name a few

The outlook towards insurance and its utility have changed in the past couple of years. Millennials, aged 18-35 years, view insurance differently. Not that their financial vulnerabilities have suddenly changed, it is just that they realise the kind and extent of cover they need. This explains the growing clamour of insurance companies to launch “micro-insurance” policies.

“Bite-sized” products as per your need

Take, for example, the recent launch of “bite-sized” products by Aegon Life Insurance and ICICI Prudential Life Insurance. Both the companies launched their respective micro-term plans in a recent collaboration with MobiKwik in May 2019. Harish Kurudi, head - product development and management, Aegon Life Insurance, explains, “With growing awareness among consumers in the recent years, bite-sized term insurance plans have gained a lot of popularity, opening up a highly underpenetrated segment in the Indian market. To beat the competition and occupy the maximum share of this pie, life insurance companies have innovated in this space and produced complex benefit packed propositions, with an aim to launch the best term insurance plan in the market. This, in turn, has transformed term insurance from a simple financial risk mitigating tool to non-customer centric complicated products.”

However, long before these big insurance companies realised the need to sell customised “bite-sized” products, Toffee Insurance, an Indian start-up, sought to relieve its customers from the burden of paying for less flexible, more traditional insurance plans. Rohan Kumar, CEO, Toffee Insurance, says, “Millennials are early adopters to a wide range of services including new financial products. Bite-sized, contextualised insurance policies make sense to them because of the relevance and introduce financial planning without neglecting their income and lifestyle requirements.”

Types of micro-insurance plans

Micro-insurance serves to benefit both the low-income strata people and the millennial population based on their needs. Depending on the purpose they serve, these small-sized insurance products may be classified as:

Need-based health coverage: A family health plan that covers the entire family and takes care of the hospitalisation expenses and other medical costs may not be useful for a young man or woman who lives alone, far from his family, in a different city. Climatic and environmental conditions may largely differ, thus, mandating the need for a specific kind of health cover. Shreeraj Deshpande, principal officer and CEO (officiating), Future Generali General Insurance, says, “Small ticket-size health insurance products do help in need-based health covers which may be specific or short duration insurance. There are health insurance policies which also cover specific illnesses like dengue and malaria caused by vectors. We have a Future Vector Care product to cover vector-borne diseases on benefit basis.”

Specifically event-based cover: What if a person plans to go on a short business trip or yearns to spend the weekend travelling? Sensing the need to cover against specific risks at low premium rates that traditional life insurance or personal accident insurance plans fail to provide, the insurance companies are now offering domestic travel products to cover accidents even for specific travel periods. Kumar says, “Toffee Insurance sells curated products, tailored to our audience's unique needs and covers everyday risks. We have products for something as simple as daily commute and as planned as international travel.”

Short-term coverage: Buyers of car insurance and two-wheeler insurance policies have to pay for third-party insurance cover for three years and five years, respectively. However, not all vehicle owners may be driving or travelling in their vehicles all the time. For those who would like to seek insurance cover for limited periods only, insurance companies track the utilisation of the vehicle and sell micro-insurance products accordingly.

Do bite-sized plans benefit customers?

Micro-insurance plans initially came into being to ensure financial inclusion of the uninsured and economically vulnerable sections of the society. The insurance companies had launched the individual or group plans to reach out to the low-income group and those belonging to the country's most remote areas.

People in the urban and rural sector can seek protection at low costs through micro-insurance policies. “Micro-insurance is an affordable and cost-effective, non-participating and non-linked group cover for the family, generally, available without any medical examination. People in low-income groups can particularly benefit both in urban as well as rural settings as there are no exclusions. These are simplified micro plans that are easily understood by all, backed by efficient processes and ready access,” says Raj Khosla, founder and managing director, MyMoneyMantra.com.

However, insurance as an essential financial investment is yet to gain a strong foothold in the minds of today's millennials. Kurudi says, “Bite-sized plans are simplistic, relevant and affordable for the masses. The bite-size approach is targeted towards inculcating the behaviour of purchasing insurance for the purpose of protection. The low premium sizes along with positioning impulse-based purchases are aimed to improve term plan adoption among millennials.”

