Illiquid securities are quarantined in side pocket; money returns to investors when the company in trouble repays or its securities get upgraded

When Tata Mutual Fund (MF) segregated the portfolio of securities of crisis-hit mortgage lender DHFL held by its debt schemes in mid-June, the term 'side pocketing' made its entry into the Indian investment lexicon. Tata MF has become the first fund house in the country to do 'side pocketing' for its schemes.

Though side pocketing is in vogue in several developed economies, markets regulator Sebi allowed it in debt schemes of MFs only in January this year. To put it simply, side pocketing removes the bad apples from the good ones. The side pocket is generally formed by creation of a separate portfolio of distressed, illiquid and hard-to-value assets. Each investor is allocated his/her pro-rata interest in the side pocketed portfolio.

In the absence of side pocketing, in case of credit events, the existing investors potentially lose all value. With side pockets the investors, who take the hit when the credit event happens, get the full upside of a future recovery. When recovery is made in the side pocketed portfolio, the same is distributed among investors on a pro-rata basis.

SMART INVESTMENT

|

- The side pocket is generally formed by creation of a separate portfolio of distressed, illiquid and hard-to-value assets

- Tata MF has become the first fund house in the country to do 'side pocketing' for its schemes

- No investment and advisory fees can be charged by the asset management company on the side pocketed portfolio

|

What a side pocket means for an investor in debt MF schemes?

You cannot redeem (exit) your units in a side pocketed portfolio straightaway. The fund house would transfer the money to the investor in the segregated portfolio of the troubled investment (for example DHFL) when the debt security matures.

You can also get money if the fund house is able to sell the troubled securities after an upgrade from credit ratings agencies. Typically, an upgrade would result in an improvement in liquidity for the troubled investment offering a window of opportunity to exit.

Does it help investors?

Personal finance experts and advisors say it is useful for investors. "Side pocketing is actually good for investors. In the absence of a side pocket, there would be huge redemption pressure. The fund house would have to sell good quality securities to meet redemption requirements," says Suresh Sadagopan, founder of Mumbai-based Ladder7 Financial Advisories.

"Side pocketing is the best possible solution in schemes stuck with bad quality paper," says Amit Trivedi, a Mumbai-based author and trainer on personal finance. "Illiquid securities are quarantined in a side pocket. Whenever the company in trouble pays back or its securities are upgraded, money returns to investors," he says.

What would your portfolio look like after the segregation?

The number of MF units in both the side pocketed and the regular portfolios would be shown as the same. However, the net asset value (NAV) of the portfolios would be different.

In the case of Tata Treasury Advantage Fund, one of the schemes that has taken a hit, the mark-down on the side-pocketed portfolio with securities of DHFL was a whopping 74%. But that constituted less than 5% of the total portfolio before segregation.

The asset management company (AMC) will send an e-mail and SMS to all unitholders of the concerned scheme on the day of creation of side pocket. A revised statement of holding indicating the units held by the unitholder in the side pocket along with the applicable NAV of the main portfolio will be communicated to the unitholders within five working days of creation of the side pocket.

Side pocketing of debt and money market instruments is permitted on the day of 'downgrade' of a debt instrument to 'below investment grade' or on the day of each subsequent downgrade from 'below investment grade'. In case of difference in rating by multiple agencies, the conservative assessment may be considered.

If a MF decides to side pocket security, approval of trustees is mandatory. For this purpose, trustees' approval would mean that at least a majority of the trustees agree to the proposal of creating side-pocket. Till the time the decision of trustees is received, subscription and redemption in the scheme is suspended.

No investment and advisory fees can be charged by the AMC (asset management company) on the side pocketed portfolio. However, TER or total expenses ratio (excluding the investment and advisory fees) can be charged on the side pocketed portfolio but only upon recovery, on a pro-rata basis i.e. on the recovered amount.

The TER (excluding the investment and advisory fees) charged shall not exceed the simple average of such expenses charged on daily basis on the non-side pocketed portfolio (in percentage terms) during the period for which side-pocket was created.

The costs related to the recovery of the assets side pocketed may be charged to the side pocketed portfolio upon recovery, within the maximum TER limit. The recovery cost in excess of the TER limit shall be borne by the AMC.

