The suggestion is part of the Budget proposals submitted by the RBI to finance minister Nirmala Sitharaman

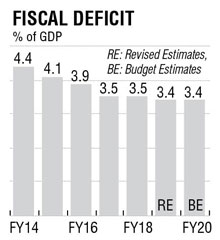

Reserve Bank of India (RBI) governor Shaktikanta Das has urged the government to stick to the fiscal deficit target in the forthcoming Budget and continue on the fiscal consolidation path. It comes amid concerns over a slowdown as the country’s Gross Domestic Product (GDP) growth fell to 6.8% in 2018-19. The suggestion is part of the pre-Budget proposals submitted by the RBI to finance minister Nirmala Sitharaman. Sitharaman is scheduled to present the first Budget of the new government on July 5.

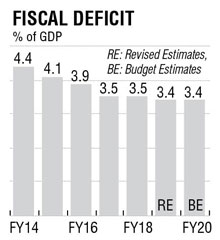

In February, the interim Budget had projected a fiscal deficit target of 3.4% for 2019-20.

“Private investment needs to pick up, as a public investment alone cannot spur growth. To make resources available for private investment, the government should stick to its fiscal deficit target. Higher fiscal deficit leaves it with no option but to borrow more,” the governor is said to have told the government.

LOWER GROWTH

|

- The Reserve Bank of India has estimated the GDP growth at 7%, lowering its earlier estimate of 7.2% for 2019-20

|

An increase in government borrowing leads to crowding out of private investment and therefore a reduction in private investment.

If the borrowings by Centre, states and public sector cross 8.5% of the GDP, very less is left for the private sector out of the available investible resources, as per the regulator.

The household sector’s net financial savings, along with net capital inflows, add up to the total investible surplus of 9.5% of the GDP.

If the government tries to fulfill the commitments made in the election manifesto, it will be difficult for it to contain fiscal deficit, thus increasing its borrowings.

At present, with the Centre’s fiscal deficit at 3.4% of the GDP, and states and public sector at 3% and 2.5% respectively, the government has no scope for breaching the fiscal deficit target, or including large expenditure programmes in the Budget.

As the deficit is financed through borrowings, less funds become available for private lending, putting pressure on interest rates.

The central bank has estimated the GDP growth at 7%, lowering its earlier estimate of 7.2% for 2019-20. To increase consumption and support growth, the RBI has already announced three consecutive repo rate cuts during 2019.

To further bolster the spending power of people, the banking regulator has suggested that the government should give tax incentives to homebuyers in the Budget. It is also in favour of giving a boost to the equity market by providing relief to investors who are facing the double whammy of Long-Term Capital Gains (LTCG) tax and Securities Transaction Tax (STT). The regulator is of the view that investors in the capital market should be given relief by allowing for adjustment of STT against LTCG tax. The government in the Budget 2018-19 brought back a 10% LTCG tax on equities while retaining the STT. Das, though, favoured LTCG tax as it helped in tracking transactions.

![submenu-img]() IND vs SL, 1st T20I: Predicted playing XIs, live streaming details, weather and pitch report

IND vs SL, 1st T20I: Predicted playing XIs, live streaming details, weather and pitch report![submenu-img]() Women's Asia Cup 2024: India beat Bangladesh by 10 wickets to reach ninth successive final

Women's Asia Cup 2024: India beat Bangladesh by 10 wickets to reach ninth successive final![submenu-img]() Apple reduces prices of iPhones across models, iPhones 13, 14 and 15 will be cheaper by Rs...

Apple reduces prices of iPhones across models, iPhones 13, 14 and 15 will be cheaper by Rs...![submenu-img]() 'Elon Musk treated me badly for...,' says Tesla chief's daughter Vivian Jenna Wilson

'Elon Musk treated me badly for...,' says Tesla chief's daughter Vivian Jenna Wilson![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...

Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...![submenu-img]() Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...

Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...![submenu-img]() Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..

Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..![submenu-img]() Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…

Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…![submenu-img]() Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...

Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...![submenu-img]() 5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024

5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024![submenu-img]() US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign

US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara

J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() NASA images: 7 mesmerising images of space will make you fall in love with astronomy

NASA images: 7 mesmerising images of space will make you fall in love with astronomy![submenu-img]() 8 athletes with most Olympic medals

8 athletes with most Olympic medals![submenu-img]() In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor

In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor![submenu-img]() Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now

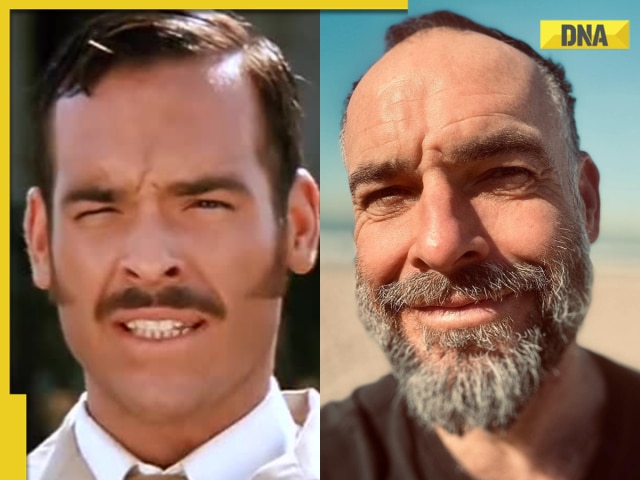

Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now![submenu-img]() This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...

This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...![submenu-img]() Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...

Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...![submenu-img]() Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed

Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed![submenu-img]() Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas

Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas![submenu-img]() Big rejig in BJP: New state chief for Bihar and Rajasthan named

Big rejig in BJP: New state chief for Bihar and Rajasthan named![submenu-img]() Mumbai rains: Schools, colleges to operate normally today, BMC urges citizens to...

Mumbai rains: Schools, colleges to operate normally today, BMC urges citizens to...![submenu-img]() DRDO fortifies India's skies: Phase II ballistic missile defence trial successful

DRDO fortifies India's skies: Phase II ballistic missile defence trial successful![submenu-img]() Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing

Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing![submenu-img]() Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas

Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas![submenu-img]() Area 51: Alien testing ground or enigmatic US military base?

Area 51: Alien testing ground or enigmatic US military base?![submenu-img]() Transforming India's Aerospace Industry: Budget 2024 and Beyond

Transforming India's Aerospace Industry: Budget 2024 and Beyond![submenu-img]() Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped

Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped ![submenu-img]() 'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa

'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa ![submenu-img]() Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'

Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'![submenu-img]() Parineeti Chopra's cryptic post about 'throwing toxic people out of life' scares fans: 'Stop living for...'

Parineeti Chopra's cryptic post about 'throwing toxic people out of life' scares fans: 'Stop living for...'![submenu-img]() Highest grossing animated film ever has earned Rs 12200 crore; beat The Lion King, Toy Story, Frozen, Minions, Shrek

Highest grossing animated film ever has earned Rs 12200 crore; beat The Lion King, Toy Story, Frozen, Minions, Shrek![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() This small nation is most important country in world, plays huge role in shaping geopolitics, it is...