Insurance companies hope that the “value for money” instinct synonymous with millennials and their focus on availing need-based coverage will ensure deeper penetration of insurance in India.

![submenu-img]() Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours

Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours![submenu-img]() IND vs SL, 1st T20I: Predicted playing XIs, live streaming details, weather and pitch report

IND vs SL, 1st T20I: Predicted playing XIs, live streaming details, weather and pitch report![submenu-img]() Women's Asia Cup 2024: India beat Bangladesh by 10 wickets to reach final for 8th straight time

Women's Asia Cup 2024: India beat Bangladesh by 10 wickets to reach final for 8th straight time![submenu-img]() Apple reduces prices of iPhones across models, iPhones 13, 14 and 15 will be cheaper by Rs...

Apple reduces prices of iPhones across models, iPhones 13, 14 and 15 will be cheaper by Rs...![submenu-img]() 'Elon Musk treated me badly for...,' says Tesla chief's daughter Vivian Jenna Wilson

'Elon Musk treated me badly for...,' says Tesla chief's daughter Vivian Jenna Wilson![submenu-img]() Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...

Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...![submenu-img]() Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...

Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...![submenu-img]() Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..

Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..![submenu-img]() Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…

Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…![submenu-img]() Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...

Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...![submenu-img]() 5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024

5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024![submenu-img]() US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign

US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara

J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() NASA images: 7 mesmerising images of space will make you fall in love with astronomy

NASA images: 7 mesmerising images of space will make you fall in love with astronomy![submenu-img]() 8 athletes with most Olympic medals

8 athletes with most Olympic medals![submenu-img]() In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor

In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor![submenu-img]() Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now

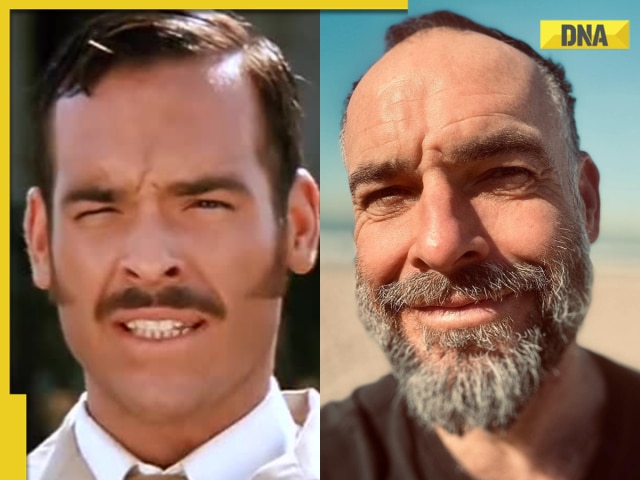

Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now![submenu-img]() This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...

This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...![submenu-img]() Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...

Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...![submenu-img]() Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed

Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed![submenu-img]() Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas

Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas![submenu-img]() Big rejig in BJP: New state chief for Bihar and Rajasthan named

Big rejig in BJP: New state chief for Bihar and Rajasthan named![submenu-img]() Mumbai rains: Schools, colleges to operate normally today, BMC urges citizens to...

Mumbai rains: Schools, colleges to operate normally today, BMC urges citizens to...![submenu-img]() DRDO fortifies India's skies: Phase II ballistic missile defence trial successful

DRDO fortifies India's skies: Phase II ballistic missile defence trial successful![submenu-img]() Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing

Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing![submenu-img]() Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas

Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas![submenu-img]() Area 51: Alien testing ground or enigmatic US military base?

Area 51: Alien testing ground or enigmatic US military base?![submenu-img]() Transforming India's Aerospace Industry: Budget 2024 and Beyond

Transforming India's Aerospace Industry: Budget 2024 and Beyond![submenu-img]() Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours

Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours![submenu-img]() Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped

Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped ![submenu-img]() 'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa

'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa ![submenu-img]() Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'

Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'![submenu-img]() Parineeti Chopra's cryptic post about 'throwing toxic people out of life' scares fans: 'Stop living for...'