![submenu-img]() 'He's contemporary...': Ravi Shastri's 'no-nonsense' take on Gautam Gambhir as Team India head coach

'He's contemporary...': Ravi Shastri's 'no-nonsense' take on Gautam Gambhir as Team India head coach![submenu-img]() Karnataka cabinet renames Ramanagara district as Bengaluru South

Karnataka cabinet renames Ramanagara district as Bengaluru South![submenu-img]() Farah Khan, Sajid Khan's mother Menka Irani passes away at 79

Farah Khan, Sajid Khan's mother Menka Irani passes away at 79![submenu-img]() Meet man who quit high-paying job, mortgaged everything to build Rs 4186 crore firm, produced India’s first…

Meet man who quit high-paying job, mortgaged everything to build Rs 4186 crore firm, produced India’s first… ![submenu-img]() Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH

Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH![submenu-img]() Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...

Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...![submenu-img]() Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...

Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...![submenu-img]() Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..

Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..![submenu-img]() Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…

Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…![submenu-img]() Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...

Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...![submenu-img]() 5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024

5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024![submenu-img]() US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign

US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara

J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() NASA images: 7 mesmerising images of space will make you fall in love with astronomy

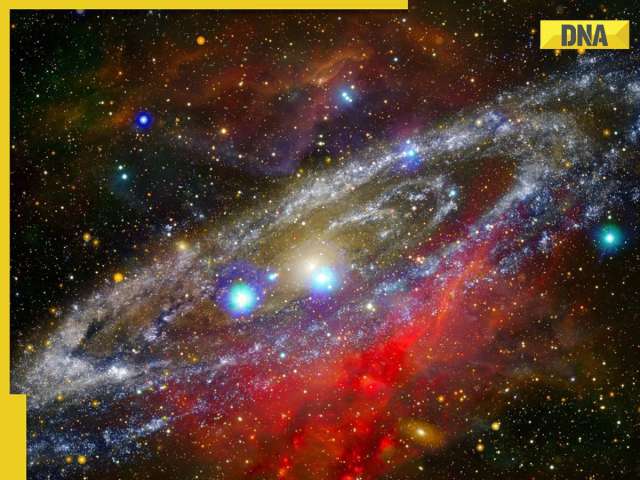

NASA images: 7 mesmerising images of space will make you fall in love with astronomy![submenu-img]() 8 athletes with most Olympic medals

8 athletes with most Olympic medals![submenu-img]() In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor

In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor![submenu-img]() Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now

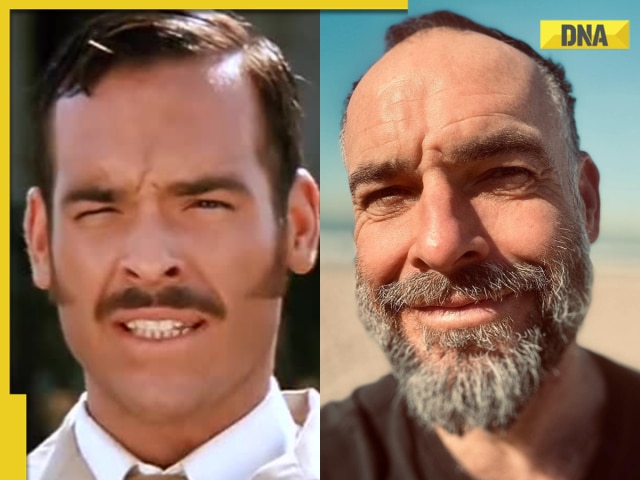

Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now![submenu-img]() This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...

This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...![submenu-img]() Karnataka cabinet renames Ramanagara district as Bengaluru South

Karnataka cabinet renames Ramanagara district as Bengaluru South![submenu-img]() Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...

Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...![submenu-img]() Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed

Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed![submenu-img]() Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas

Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas![submenu-img]() Big rejig in BJP: New state chief for Bihar and Rajasthan named

Big rejig in BJP: New state chief for Bihar and Rajasthan named![submenu-img]() DRDO fortifies India's skies: Phase II ballistic missile defence trial successful

DRDO fortifies India's skies: Phase II ballistic missile defence trial successful![submenu-img]() Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing

Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing![submenu-img]() Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas

Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas![submenu-img]() Area 51: Alien testing ground or enigmatic US military base?

