Tata Steel’s acquisition impulse has got it into a huge debt. As it continues on a buyout spree, this time on the domestic turf, the steel major’s gross debt jumped 29% to over Rs 1 lakh crore in just six months of last fiscal. With its bid to cut some of its debt through ThyssenKrupp deal failing, India’s leading private sector steel company has turned all its attention to the domestic market

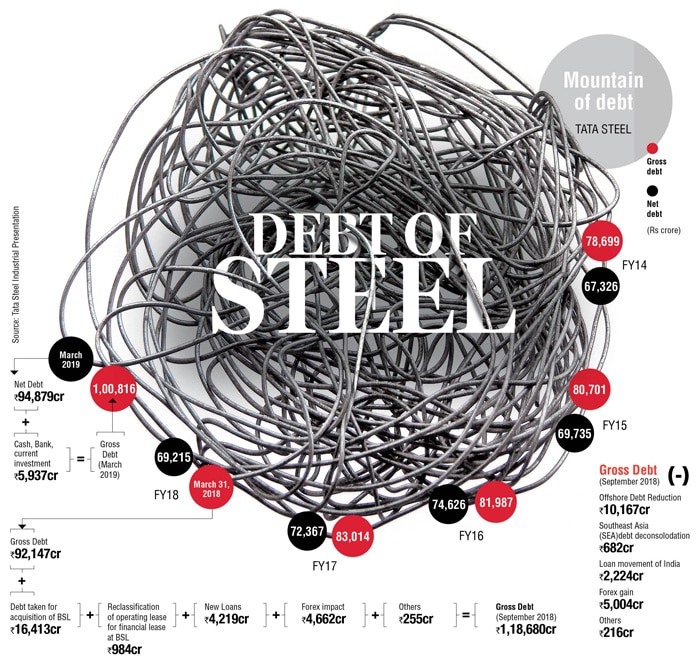

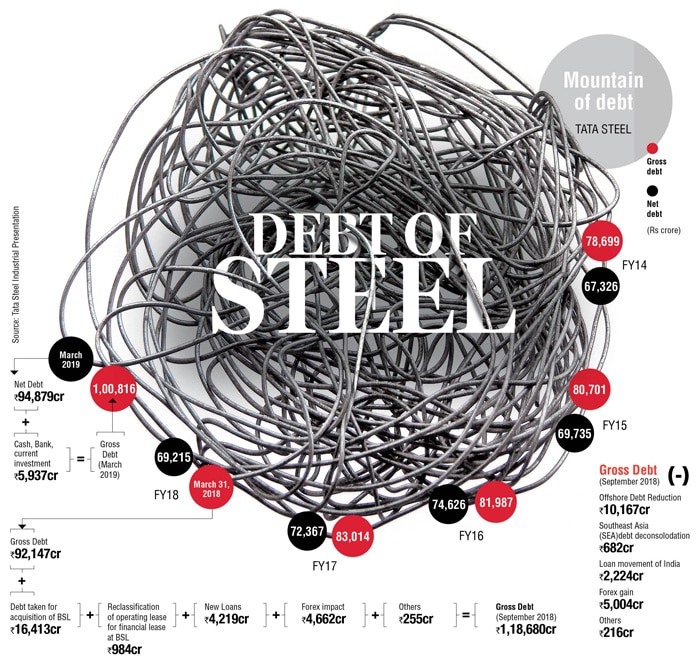

Last fiscal – between the March and September quarters – Tata Steel's gross debt leapt 28.7% to Rs 1,18,680 crore from Rs 92,147 crore.

It broke the psychological barrier of Rs1-lakh crore and alarmed experts and analysts.

The steel major's debts surged as it was aspiring for a dominant position in the domestic market, and aggressively chased takeover targets such as Bhushan Steel Ltd (BSL) and Usha Martin.

The company repeated a pattern it had followed in the past too.

More than a decade ago, the Tata group company wanted to spread its footprint overseas and went on an acquisition spree. As it snapped up a slew of steel and downstream companies abroad – Singapore's NatSteel Asia, Thailand's Millennium Steel Company, Australia's Carborough Downs and BlueScope Steel, South Africa's Richards Bay and Anglo-Dutch Corus and others – it's net debt piled up from a minuscule Rs 192 crore in fiscal 2005 to a massive Rs 69,215 crore in fiscal 2018.

That was an over 350 times jump in the net debt. This mountain of loans was created as Tata Steel tried to operate and manage its acquisitions.

Debt spiral

Has the company sparked off another round of debt spiral with its recent domestic buyouts?