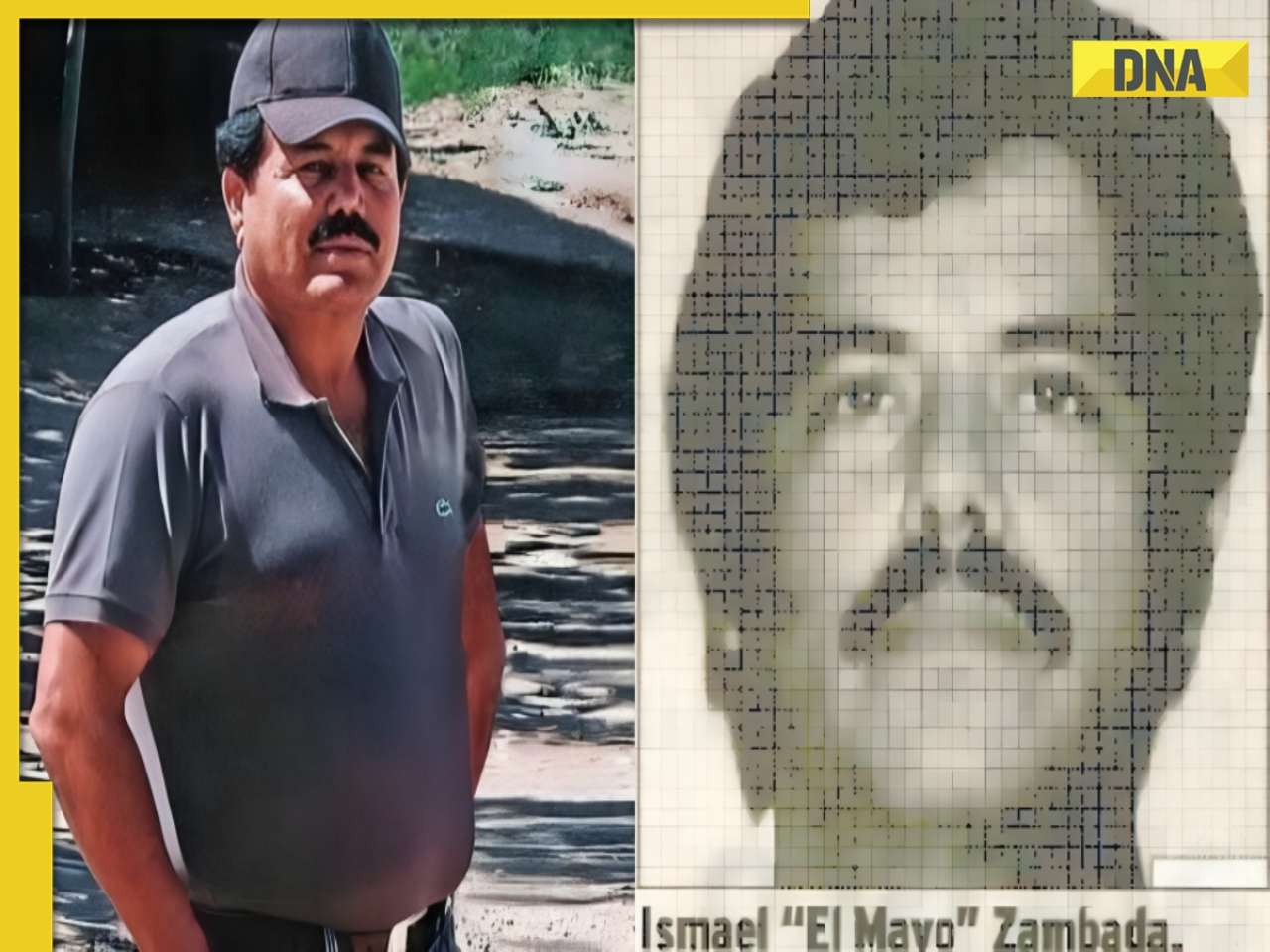

This small nation is most important country in world, plays huge role in shaping geopolitics, it is...![submenu-img]() El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?![submenu-img]() Viral video: 15-foot python attacks and nearly swallows Jabalpur man, here's how locals save him, watch

Viral video: 15-foot python attacks and nearly swallows Jabalpur man, here's how locals save him, watch![submenu-img]() 'Anant knows everything': Akash Ambani, Isha Ambani tell Amitabh Bachchan as…

'Anant knows everything': Akash Ambani, Isha Ambani tell Amitabh Bachchan as…

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)