Area 51: Alien testing ground or enigmatic US military base?![submenu-img]() Transforming India's Aerospace Industry: Budget 2024 and Beyond

Transforming India's Aerospace Industry: Budget 2024 and Beyond![submenu-img]() Farah Khan, Sajid Khan's mother Menka Irani passes away at 79

Farah Khan, Sajid Khan's mother Menka Irani passes away at 79![submenu-img]() Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours

Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours![submenu-img]() Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped

Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped ![submenu-img]() 'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa

'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa ![submenu-img]() Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'

Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'![submenu-img]() Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH

Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH![submenu-img]() 'BMW, Mercedes, all gone’: Man's luxury cars worth over Rs 10000000 ruined, watch viral video

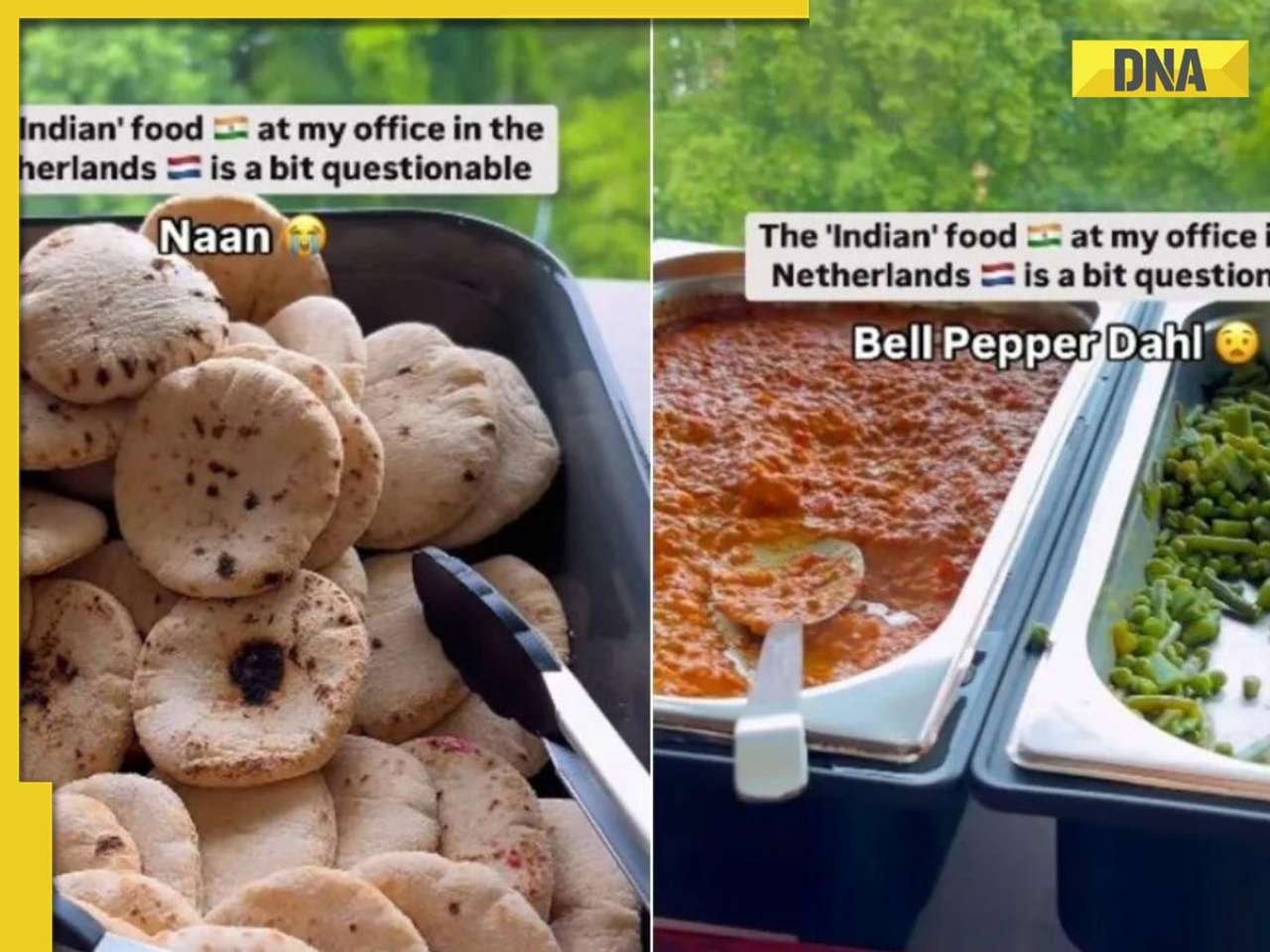

'BMW, Mercedes, all gone’: Man's luxury cars worth over Rs 10000000 ruined, watch viral video![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() This small nation is most important country in world, plays huge role in shaping geopolitics, it is...