Koushik Chatterjee, executive director and CFO, Tata Steel, told DNA Money that the debt raised for Indian operations was just 25-30% of the total debt.

He justified the increasing debt by pointing to the growing installed capacity. Furnishing numbers, the senior Tata executive said it has grown over four times from 4 million tonne per annum (mtpa) in 2006 to 19 mtpa, including BSL and Usha Martin, in 2019.

He clarified Tata Steel's debts were growing not just because of acquisitions but also due to its organic expansions. Chatterjee said the company had always strived for a debt-equity ratio of 1:1 and has been able to maintain it at all times.

“When we acquired Corus in 2006, we had 50% debt and 50% equity. At all points in time, we have a principle of looking at marginal funding strategy at a prudent 1.1 debt-equity. For a capital-intensive industry, that is actually very conservative and prudent,” he said.

In the mid-2000, the domestic steel major's net-debt-to-equity ratio was as low as 0.02. It had eased from 1.75 in fiscal 2002, and now stands at 0.42. Its gross borrowing has only risen from Rs 78,699 crore in FY14 to Rs 1,00816 crore in FY19.

“BSL was a very important acquisition because it was a once-in-a-lifetime opportunity under the IBC (Insolvency and Bankruptcy Code) to acquire a good asset in India, which has a high level of synergies and appropriate integration opportunities to leverage our strength in the market to get a good profile in the product mix. If I look at it from the funding point of view, we had put in about Rs 18,000 crore equity and internal cash flows and we have levered around Rs 18,000 crore on the asset side. So, it was 50:50 debt-equity,” he said.

Despite the company's attempt to contain its debt exposure for the acquisition, its gross debt soared by over Rs 26,000 crore in the quarters that followed the BSL acquisition. The increase in gross debt included Rs 16,413 crore borrowings raised for BSL takeover, Rs 984 crore reclassification of an operating lease to financial lease, new loans of Rs 4,219 crore, Rs 4,662 crore forex hit and a Rs 225 crore debt.

'Aspirational mistake'

Just two years back in 2017, former managing director of the company J J Irani, had alluded to the “aspirational mistake” made by the company in acquiring Corus at a bloated price of $12 billion; “acquisition of Corus was a mistake. Not an intentional one but an aspirational mistake".

The acceptance of this erroneous takeover was seen in the Tata Steel's desperate bid to strip the Anglo-Dutch company's assets for sale and transfer its debts to the now failed joint venture proposal with the German steel manufacturer ThyssenKrupp. This partnership deal collapsed with European Commission refusing to give its approval for it.

This was a major setback for the company's deleveraging effort. The ThyssenKrupp deal would have deconsolidated 20% of its debt.

Chatterjee said now that the JV is off, the company would “ensure” reduction in debt through its servicing.

In the second half of the last fiscal, Tata Steel managed to bring down its gross debt by around Rs 18,000 crore to Rs 1,00,816 crore by March 31, 2019. This was done by slicing offshore debt by Rs 10,167 crore, deconsolidation of Southeast Asian (SEA) debt of Rs 682 crore, loan movement of Rs 2,224 crore, forex gains of Rs 5,004 crore and others.

The Tata Steel senior executive said the company could repay its debts because of improved cash-flow from BSL. “Bhushan cash-flow was much lower, we improved it through synergies, volumes, working capital management and investment in the right assets to ensure they performed on a stretched basis. It was a combination of these things that enabled the cash-flows to be higher. Once volumes were higher, the cost came down and margin improved; also working capital was reset and therefore the cash-flows started coming in. That enabled us to prepay some debts,” he said.

For the current fiscal, the company is looking at additional de-leveraging of $1 billion debt, which is likely to slash its net debt to around Rs 90,000 crore from Rs 95,000-96,000 crore.

“Net debt may come down from Rs 96,000 crore to Rs 90,000 or a shade lower than that, in a market which is much more challenging,” said Chatterjee.

Pricey buys

A research analyst of a leading brokerage firm, who spoke off-the-record, said the easiest way for the company would have been to sell off European assets, but the ThyssenKrupp deal not coming through will now be a drain on its resources.

According to him, BSL buyout would have worked out well with the removal of part of the overseas debt from Tata Steel's books.