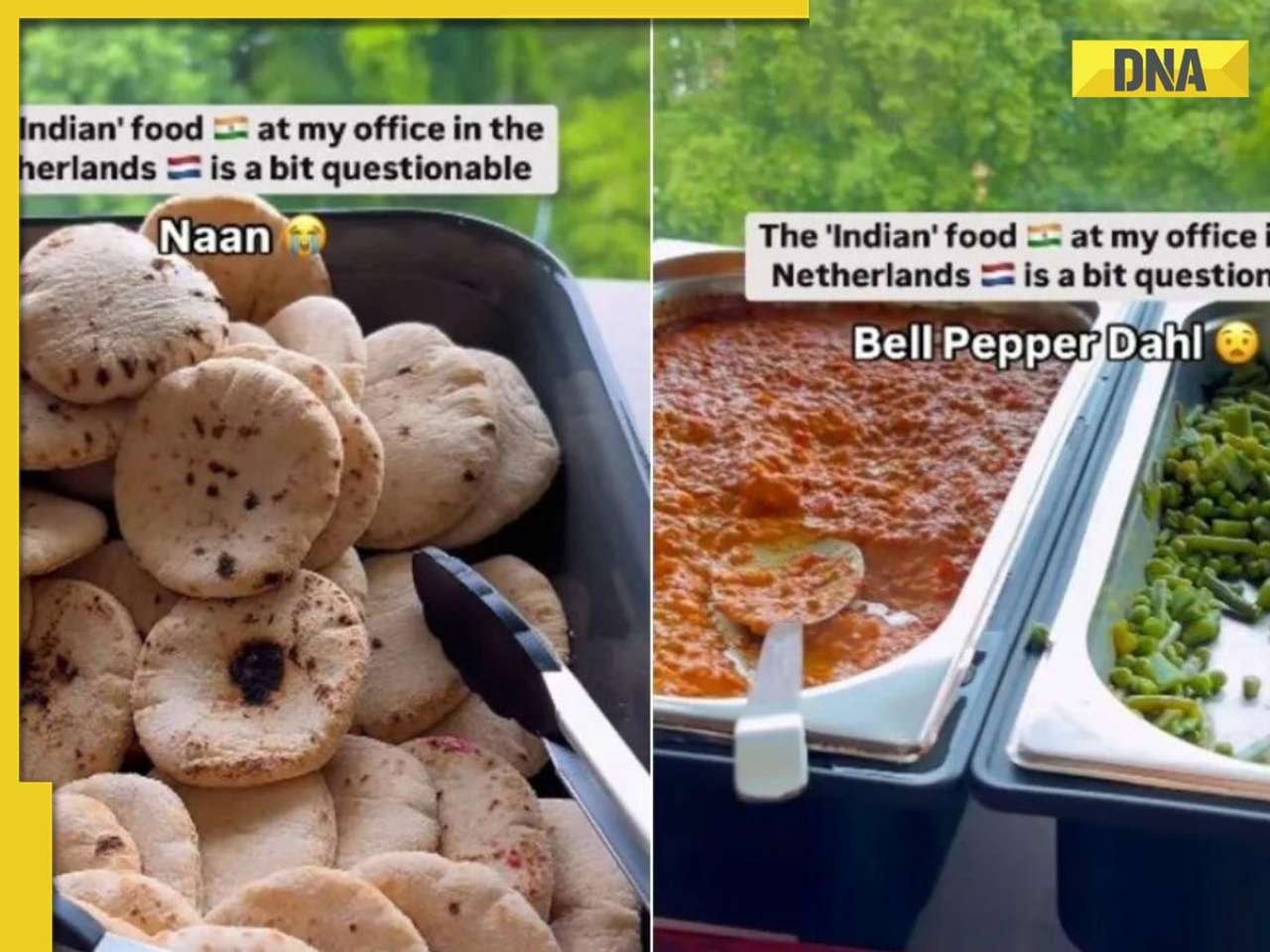

Parineeti Chopra's cryptic post about 'throwing toxic people out of life' scares fans: 'Stop living for...'![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() This small nation is most important country in world, plays huge role in shaping geopolitics, it is...