This small nation is most important country in world, plays huge role in shaping geopolitics, it is...![submenu-img]() El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

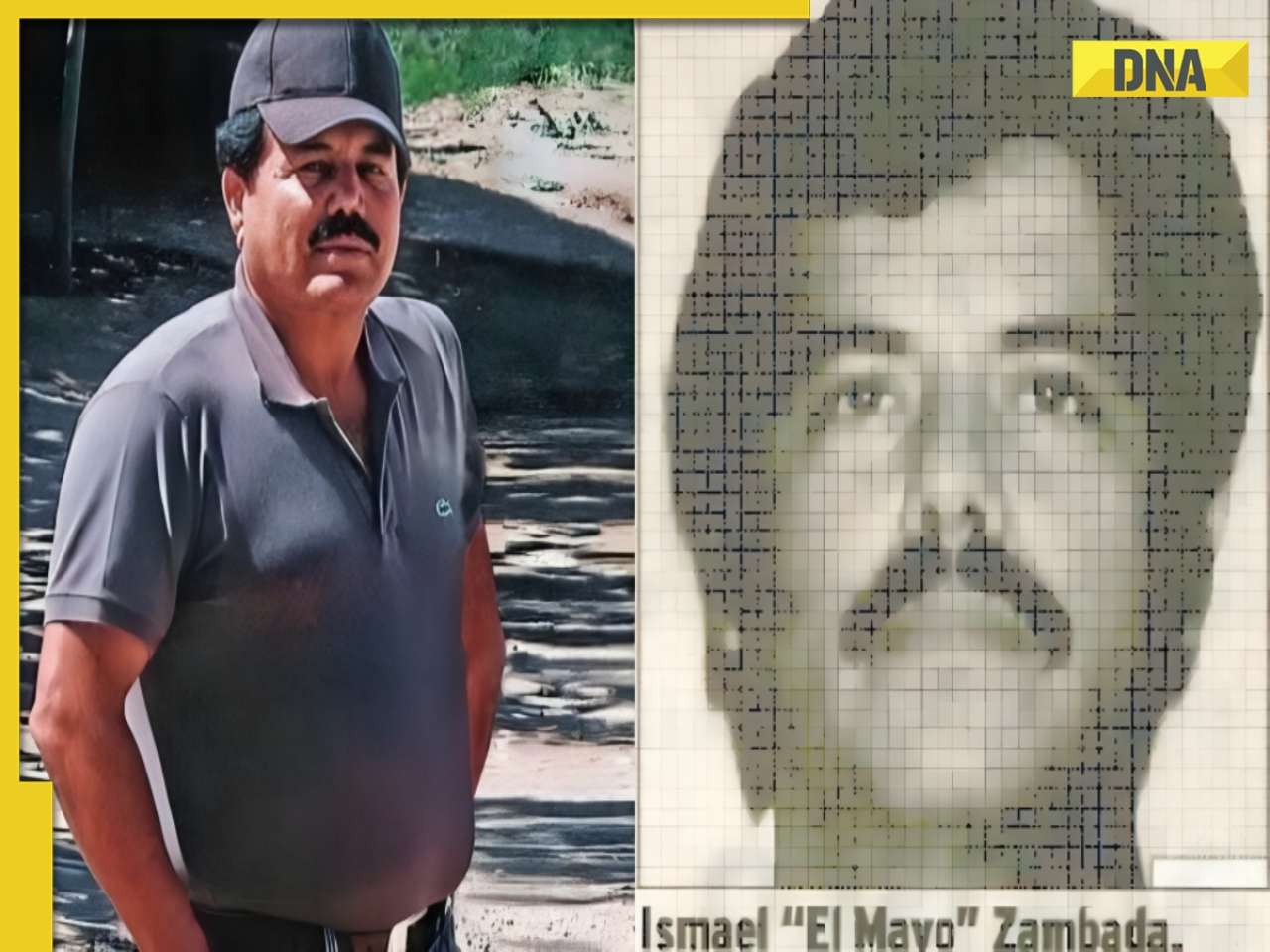

El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)