“Now, with no (ThyssenKrupp) deal, it is going to be very painful for the Tatas because those European plants need investment, otherwise they cannot run. This is going to be a challenge for them. If they have to be run, Tatas will have to take very stringent decisions. Just to put pressure on the (European) administration, they might have to cut huge jobs. In that case too, in Europe, they have to pay for their pension liabilities. From the balance-sheet point of view, it will be very difficult for them. They also do not have too many options to generate cash or funds. If Tata Sons gives some backup or support then that is a different thing. If you look at the promoter holding in the company, it is just about 28%-odd. So they cannot sell a stake to somebody else or enter the market or offer more equity in the market to generate funds. So, they have to raise through the corporate bonds,” he said.

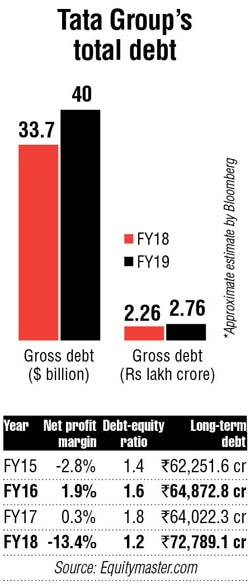

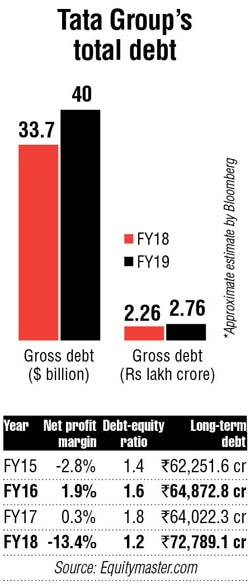

With the finances of Tata Group already stretched with a total debt of around $40 billion – as per Bloomberg estimates – it may not be to help in a big way. Tata Motors and Tata Power, other highly-leveraged Tata companies, are also grappling with an over-stretched balance-sheet.

The analyst feels Tata Steel has overpaid for most acquisitions, including Corus and BSL. He saw the latest acquisition more strategically driven than commercially. “It's a strategic decision to keep JSW out of the eastern steel market. If I keep the reasons aside and look at valuation, they have paid Rs 35,000 crore for the facility of 5.6 million tonne (mt) capacity. It was operating at around 3.5 mt per annum. Definitely, they have overpaid because they have paid an amount equal to greenfield project. You don't pay the cost of a greenfield project for an ongoing plant which is old. Secondly, it was a stressed asset and being resolved under the National Company Law Tribunal but there was no stress valuation. It was entirely done as if a new plant was being acquired by a company”.

Chatterjee refuted the over-valuation charge, saying the BSL's plant was “financial stressed, not physically”.

He said that the company's book value was Rs 55,000 crore when it went to the NCLT. Therefore, at Rs 35,000 crore it was fairly priced looking considering the replacement value of Rs 49,000 crore for setting up a 5.6-mtpa greenfield steel project worked out by his company.

But there is no denying that Tata Steel's recent domestic acquisition has spiked its borrowing. Its net debt is up 37% to Rs 94,879 crore in fiscal 2019 from Rs 69,215 crore in the fiscal before.

Homing in on the domestic market

Tata Steel's finance chief said the company was looking at turning its focus on India to trim its debt level. A presentation of the domestic steel major on the geographical distribution of its revenues shows India now constitutes 56% of its total income, up from 15% in fiscal 2006 while overseas revenues is 44%, down from 69% in fiscal 2006. The company wants to earn 100% of its revenues from the domestic market by 2025.

“We are also looking to aligning our debt with our asset profile. With the business being more India-centric, a larger part of the debt will be in India. In the fourth quarter alone, the gross debt was reduced by Rs 8,781 crore, out of which Rs 6,181 crore of reduction was on account of net repayment. In the process, we have actually reduced our debt by a little more than one billion dollars,” he said.

Chatterjee said, “We are working towards lengthening our debt profile and despite the ongoing liquidity crunch in the Indian markets, we raised about Rs 2,300 crore through a 15-year convertible debenture that has effectively allowed us to diversify our source of capital and lengthen the tenure of our capital structure. We have also completed the capital restructuring of Tata Steel BSL this year. Tata Steel BSL has also repaid Rs 2,600 crore from its internal cash generations. Our gross debt to equity has also reduced from 1.82 times from FY18 to 1.25 times in FY19 and gross debt to Ebidta has declined from 4.31 times in FY18 to 3.39 times in FY19,” said the Tata executive.