This small nation is most important country in world, plays huge role in shaping geopolitics, it is...![submenu-img]() El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

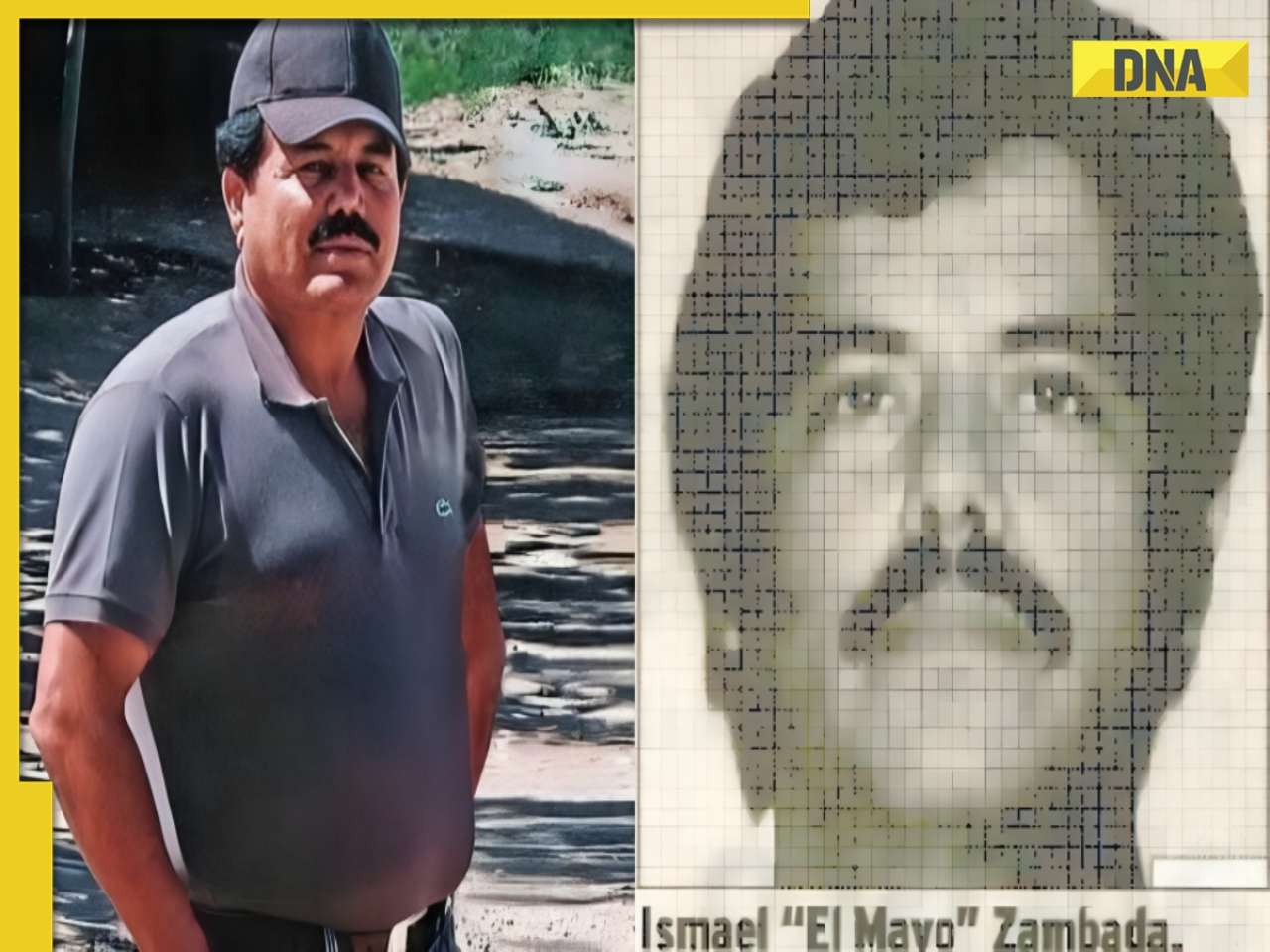

El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?![submenu-img]() Viral video: 15-foot python attacks and nearly swallows Jabalpur man, here's how locals save him, watch

Viral video: 15-foot python attacks and nearly swallows Jabalpur man, here's how locals save him, watch![submenu-img]() 'Anant knows everything': Akash Ambani, Isha Ambani tell Amitabh Bachchan as…

'Anant knows everything': Akash Ambani, Isha Ambani tell Amitabh Bachchan as…

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)