![submenu-img]() IND vs SL, 1st T20I: Predicted playing XIs, live streaming details, weather and pitch report

IND vs SL, 1st T20I: Predicted playing XIs, live streaming details, weather and pitch report![submenu-img]() Women's Asia Cup 2024: India beat Bangladesh by 10 wickets to reach ninth successive final

Women's Asia Cup 2024: India beat Bangladesh by 10 wickets to reach ninth successive final![submenu-img]() Apple reduces prices of iPhones across models, iPhones 13, 14 and 15 will be cheaper by Rs...

Apple reduces prices of iPhones across models, iPhones 13, 14 and 15 will be cheaper by Rs...![submenu-img]() 'Elon Musk treated me badly for...,' says Tesla chief's daughter Vivian Jenna Wilson

'Elon Musk treated me badly for...,' says Tesla chief's daughter Vivian Jenna Wilson![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...

Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...![submenu-img]() Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...

Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...![submenu-img]() Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..

Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..![submenu-img]() Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…

Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…![submenu-img]() Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...

Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...![submenu-img]() 5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024

5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024![submenu-img]() US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign

US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara

J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() NASA images: 7 mesmerising images of space will make you fall in love with astronomy

NASA images: 7 mesmerising images of space will make you fall in love with astronomy![submenu-img]() 8 athletes with most Olympic medals

8 athletes with most Olympic medals![submenu-img]() In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor

In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor![submenu-img]() Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now

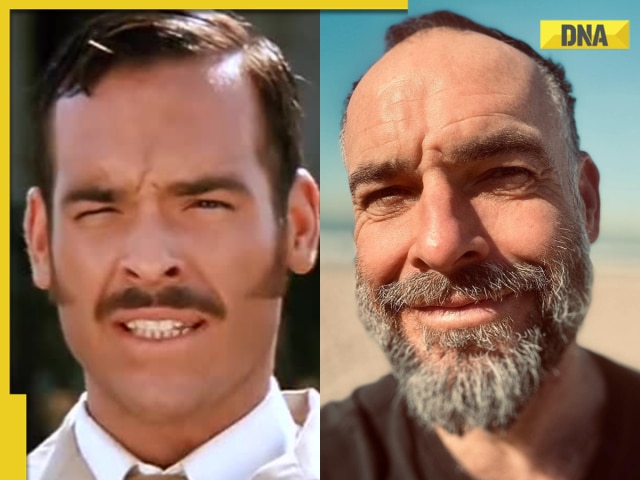

Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now![submenu-img]() This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...

This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...![submenu-img]() Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...

Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...![submenu-img]() Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed

Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed![submenu-img]() Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas

Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas![submenu-img]() Big rejig in BJP: New state chief for Bihar and Rajasthan named

Big rejig in BJP: New state chief for Bihar and Rajasthan named![submenu-img]() Mumbai rains: Schools, colleges to operate normally today, BMC urges citizens to...

Mumbai rains: Schools, colleges to operate normally today, BMC urges citizens to...![submenu-img]() DRDO fortifies India's skies: Phase II ballistic missile defence trial successful

DRDO fortifies India's skies: Phase II ballistic missile defence trial successful![submenu-img]() Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing

Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing![submenu-img]() Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas

Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas![submenu-img]() Area 51: Alien testing ground or enigmatic US military base?

Area 51: Alien testing ground or enigmatic US military base?![submenu-img]() Transforming India's Aerospace Industry: Budget 2024 and Beyond

Transforming India's Aerospace Industry: Budget 2024 and Beyond![submenu-img]() Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped

Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped ![submenu-img]() 'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa

'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa ![submenu-img]() Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'

Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'![submenu-img]() Parineeti Chopra's cryptic post about 'throwing toxic people out of life' scares fans: 'Stop living for...'

Parineeti Chopra's cryptic post about 'throwing toxic people out of life' scares fans: 'Stop living for...'![submenu-img]() Highest grossing animated film ever has earned Rs 12200 crore; beat The Lion King, Toy Story, Frozen, Minions, Shrek

Highest grossing animated film ever has earned Rs 12200 crore; beat The Lion King, Toy Story, Frozen, Minions, Shrek![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() This small nation is most important country in world, plays huge role in shaping geopolitics, it is...

This small nation is most important country in world, plays huge role in shaping geopolitics, it is...![submenu-img]() El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?![submenu-img]() Viral video: 15-foot python attacks and nearly swallows Jabalpur man, here's how locals save him, watch

Viral video: 15-foot python attacks and nearly swallows Jabalpur man, here's how locals save him, watch![submenu-img]() 'Anant knows everything': Akash Ambani, Isha Ambani tell Amitabh Bachchan as…

'Anant knows everything': Akash Ambani, Isha Ambani tell Amitabh Bachchan as…

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)